Soldier of Finance (8 page)

Read Soldier of Finance Online

Authors: Jeff Rose

Gathering intelligence is the most important part of planning any military operation. Likewise, you cannot improve your credit score if you do not keep up with the information in your credit report. Now that you know how to check your report, there is no excuse for not keeping your eye on it.

Errors found on your credit report should be disputed as quickly as possible. This is not complicated, but it does require that you contact the credit reporting agency and the creditor. You can start with phone calls to clarify any questions you may have, but you will most likely need to write a letter to the creditor and each agency explaining the item you are disputing. Include copies (not originals) of any documents that support your claim. I recommend sending the letters by certified mail so that you have proof they were received.

Credit reporting companies (sometimes referred to as “bureaus”) will investigate your claims, usually within thirty days, unless they consider your claims to be frivolous. If the issue is decided in your favor, you can ask that they send a notice of the change to your credit report to anyone who has requested the report in the past six months.

Never assume that your report is correct. Keep up a regular reconnaissance by checking your report at least once a year. You could save yourself a lot of money.

Obtain Credit Report

- Log on to the website

www.AnnualCreditReport.com

. - Find one of the big three credit reporting companies.

- Follow the instructions for obtaining your free credit report.

- Print out the report and read through it carefully, looking for errors.

Â

Go / No Go

Credit Report Check

Have you obtained your credit report in the past year?

_______ Go     ________ No Go

Is the personal information on your credit report accurate?

_______ Go     ________ No Go

Does your credit report show late payments? Are they really payments you made late?

_______ Go     ________ No Go

Are there negative items in your credit report that should have been removed?

_______ Go     ________ No Go

Are there duplicate entries on your credit report?

_______ Go     ________ No Go

- A credit report is a history of your credit habits.

- As many as three-fourths of credit reports have errors that pull down credit scores.

- You need to regularly check your credit report.

- TransUnion, Experian, and Equifax are the best-known credit reporting companies. They will each provide a free credit report once a year. You also can obtain your credit score from them for a small fee.

- Make sure you get your true FICO score and not an impostor.

- You can request your credit report at

www.AnnualCreditReport.com

. - Your report will contain personal information, types of credit you use, how long you have had lines of credit, whether or not you have paid bills on time, credit balances and available credit, banking information, and other public records.

- Make sure that you check your credit report for errors.

THE LOW CRAWLâCREDIT REPAIR

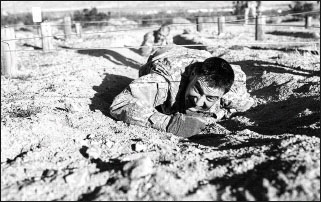

Part of our Army training consisted of learning the Military Low Crawl. I suppose it would have been pleasant if I liked the taste of dirt, but I didn't. Our drill sergeants, however, loved it! So, naturally, we spent a lot of time crawling.

The Low Crawl meant flattening ourselves face down on the ground, as low as possible, and dragging ourselves forward for long periods of time. The object was to stay as invisible as possible when approaching the enemy. To move, we extended our arms forward and slid our legs as far to the side and forward as we could without raising them from the ground. Then, using only our arms and legs, we slid forward along the ground.

The process is slow and methodical, and (hopefully) not very conspicuous. You don't want your enemy to know you are there. If you got too high or put your head up too far, that's when you could be seen and shot. The thing I most remember about the Low Crawl was that it took a lot of energy and I never felt like I was going anywhere.

This is not much different from how people feel when they first tackle the problem of fixing bad credit. It takes time, and you might not feel like you're getting very far. But steady progress is the only way you can get there. Don't be discouraged. Your credit can be fixed, no matter how bad it is. Not unlike making your way through a minefield, you cannot hurry through your credit repair.

Don't expect major results overnight. If you are able to pay down significant amounts of debt quickly, you might see some quick changes in your score, but most likely, it will take time. How much time depends on what is on your credit report. If there are some serious marks, such as bankruptcies or foreclosures, you might not see a great credit score until enough time has passed for those items to drop off the report. Most things drop off the report after seven years, but bankruptcies are there for ten. A few hits, such as applications for certain jobs or for large amounts of insurance, stay on your record indefinitely.

The Low Crawl is slow, and so is credit repair. In time, you do cover ground. Stick with it and you can regain a good credit score. Don't give up. The sooner you start, the sooner you'll get there.

A word of warning: Now that you're thinking about your credit, I have no doubt you will notice advertisements for quick ways to improve your credit score.

Do not fall for them.

They might improve your score a little in the short term, but down the road, unless you make changes in your credit history, the “fix” will be short-lived.

It doesn't take much to start improving your credit score. You can raise it if you work at it. There are a few essential steps you will need to take, and you must understand how credit works.

