All The Devils Are Here: Unmasking the Men Who Bankrupted the World (70 page)

Read All The Devils Are Here: Unmasking the Men Who Bankrupted the World Online

Authors: Joe Nocera,Bethany McLean

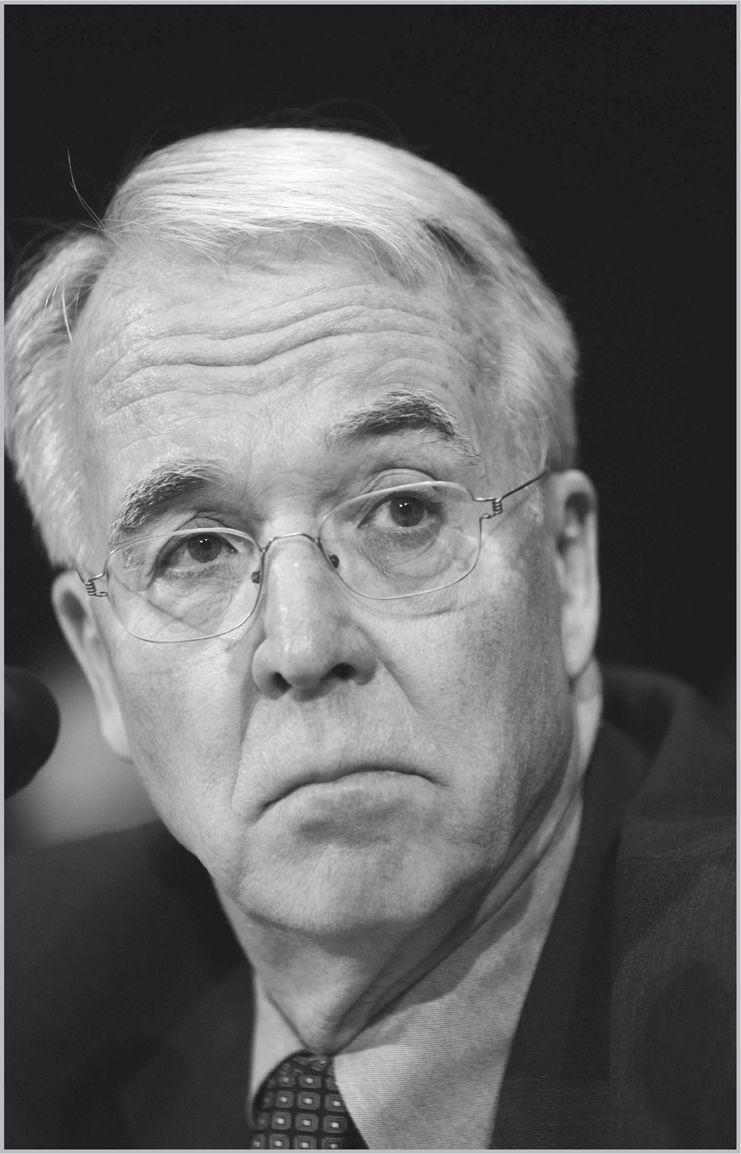

A tenacious lawyer, Brooksley Born attempted to increase oversight of derivative dealers as chair of the CFTC, but was thwarted by her fellow regulators.

(© Larry Downing/Reuters)

