The Great Destroyer: Barack Obama's War on the Republic (19 page)

Read The Great Destroyer: Barack Obama's War on the Republic Online

Authors: David Limbaugh

BOOK: The Great Destroyer: Barack Obama's War on the Republic

9.11Mb size Format: txt, pdf, ePub

Scandalously, on February 11, 2011, the U.S. Commission on Civil Rights, with the help of Obama’s newly appointed commissioners, voted to shut down its investigation of the DOJ’s dismissal of the Panther case. This was a sweet reward for Eric Holder, who had been trying to suppress the investigation for eighteen months by stonewalling document requests and forbidding his subordinates from being deposed or interviewed. Writing for Pajamas Media, former FCC commissioner Hans A. von Spakovsky said he “couldn’t believe how the Commission’s Democratic appointees abandoned their duty as civil rights commissioners in order to defend the administration’s stonewalling.” He claimed some commissioners had “acted as the virtual defense counsel for the Obama administration, trying to stop the investigation and obscure and obfuscate the Commission’s findings.”

143

143

The inexplicable dismissal of the New Black Panther case reflected deeply disturbing trends at the Obama-Holder DOJ. In his book

Injustice

, J. Christian Adams, a former DOJ attorney who had worked on the New Black Panther case, gave a firsthand account of how the DOJ, under Obama’s presidency, has been staffed top-to-bottom with radical racialists who believe civil rights laws should not be enforced in cases involving black offenders and white victims. Adams further recounted how numerous aspects of the DOJ’s expansive authority—from voting rights to business regulations to employment and housing rules—now serve a fringe racial agenda that would repulse the vast majority of Americans.

144

Adams and others also alleged that those at the Justice Department fighting for race-neutral application of the civil rights laws were subjected to harassment and intimidation.

145

Injustice

, J. Christian Adams, a former DOJ attorney who had worked on the New Black Panther case, gave a firsthand account of how the DOJ, under Obama’s presidency, has been staffed top-to-bottom with radical racialists who believe civil rights laws should not be enforced in cases involving black offenders and white victims. Adams further recounted how numerous aspects of the DOJ’s expansive authority—from voting rights to business regulations to employment and housing rules—now serve a fringe racial agenda that would repulse the vast majority of Americans.

144

Adams and others also alleged that those at the Justice Department fighting for race-neutral application of the civil rights laws were subjected to harassment and intimidation.

145

Testifying before the U.S. Commission on Civil Rights, Christopher Coates, a DOJ Voting Section veteran with extensive civil rights credentials, said the election of President Obama “brought to positions of influence and power with the Civil Rights Division many of the very people who had demonstrated hostility to the concept of equal enforcement of the Voting Rights Act.” Coates provided specific examples of how the division refused to enforce civil rights laws to protect white victims against black perpetrators. He averred that his supervisor, Loretta King, who was then acting assistant attorney general, expressly forbade him from even asking prospective DOJ employees if they would be willing to commit to race-neutral law enforcement. Moreover, Coates testified that the DOJ is refusing to enforce federal laws requiring states to remove ineligible voters from their rolls, including dead people and incarcerated felons—laws that DOJ radicals believe somehow to be racist.

146

146

After more than three years of Obama’s presidency, it is hard to deny that his administration is engaged in a sustained attack on Americans’ most cherished values. This makes perfect sense when you consider how Obama and his officials view a large segment of the American people: we are unenlightened cowards, bitterly clinging to guns and religion, brimming with xenophobia and racism, a people with a history that demands a lot of apologies. To improve our condition, Obama and his allies seek to enlighten us, putting us on the righteous path of federally funded abortion and racial preferences. That is their vision—and if we don’t share it, then they’ll use all the coercive power of government to make us see the light.

CHAPTER FIVE

THE WAR ON THE ECONOMY

O

n July 3, 2008, campaigning in Fargo, North Dakota, Obama told us who he thinks is responsible for the government’s deficit spending and the national debt: “The problem is, is that the way Bush has done it over the last eight years is to take a credit card from the Bank of China in the name of our children, driving up our national debt from $5 trillion dollars for the first 42 presidents—number 43 added $4 trillion dollars by his lonesome, so that we now have over $9 trillion dollars of debt that we are going to have to pay back—$30,000 for every man, woman and child.” He then added a striking accusation: “That’s irresponsible. It’s unpatriotic.”

