The Buying Brain: Secrets for Selling to the Subconscious Mind (23 page)

Read The Buying Brain: Secrets for Selling to the Subconscious Mind Online

Authors: A. K. Pradeep

Tags: #Non-Fiction, #Psychology

Emotional Engagement at this critical level is well below the threshold of conscious awareness. It is influencing our behavior in ways we cannot consciously track. If we did, we would react so slowly to the world that we would be at risk in a hostile environment like our ancestral homes. If a diligent market researcher tries to extract an articulated expression of Emotional Engagement, what he or she will get is a supposition or rationalization of that Engagement.

The person having the emotion would be guessing just as much as the questioner! As many of our clients tell us, this is not the kind of data they want to rely on to make multimillion dollar decisions.

Memory

Memory is the third fundamental building block of responses to commercial stimuli, especially marketing messages in all their forms. It’s obvious that if you can’t remember it, it cannot influence you later on when you are in a buying situation.

Memory is one of the most deeply studied aspects of the brain in action.

The mechanisms and structures by which the brain engages in both memory

encoding

and memory

retrieval

have been closely mapped and analyzed. As with Attention and Emotion, these Memory processes generate consistent and measurable brainwave patterns that indicate when memory processing is active. Researchers have been able, for example, to measure brainwaves P1: OTA/XYZ

P2: ABC

c10

JWBT296-Pradeep

June 7, 2010

6:45

Printer Name: Courier Westford, Westford, MA

106

The Buying Brain

during a memorization task and, by looking at those brainwaves only, predict with excellent accuracy the success or failure of a later effort to recall the memorized task.

Our Memory NeuroMetric builds on this research to identify markers of Memory activity as a person watches a message or engages in a consumer experience.

Memory comes in many shapes and forms, and although you would expect that a memory could only influence a person if he or she were aware of it, in fact the situation is much more interesting. There is a well-documented phenomenon called

implicit memory

that enables memories to influence attitudes, decisions, and behaviors without entering conscious thought. So measuring the likelihood that a persistent Memory has been formed at the moment of encoding is often the only way to determine whether that memory might have a later effect. Only a NeuroMetric indicator can identify such a memory-encoding event.

Purchase Intent/Persuasion

We now come to our three derived NeuroMetrics. Each of these can be thought of as being derived from a combination of two of the primary NeuroMetrics.

How can I possibly be so bold as to claim we can measure purchase intent? Every marketer knows that there are innumerable “intervening variables”

between watching an ad and making a purchase. The answer is not so mysterious; it has to do with the concept of a

predictor variable

in contrast to an

explanatory variable

.

What we have found after analyzing thousands of ads and other marketing messages, including our ongoing program of analyzing messages that we

know

worked or didn’t work in the marketplace (because our clients have shared their marketplace experience with us) is that a combination of two of our primary NeuroMetrics—

Emotional Engagement

and

Memory

—produce an extremely sensitive predictor of marketplace success. We know that a combination of Emotion and Memory while watching an ad does not

cause

someone to go out and buy a product. That would be what we call “the zombie reaction,” and we know that normal brains don’t operate that way. But we do know that high scores on our Emotional Engagement and Memory Activation NeuroMetrics do tend to be

associated

with increased purchasing. Thus, we can help our clients predict purchase behavior using this metric, even if we can’t fully explain exactly why it works the way it does.

P1: OTA/XYZ

P2: ABC

c10

JWBT296-Pradeep

June 7, 2010

6:45

Printer Name: Courier Westford, Westford, MA

Neuromarketing Measures and Metrics

107

This is not to say that we don’t have some ideas about why it works.

Think about how an ad can make you more inclined to buy a product. If the ad is highly engaging, you are more likely to remember it. If your brain gets emotionally involved whenever you see the ad, and you reinforce your memory network for this product or brand every time the ad appears, is it so surprising that you might be more inclined to purchase the product the next time you have an opportunity to do so? You see the product on the shelf, this triggers the memory of the ad, that memory triggers the feeling of emotional engagement, and you say, “what the heck, let’s give it a try.”

