All The Devils Are Here: Unmasking the Men Who Bankrupted the World (69 page)

Read All The Devils Are Here: Unmasking the Men Who Bankrupted the World Online

Authors: Joe Nocera,Bethany McLean

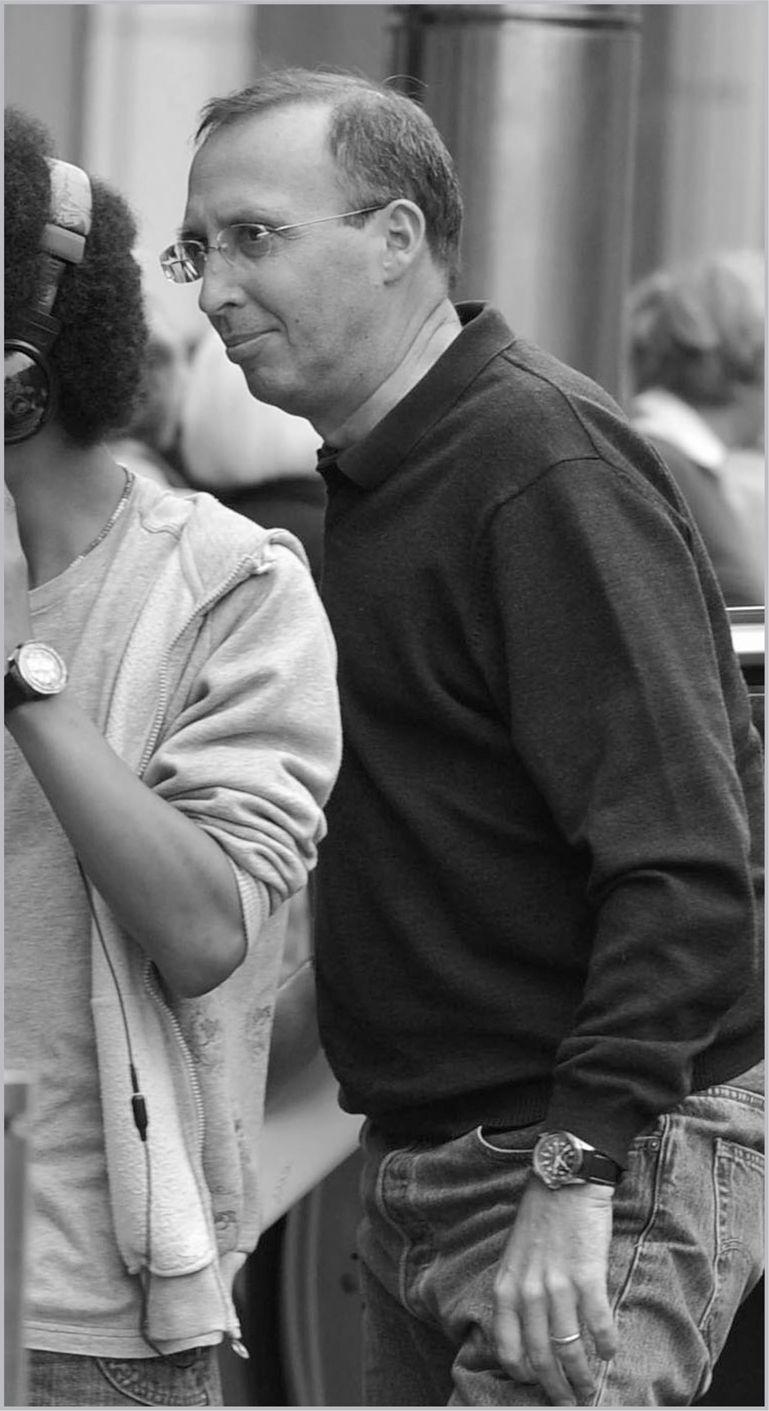

Joe Cassano was known for his raging temper and his modest lifestyle. He pushed AIG-FP to begin selling credit default swaps on CDOs. The AIG-FP swap contracts had “collateral triggers” that would eventually help bring the company down.

