Don't Break the Bank: A Student's Guide to Managing Money (13 page)

Read Don't Break the Bank: A Student's Guide to Managing Money Online

Authors: Peterson's

Tags: #Azizex666

~

Rachel Cruze, dynamic speaker and daughter of financial expert Dave Ramsey

The “Rule of 72” is a term used in banking—it’s basically a little trick for figuring out how long it will take you to double your money at a certain interest rate. Here’s how it is explained on TheMint.org, operated by the Northwestern Mutual Foundation:

You take the interest rate you expect to earn and divide it into 72. If you expect a return of 6%, it will take 12 years to double your money.

Example:

You are 24 and have $3,000 in savings. You put it in an account that you expect to earn 8%. According to the Power of 72, it will take 9 years to double your money, so at age 33 you will have $6,000 if you add nothing more to the account. At age 42, you will have $12,000. Then, at age 60, you’ll have $48,000 from a $3,000 investment. Your money is working for you. All you had to do was to leave it alone!

How to Choose a Bank

There are a ton of banks out there—in some towns, it may seem like there’s a bank on every block, especially when you count

ATM

s, drive-through branches, and bank locations in grocery stores.

So how do you pick the best bank for you? There are a few things you need to think about. First, what different types of accounts does the bank offer? Banks often have several different types of checking and savings accounts, each with their own perks and fees. It’s important to check out the fees, as they can really add up.

You also want to think about location. Does the bank have a lot of branches and/or ATMs in your area and areas where you go frequently? If you’re in college or will be heading there soon, make sure you pick a bank that’s available in that area.

Questions to Ask

• Do I need a minimum

balance

in my account?

• What fees are charged for this account?

• How many ATMs do you have, and where?

• What fees will I be charged for

ATM

or

debit card

transactions?

Be sure to ask about any special perks or accounts the bank may offer for students. Just make sure you also find out what happens when you graduate or otherwise are no longer a student. You don’t want to suddenly start getting hit with a bunch of fees.

Bank vs. Credit Union

A credit union is another type of financial institution that is popular with many people. You must be a member of a credit union in order to be a customer. The rules of who can be a member vary. Some credit unions are for employees of a certain industry or company. The credit union is run by a board of directors.

Some people prefer credit unions because they tend to be smaller than banks and offer a more personal touch, unlike big banks where you are often dealing with what feels like a huge corporate machine.

Credit unions are becoming very common on college campuses and also offer some services that traditional banks do not. So, it may be worthwhile to check into some local credit unions in your area to see what they may be able to offer you.

Reading Your Bank Statement

Tales from a Real Teen

“I opened up a student account when I was 18 with a national bank. When I first had my account, there were no fees associated with my checking and savings account. However, when I graduated, I started having to pay close to $15 a month for my accounts and that can really add up over a year. You may also have to send your bank a current school transcript if you are in school for more than four years because most student accounts won’t maintain their student status longer than that without proof that you are still in school.”

~

Lindsay Long, Austin, Texas

You should get a bank statement every month. This statement is basically a log of all the activity for that account during the month. While banks traditionally sent statements via postal mail, many banks now allow you to access your statements online instead.

It’s important to read your statement carefully. For one thing, there’s always the possibility that there is some type of mistake. But you also need to make sure you are aware of every transaction, so that you have an accurate picture of your account and know exactly what your available balance is.

Depending on your bank, statements can range from simple to extremely complicated. If you access your statement online, there are often links where you can get more information about a particular transaction or find out what certain terms mean.

Common Terms Used by Banks

Assets:

Things that you own, such as your iPod and smartphone (if you’re lucky).

ATM:

Automated Teller Machine. It’s a machine that gives you money from your account.

Just remember that you need to deposit money in your account in order to take it out.

Balance:

The amount of money in your bank account.

Always pay close attention to what this is.

Bank:

A place that stores money for later use.

(The thing cheaters are in charge of in a MONOPOLY game.)

Cash:

Paper money and coins.

Check:

A written promise that the bank will pay someone money.