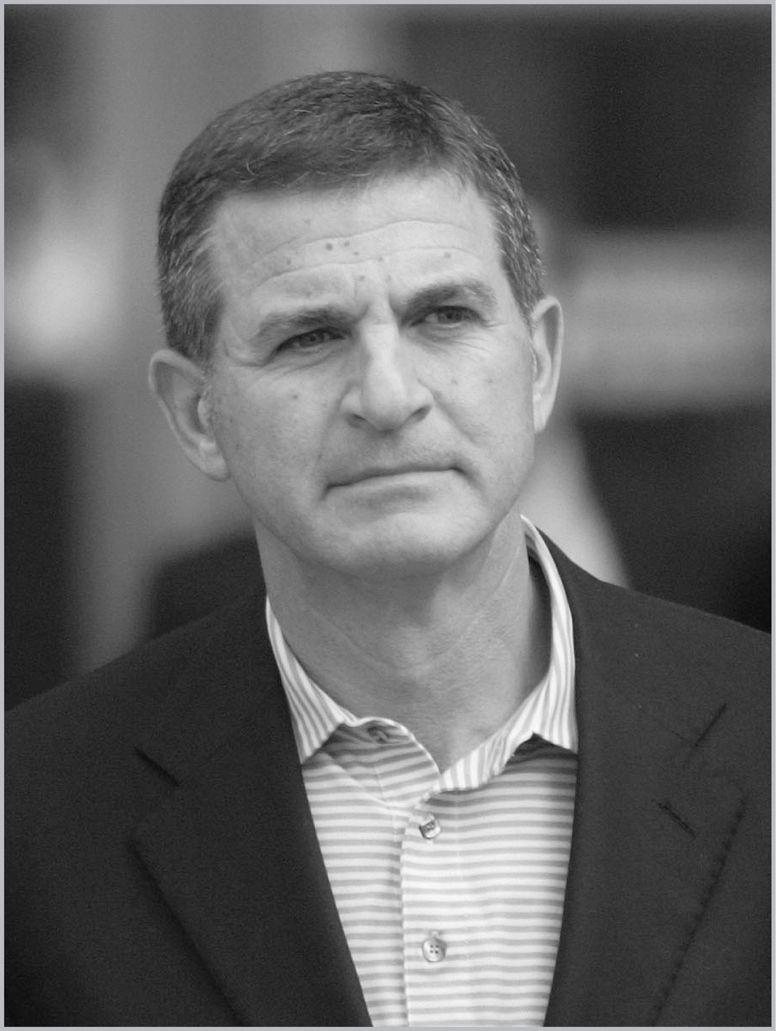

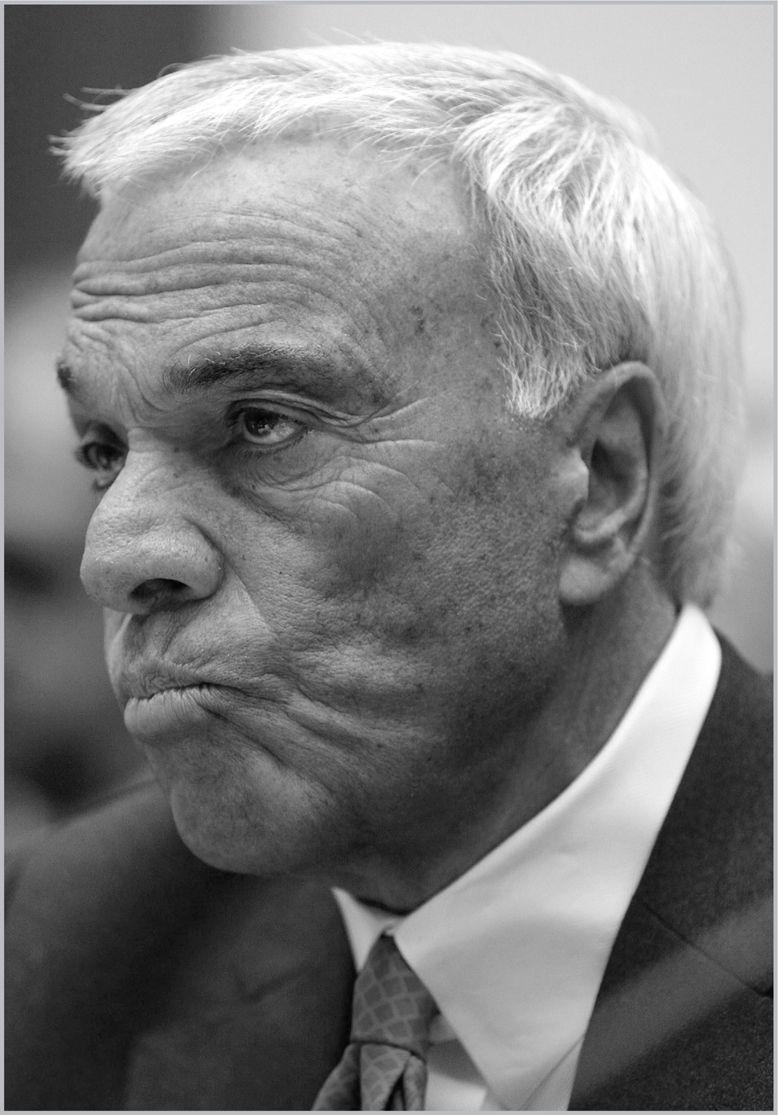

Edward “Ned” Gramlich was one of the leading critics of subprime mortgages, but as a governor of Greenspan’s Federal Reserve, he was a minority of one.

