The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment (38 page)

Read The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment Online

Authors: Chris Martenson

Tags: #General, #Economic Conditions, #Business & Economics, #Economics, #Development, #Forecasting, #Sustainable Development, #Economic Development, #Economic Forecasting - United States, #United States, #Sustainable Development - United States, #Economic Forecasting, #United States - Economic Conditions - 2009

Of all the steps that I’ve taken, building my community has developed the most important element of my resilience. Whatever the future holds, I’d rather face it surrounded by the people I respect, admire, and love in my local community, people whom I trust and know I can count on. That’s my measure of true wealth.

In my case, I joined up with a number of other individuals who were interested in actively preparing for the future. Over the course of a year, we met as a group and went through each and every component of a self-assessment that we designed, covering nine basic areas of our lives. (You can find a free version of this self-assessment on my web site at

www.ChrisMartenson.com/self-assessment

.) We took a good, hard look at our then-current situations, made plans for preparation and change, and held each other accountable for following through with our plans. The support we shared was, and still is, invaluable.

The rest of my family has become deeply hooked into a wider community of people who are actively engaged in nature awareness, permaculture, native skills, fruit collection, and other pastimes that feel recreational but also offer deeper and more resilient connections to people and nature.

I would recommend working with people you trust or with whom you already share basic values. The closer they live to you geographically, the better. I have no interest in living in fear, and my plan is to live through whatever comes next with a positive attitude and with as much satisfaction and fun as I can possibly muster. So it has always been important to me to be in community with others who share this outlook.

I now count this group as one of the most important elements in my life. I know the people I can talk to about next steps, I know people whom I can count on in an emergency, and I know who will look after my family if I happen to be out of town when something big goes awry. And now that I have experienced the pleasures (and joys and frustrations) of working in a group setting on matters of preparation, I would immediately join or start another group if I happened to move to a different area.

It’s incredibly helpful to find people to join forces with as you step through the basics of self-preparation. I encourage you to consider seeking like-minded locals with whom to form such a group, if you haven’t already done so, and to encourage others to do the same.

My preparation group is now working outside of our core and exploring ways to help get our larger community into a more resilient position. I’m only as secure as my neighbor is, and we’re only as secure as our town, and our town is only as secure as the next town over. But it all begins at the center, like a fractal pattern, with a core of resilient households determining how the future unfolds.

The sixth concept of preparation is that community is essential.

Protecting Your Wealth

The time has come to put one foot in front of the other and take responsibility for your own financial future. We’ve entered some truly treacherous investing waters, where we must question everything and accept nothing, even (and especially) the base assumption that any given currency, be it the U.S. dollar or euro or yen, will retain its value. If you ascribe to the view that our structural predicaments in the economy, energy, and the environment won’t lend themselves to easy fixes involving injections of thin-air money and more government deficit spending, then you should take steps to protect your wealth from the likely consequences of those ill-fated efforts.

What follows are the initial steps that I undertook when I first became convinced of the depth and the seriousness of the predicament we’re in. Whether you choose to do something similar or very different is entirely up to you. I only offer these suggestions for your edification and consideration, not as specific investment advice.

1.

Get out of personal debt

. This means paying down what you can and taking on no new debt, especially if it won’t increase your future cash flows. During the Great Depression, debt was a killer. During the 1990s and 2000s, credit (debt) advanced the living standards of many and became to be viewed benignly as “something to manage,” but the ultimate price was high. Being in debt severely limits your options during good times, and it’s a positive destroyer during down times. Less tangibly, being out of debt feels really, really good, as if an invisible weight has been lifted. During stressful times like these, removing a nagging source of worry has a value all its own, which should not be underestimated.2.

Get some inflation protection

. We can be fairly certain that we’ll see inflation over time, especially as resource constraints appear while electronic money presses are working hard to conjure up an economic miracle. But there’s another potentially concerning source of inflation in the trillions and trillions of dollars in U.S. debt held by foreign countries that would wreak havoc on the dollar if their holders felt it necessary to cash them in all at once.So what does it mean to have good “inflation protection”? It means holding non–paper-based assets. Gold, silver, oil, grains, and base metals are a few examples that will suffice to help navigate the first period of transition away from paper and toward things. My personal choice has been to hold gold and silver, but there are many other reasonable vehicles. For those who are interested, there’s a short document available on my web site that details the hows and whys of gold/silver purchasing (

www.chrismartenson.com/buying_gold

).On a longer-term basis, moving funds out of paper wealth and into productive assets will certainly be the way to go. In this regard, holding titles to productive sources of energy such as gas fields, oil reserves, woodland, and electrical production (such as wind towers and other alternatives) offers the best chance of return, regardless of whether your local currency holds its value or bursts into flames.