1

n July 3, 2008, campaigning in Fargo, North Dakota, Obama told us who he thinks is responsible for the government’s deficit spending and the national debt: “The problem is, is that the way Bush has done it over the last eight years is to take a credit card from the Bank of China in the name of our children, driving up our national debt from $5 trillion dollars for the first 42 presidents—number 43 added $4 trillion dollars by his lonesome, so that we now have over $9 trillion dollars of debt that we are going to have to pay back—$30,000 for every man, woman and child.” He then added a striking accusation: “That’s irresponsible. It’s unpatriotic.”

1

After years of President Obama’s unprecedented scapegoating of his predecessor for every imaginable problem facing the United States while refusing to acknowledge his own culpability in our current economic troubles and debt crisis, people tend to forget what the economy was actually like under most of President George W. Bush’s tenure. Like President Obama, he inherited a recession. Following passage of his unfairly maligned tax cut package, we experienced six consecutive years of economic growth, from the fourth quarter of 2001 until the fourth quarter of 2007. Real GDP grew more than 17 percent between 2000 and 2007, and labor productivity gains averaged 2.5 percent after 2001, which exceeded the averages of the three preceding decades. Furthermore, real after-tax income per capita increased by more than 11 percent, and there was a 4.7 percent increase in the number of new businesses formed.

Contrary to Obama’s propaganda, the tax cuts did not only benefit the “wealthy.” All income groups received a cut as tax relief reached 116 million Americans. Nor did the tax cuts starve the federal Treasury. Just as with the Kennedy and Reagan tax cuts, revenues grew—tax receipts rose $542 billion between 2000 and 2007.

2

And while President Bush undoubtedly spent way too much money, his deficits have been dwarfed by Obama’s. In the first four years of the Bush tax cuts, the deficit shrank 57.3 percent, and in 2007, the last year before the onset of the financial crisis, the deficit shrank to $161 billion, a mere fraction of Obama’s deficit for fiscal year 2011.

3

JOBS “SAVED OR CREATED”? TRY “DESTROYED”2

And while President Bush undoubtedly spent way too much money, his deficits have been dwarfed by Obama’s. In the first four years of the Bush tax cuts, the deficit shrank 57.3 percent, and in 2007, the last year before the onset of the financial crisis, the deficit shrank to $161 billion, a mere fraction of Obama’s deficit for fiscal year 2011.

3

President Obama has repeatedly acknowledged that he expects to be judged on his economic performance, and that if he does poorly the people will not reelect him.

4

So let’s take a look at his record. On February 17, 2009, Obama signed into law his $868 billion dollar stimulus bill, promising it would “save or create”—a ludicrous, immeasurable metric—3 to 3.5 million jobs by the end of 2010 and keep employment below 8 percent. In fact, unemployment greatly exceeded that the entire time, often surging past 9 percent.

5

4

So let’s take a look at his record. On February 17, 2009, Obama signed into law his $868 billion dollar stimulus bill, promising it would “save or create”—a ludicrous, immeasurable metric—3 to 3.5 million jobs by the end of 2010 and keep employment below 8 percent. In fact, unemployment greatly exceeded that the entire time, often surging past 9 percent.

5

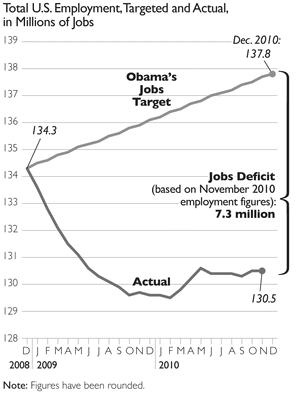

How about those 3.5 million jobs? Well, J. D. Foster of the Heritage Foundation reports that at the end of 2010, Obama had amassed a 7.6 million jobs deficit. When he made his promise there were 135.1 million jobs in the economy, so to reach his target we would have needed 138.6 million jobs by the end of December 2010. As it turned out, there were only 131 million jobs.