(© Parsons/Bauer-Griffin)

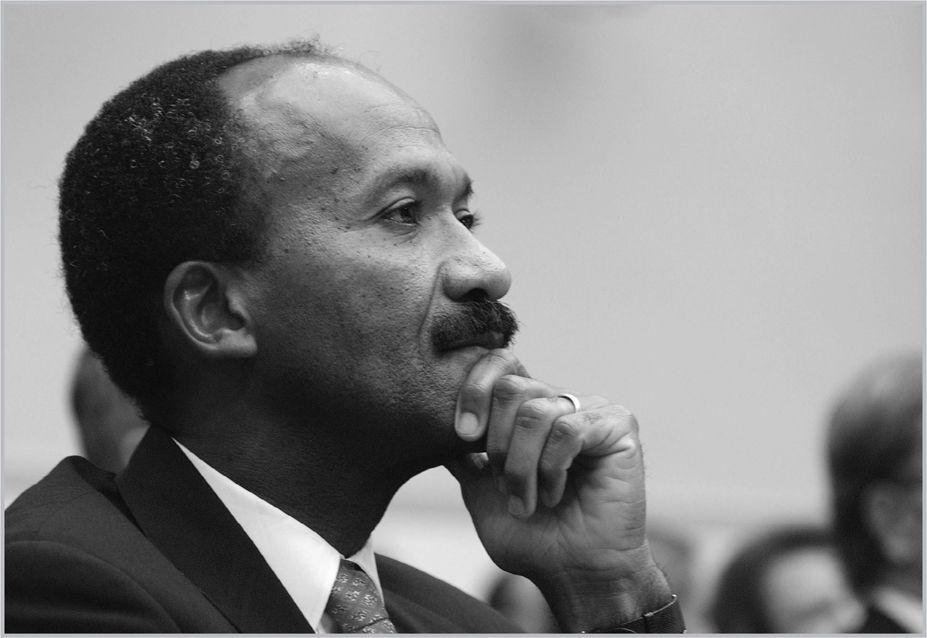

Jim Johnson and Franklin Raines followed David Maxwell as CEOs of Fannie Mae, driving up profits, bullying its regulator, and pushing the company further from its original mission.

(Johnson: © Manuel Balce Ceneta/AP Photo; Raines: © Bloomberg/Getty Images)

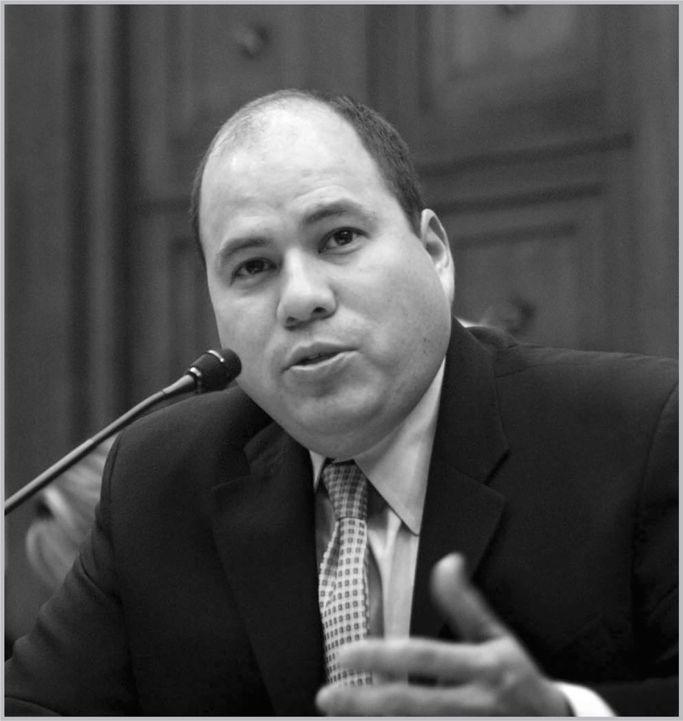

As the head of the OFHEO, Fannie Mae and Freddie Mac’s regulator, Armando Falcon Jr. went to war with the companies he was charged with regulating.