Sometimes we call this NeuroMetric Persuasion rather than Purchase Intent, mostly when we are talking about a message that is not trying to drive a purchase. For example, in the broadcasting business a TV spot may be aimed at encouraging you to watch a particular show. No purchase is intended, but there is a definite persuasion attempt going on. We find that measuring Emotional Engagement and Memory during the spot is a good predictor of whether or not you will actually watch that show when it comes on.

Because it is composed of two moment-to-moment metric components, Purchase Intent/Persuasion itself has the useful property of being a moment-to-moment measure as well as a summary measure. This can be crucially important for pinpointing not only the overall persuasiveness of an ad, but the key moments in the ad that contribute most to that persuasiveness, and other moments that contribute least.

Novelty

The brain loves novelty, as we have seen, and advertisers and marketers often want to know if their message is perceived as novel or just as “more of the same.” Millions of dollars may ride on the answer.

We have found that novelty can be inferred from a particular combination of the primary NeuroMetrics Attention and Memory. In explaining this metric, I often ask my audience to imagine a monkey swinging happily through the trees. Suddenly the monkey spots a new plant with a new kind of fruit hanging from it. The fruit may represent a new source of nutrition that could have great survival value for the monkey and his monkey troop. To take advantage of that new food source, he has to first notice it (pay attention) when he sees it, and second, he has to remember where he saw it. So it is not surprising that novel stimuli activate both attention and memory when people experience them.

Novelty is a valuable end in itself, and we suspect it is also a contributing ingredient in other aspects of responding to an ad or marketing message.

P1: OTA/XYZ

P2: ABC

c10

JWBT296-Pradeep

June 7, 2010

6:45

Printer Name: Courier Westford, Westford, MA

108

The Buying Brain

Novelty contributes to interest, surprise, and attraction, and can even contribute to a decision to purchase.

Novelty in advertising and messaging needs to be monitored over time, because novelty is a perishable good. Anything, no matter how original and unique at first, becomes familiar and commonplace over time. Advertisers need to know when novelty turns into boredom and ultimately into irritation, if they want to keep their messages fresh and interesting in the minds of their consumers. (This represents another advantage that neurological testing provides to advertisers: The ability to measure with explicit accuracy the habituation or “wear-in/wear-out” factor involved with television advertising.) As with

Persuasion

,

Novelty

measurement can fluctuate on a moment-to-moment basis. It tells you not only an overall score for Novelty, but also which moments in an ad or message are most or least novel across the full experience.

Awareness/Understanding/

Comprehension

If I am an advertiser, I definitely want to know if my ad is Persuasive and Novel. But just as importantly, I want to know if people understand it. Do they comprehend the message? Is that message crystal clear or cloudy in its delivery? Are they confused or did they possibly misunderstand my message altogether? There’s a NeuroMetric for that.

Understanding and Comprehension, we have found, are predictable from a combination of the primary NeuroMetrics Attention and Emotional Engagement. Why is this so? To illustrate this relationship when I am speaking to an audience, I often ask the audience members to try to recall the most illuminating lecture they ever heard in college, the one that really turned on the proverbial light bulb above their heads. What caused that lecture to imbue them with Understanding and Comprehension? Usually, it was because the lecture was emotionally engaging and captured your attention. The most profound lectures held my attention like a laser beam, and the professor was able to engage me emotionally in a way that made it impossible to look away.

The net effect is deep and sustained understanding.

We have found in case after case that message Understanding is correlated with a combination of Attention and Emotion. We have fine-tuned that relationship in a formula, and today we can predict with great accuracy the degree of Understanding any ad or marketing message can achieve.

Awareness is also a moment-to-moment metric, allowing us to identify not just if a message achieves clarity, but exactly when it fails to do so as well. For

P1: OTA/XYZ

P2: ABC

c10

JWBT296-Pradeep

June 7, 2010

6:45

Printer Name: Courier Westford, Westford, MA

Neuromarketing Measures and Metrics

109

messaging that depends on getting a clear message across, such information is invaluable.