6

Not only did Obama fail to reach his goal, but we had much fewer jobs than we had when he started and much fewer than we would have had if he’d just left things alone.

6

Not only did Obama fail to reach his goal, but we had much fewer jobs than we had when he started and much fewer than we would have had if he’d just left things alone.

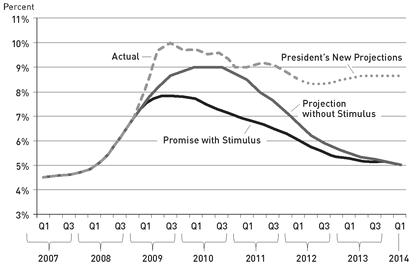

The following charts show the disparity between Obama’s promises on jobs and actual employment trends. The first chart, from the House Budget Committee, shows the unemployment percentages he promised with his stimulus against both those he delivered, and what would have occurred with no stimulus. Not only did he fail to come close to his projections; he made matters worse than they would have been without the stimulus. The second, from the Heritage Foundation, shows the net jobs deficit between what Obama promised (to save or create 3.5 million jobs) and the actual results (a net loss of 7.3 million jobs; this chart was prepared before revised calculations showed the net deficit was actually slightly higher—7.6 million jobs).

Broken Promise on JobsSOURCE: Report by Christina Romer, Chair of President’s Council, “The Job Impact of American Recovery and Reinvestment Plan,” Jan. 9, 2009; Department of Labor.

Obama Jobs Deficit: 7.3 Million JobsPresident Obama pledged to create 3.5 million new jobs by 2010, which would place total U.S. employment at 137.8 million. Using that figure as a target, Obama’s jobs deficit currently stands at 7.3 million.Source:

Heritage Foundation calculations and U.S. Department of Labor, Bureau of Labor Statistics,“The Employment Situation—November 20 10,“Table B-1 at

http://www.bls.gov/news.release/pdf/empsit.pdf

(November 3, 2010).heritage.org

Economists Timothy Conley and Bill Dupor conducted a separate study on the effects of the stimulus and came to different conclusions, but still very unfavorable to Obama. In their paper, “The American Recovery and Reinvestmaent Act: Public Sector Jobs Saved, Private Sector Jobs Forestalled,” they reported, “Our benchmark results suggest that the ARRA [i.e., the “stimulus”] created/saved approximately 450 thousand state and local government jobs and destroyed/forestalled roughly one million private sector jobs. State and local government jobs were saved because ARRA funds were largely used to offset state revenue shortfalls and Medicaid increases rather than boost private sector employment. The majority of destroyed/forestalled jobs were in growth industries including health, education, professional and business services.”

7

7

Shortly after the release of this report, the administration’s own figures revealed that the stimulus was a stunningly inefficient catalyst for job growth. The White House’s Council of Economic Advisors reported that using “mainstream estimates of economic multipliers for the effects of fiscal stimulus,” the stimulus had added or saved nearly 2.4 million jobs at a cost of $666 billion. That translates to $278,000 per job—and that’s accepting the absurd assumption that 2.4 million net jobs were “created or saved” using some mythical multiplier effect. The report also revealed that as of just six months before the report was issued, the stimulus had created or saved just under 2.7 million jobs, which meant that in that half-year period it had

cost

the economy almost 300,000 jobs.

8

Even CBO director Douglas Elmendorf told the Senate Budget Committee that the stimulus had a “negative effect on the growth of GDP over 10 years.”

9

“THE LONGEST STRETCH OF HIGH UNEMPLOYMENT SINCE THE GREAT DEPRESSION”cost

the economy almost 300,000 jobs.

8

Even CBO director Douglas Elmendorf told the Senate Budget Committee that the stimulus had a “negative effect on the growth of GDP over 10 years.”

