Financial Markets Operations Management (10 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

When a derivatives exchange develops a new product, the contract specifications have to have sufficient information for a user to understand the contract. A good example to look at would be an interest rate derivative for which the underlying asset is a government security. In

Table 2.38

, you will see headline contract specifications for three long-dated government securities as issued by three separate derivatives exchanges.

TABLE 2.38

Comparison of USD, GBP and EUR bond futures contracts

| US Treasury Bond | |||

| Futures | Long Gilt Futures | Eurobond Futures | |

| Exchange | CME Group | NYSE LIFFE | EUREX |

| Underlying unit (face value) | USD 100,000 | GBP 100,000 | EUR 100,000 |

| Deliverable grade (See Note) | US T-bond with a notional 6% coupon with a maturity from 15 to 25 years | UK gilt with a notional 4% coupon with a maturity from 8.75 to 13 years | German bund with a notional 6% coupon with a maturity from 8.5 to 10.5 years |

| Price quote | Points and 1/32nd of a point (e.g. 120â16 is 120 16/32) | As a percentage of the par value | As a percentage of the par value |

| Tick size | 1/32 of one point (USD 31.25) | 0.01 (GBP 10.00) | 0.01 (EUR 10.00) |

| Contract months | First three consecutive contracts (i.e. up to nine months) in the March, June, September and December cycle | ||

| Last trading day | Closes at 12:01, seventh business day preceding the last business day in the delivery month | Closes at 11:00, two business days prior to the last business day in the delivery month | Closes at 12:30 CET, two exchange days prior to the last business day in the delivery month |

| Last delivery day | Last day in the delivery month | Any business day in the delivery month (at seller's choice) | Tenth calendar day in the delivery month |

Note:

A delivery obligation arising out of a short position may only be fulfilled by the delivery of certain debt securities issued by Germany, Italy, France or Switzerland. Each country's bonds have slightly different maturities.

By making a comparison of these three futures contracts you can see that there are both similarities and differences between them. First of all, these are the similarities:

- The deliverables are all long-dated government bonds.

- The face value of each underlying unit (contract) is 100,000.

- The price quote convention mirrors that of the underlying bond.

- The contract months follow the same March quarterly cycle.

- The tick size follows a similar pattern, although the USA convention is to quote in 1/32nd whilst the other two countries quote in decimals.

Secondly, here are the differences:

- The notional coupon rate is different for the long gilt future at 4%.

- In the delivery month, the CME and EUREX contracts are deliverable on one particular day whereas the NYSE LIFFE contract is deliverable on any business day in the delivery month. There are also differences in terms of which day is the last day for the CME and EUREX contracts.

Closer examination of the contract specifications will show that there is no one particular bond designated as being the deliverable bond. The implication is that there is a choice of one or more bonds which meet the criteria to a certain extent.

In all probability there is no such bond that has a coupon rate as stated and with a maturity that fits within the timeline. The exchange overcomes this problem by publishing a list of bonds that would be suitable for any particular delivery month.

Take, for example, the June 2014 long gilt futures contract, remembering that the contract specifies a 4% coupon with a maturity from 8 years and 9 months out to 13 years. Therefore, for this particular contract, we are looking at an underlying security maturing from March 2023 to June 2027. NYSE LIFFE published its initial list of two deliverable gilts in September 2013,

8

with an update in March 2014.

9

The list now contains three securities:

- 2.25% Treasury bond due 7 September 2023;

- 2.75% Treasury bond due 7 September 2024; and

- 5.00% Treasury bond due 7 March 2025.

On occasion, there can be up to four or five different deliverable securities.

Questions now arise as to which of these three bonds would be delivered and at what price.

We saw from the contract specification that it is the seller who chooses when to deliver. In the case of the June 2014 contract, the seller can choose one of these three bonds. However, the delivered bond tends to be the one that has been calculated as the cheapest to deliver (CTD). We will look at CTD in the next section on futures pricing. From an Operations point of view, this is an example of a transformation from a derivative product into a cash market product. Normally, users tend to close out their long and short positions before the last date for trading, removing the need to deliver/receive against the contract.

