The Mystery of the Shemitah (12 page)

Read The Mystery of the Shemitah Online

Authors: Jonathan Cahn

Cycles and Turning Points

T

HE GREATEST HIGHS

or peaks of the stock market constitute turning points—the ending of a period of expansion and the beginning of decline. A peak in the financial realm, by definition, will mark the beginning of a downturn or a collapse. A major descent in the stock market will often be connected to an economic collapse, either as its foreshadowing or its effect.

If the financial and economic realms of ancient Israel could be plotted on a line graph, what would it look like? With the coming of the Shemitah, it would manifest as turning points, very similar to those appearing in a stock market graph. The Sabbath year would, in effect, produce a peak followed by a plummeting line. The descending line would represent the nation’s productivity as well as a “remission” in its financial realm.

What happens if we now look at the greatest turning points, the highest apogees in the last forty years of stock market history, along with the key turning points in the economic realm, the recessions and economic downturns of that same period? What will it reveal?

It will certainly include some of the great crashes of modern times, which we have seen in the last chapter—but much more. It will present a progressive record of the financial and economic fortunes of America and the world over the last several peaks and crashes in the order in which they occurred. It will provide a clear and large-scale view of the timing of each turning point as well as the relationship of each turning point to the others.

The data relating to the financial realm will come from the list of the stock market’s greatest turning points, its greatest peaks, and troughs of the past forty years. Will any pattern emerge? And is it possible that there will exist any connection to the ancient cycles ordained in the sands of Sinai?

In the last forty years there have been five major peaks and turning points in stock market history.

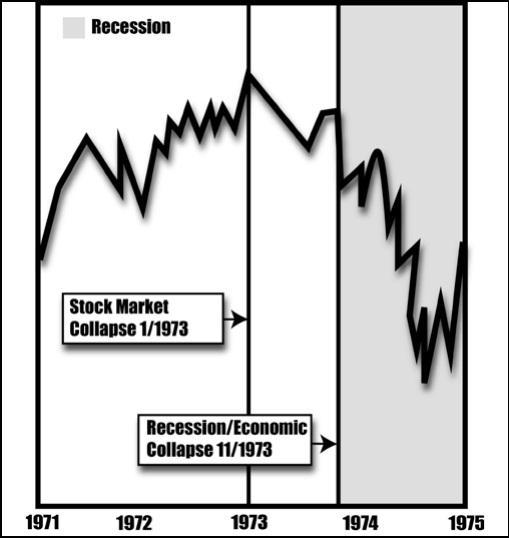

First Turning Point: 1973

The first turning point comes at the start of 1973. On January 11 the Standard and Poor’s (S&P) 500 reached a peak of 120. The market then began a long descent through the rest of the year and through much of the following year. It hit bottom on October 3, 1974, at a level of 62. The loss represented 48 percent of the market’s value. The collapse in the financial world foreshadowed and then overlapped with a collapse in the economic realm and a severe global recession.

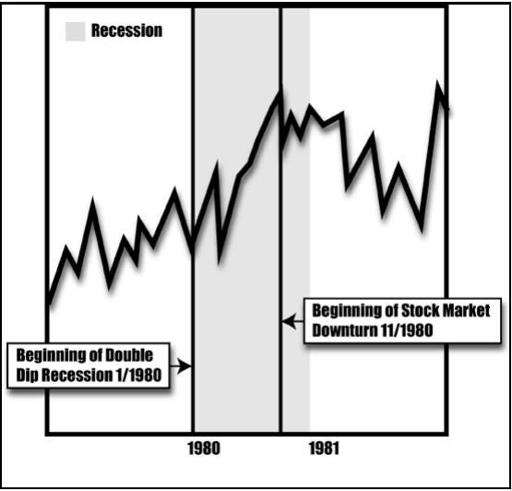

Second Turning Point: 1980

The second turning point happened on November 28, 1980, as the S&P 500 reached a level of 140. After this, came a long descent through all of 1981, reaching its low point on August 12, 1982, at 102, the stock market having lost 27 percent of its value. This collapse had been preceded by an earlier one in 1980, when the Dow Jones Industrial dropped from a level of 903 on February 13 to a low of 759 on April 21.

But the turning point in the financial realm would be preceded by another in the economic realm in January of 1980 as the economy entered a severe recession. This has been thus called a “double-dip recession,” and although there would later be a slight recovery, the economy would resume its downward slide in July of 1981. The collapse would affect much of the developed world and witness the highest levels of unemployment since the Great Depression.

The economic crisis had begun even earlier in 1979 as the Iranian Revolution triggered a massive spike in oil prices. The period from 1979 to the beginning of 1980 was one of stagflation, rising inflation combined with declining output growth. During this time the nation’s gross national product (GNP) shrank from 5 percent to 1.5 percent. It was 1979 as well that saw the nation’s rate of inflation soar into double digits.

So here we have a clustering of turning points. The economic crisis crystalized in 1979, became a worldwide recession in January 1980, and resulted in the fall of the stock market in November of that same year.