9

Three years after the stimulus bill passed, the Congressional Budget Office released a devastating report card on its effect on unemployment—though that is not quite how the report was presented. The report said,

The rate of unemployment in the United States has exceeded 8 percent since February 2009, making the past three years the longest stretch of high unemployment in this country since the Great Depression. Moreover, the Congressional Budget Office (CBO) projected that the unemployment rate would remain above 8 percent until 2014. The official unemployment rate, of course, excludes those individuals who would like to work but have not searched for a job in the past four weeks as well as those who are working part-time but would prefer full-time work; if those people were counted among the unemployed, the unemployment rate in January 2012 would have been about 15 percent…. Compounding the problem of high unemployment, the share of unemployed people looking for work for more than six months—referred to as the long-term unemployed—topped 40 percent in December 2009 for the first time since 1948, when such data began to be collected; it has remained above that level ever since.

10

While the economy has finally begun to show some signs of recovery, it has been too little, too late. Proponents of Keynesian stimulus spending would have us believe that the government, almost like magic, can quickly create economic activity and jobs by injecting borrowed money into the economy. Some Keynesians even claim the spending elixir is so powerful that jobs will appear almost regardless of how or where the money is spent. So, in essence, unemployed workers can be paid to dig and re-fill ditches, and that will stimulate the economy.

History has proved otherwise, as with FDR’s New Deal spending designed to deliver the nation from the Great Depression. In 1939, when a doubling of federal spending failed to boost economic growth, FDR’s Treasury secretary Henry Morgenthau said something that the die-hard Obama ideologues would never concede. Morgenthau lamented, “We have tried spending money. We are spending more than we have ever spent before and it does not work…. After eight years of this administration we have just as much unemployment as when we started… and an enormous debt to boot!”

The Keynesian model—which also failed quite spectacularly when tried in Japan during the 1990s

11

—does not acknowledge that money spent by the government has to come from somewhere. Thus, whenever money is artificially allocated to government spending, it reduces spending, savings, or investment elsewhere—specifically, in the private-sector. The net stimulative effect is often zero—or it can be worse, since the government’s top-down decisions on where to spend money are rarely as economically efficient as money spent in response to market signals. The more sobering reality, though, is that even if stimulus packages worked, we could hardly afford the addition of this reckless deficit spending to our already crippling national debt.

11

—does not acknowledge that money spent by the government has to come from somewhere. Thus, whenever money is artificially allocated to government spending, it reduces spending, savings, or investment elsewhere—specifically, in the private-sector. The net stimulative effect is often zero—or it can be worse, since the government’s top-down decisions on where to spend money are rarely as economically efficient as money spent in response to market signals. The more sobering reality, though, is that even if stimulus packages worked, we could hardly afford the addition of this reckless deficit spending to our already crippling national debt.

In his January 2012 State of the Union speech, Obama bragged that he’d presided over twenty-two consecutive months of private-sector job growth—the greatest growth since 2005, he said. James Sherk of the Heritage Foundation conceded that the labor market was stronger than a year before, but noted that Obama cited his statistics out of context. The recession technically ended in June 2009, and the unemployment rate, after skyrocketing above 10 percent and remaining above 9 percent for a few years, had finally fallen below 8.5 percent.

12

12

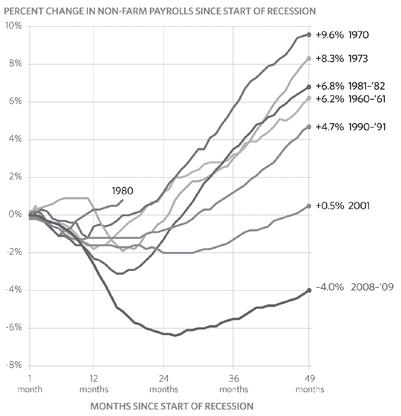

Historically, said Sherk, job creation surges after a deep recession. Unemployment rose to 10.8 percent in 1981 - 1982 before Reagan’s tax cuts had kicked in. After the recession ended, “hiring boomed…. Millions of formerly unemployed workers found new jobs and unemployment rapidly returned to pre-recession levels.” But this has not happened in President Obama’s recovery—“the weakest recovery in more than half a century.” In fact, in every previous recovery following World War II, employment had completely recovered inside of four years. But in December 2011, some four years after the recession began, payroll employment was 4.0 percent below its level in December 2007. As of December 2011, private-sector employment was 4.5 percent below its pre-recession level. In all, there were 5.6 million net fewer jobs, the lion’s share—5.2 million—being private-sector jobs. In the fourth quarter of 2011, net hiring was 40 percent less than during the recovery in 1983. Job creation, then, was significantly below the normal pace following a major recession and even below 2005 levels. The following U.S. Department of Labor chart illustrates the relative sluggishness of Obama’s “recovery.”

