Thinking, Fast and Slow (41 page)

Read Thinking, Fast and Slow Online

Authors: Daniel Kahneman

Next, consider the two causes in joint evaluation. Which of the two, dolphins or farmworkers, deserves a larger dollar contribution? Joint evaluation highlights a feature that was not noticeable in si Bmakecksider the ngle evaluation but is recognized as decisive when detected: farmers are human, dolphins are not. You knew that, of course, but it was not relevant to the judgment that you made in single evaluation. The fact that dolphins are not human did not arise because all the issues that were activated in your memory shared that feature. The fact that farmworkers are human did not come to mind because all public-health issues involve humans. The narrow framing of single evaluation allowed dolphins to have a higher intensity score, leading to a high rate of contributions by intensity matching. Joint evaluation changes the representation of the issues: the “human vs. animal” feature becomes salient only when the two are seen together. In joint evaluation people show a solid preference for the farmworkers and a willingness to contribute substantially more to their welfare than to the protection of a likable non-human species. Here again, as in the cases of the bets and the burglary shooting, the judgments made in single and in joint evaluation will not be consistent.

Christopher Hsee, of the University of Chicago, has contributed the following example of preference reversal, among many others of the same type. The objects to be evaluated are secondhand music dictionaries.

| Dictionary A | Dictionary B |

Year of publication | 1993 | 1993 |

Number of entries | 10,000 | 20,000 |

Condition | Like new | Cover torn, otherwise like new |

When the dictionaries are presented in single evaluation, dictionary A is valued more highly, but of course the preference changes in joint evaluation. The result illustrates Hsee’s

evaluability hypothesis

: The number of entries is given no weight in single evaluation, because the numbers are not “evaluable” on their own. In joint evaluation, in contrast, it is immediately obvious that dictionary B is superior on this attribute, and it is also apparent that the number of entries is far more important than the condition of the cover.

Unjust Reversals

There is good reason to believe that the administration of justice is infected by predictable incoherence in several domains. The evidence is drawn in part from experiments, including studies of mock juries, and in part from observation of patterns in legislation, regulation, and litigation.

In one experiment, mock jurors recruited from jury rolls in Texas were asked to assess punitive damages in several civil cases. The cases came in pairs, each consisting of one claim for physical injury and one for financial loss. The mock jurors first assessed one of the scenarios and then they were shown the case with which it was Bmak in, eac paired and were asked to compare the two. The following are summaries of one pair of cases:

Case 1: A child suffered moderate burns when his pajamas caught fire as he was playing with matches. The firm that produced the pajamas had not made them adequately fire resistant.

Case 2: The unscrupulous dealings of a bank caused another bank a loss of $10 million.

Half of the participants judged case 1 first (in single evaluation) before comparing the two cases in joint evaluation. The sequence was reversed for the other participants. In single evaluation, the jurors awarded higher punitive damages to the defrauded bank than to the burned child, presumably because the size of the financial loss provided a high anchor.

When the cases were considered together, however, sympathy for the individual victim prevailed over the anchoring effect and the jurors increased the award to the child to surpass the award to the bank. Averaging over several such pairs of cases, awards to victims of personal injury were more than twice as large in joint than in single evaluation. The jurors who saw the case of the burned child on its own made an offer that matched the intensity of their feelings. They could not anticipate that the award to the child would appear inadequate in the context of a large award to a financial institution. In joint evaluation, the punitive award to the bank remained anchored on the loss it had sustained, but the award to the burned child increased, reflecting the outrage evoked by negligence that causes injury to a child.

As we have seen, rationality is generally served by broader and more comprehensive frames, and joint evaluation is obviously broader than single evaluation. Of course, you should be wary of joint evaluation when someone who controls what you see has a vested interest in what you choose. Salespeople quickly learn that manipulation of the context in which customers see a good can profoundly influence preferences. Except for such cases of deliberate manipulation, there is a presumption that the comparative judgment, which necessarily involves System 2, is more likely to be stable than single evaluations, which often reflect the intensity of emotional responses of System 1. We would expect that any institution that wishes to elicit thoughtful judgments would seek to provide the judges with a broad context for the assessments of individual cases. I was surprised to learn from Cass Sunstein that jurors who are to assess punitive damages are explicitly prohibited from considering othe

r cases. The legal system, contrary to psychological common sense, favors single evaluation.