(© Bloomberg/Getty Images)

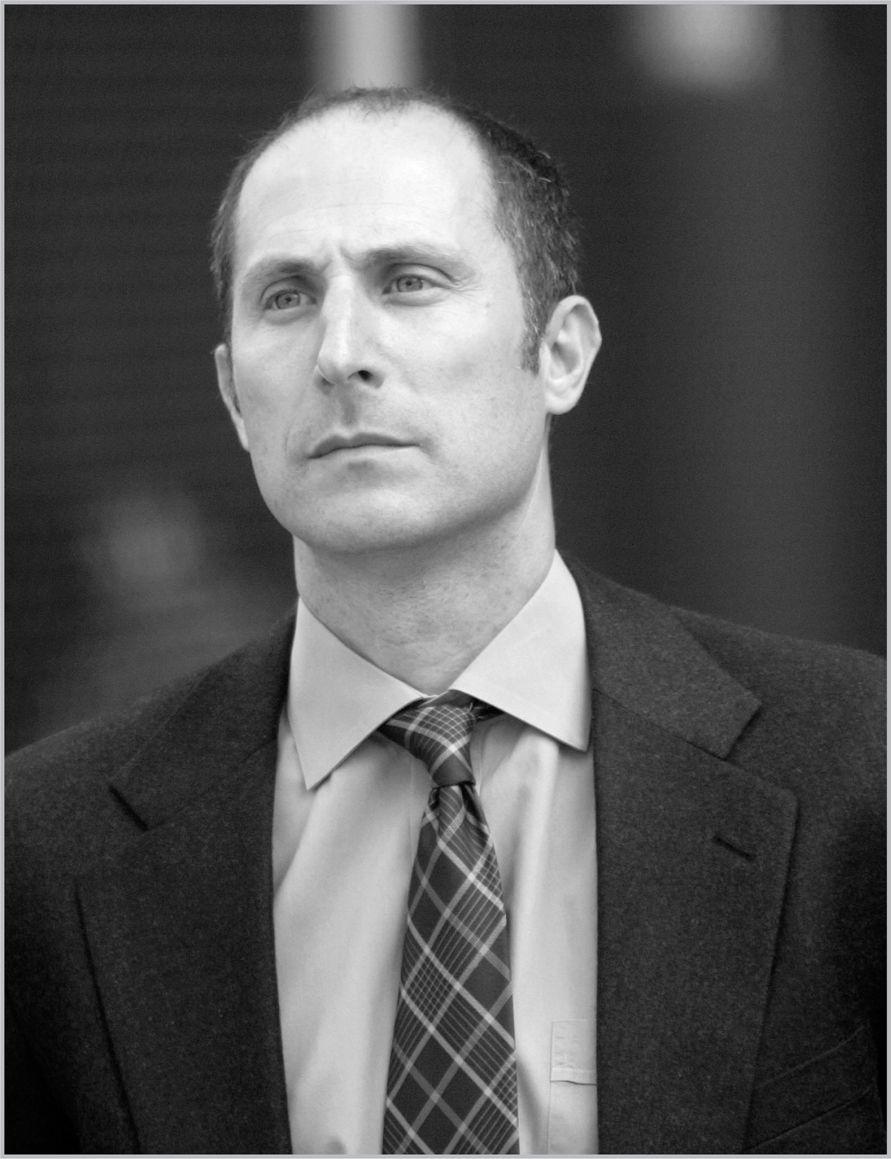

Ralph Cioffi and Matthew Tannin, who ran two hedge funds with $20 billion in investments for Bear Stearns. The collapse of the fund in the summer of 2007 marked the onset of the financial crisis.