13

13

CHART 149 Months Later, Recovery Still LagsEmployment today is 4 percent lower than it was before the recession began 49 months ago. That places the current economic recovery far below any other recovery since the 1960s.Source:

U.S. Department of Labor, Bureau of Labor Statistics / Haver Analytics. Figures exclude temporary Census workers.

B2652heritage.org

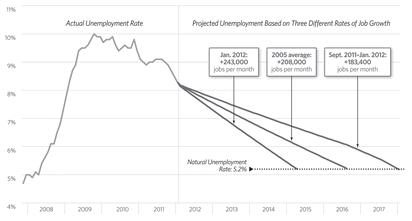

Even though joblessness has fallen to 8.3 percent, that’s still extraordinarily high based on historical standards, and especially based on the Democrats’ blistering critique of the George W. Bush years, when unemployment was often below 5 percent and averaged 5.3 percent. Not since the recession of the early 1980s has unemployment been so high. And while the January 2012 job growth numbers—243,000 net jobs added—were encouraging, they weren’t good enough. Even at this steady growth rate, which is hardly certain, unemployment would still be 7.3 percent at the end of 2012 and not down to what economists consider the natural rate of unemployment—around 5.2 percent—before April 2015. This Heritage Foundation chart shows the jobs picture:

CHART 2Economy Adds Jobs—But SlowlyThe U.S. economy added 243,000 jobs in January 2012. lf jobs continue to be added at that rate, it will take three more years before the unemployment rate returns to the natural rate of 5.2 percent. If jobs are added at the rate of the past five months, unemployment won’t return to 5.2 percent until early 2018.Source:

Heritage Foundation calculations using data from the U.S. Department of Labor, Bureau of Labor Statistics/ Haver Analytics.B2652heritage.org

And there’s more bad news. In addition to unemployment among blacks reaching a 27-year high,

14

Obama’s term has seen the largest drop in income ever for the poorest Americans—the bottom 20 percent. Obama’s broken promises to produce economic growth and upward mobility, especially for the lowest income groups, might be an additional reason—beyond class warfare politics—he incessantly demands more income redistribution. He gets to blame the “rich,” deflecting his own responsibility, and compensate for his policy failures by shifting more of their money to the lower income groups, rather than helping to make them part of an opportunity society. In the process, he even gets to invoke Christian principles, telling his audiences, “I am my brother’s keeper.”

15

This chart, based on Census Bureau data, tells the story:

14

Obama’s term has seen the largest drop in income ever for the poorest Americans—the bottom 20 percent. Obama’s broken promises to produce economic growth and upward mobility, especially for the lowest income groups, might be an additional reason—beyond class warfare politics—he incessantly demands more income redistribution. He gets to blame the “rich,” deflecting his own responsibility, and compensate for his policy failures by shifting more of their money to the lower income groups, rather than helping to make them part of an opportunity society. In the process, he even gets to invoke Christian principles, telling his audiences, “I am my brother’s keeper.”

15

This chart, based on Census Bureau data, tells the story:

Lowest Quintile % Change in Income1968-2010 (in 2010 dollars)SOURCE: Census Bureau

LABOR PARTICIPATION: EVEN WORSE THAN IT SEEMS

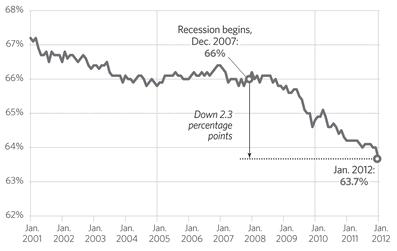

As noted, although unemployment was marginally improving, the figures being reported were misleading because they failed to factor in the falling labor force participation, i.e, those people who were no longer seeking employment. The actual labor force—the combined number of those employed and those still looking for a job—was at its lowest percentage since 1983. Only 63.7 percent of adult Americans were in the labor force at the beginning of 2012 compared to 66.2 percent at the beginning of 2008, a drop of 2.5 percentage points.