First, if you can't pay your bills, you can't establish a good credit record. The initial step is to get your financial life under control. Using the information from your SIT Report, assess your position. (If you haven't already done your SIT Report, see

Chapter 3

.) If your monthly debt payments are more than you are making, you will have to make some changes, such as getting a part-time job for a while or consolidating debts if you can. Trading in your expensive car for a cheaper one that you can afford could also prove prudent. Whatever it takes, you must be realistic about your position and act accordingly.

You may need to make some lifestyle changes. If you eat out a lot, learn how to cook. Everyone needs recreation time, but if you can't pay for expensive concert tickets or a day at a sporting event and still make your payments, find a less expensive form of relaxation, at least until your situation becomes manageable.

The most important thing to remember is that having credit cards and installment loans on your credit record demonstrates that you can be trusted to repay your debts, but only if you fulfill all the commitments you made when you took the loan. To keep your credit score high, you cannot miss payments. Ever.

I wish I could tell you that I have never gotten into unnecessary debt. But I have, which is how I know you can get it under control. I've done it.

The worst debt I've ever had came from the years I was in college. The National Guard paid my tuition and fees, and I had my one-weekend-a-month military service bringing in some money, in addition to a part-time job. There was absolutely no reason for me to get into debt.

Unfortunately, I inherited my father's money skills. I started applying for credit cards from a few local department stores. The Buckle, a clothing boutique for the young and trendy, was one of my favorites. Since I was young, I felt a great need to be trendy. It didn't take long to max out my card. Other cards weren't as bad, but I carried balances on all of them from month to month.

Then a friend educated me on the ease of getting student loans. My college was completely paid for, so I had absolutely no need for the loan, but I discovered all I had to do was apply and it was mine. It was easier than a payday loan. I filled out a couple of applications and within weeks a check for $2,700 arrived in the mail, with absolutely no requirements. I could spend it on anything I wanted. And I didn't have to begin to pay it back until after I graduated.

Three semesters on, I suddenly had student loans of more than $10,000. By that time my credit cards were up to $8,000. That's a lot of debt with virtually nothing to show for it other than a lot of junk that I not only didn't need, but wasn't worth $18,000.

My dilemma hit me one day and I became angry with myself when I realized how far I had let myself go. Enough was enough. I couldn't blame the credit card companies for extending the credit to me. It was my own fault that I bought things. I couldn't blame the government for giving me a student loan that I had no business applying for in the first place. I vowed I would never do that again. With the help of my future wife, I made a plan to pay it off. I felt lucky to graduate with only $18,000 in debt. I realize many people rely on student loans to finance their education. If you genuinely need it, I understand, but most people build up far more debt than they need to. Most of the things we buy, we do not

need.

There is only one way to really improve your credit score: by paying off your debt. If your debt balances are too high, you run a much larger risk of being hit with the inability to keep up, resulting in collection calls and a direct hit on your FICO score. The faster you pay it off, the faster your credit will improve.

No magic formula exists for paying down debt. The first step is to stop incurring more. Next, take a look at your debt and see how you can optimize it. Do you have credit cards that you can use to complete a balance transfer, saving on interest immediately? If you found errors on your credit report, your newly improved credit score may give you the option of refinancing at lower interest rates. Any time you can move credit card debt from the card to an installment loan, you will likely be better off.

Once you have explored these options, focus on paying off one debt at a time. Based on your cash flow, budget, and list of debts, devise a plan to reduce your debt as quickly as possible. This is where your SIT Report will be useful in a positive way.

If you can pay more on a loan than the minimum monthly payment, start paying down the principal. You need to make the required payments on all of your loans, of course, but if your cash flow allows, place extra focus on eliminating one debt. Which one you choose to focus on will depend on the size of the loan and the interest rate you are paying. The higher the interest, the more desirable it is to eliminate the debt.

The longer you practice this discipline, the faster your debts will disappear. And one day you will breathe a sigh of relief that you are no longer getting calls or angry letters from creditors. You have regained control of that part of your life.

No Credit to Good Credit

One of the hardest aspects of building good credit is the fact that high debt lowers your credit score, but so does no debt. I had an intern recently who was ready to graduate from college debt free. He had no credit cards, which was good, but he also had no credit. We were talking one day about his financial prospects, and as a matter of course, I asked him, “What is your credit score?”

“I don't know,” he replied.

That's not unusual. Most people don't know, and he had never applied for anything that required checking his score. But since I asked, we decided to run a free check. His score was a very low 621. Since anything under 650 is considered bad credit, we felt that we should take a look at it.

This kid had been completely dependable and responsible about his finances, yet his credit score was horrible. His parents had advised him not to get a credit card, and he followed their advice. Unfortunately, if you don't use credit, you can't establish a credit history. A decent credit score requires that you demonstrate you have handled credit in the past. There must be a record of making payments. A good credit score results from showing that you can incur debt and be responsible for paying it off on time.

His first attempt to secure a credit card was rejected. He approached a couple of banks, and after he told them he was unemployed and had no credit history, they laughed at him.