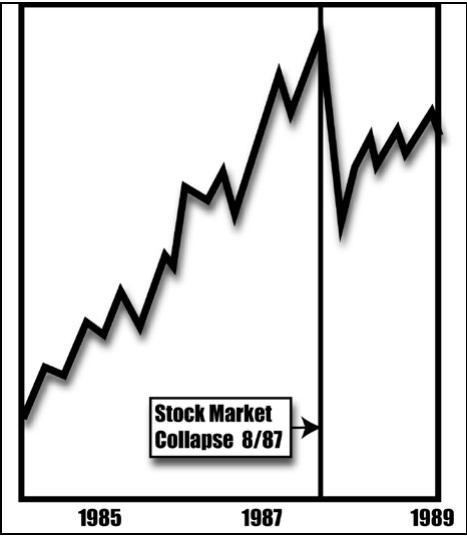

Third Turning Point: 1987

The third turning point came on August 25, 1987. This followed a seven-month boom in stock market prices beginning at the start of the year. At the end of August the S&P 500 reached a peak of 336 and then began to fall. That collapse contained, in October, the greatest stock market percentage crash in American history, known as “Black Monday.”

The descent was short lived, reaching its conclusion on December 4, 1987, at a low point of 224. Its short and unique nature avoided triggering a recession. But in its brief duration its impact was severe, causing the market to lose over 33 percent of its worth. It took two years to regain the levels lost in August 1987. It became one of the most enigmatic collapses in financial history. Its causes are still debated to this day.

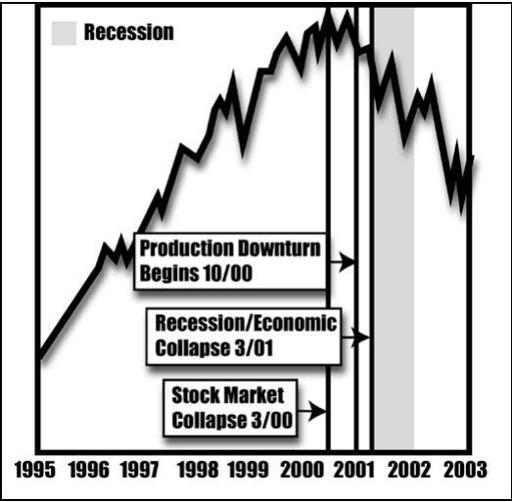

Fourth Turning Point: 2000

The stock market reached its fourth major apogee on March 24, 2000, attaining a level of 1,527. Its fall coincided with the bursting of the Dot-Com Bubble. This led to an economic recession in March of 2001. The recession continued until November of 2001. In the midst of the recession came 9/11. The impact of the events of 9/11 caused one of the most dramatic collapses in Wall Street history and further crippled the nation’s financial realm. The market continued a long descent until hitting bottom on October 9, 2002, having lost 49 percent of its value. In this case the financial collapse preceded, exceeded, and contained the economic collapse.

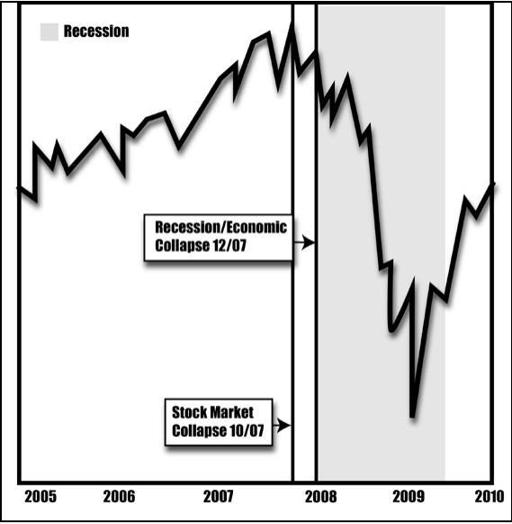

Fifth Turning Point: 2007

The fifth turning point took place on October 9, 2007, when the S&P 500 peaked at 1,565. The stock market then began a dramatic year-and-a-half collapse. Soon after the financial turning point came the economic turning point as the economy entered into recession in December 2007. The financial collapse reached its lowest point on March 9, 2009, at 676, having lost over 56 percent of its value. Three months later, in June 2009, the recession drew to its close. The period between apogee and the trough became known as “the Great Recession.”

The Mystery of Cycles

We have just looked at the five major peaks in modern stock market history or the five major turning points and collapses in the financial world. Is there anything striking about the resulting picture?

When do the greatest peaks and key turning points of modern stock market history take place?

•

The first takes place in 1973.

•

The second takes place in 1980.

•

The third takes place in 1987.

•

The fourth takes place in 2000.

•

And the fifth takes place in 2007.

What is the relationship of one peak to the next? The math is, of course, simple, but for the sake of clarity, here it is:

•

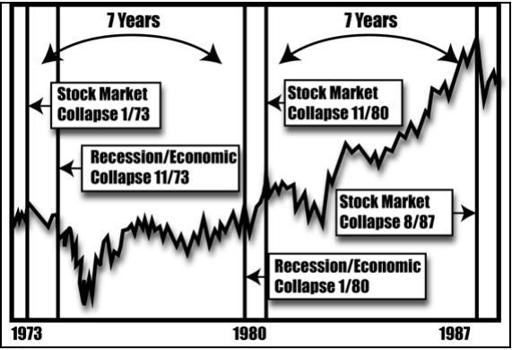

The first and second peaks and turning points, of 1973 and 1980—a cycle of seven years

•

The second and third peaks, of 1980 and 1987—a cycle of seven years

•

The fourth and fifth peaks, of 2000 and 2007—a cycle of seven years

The mystery of the Shemitah ordains that an economic and financial transformation take place in the seventh year. Thus these two realms are altered according to a seven-year cycle. What we see now in the rise and fall of the stock market is that all five of the greatest peaks or turning points in modern financial history are connected to the preceding peak or the following peak by a cycle of seven years.

Crashes of 1973, 1980, and 1987 Seven-Year Cycles