3.

Diversify out of U.S. dollars

. Many residents of European countries consider holding all of one’s assets in a single currency to be a sign of madness. Of course, Europe has a history of repeatedly and violently supporting the validity of this viewpoint, but you may also want to consider that the highly wealthy in the United States traditionally handle their affairs with assets in multiple currencies and countries. Having a bit of diversification here can be useful, and if you have the opportunity to hold foreign bank accounts, those can offer an important buffer. These opportunities are rapidly dwindling as the IRS and Treasury Department have been extremely active of late in shutting down such avenues for all but the very rich, who can afford the necessary legal teams required to establish foreign accounts.

What to Look for if Relocating

After coming to the realization that the future may well be quite different from the past, you may be thinking about whether your current location is where you want to stay. My wife and I picked up our entire family and moved to a place that we judged would provide an excellent quality of life under almost any circumstances. We specifically sought a town or city that would be a fun, enjoyable place during times of both relative abundance and declining energy, and we moved away from an area that struck us as dangerously resistant to new ideas and change.

Community

A detectably functioning community encompassing a healthy spread of ages and skills was a nonnegotiable element for us. The first thing we looked for was a vibrant community where people had already demonstrated an ability to self-organize to create what they wanted. Becca identified the presence of “cooperative grocery stores” (a.k.a. co-ops) as an indicator that the local culture had what we were looking for. Her reasoning was that if people cared enough about their food to organize and sustain their own commercial enterprise around it, then they were the kind of people we wanted to be around.

Once we found an area rich with co-ops, we dug around further looking for other signs of life indicating the local people were actively creating their own opportunities and meeting some of their own needs. Fairs, festivals, and cohesive traditions, such as holiday extravaganzas and block parties, are good indicators that the local population knows how to do more together than accidentally bump into each other at the nearest big-box store.

Next, we looked within each community to see if it was well represented by residents of all ages. We found a few that seemed predominantly inhabited by boomers or retired folks; this is a valuable subset within a community, but we were looking to find a balance that included young families with children along with our middle-aged peers. We also hoped to find a variety of skill sets represented, as having a good mix of tradespeople, business professionals, laborers, artists, thinkers, and doers was important to us.

Population Density

We also wanted to live near enough to other people that we would have ample opportunities to socialize and have fun within our local sphere. Movies, concerts, events, shows, parties, and so forth all require sufficient population density. So does finding the right kinds of people with which to create a new future. Children need a group of friends and the sense that they are living in the middle of someplace exciting. We didn’t want driving to dominate our lives, and we wanted to feel that we really knew our neighbors, so getting the density just right felt very important to us—neither overpopulated nor underpopulated.

Rural with Farmland

Next, we wanted to be in a semirural location with the specific distinction that the local cropland be sufficient to sustainably support the existing population. The area we chose has lots of working farms and some of the best soil in the country. This distinguishes it from places that appear rural but are merely wooded and/or consist of thin, poor soils and are therefore incapable of supporting much in the way of a vibrant, relatively dense local population. Basically, we steered clear of “dirt poor” areas. Yes, you can build soils over time, but starting with thick, healthy soils is a lot easier.

Water

Not much happens without plenty of fresh water, especially predictable crop yields. The area we chose has ample water in the form of rainfall, rivers, and ground water (aquifers), and isn’t overly prone to regular droughts. Water was another nonnegotiable element in our equation, and I wouldn’t feel at all comfortable living in a place where water availability was questionable. For instance, you couldn’t get me to own or invest in property in much of the American southwest, where the dominant source of water is a rapidly depleting aquifer. Definitely consider the available sources of water, both for regular and emergency use, when evaluating your location.

Work

Living and working and playing should ideally happen as close to each other as possible. We looked for an area that did not require significant amounts of driving to address all three of those needs. While many communities will figure out the relocalization details by necessity, we wanted to start in a place where at least some of the details had already been worked out.

Do bike trails exist? Is there navigable water nearby? Does public transportation exist? Do people tend to live close to where they work?

Some areas don’t offer the perfect answers to all three needs, but creative solutions may already exist . . .or perhaps they’re waiting for someone like you to implement them.

What Should I Do?

What

should

you do? The list is potentially endless in its details, but simple enough in total: Begin preparing for change. This chapter has offered just a sampling of potential areas of change. I invite you to visit my web site,

www.ChrisMartenson.com

, for more information on the many subjects that are involved in preparation and to stay abreast of current developments. I have done my best to make this process easier with a free, online preparation guide that addresses the suggestions raised in this chapter in more specific detail (

www.ChrisMartenson.com/what-should-i-do

).