(Both photographs: © Chip East/Reuters)

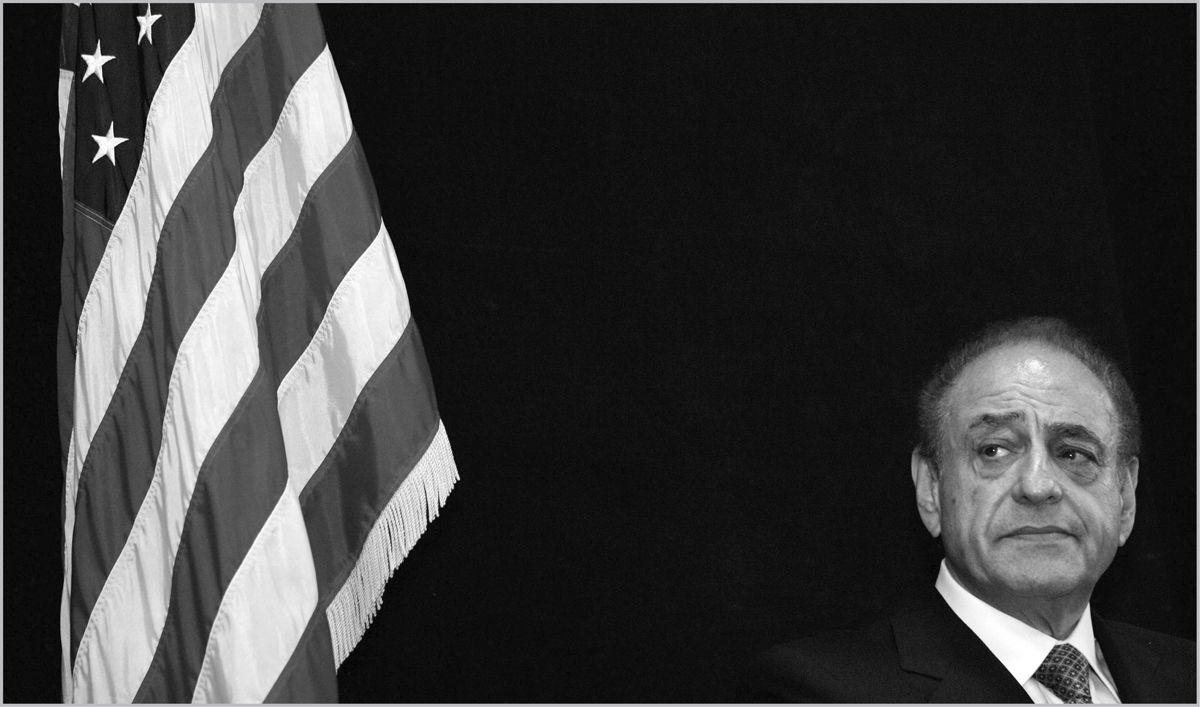

Roland Arnall was a respected philanthropist and diplomat, but he made his fortune building Ameriquest, a subprime lending empire that relied on blatantly deceptive lending practices. Other lenders adopted similar tactics in an effort to compete with Ameriquest.

(© Bas Czerwinski/AP Photo)

Angelo Mozilo, the CEO of Countrywide Financial, dreamed of spreading home-ownership to the masses and became a billionaire in the process. But he couldn’t resist pressure to enter the subprime mortgage business.

(© Mark Wilson/Getty Images)