In another study of incoherence in the legal system, Sunstein compared the administrative punishments that can be imposed by different U.S. government agencies including the Occupational Safety and Health Administration and the Environmental Protection Agency. He concluded that “within categories, penalties seem extremely sensible, at least in the sense that the more serious harms are punished more severely. For occupational safety and health violations, the largest penalties are for repeated violations, the next largest for violations that are both willful and serious, and the least serious for failures to engage in the requisite record-keeping.” It should not surprise you, however, that the size of penalties varied greatly across agencies, in a manner that reflected politics and history more than any global concern for fairness. The fine for a “serious violation” of the regulations concerning worker safety is capped at $7,000, while a vi Bmaknseflected polation of the Wild Bird Conservation Act can result in a fine of up to $25,000. The fines are sensible in the context of other penalties set by each agency, but they appear odd when compared to each other. As in the other examples in this chapter, you can see the absurdity only when the two cases are viewed together in a broad frame. The system of administrative penalties is coherent within agencies but incoherent globally.

Speaking of Reversals

“The BTU units meant nothing to me until I saw how much air-conditioning units vary. Joint evaluation was essential.”

“You say this was an outstanding speech because you compared it to her other speeches. Compared to others, she was still inferior.”

“It is often the case that when you broaden the frame, you reach more reasonable decisions.”

“When you see cases in isolation, you are likely to be guided by an emotional reaction of System 1.”

Italy and France competed in the 2006 final of the World Cup. The next two sentences both describe the outcome: “Italy won.” “France lost.” Do those statements have the same meaning? The answer depends entirely on what you mean by

meaning

.

For the purpose of logical reasoning, the two descriptions of the outcome of the match are interchangeable because they designate the same state of the world. As philosophers say, their truth conditions are identical: if one of these sentences is true, then the other is true as well. This is how Econs understand things. Their beliefs and preferences are reality-bound. In particular, the objects of their choices are states of the world, which are not affected by the words chosen to describe them.

There is another sense of

meaning

, in which “Italy won” and “France lost” do not have the same meaning at all. In this sense, the meaning of a sentence is what happens in your associative machinery while you understand it. The two sentences evoke markedly different associations. “Italy won” evokes thoughts of the Italian team and what it did to win. “France lost” evokes thoughts of the French team and what it did that caused it to lose, including the memorable head butt of an Italian player by the French star Zidane. In terms of the associations they bring to mind—how System 1 reacts to them—the two sentences really “mean” different things. The fact that logically equivalent statements evoke different reactions makes it impossible for Humans to be as reliably rational as Econs.

Emotional Framing

Amos and I applied the label of framing effects to the unjustified influences of formulation on beliefs an Con d preferences. This is one of the examples we used:

Would you accept a gamble that offers a 10% chance to win $95 and a 90% chance to lose $5?

Would you pay $5 to participate in a lottery that offers a 10% chance to win $100 and a 90% chance to win nothing?

First, take a moment to convince yourself that the two problems are identical. In both of them you must decide whether to accept an uncertain prospect that will leave you either richer by $95 or poorer by $5. Someone whose preferences are reality-bound would give the same answer to both questions, but such individuals are rare. In fact, one version attracts many more positive answers: the second. A bad outcome is much more acceptable if it is framed as the cost of a lottery ticket that did not win than if it is simply described as losing a gamble. We should not be surprised:

losses

evokes stronger negative feelings than

costs

. Choices are not reality-bound because System 1 is not reality-bound.