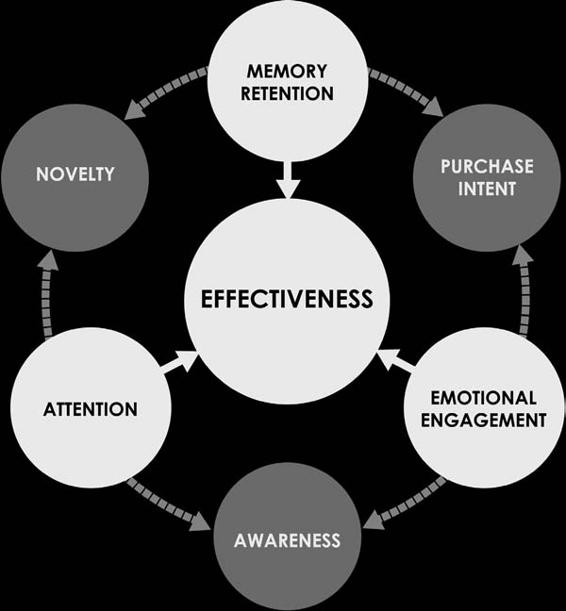

Effectiveness

Our summary NeuroMetric,

Effectiveness

, is derived simply as a linear combination of the three primary NeuroMetrics. Since these three are already combined in the derived NeuroMetrics, these latter metrics are implicitly included in the equation as well (see Figure 10.1).

Figure 10.1

NeuroMetrics: Attention, Emotion, Memory

Purchase Intent, Novelty, Awareness, and Overall Effectiveness.

Memory

Retention

Novelty

Purchase

Intent

Effectiveness

Attention

Emotional

engagement

Awareness

Source:

NeuroFocus, Inc.

P1: OTA/XYZ

P2: ABC

c10

JWBT296-Pradeep

June 7, 2010

6:45

Printer Name: Courier Westford, Westford, MA

110

The Buying Brain

The exact equation that generates our Effectiveness NeuroMetric is, of course, a closely guarded secret, much like the Google Page Rank algorithm or the legendary Coca-Cola formula. But, as in both those cases, the value of the formula is apparent in its power to differentiate one result from another—for Google, a superior page ranking and for Coke, an unforgettable flavor. For NeuroFocus, the value of our Effectiveness metric is in its performance. It is a precise indicator and reliable predictor that is completely language-neutral and directly calculated from real-time brainwave measurements.

In the chapters that follow, you will see many examples of how these NeuroMetrics have revealed truths and insights that were previously inaccessible by traditional research techniques.

Deep Subconscious Response

Methodology

Our patented

Deep Subconscious Response

methodology is a clever use of a before-and-after Event Related Potential (ERP) design to compare precisely how a given experience, like watching an ad or engaging in a customer experience like using a product, affects the brain’s receptivity to, or resonance with, a given process or design.

In a nutshell, what we do is first get a “baseline” measure of how receptive a person is to a set of concepts provided by the client. Then we

have the subject

engage in an experience

like watching an ad or eating a food product. Next, we measure their receptivity to the concepts again after the experience. If a concept is reinforced by the experience, the “after” effect will be greater than the “before” effect—the subject will be more receptive to the concept and its association with the brand or product included in the experience. If, on the other hand, the concept is not reinforced by the experience, its “after”

effect will be either the same or, in some cases, even less than the “before”

effect.

Note that this is not a moment-to-moment measure, but rather

a summary

impact measure.

Importantly, this task is entirely implicit. We never ask a single question. We take a snapshot, in effect, at two points in time, and measure the differences between the two. Since the only thing different between the

“before” and “after” snapshot is the experience, we can attribute changes in the measures to the direct, subconscious impact of the experience itself.

Using this methodology, clients can rank-order concepts in terms of their affinity with a product or brand experience and determine which concepts are most associated with the experience and which are least associated.