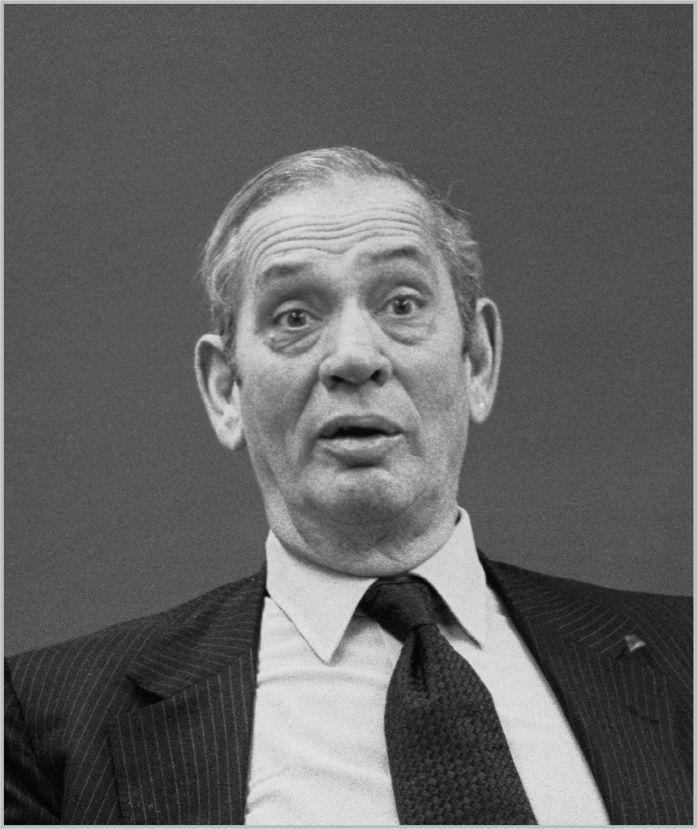

Gus Levy, Rubin’s mentor, was a tough trader who rose to run Goldman Sachs from 1969 to until his death in 1976.

(© Bettmann/CORBIS)

Henry “Hank” Paulson Jr., Steve Friedman, and Jon Corzine (left to right). After Friedman departed as senior partner in 1994, Corzine persuaded the partnership to turn Goldman Sachs into a public company. Shortly before the IPO, he was ousted in a coup and replaced by Paulson. Goldman attempted to portray Corzine’s departure as an amicable event.

(© Ed Quinn/Corbis)

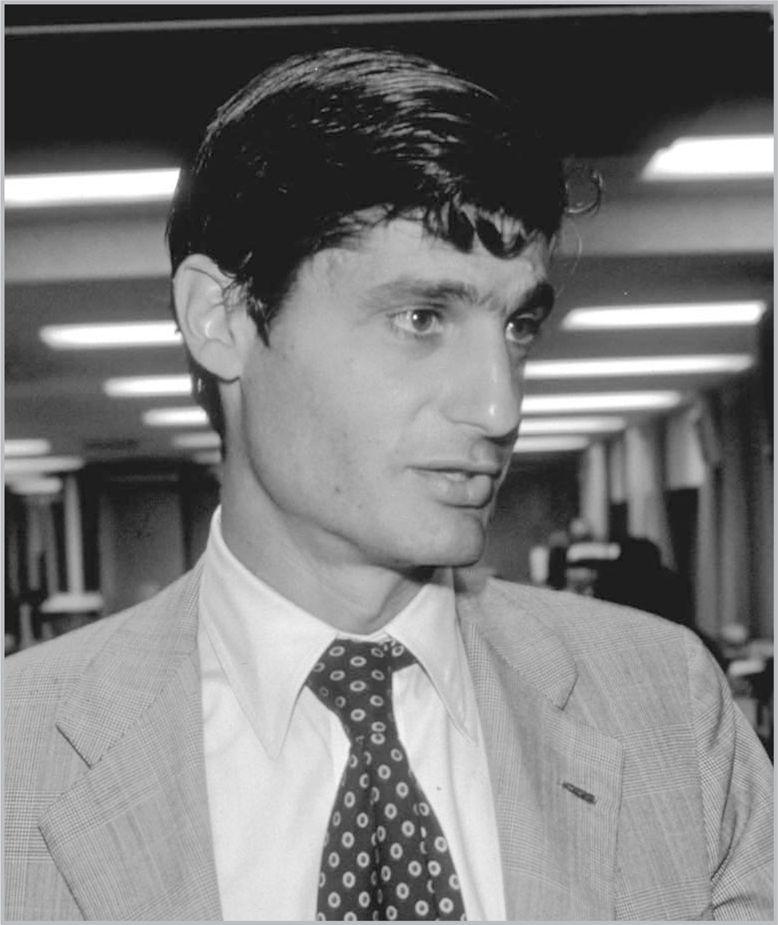

Robert Rubin’s tenure at Goldman Sachs coincided with the firm’s rise as a global powerhouse. But in the 1980s, “he was always the guy saying, ‘I’m not sure how much principal risk we should be taking with the derivative book.’”

(© John Marmaras/Woodfin Camp/Getty Images)

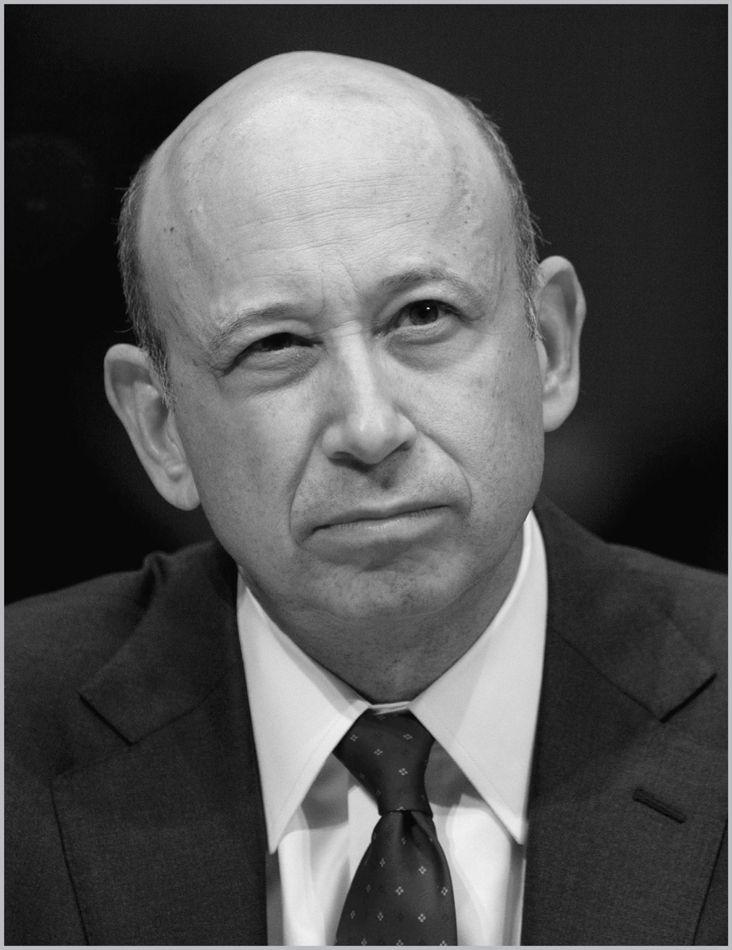

Goldman Sachs CEO Lloyd Blankfein helped engineer the shift at Goldman that critics say turned “customers” into “counterparties.”

(© Bloomberg/Getty Images)

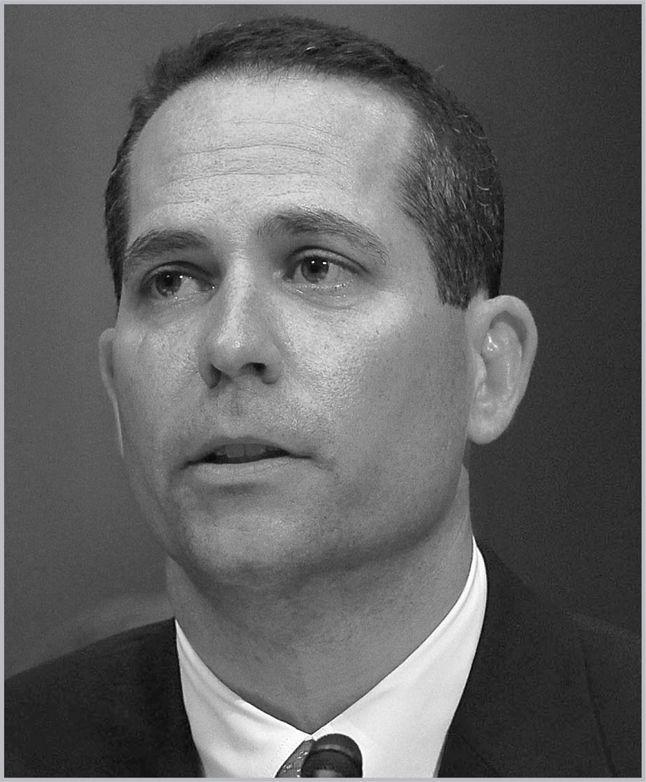

Under Dan Sparks, Goldman Sachs’s mortgage department moved aggressively to get subprime mortgage exposure off the company’s books.

(© Mark Wilson/Getty Images)

Goldman Sachs mortgage trader Fabrice Tourre at a Senate subcommittee hearing on April 27, 2010. Tourre was the only Goldman employee named in the SEC’s suit when it charged the company with fraud.

(© ASTRID RIECKEN/epa/Corbis)