The price at which the delivered bond is traded is dictated by the exchange and this price is known as the

exchange delivery settlement price

(EDSP). We will describe how the EDSP works in practice in Chapter 9: Derivatives Clearing and Settlement.

Futures contracts are priced using the same pricing convention as the underlying bond. At the same time, the underlying deliverable gilts are also similarly priced.

Listed in

Table 2.39

are the closing prices for the June 2014 contract together with the three underlying deliverable gilts.

TABLE 2.39

NYSE LIFFE June 2014 long gilt futures contract

| Product | Price | Source | Date |

| Long gilt future June 2014 | 110.66 | NYSE LIFFE | 2014-04-25 |

| 2.25% Treasury bond 7 Sep 2023 | 96.84 | DMO reference prices | 2014-04-25 |

| 2.75% Treasury bond 7 Sep 2024 | 99.88 | DMO reference prices | 2014-04-25 |

| 5.00% Treasury bond 7 Mar 2025 | 121.05 | DMO reference prices | 2014-04-25 |

Sources:

NYSE LIFFE (online) Settlement prices. Available from

https://globalderivatives.nyx.com/en/products/bond-futures/R-DLON/settlement-prices

. [Accessed Tuesday, 29 April 2014]

DMO (online) Reference prices. Available from DMO (online) Reference prices. Available from

www.dmo.gov.uk/rpt_parameters.aspx?rptCode=D3B&page=Gilts%2fDaily_Prices

. [Accessed Tuesday, 29 April 2014]

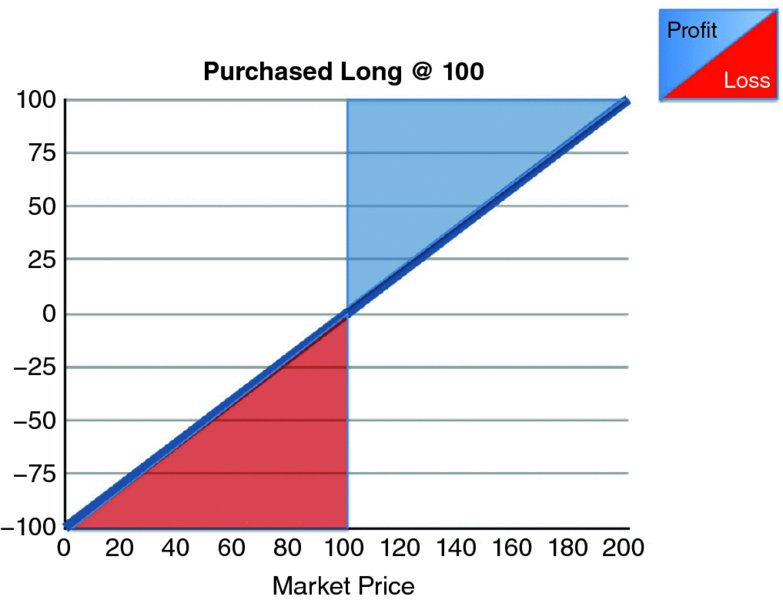

Prices on futures contracts are regarded as being linear, meaning that if you buy a futures contract and the price goes up, you have an unrealised profit; if the price goes down, you have an unrealised loss (see

Figure 2.2

).