The sooner you get started, the sooner you’ll begin to feel happier, more in control, and ready to face the future with your eyes fixed on the opportunities and options that do inevitably exist.

CHAPTER 28

The Opportunities

The story that I’ve told here is one of change. In any such story, both challenges and opportunities await. I’m hoping for a favorable, less painful outcome, but I’m also prepared for things to get worse before they get better. One thing that I absolutely don’t see happening is a one-way descent into chaos. Yes, there may be dips in the road, and, yes, it may be a long slog toward the light, but even so, we’ll pick ourselves up and carry on again. I see enormous opportunities waiting to be claimed, both during the period of adjustment and afterward.

The first opportunity in this story is to take advantage of this information to make changes in your life, investments, and community now, while the options remain abundant, reasonably accessible, and relatively easy. As I shared in the introduction to this book, my family and I have made enormous changes in our lives in response to this information, and we feel strongly that we are better off and enjoy a higher quality of life as a result. No matter how the future turns out, I will enjoy a better outcome because of my actions.

One set of opportunities that the future will not offer is anything that relies upon or requires a simple continuation of the past: an uninterrupted extrapolation of the past trajectory into the wild blue yonder. The energy for such a jaunt will be insufficient, and whether or not that turns out to be a limiting factor (as I believe it will be), the Great Credit Bubble will need to deflate quite a bit more before a renewed bout of debt accumulation can possibly begin again.

Below are the opportunities that I see, based on the understanding that energy and resources will have to be more carefully utilized in the future. Their careful stewardship and higher cultural value will support certain types of jobs, investments, and wealth accumulation, but not others. In most cases, I’m assuming that primary and secondary sources of wealth will triumph over tertiary forms, as we “get back to the basics” for a while. You may not share my assessment, and that’s perfectly all right; nobody has a lock on the future and what it might hold. If anything, I feel I’m more prepared than most to be surprised by how things unfold.

Still, here are a few basic “truths” that I think will shape the future significantly:

1.

Net energy has peaked (or will soon), and this is a permanent condition.2.

The global energy allotment available for economic development and the economy itself will decline in lockstep.3.

Without increasing energy flows, the economy will “simplify,” which is a euphemism for a massive structural shift that may be incredibly disruptive for a lot of people.4.

Without growth, most tertiary forms of wealth, such as stocks and bonds, will lose an enormous amount of their current value.5.

As with any shift, there will be winners and losers, largely segregated by who sees the changes coming first and adapts most rapidly—and who doesn’t.

I reserve the right to change these views, should reliable new information arrive that runs counter to the data that formed these conclusions, and I encourage you to leave space in your thinking for changes based on new information that we may not even be capable of anticipating yet. But the past six years leading up to the writing of this book have seen an almost uninterrupted string of confirmations supporting the ideas and concepts contained herein. With that in mind, here are the opportunities that I see:

Resource Management and Materials Efficiency

In the future, reduce/reuse/recycle will no longer be just a feel-good slogan of environmentalists—it will be an important operating paradigm. Those countries and companies that perform the task of managing their energy and materials streams the most efficiently will fare better than the rest. There will be enormous opportunities in this arena going forward, including everything from point-of-source collection and separation, to recovery and reclamation services for waste streams, to designing more efficient production processes that absolutely minimize waste and loss. New jobs and skills will be required and created in this field. While doing more with less has always been the essence of good business, this field will require a parallel mind-set that can measure and incorporate the intrinsic value of things that simple prices based on money have traditionally overlooked.

If I owned a company that relied upon resource flows, I would seriously consider building up my inventories of those items most critical to value creation. I would trade a few points of profitability gained from cost-effective inventory management for the certainty of knowing that my business had what it needed to continue operating at a time when markets and circumstances might be too turbulent to support my resource requirements.

Part of the new measure of intrinsic value will need to include energy returned on energy invested, or EROEI. Companies and countries alike will need to begin making decisions based on the energy impacts of various factors. For example, should a government support investment in a new high-speed rail system, or the retrofitting of existing structures with additional insulation? Which one would be better for society in the long run? Right now, the decision would be based on cost and political considerations. In the future, the EROEI of the two options should be prominently displayed, like a window tag in a new car revealing the mileage per gallon of the vehicle being considered, so that this information can be weighed alongside other criteria. Developing useful EROEI estimates is not trivial work and will require the services of many bright people.