One of the banks that denied him offered good advice that set him on the right track. First, they told him to stop applying for credit. Every time a credit check had been run, it lowered his credit score. Part of the credit bureau calculation is the number of credit checks run.

He then applied for a secured credit card. There are numerous options for this. In his case, it was a card offered through Capital One. The terms of the card are heavily weighted in favor of the lender, but it allowed him to establish credit.

A secured card works similarly to a regular card, except you give the lender a deposit, which is held as a guarantee for payments on any credit card purchases. The amount of the deposit sets the limit of the card. Most of them add an annual fee, in this case $34, for maintaining the card. In the eyes of credit bureaus, the secured card is treated exactly as any other credit card.

The card worked. He was very careful to only use the card to purchase things for which he had money. Opening the account with a limit of $1,000, he used it regularly for purchases from soft drinks to airline tickets, and paid off the balance each month religiously.

After just five months, he decided to buy a car. With the original credit score of 621, he would have either been denied a car loan or ended up with an interest rate of more than 9%. But in that short time, his score had gone up 110 points to 731. Instead of rejecting him, they approved the loan at a rate of 3.99%.

Â

The reality is, as my intern's story illustrates, you must use credit in order to

have

credit. It's not the fact you use credit cards that causes problems; it's how you use them. Maximize the benefit of your cards by understanding what affects your credit score. Here are a few guidelines that should help you make decisions:

- Get the right cards.

If you have no credit at all, cards from department stores and gas companies are not the best way to get started. In fact, they might be hurting your credit score. Cards are not all created equal. To achieve the highest credit scores, you need to use the biggest cards: Visa, MasterCard, Discover, or American Express.

Department store and subprime cardsâcards issued to those with substandard credit scoresâcarry the highest interest rates, making them the most expensive to maintain, plus they have frequent incentives to use them. If you are a shopaholic, this is a dangerous position to put yourself in. Additionally, every time you open a new card, you add a credit inquiry to your credit report, which lowers your score. Department store card limits are usually lower, which makes it more difficult to maintain a good utilization ratio, as explained later in this section. You will always be better off if you stick with the major cards.

If you don't qualify for one of those cards, consider starting with a secured card, as my intern did. You can find options at a number of sites, such as

www.CardRatings.com

,

www.CreditCards.com

,

www.LowCards.com

, and

www.NerdWallet.com

. Make sure the site you choose reports to the three big credit bureaus, and request secured cards that can be converted to regular credit cards after a year or two of on-time payments. - Limit the number of cards.

When I first looked at my credit report, I realized I had a large number of cardsâparticularly department store cardsâthat just sat there. I never used them anymore. There is a ratio of how much credit limit you have to how much debt you have. Cards sitting idle don't help your numbers. Don't cancel them, however; keep making payments and stop using them until they go inactive. If you do decide to close them, don't do it all at once. Closing a large amount of credit cards could also hurt your credit.

You should have at least three lines of credit for the best scores. Any less than that, and the credit bureaus won't have enough information about your spending habits to form an accurate judgment.

Conversely, if you have more than five cards, credit bureaus will figure you have more opportunities to overextend yourself, and are more likely to lower your score. Besides, the more cards you have, the greater the chance that errors will find their way onto your credit report. - Be aware of your utilization ratio.

That's a fancy term to describe how much you use your cards. More than a third of your credit score is determined by the amount of credit available to you that you don't use. The more unused available credit you have, the better your credit score will be. You should always try to keep your balance below 30 percent of a card's limit. It's even better if you can keep it below 10 percent. For example, if you have a credit limit of $10,000, you should never have more than a $1,000 balance.

This applies to each card. For example, if you have two cards, each with a limit of $10,000, and Card A has a balance of $1,000, it reflects 10 percent utilization. If Card B has a balance of $4,000, it shows a 40 percent ratio, and you need to bring it down to 30 percent or lower. There are several ways you can do this. The most obvious is to pay off $1,000 on Card B. If you don't have that much cash, however, there are other options.

First, you can ask the credit card company to increase the limit on the card. Or, complete a balance transfer from Card B to Card A, raising the lower balance and reducing the larger, keeping both within the 30 percent range.

Another possibility is to open a new card and transfer the necessary amount to the new account. Be careful with this choice: Open the account first and then initiate the transfer. If you open the card by doing the transfer, the new card may only give you a limit equal to the amount you want to transfer, which would make the utilization ratio for the new card 100 percent.

Be aware that your utilization ratio is computed even if you pay off the entire balance each month. The balance reported to the credit bureau is usually whatever amount was on your last statement; if you pay off the total balance each time you get a bill, you must still be cautious not to charge more than 30 percent of the card's limit. - Don't let the card sit idle.

While using your card too much is unfavorable, it is unwise to never use them. Optimal use is to keep your card activity low and pay off the balance each month, so that you don't end up paying a ton of interest. You don't have to carry a large balance in order to use credit.