The problem we constructed was influenced by what we had learned from Richard Thaler, who told us that when he was a graduate student he had pinned on his board a card that said costs are not losses. In his early essay on consumer behavior, Thaler described the debate about whether gas stations would be allowed to charge different prices for purchases paid with cash or on credit. The credit-card lobby pushed hard to make differential pricing illegal, but it had a fallback position: the difference, if allowed, would be labeled a cash discount, not a credit surcharge. Their psychology was sound: people will more readily forgo a discount than pay a surcharge. The two may be economically equivalent, but they are not emotionally equivalent.

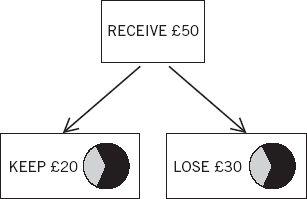

In an elegant experiment, a team of neuroscientists at University College London combined a study of framing effects with recordings of activity in different areas of the brain. In order to provide reliable measures of the brain response, the experiment consisted of many trials. Figure 14 illustrates the two stages of one of these trials.

First, the subject is asked to imagine that she received an amount of money, in this example £50.

The subject is then asked to choose between a sure outcome and a gamble on a wheel of chance. If the wheel stops on white she “receives” the entire amount; if it stops on black she gets nothing. The sure outcome is simply the expected value of the gamble, in this case a gain of £20.

Figure 14

As shown, the same sure outcome can be framed in two different ways: as KEEP £20 or as LOSE £30. The objective outcomes are precisely identical in the two frames, and a reality-bound Econ would respond to both in the same way—selecting either the sure thing or the gamble regardless of the frame—but we already know that the Human mind is not bound to reality. Tendencies to approach or avoid are evoked by the words, and we expect System 1 to be biased in favor of the sure option when it is designated as KEEP and against that same option when it is designated as LOSE.

The experiment consisted of many trials, and each participant encountere Bon p>

The activity of the brain was recorded as the subjects made each decision. Later, the trials were separated into two categories:

1 Trials on which the subject’s choice conformed to the frame

preferred the sure thing in the KEEP version

preferred the gamble in the LOSS version

2 Trials in which the choice did not conform to the frame.

The remarkable results illustrate the potential of the new discipline of neuroeconomics—the study of what a person’s brain does while he makes decisions. Neuroscientists have run thousands of such experiments, and they have learned to expect particular regions of the brain to “light up”—indicating increased flow of oxygen, which suggests heightened neural activity—depending on the nature of the task. Different regions are active when the individual attends to a visual object, imagines kicking a ball, recognizes a face, or thinks of a house. Other regions light up when the individual is emotionally aroused, is in conflict, or concentrates on solving a problem. Although neuroscientists carefully avoid the language of “this part of the brain does such and such…,” they have learned a great deal about the “personalities” of different brain regions, and the contribution of analyses of brain activity to psychological interpretation has greatly improved. The framing study yielded three main findings:

- A region that is commonly associated with emotional arousal (the amygdala) was most likely to be active when subjects’ choices conformed to the frame. This is just as we would expect if the emotionally loaded words KEEP and LOSE produce an immediate tendency to approach the sure thing (when it is framed as a gain) or avoid it (when it is framed as a loss). The amygdala is accessed very rapidly by emotional stimuli—and it is a likely suspect for involvement in System 1.

- A brain region known to be associated with conflict and self-control (the anterior cingulate) was more active when subjects did not do what comes naturally—when they chose the sure thing in spite of its being labeled LOSE. Resisting the inclination of System 1 apparently involves conflict.

- The most “rational” subjects—those who were the least susceptible to framing effects—showed enhanced activity in a frontal area of the brain that is implicated in combining emotion and reasoning to guide decisions. Remarkably, the “rational” individuals were not those who showed the strongest neural evidence of conflict. It appears that these elite participants were (often, not always) reality-bound with little conflict.

By joining observations of actual choices with a mapping of neural activity, this study provides a good illustration of how the emotion evoked by a word can “leak” into the final choice.