(© Bloomberg/Getty Images)

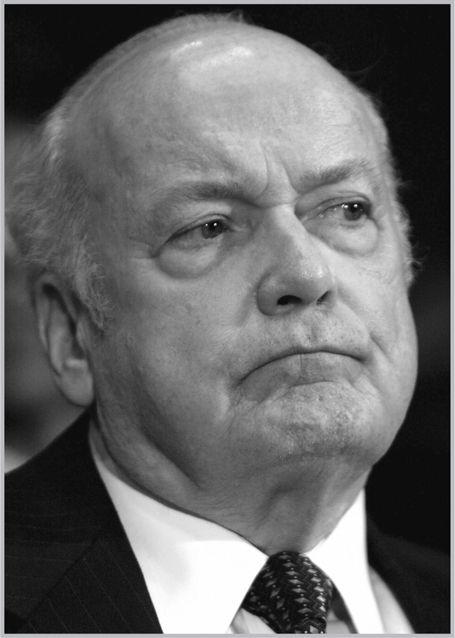

Daniel Mudd, who ran Fannie Mae from 2005 to 2008, described the many problems he faced as “a choice between poking my eye out and cutting off a finger.”

(© Bloomberg/Getty Images)

John Reich and James Gilleran, directors of the Office of Thrift Supervision under George W. Bush, pushed to get rid of what they saw as the red tape of regulation.

(Reich: © Jonathan Ernst/Reuters; Gilleran: © Paul J. Richards/Getty Images)

As comptroller of the currency from 1998 to 2004, John Hawke exempted banks from state and local regulations intended to curb subprime lending.

(© Scott J. Ferrell/Getty Images)