FIGURE 2.2

Long futures contract purchased at a price of 100

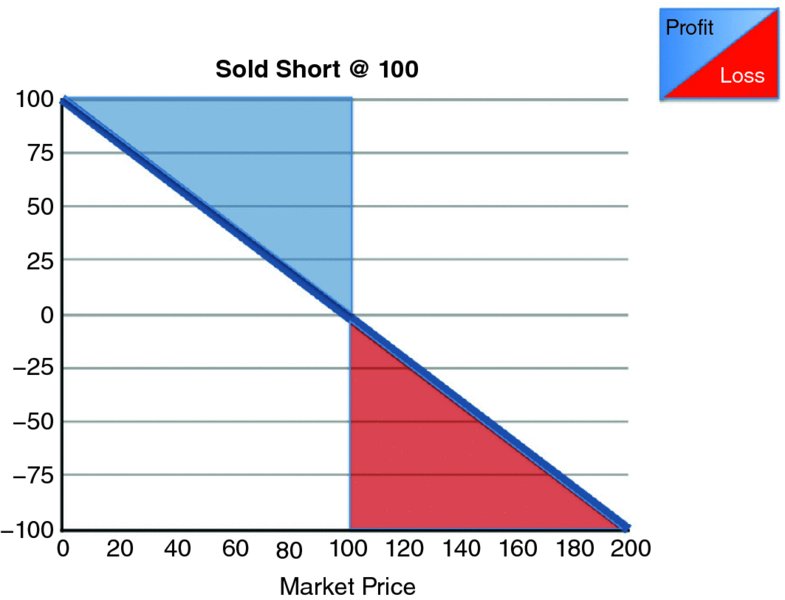

The reverse is true if you have a short futures position. If the price goes up, you lose and if the price goes down, you gain. This is approximately the same economic position as if you had purchased or sold the underlying asset (see

Figure 2.3

).

FIGURE 2.3

Short futures contract purchased at a price of 100

When you trade in the underlying asset, you are expected to settle the full economic value of the transaction almost straight away (e.g. T+3). Once settled, the legal contract is finalised and the original counterparty risk exposure removed. With derivatives such as a futures contract, the full economic value is not settled straight away. It will only be settled if and when the contract goes to delivery and if that happens, it will be several months away. This creates a counterparty risk exposure that would be unacceptable if it were not for the fact that a clearing house assumes the counterparty risk for the purchaser and for the seller (we refer to this as

novation

).

Until such time as the futures contract is either closed or delivered, both the buyer and the seller will reflect changes in the value of the contracts by a system known as

margin

. If a contract has gone up in value for a counterparty, the clearing house will credit that counterparty's account with the difference. Conversely, if a contract has gone down in value for a counterparty, the clearing house will debit that counterparty's account with the difference.

In effect, a counterparty is taking its profits and paying its losses on a day-by-day basis. This is in contrast with the underlying asset, where the profits or losses are not taken until the asset is either sold (from a long position) or purchased (for a short position).

For the June 2014 contract,

10

we have seen that there are three bonds that have been selected as deliverable. In order to make these bonds “look like” the 4% gilt, each gilt is given a price factor (PF). These PFs are fixed from the outset and do not change throughout the life of the contract. The PF for a gilt with a coupon less than 4% will be less than 1 and for a gilt with a coupon greater than 4%, the PF will be greater than 1. In the case of the three deliverable gilts, the PFs were stated as:

| 2.25% gilt due 7 September 2023 | PF is 0.8655782 |

| 2.75% gilt due 7 September 2014 | PF is 0.8955672 |

| 5.00% gilt due 7 March 2025 | PF is 1.0867250 |

On exercise, the exchange will announce the exchange delivery settlement price (EDSP) and this is multiplied by the price factor. Accrued interest is then factored into the calculation:

This formula is valid for futures contracts that have one delivery date only; in the case of the long gilt future, the contract is deliverable on any business day in the delivery month. The formula must be adjusted to reflect interest that accrues to the delivery date chosen:

This can be restated as:

If we take the first of the three gilts and the EDSP is 110.66, then the invoicing amount on ten contracts will be GBP 963,901.83 for delivery 14 June 2014 (see

Table 2.40

).

TABLE 2.40

Invoicing amount for the first of the three gilts

| Parameters | EDSP | Price Factor | Initial Interest | Daily Interest | No. Contracts | Delivery Day |

| 2.25% due 7 Sep 2023 | 110.66 | 0.8655782 | 519.701087 | 6.114130 | 10 | 14 |

| Invoicing amount: | GBP 963,901.83 | |||||

| Formula per GBP 100,000: | (1,000 à EDSP à PF) + Initial accrued interest + (days à daily interest) |