An experiment that Amos carried out with colleagues at Harvard Medical School is the classic example of emotional framing. Physician participants were given statistics about the outcomes of two treatments for lung cancer: surgery and radiation. The five-year survival rates clearly favor surgery, but in the short term surgery is riskier than radiation. Half the participants read statistics about survival rates, the others received the same information in terms of mortality rates. The two descriptions of the short-term outcomes of surgery were:

The one-month survival rate is 90%.

There is 10% mortality in the first month.

You already know the results: surgery was much more popular in the former frame (84% of physicians chose it) than in the latter (where 50% favored radiation). The logical equivalence of the two descriptions is transparent, and a reality-bound decision maker would make the same choice regardless of which version she saw. But System 1, as we have gotten to know it, is rarely indifferent to emotional words: mortality is bad, survival is good, and 90% survival sounds encouraging whereas 10% mortality is frightening. An important finding of the study is that physicians were just as susceptible to the framing effect as medically unsophisticated people (hospital patients and graduate students in a business school). Medical training is, evidently, no defense against the power of framing.

The KEEP–LOSE study and the survival–mortality experiment differed in one important respect. The participants in the brain-imaging study had many trials in which they encountered the different frames. They had an opportunity to recognize the distracting effects of the frames and to simplify their task by adopting a common frame, perhaps by translating the LOSE amount into its KEEP equivalent. It would take an intelligent person (and an alert System 2) to learn to do this, and the few participants who managed the feat were probably among the “rational” agents that the experimenters identified. In contrast, the physicians who read the statistics about the two therapies in the survival frame had no reason to suspect that they would have made a different choice if they had heard the same statistics framed in terms of mortality. Reframing is effortful and System 2 is normally lazy. Unless there is an obvious reason to do otherwise, most of us passively accept decision problems as they are framed and therefore rarely have an opportunity to discover the extent to which our preferences are

frame-bound

rather than

reality-bound

.

Empty Intuitions

Amos and I introduced our discussion of framing by an example that has become known as the “Asian disease problem”:

Imagine that the United States is preparing for the outbreak of an unusual Asian disease, which is expected to kill 600 people. Two alternative programs to combat the disease have been proposed. Assume that the exact scientific estimates of the consequences of the programs are as follows:

If program A is adopted, 200 people will be saved.

If program B is adopted, there is a one-third probability that 600 people will be saved and a two-thirds probability that no people will be saved.

A substantial majority of respondents choose program A: they prefer the certain option over the gamble.

The outcomes of the programs are framed differently in a second version:

If program A' is adopted, 400 people will die.

If program B' is adopted, there is a one-third probability that nobody will die and a two-thirds probability that 600 people will die.

Look closely and compare the two versions: the consequences of programs A and A' are identical; so are the consequences of programs B and B'. In the second frame, however, a large majority of people choose the gamble.

The different choices in the two frames fit prospect theory, in which choices between gambles and sure things are resolved differently, depending on whether the outcomes are good or bad. Decision makers tend to prefer the sure thing over the gamble (they are risk averse) when the outcomes are good. They tend to reject the sure thing and accept the gamble (they are risk seeking) when both outcomes are negative. These conclusions were well established for choices about gambles and sure things in the domain of money. The disease problem shows that the same rule applies when the outcomes are measured in lives saved or lost. In this context, as well, the framing experiment reveals that risk-averse and risk-seeking preferences are not reality-bound. Preferences between the same objective outcomes reverse with different formulations.

An experience that Amos shared with me adds a grim note to the story. Amos was invited to give a speech to a group of public-health professionals—the people who make decisions about vaccines and other programs. He took the opportunity to present them with the Asian disease problem: half saw the “lives-saved” version, the others answered the “lives-lost” question. Like other people, these professionals were susceptible to the framing effects. It is somewhat worrying that the officials who make decisions that affect everyone’s health can be swayed by such a superficial manipulation—but we must get used to the idea that even important decisions are influenced, if not governed, by System 1.