Food

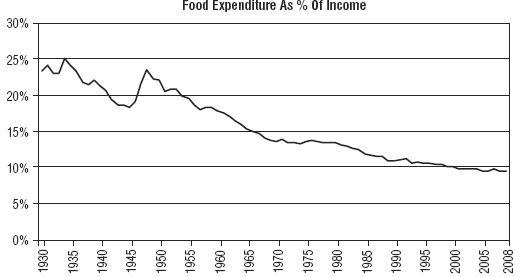

Food is a multihundred-billion-dollar industry, and it will be undergoing a radical transformation over the coming years. Once the energy crunch begins, food will, by necessity, go up in price. The opportunity here, already being seized by communities in all corners of the world, is to get involved in the relocalization of food production, storage, and distribution. As a contrarian investor, when I look at a chart like this, I think that there’s only one way for food expenditures as a percent of income to go: up (see

Figure 28.1

).

Because of the massive energy subsidy provided by petroleum, food expenditures have trended down to all-time lows. When that subsidy is removed, the trend will reverse. One way to combat the trend will be to keep the energy costs of food production as low as possible. That will, in many cases, involve using much less packaging and consuming food much closer to its point of origin (this means no more 1,800-mile Caesar salads).

If you don’t have it in you to become a farmer, there are thousands of young people with strong backs and even stronger work ethics who are ready, willing, and able to take on the task but lack the capital to make it happen. If you have the capital, you can facilitate farming by buying a piece of fertile land and developing an agreement with people who will work and improve that land for you as they make a living off of it. It’s a win for both parties—your land, a reliable investment, will be steadily improved over time as it’s worked in a sustainable fashion, and the tenant farmers will be able to work a more profitable piece of land than if they had taken on debt to buy their own meager parcel.

The next opportunity will be in food storage. Once upon a time, everybody had a means of storing food throughout the winter, either in root cellars or by preserving food. Clearly those features are largely missing from our current landscape and will have to be replicated somehow. While some people will opt to recreate these features for themselves in their own homes, many won’t. For those people who won’t, engaging a local business to perform the food storage tasks for them may be the preferred option. Very few of these operations currently exist; they will all have to be conceived and constructed. Think of centralized root cellars, where local crops can be stored in idealized conditions under the watchful eye of an experienced person.

People cannot escape the need to eat, and the number of opportunities in this arena are almost too numerous to count.

Energy

The big opportunities in energy will be around the areas of efficiency and relocalization. I see a prime area of opportunity in energy retrofits and green energy solutions for existing houses.

When I decided to put solar hot water panels on my house, I began with the usual online research and investigation to determine what the various options and features were. To my surprise, I found only a patchy network of web sites offering very little structured, useful information. When I turned to local installers as a potential source of information, I was quite surprised that not a single one came to my house prepared to type my requirements into a simple spreadsheet and offer a range of quotes based on the two or three key components of the system in a “good”—“better”—“best” configuration. Each quote was laboriously crafted elsewhere, and in each case, materials took several weeks on average to be produced and delivered. When the components finally arrived, they were delivered in a rental truck driven by the proprietor of the retail operation himself from a location over four hours away.

These experiences tell me that the American solar industry is ripe for improvement, and therefore with opportunity. I got the clear sense that if even 1 percent of the people in my region decided to install solar components, the local installation capacity and regional distributors would have been completely swamped and unable to meet the demand.

As energy becomes more expensive—and it will—retrofitting existing structures to make them more energy-efficient will become a very important occupation. Everything from insulating, to air sealing, to subdividing the interiors of oversized McMansions into smaller living units will go through an explosive phase of growth. Many of these retrofits can be marketed and sold as pure investments in which the improved cash flows alone can justify such a project for the homeowner, but we can also almost certainly count on government tax credits and other incentives to continue to play a role in nudging these activities forward.

Financial Services

It’s time to dust off the old valuation books and begin to perform very basic fundamental analysis on individual stocks and bond offerings that will help separate the winners from the losers. Because growth will no longer work as a general, across-the-board concept, index fund investing won’t work. To deliver truly superior returns, or any at all, you’ll need to know everything about a company—especially its dedication toward energy and materials conservation—and much of this won’t appear in the annual report. The opportunity exists for fundamental analysis to regain its footing, and lots of jobs will be created in this area.

The future that I see will require far more nimble and alert money management than ever before. Many clients are going to demand a higher degree of engagement from their financial advisors, and this will open up new avenues for alert professionals in winning and retaining clients. The services to be performed here could include helping people find a qualified investment professional who can operate effectively in the new wealth-generating landscape of the future, or even training financial advisors toward better performance in that new landscape.

Unfortunately for the industry as a whole, I see a coming reduction in the amount of services currently offered. I doubt that the new future will be able to afford having 40 percent of its total profits funneled into the financial industry. But even though I see a lot of shrinkage visiting this industry, I also see plenty of work for those who can shift with the times.

Government Employment