In the old days, it was written on an official piece of paper, but these days it’s often an electronic transaction.

Credit:

Buying on the promise that you will pay for it later.

Debit Card:

A card linked to a bank account used to pay for things instead of cash or check.

Interest:

Fee paid by the bank to use money.

Money:

Stuff used to exchange for goods and services.

Some would say it’s the source of all happiness.

Mortgage:

A loan from the bank used to buy a house.

PIN number:

Personal Identification Number, which you use to access your account.

Tip:

This should not be 1234. You think nobody would ever guess that number, but trust us, somebody will.

Withdrawal:

Money taken out of an account.

Check, Please!

Jump$tart Coalition did a survey on financial literacy among high school students. According to this study, only 45% of the high school seniors surveyed had a checking account. Once they go off to college and are more or less on their own, they begin making mistakes. Of those college students surveyed, 30% admitted to bouncing a check.

~ Danny Kofke, special education teacher and author of

“A Simple Book of Financial Wisdom: Teach Yourself (and Your Kids) How to Live Wealthy with Little Money”

(Wyatt-MacKenzie, September 2011)

A checking account allows you to deposit money that you can then use to pay for bills, purchases, and other expenses by writing out a check. (Most people use few actual paper checks these days; instead, they use their checking account to pay bills online using electronic payments.)

Unlike a savings account, a checking account usually doesn’t earn interest (although some banks are now offering interest-earning checking accounts—but there are often a lot of conditions you must meet in order to be eligible to earn interest with these accounts). So, if you want to stockpile money and let it grow, you would use a savings account. A checking account is mainly used to pay bills and expenses.

A checking account is an asset because it establishes a financial identity. It gives you credibility in the financial and professional worlds and means that you can both spend and receive money in an above-board way. When you’re in high school, there’s nothing wrong with operating on a cash-only basis, but that gets risky and cumbersome when you get older and your expenditures get more complex. A checkbook gives you credibility for not only employers, but rental agencies, car dealerships, and educational institutions.

Farewell to the Float

Up until fairly recently, when you wanted to pay for something with money from your checking account, you wrote out a paper check and gave it to the store or whomever you were paying. The receiver of your check would then deposit it at his or her bank and wait for it to clear. The process usually took several days. So even if you didn’t have enough money in your account to cover the check at the time you wrote it, you usually had a least a day or two in which you could make a deposit before the check would come in. This was often referred to as the “float” time.

These days, check processing is done electronically. In fact, at many stores, if you pay by check, the register actually scans the check and then the cashier returns it to you. That’s because the register’s computer is able to record the scanned information and electronically process the check. As a result, the money can be taken out of your account immediately. This means you can no longer enjoy the float.

Some people prefer to deal with local community banks, which tend to be smaller and often focus on a more individual, personal touch. To find a community bank, download The Independent Community Bankers of America’s (ICBA) free community bank locator app for your iPhone, Android, or Blackberry. Simply put in your zip code, and the ICBA locator app will show you all the community banks in your area.

Visit: http://www.icba.org/locate

Attack of the Killer Fees

It’s important to be aware of all the fees the bank may charge you. The type and amount of fees can vary widely depending on the type of account you have. Some banks charge you a fee if you write more than a certain number of checks each month. Your bank may also charge you a fee if your balance drops below a certain amount. The fees can really add up, so make sure you find out about all the fees you may need to worry about.

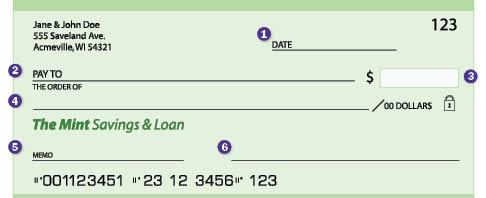

Practice Makes Perfect—Filling out a Check

Even though so much of banking takes place online these days, there are those occasions when you still will need to fill out a check. If you’ve never done this before, don’t worry. It’s not hard at all. Here are some tips below, thanks to TheMint.org: