Start Your Own Business (107 page)

Read Start Your Own Business Online

Authors: Inc The Staff of Entrepreneur Media

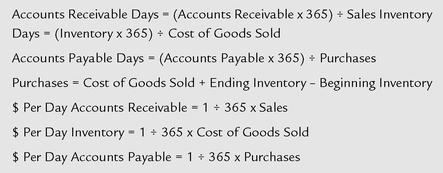

Since we are dealing with cash flow, and depreciation is a noncash expense, it is subtracted from the operating expenses. The break-even calculation for sales is:

Let’s use ABC Clothing as an example and compute this company’s break-even sales for Years 1 and 2:

| Year 1 | Year 2 | |

|---|---|---|

| Gross Profit Margin | 25.0% | 30.0% |

| Operating Expenses (less depreciation) | $170,000 | $245,000 |

| Annual Current Maturities of Long-Term Debt* | $30,000 | $30,000 |

| *This represents the principal portion of annual debt service; the interest portion of annual debt service is already included in operating expenses. |

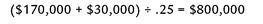

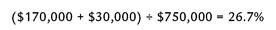

Break-Even Sales for Year 1:Break-Even Sales for Year 2:

It is apparent from these calculations that ABC Clothing was well ahead of break-even sales both in Year 1 ($1 million in sales) and Year 2 ($1.5 million).

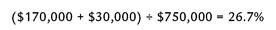

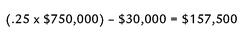

Break-even analysis also can be used to calculate break-even sales needed for the other variables in the equation. Let’s say the owner of ABC Clothing was confident he or she could generate sales of $750,000, and the company’s operating expenses are $170,000 with $30,000 in annual current maturities of long-term debt. The break-even gross margin needed would be calculated as follows:

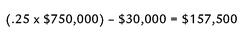

Now let’s use ABC Clothing to determine the break-even operating expenses. If we know that the gross margin is 25 percent, the sales are $750,000 and the current maturities of long-term debt are $30,000, we can calculate the break-even operating expenses as follows:

Working Capital Analysis

Working capital is one of the most difficult financial concepts for the small-business owner to understand. In fact, the term means a lot of different things to a lot of different people. By definition, working capital is the amount by which current assets exceed current liabilities. However, if you simply run this calculation each period to try to analyze working capital, you won’t accomplish much in figuring out what your working capital needs are and how to meet them.

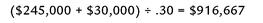

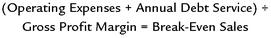

A more useful tool for determining your working capital needs is the operating cycle. The operating cycle analyzes the accounts receivable, inventory and accounts payable cycles in terms of days. In other words, accounts receivable are analyzed by the average number of days it takes to collect an account. Inventory is analyzed by the average number of days it takes to turn over the sale of a product (from the point it comes in your door to the point it is converted to cash or an account receivable). Accounts payable are analyzed by the average number of days it takes to pay a supplier invoice.

WARNINGHere are seven signs that you might be experiencing embezzlement or employee theft:1. Employees who don’t want a vacation2. Employees who refuse to delegate certain tasks3. Ledgers and subledgers that don’t balance4. Financial statements that don’t balance5. Lack of audit trails6. Regular customer complaints that inventory shipments aren’t complete7. Bookkeeper or accountant who won’t share information

Most businesses cannot finance the operating cycle (accounts receivable days + inventory days) with accounts payable financing alone. Consequently, working capital financing is needed. This shortfall is typically covered by the net profits generated internally or by externally borrowed funds or by a combination of the two.

Most businesses need short-term working capital at some point in their operations. For instance, retailers must find working capital to fund seasonal inventory buildup between September and November for Christmas sales. But even a business that is not seasonal occasionally experiences peak months when orders are unusually high. This creates a need for working capital to fund the resulting inventory and accounts receivable buildup.

Some small businesses have enough cash reserves to fund seasonal working capital needs. However, this is very rare for a new business. If your new venture experiences a need for short-term working capital during its first few years of operation, you will have several potential sources of funding. The important thing is to plan ahead. If you get caught off guard, you might miss out on the one big order that could put your business over the hump.

Here are the five most common sources of short-term working capital financing:

1.

Equity

. If your business is in its first year of operation and has not yet become profitable, then you might have to rely on equity funds for short-term working capital needs. These funds might be injected from your own personal resources or from a family member, a friend or a third-party investor.

2.

Trade creditors

. If you have a particularly good relationship established with your trade creditors, you might be able to solicit their help in providing short-term working capital. If you have paid on time in the past, a trade creditor may be willing to extend terms to enable you to meet a big order. For instance, if you receive a big order that you can fulfill, ship out and collect in 60 days, you could obtain 60-day terms from your supplier if 30-day terms are normally given. The trade creditor will want proof of the order and may want to file a lien on it as security, but if it enables you to proceed, that should not be a problem.TIPIf you decide to hire a factoring company, you could look in the Yellow Pages under “Factoring” to start your search, but a safer bet is to call your bank for a recommendation. You might also want to seek recommendations from your industry’s trade associations or local business chamber of commerce.

3.

Factoring

. Factoring is another resource for short-term working capital financing. Once you have filled an order, a factoring company buys your account receivable and then handles the collection. This type of financing is more expensive than conventional bank financing but is often used by new businesses.

4.

Line of credit

. Lines of credit are not often given by banks to new businesses. However, if your new business is well-capitalized by equity and you have good collateral, your business might qualify for one. A line of credit allows you to borrow funds for short-term needs when they arise. The funds are repaid once you collect the accounts receivable that resulted from the short-term sales peak. Lines of credit typically are made for one year at a time and are expected to be paid off for 30 to 60 consecutive days sometime during the year to ensure that the funds are used for short-term needs only.Operating CycleABC Clothing Inc.

Year 1 Year 2 Accounts Receivable Days 30 35 Inventory Days 90 80 Operating Cycle 120 115 Accounts Payable Days -32 -29 Days To Be Financed 88 86 Purchases $935,000 $1,095,000 $ Per Day Accounts Receivable $2,740 $4,110 $ Per Day Inventory $2,055 $2,877 $ Per Day Accounts Payable $2,562 $3,000 Calculations are as follows:

5.

Short-term loan

. While your new business may not qualify for a line of credit from a bank, you might have success in obtaining a one-time short-term loan (less than a year) to finance your temporary working capital needs. If you have established a good banking relationship with a banker, he or she might be willing to provide a short-term note for one order or for a seasonal inventory and/or accounts receivable buildup.

Other books

Edge of Nowhere by Michael Ridpath

The Yearning by Tina Donahue

Becoming by Chris Ord

Flame of the Phoenix: Hades' Carnival, Book 6 by N.J. Walters

The Late Blossoming of Frankie Green by Laura Kemp

When the Cherry Blossoms Fell by Jennifer Maruno

The Tapestry in the Attic by Mary O'Donnell

Tell Me Again How a Crush Should Feel by Sara Farizan

Not Quite Married by Betina Krahn

The Manny Files book1 by Christian Burch