Don't Break the Bank: A Student's Guide to Managing Money (6 page)

Read Don't Break the Bank: A Student's Guide to Managing Money Online

Authors: Peterson's

Tags: #Azizex666

Coinstar estimates there is more than $10 billion in loose change lying around in homes across the United States. You might want to check those couch cushions in your home!

Nickel

The nickel shows Thomas Jefferson on the front and Monticello (Jefferson’s estate in Virginia) on the back.

Dime

The dime is the smallest and thinnest of the coins in use today. The front shows Franklin Roosevelt, and the back shows a design with a torch, an olive branch, and an oak branch.

Quarter

The quarter (short for the quarter-dollar) features George Washington on the front. The design on the back has featured lots of different images in recent years.

From 1999 to 2008, the U.S. Mint conducted the 50 State Quarters program, where special quarters were released, one for each state, in the order in which the states joined the Union. Starting in 2010, the Mint began releasing a series of 56 quarters with designs of national parks and other important national sites as part of the America the Beautiful Quarters program.

This is the reverse side of the Yellowstone National Park version of the quarter (issued as part of the America the Beautiful Quarters program).

Half-Dollar

The half-dollar features John F. Kennedy on the front and a design based on the presidential seal on the back.

Dollar

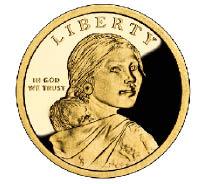

Right now, there are two dollar coins being produced in the United States: the Presidential $1 Coin Series (started in 2007) and the Native American $1 Coin. Both types of dollar coins look golden in color, although there is no gold in the mixture of metals used to make these coins.

Presidential $1 Coin

Native American $1 Coin

Inflation and How It Affects Your Money

Inflation is the rate at which the price of goods and services is rising. Example: if the inflation rate is 3%, then something that costs you a dollar today would cost you $1.03 a year from now.

The bad thing about inflation is it means your money won’t stretch as far as it previously did. If you make $100 a week now, you won’t be able to buy as much as you did a year or two ago with that same weekly salary. So as inflation increases, the amount of stuff you can buy decreases. (If you are really lucky, you have a job where your annual raise is roughly the same—or more than—the rate of inflation, but that’s pretty rare these days.)

Inflation and Buying Power

When talking about inflation, the term “buying power” is sometimes used to describe how much a certain amount of money would be worth in today’s economy—or what you could buy with that amount. For example, $100 in 1990 is the equivalent of $175.78 today, adjusted for inflation. So they have the same amount of buying power.

Inflation and its relation to rising prices or the value of money can be challenging to try and really understand, because in many cases it doesn’t seem to follow a formula.

For example, let’s take a look at how some prices today compare with those from 1990.

1990 Prices

A gallon of gas cost an average of $1.34 in 1990. Adjusted for inflation, it should cost $2.35 now. If you’ve put gas in a car lately—or heard someone else complain about the cost of filling up—you know that gas costs way more than that, so the prices have been rising much faster than the rate of inflation.

The average cost of a new car in 1990 was $16,000.If you adjust that for inflation, you have a price of $28,125 today.

(By the way, an IBM PS1 desktop computer—which saved files on storage devices called floppy disks—cost between $999 and $1,999 that year.)