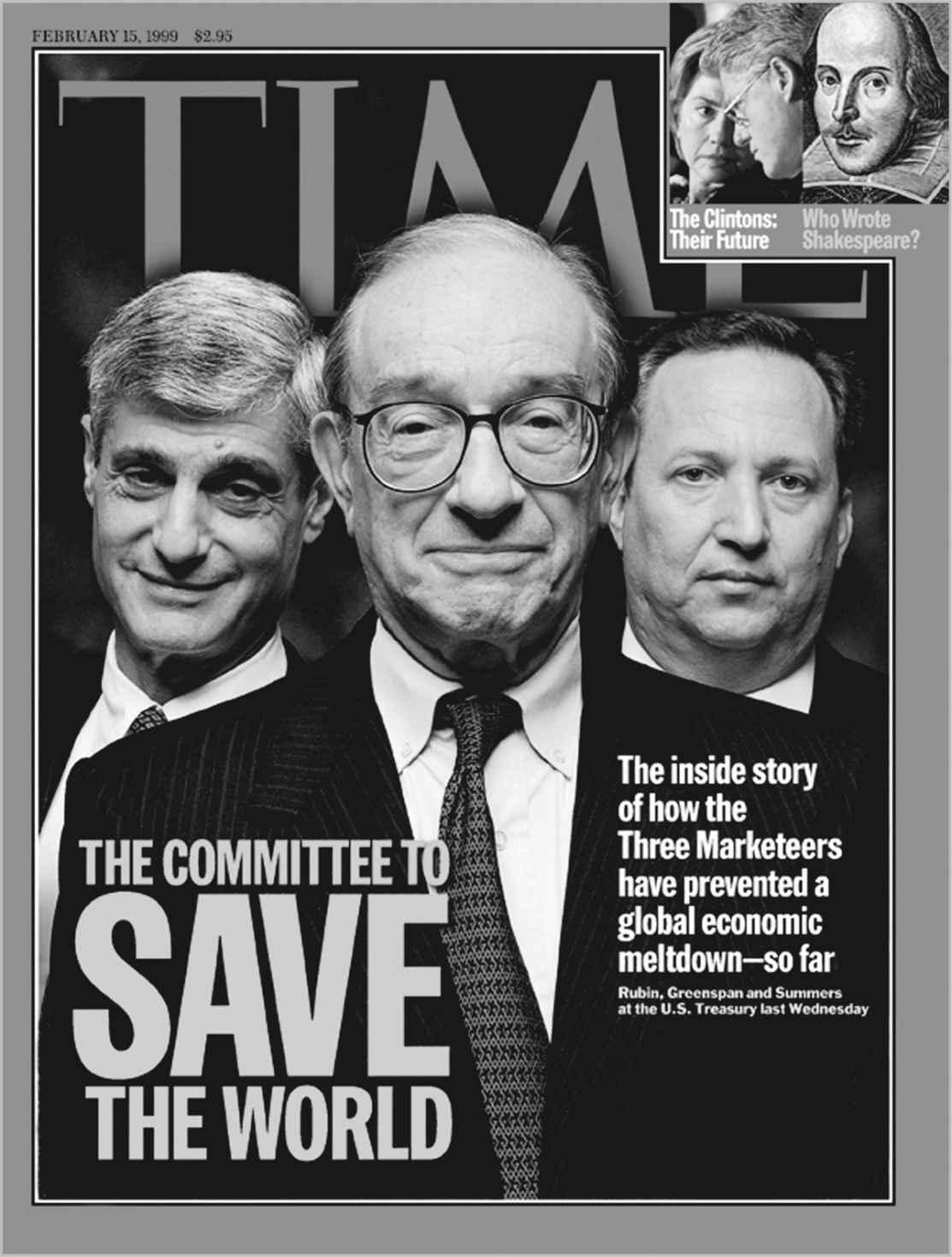

Robert Rubin, who spent twenty-six years at Goldman Sachs before becoming the secretary of the Treasury in 1995, knew firsthand the problems derivatives could cause. But he refused to do anything about them.

(© Bloomberg/Getty Images)

Larry Summers served as Robert Rubin’s deputy before succeeding him as Treasury secretary. On his watch, Treasury backed a law that exempted derivatives from regulation.

(© Reuters Photographer/Reuters)

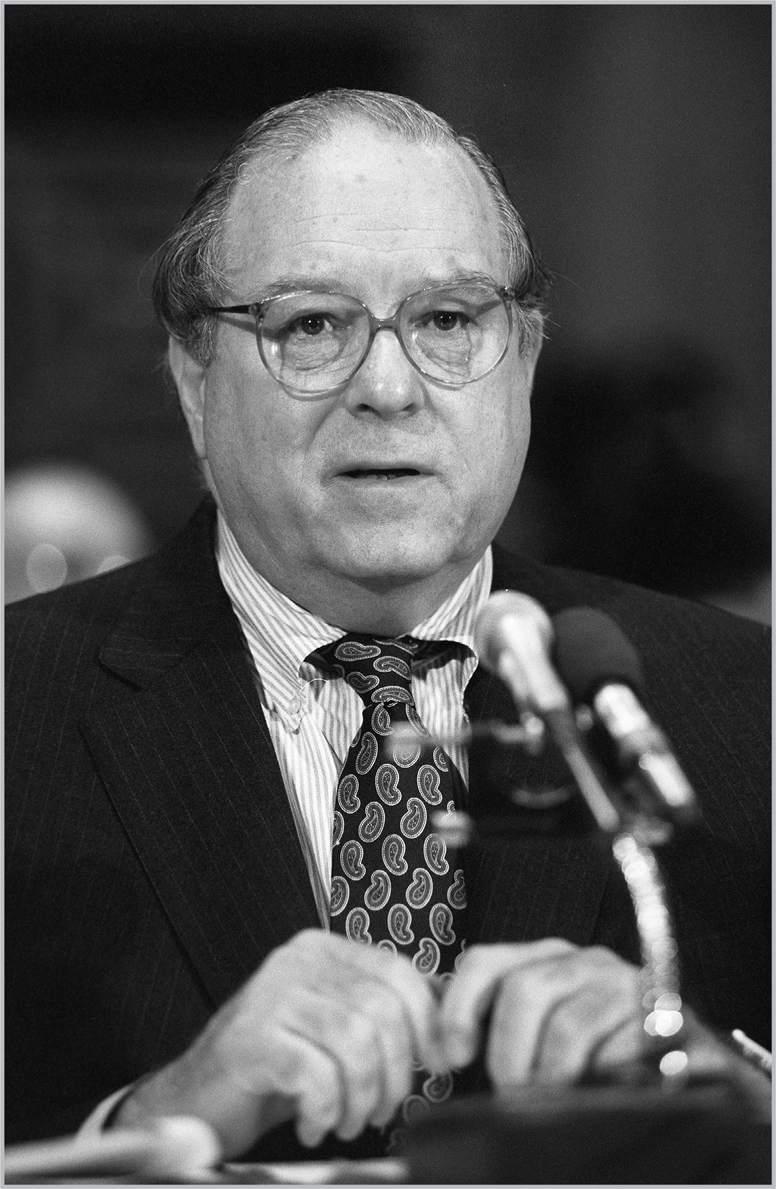

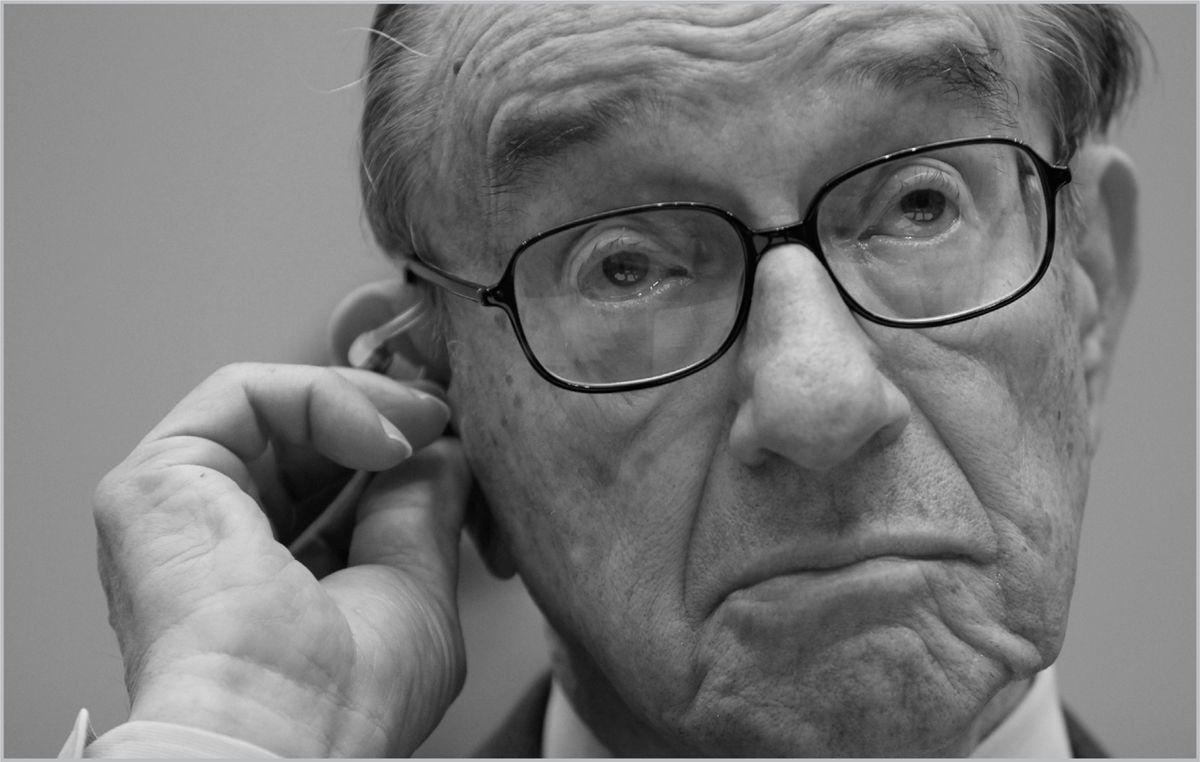

As chairman of the Federal Reserve, Alan Greenspan was seen as a heroic figure. Highly skeptical of regulation while in office, he later admitted that “market discipline” failed to curb the market’s excesses.

(© Kevin Lamarque/Reuters)

In a February 1999 cover story,

Time

proclaimed that Robert Rubin, Alan Greenspan, and Larry Summers “have outgrown ideology… . Their faith is in the markets and in their own ability to analyze them.”

(From TIME Covers Magazine, 2/15/1999 © 1999 Time Inc. Used under license. All rights reserved. Used by permission and protected by the Copyright Laws of the United States. The printing, copying, redistribution, or retransmission of the Material without express written permission is prohibited. TIME Covers and Time Inc. are not affiliated with, and do not endorse products or services of, Licensee.)