17

17

Some of this was attributable to demographic factors such as the retirement of baby boomers. But there was more to the story. Since the recession began, participation rates plunged by two percentage points, unrelated to demographic factors. The Congressional Budget Office estimates that the jobless rate would be 1.25 points higher if labor force participation had not decreased; the CBO, as noted above, say it would be even higher than that.

Unfortunately, the “recovery” has not resulted in the participation rate climbing back up.

18

The chart below shows the dramatic decline in labor force participation:

18

The chart below shows the dramatic decline in labor force participation:

CHART 4Labor Force Participation DeclinesSource:

Heritage Foundation calculations using data from the U.S. Department of Labor, Bureau of Labor Statistics/ Haver Analytics.B2652heritage.org

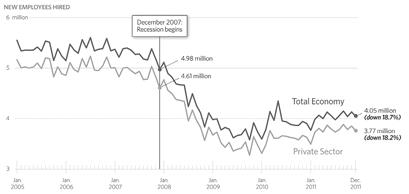

The standard unemployment figures also downplay another unsettling trend: private-sector job creation is at near record lows. Fewer existing businesses are hiring and fewer entrepreneurs are starting new businesses, meaning fewer jobs are available for the unemployed. Prior to the recession, more than 5 million new employees were hired each month, but this figure fell to 3.6 million by June 2009. By February 2012 it had only slightly improved to 4 million.

19

While fewer employees are being laid off since the start of the recession, unemployment remains high because of these sluggish job creation figures, as the following chart demonstrates:

19

While fewer employees are being laid off since the start of the recession, unemployment remains high because of these sluggish job creation figures, as the following chart demonstrates:

CHART 3Monthly Hiring Down More Than 18 PercentBefore the recession, more than 5 million new employees were hired each month. Currently, the rate is about 4 million per month, a decline of more than 18 percent since the recession began.Source:

U.S. Department of Labor, Bureau of Labor Statistics, “Job Openings and Labor Turnover Survey,” 2007-2011 / Haver Analytics.B2652heritage.org

CORRUPTION AND WASTE

“A BUDGET WORTHY OF GREECE”

The Obama administration’s extravagant spending schemes inevitably involve enormous amounts of waste and corruption. Take the stimulus: the Government Accountability Office found that the federal government awarded $24 billion in stimulus funds to some 3,700 contractors and vendors—5 percent of all stimulus recipients—who owed a combined three-quarters of a billion in unpaid federal taxes. Senator Tom Coburn remarked, “That such a huge amount of the stimulus money went to known tax cheats should be a wakeup call for Congress.”

20

20

Senators Coburn and John McCain issued a report, called “Summertime Blues,” on the 100 most wasteful projects funded in President Obama’s $868 billion stimulus bill. Here are just a few blood-boiling examples:

* The U.S. Forest Service was set to spend $554,763 to replace windows at a visitors center on Mount St. Helens in Washington state that was closed in 2007.

* The government gave $762,372 to the University of North Carolina to develop a computerized choreography program that could lead to a YouTube-like “Dance Tube” online application.

* An abandoned train station in Glassboro, New Jersey, was converted into a museum with $1.2 million in federal stimulus funds.

21

* The GOP research team also analyzed stimulus waste, state by state, citing such examples as a $15 million grant to construct an airport in an Alaskan village with 165 residents, a $950,000 study on the genetic makeup of ants, and $4.3 billion to build high-speed rail between two sparsely populated rural towns.

22

In November, the Treasury Department revised its loss estimate for the GM bailout from $14.33 billion to $23.6 billion, racking up another confirmed failure for Obama’s economic record. The $23.6 billion amounted to a 25 percent loss for the federal government on its $60 billion “investment” in GM. In addition, according to Shikha Dalmia of

Reason

, taxpayers would also take a hit because the administration allowed GM to write off $45 billion in losses, which could amount to $15 billion in lost revenues. The total hit to taxpayers could amount to $38.6 billion.

23

Reason

, taxpayers would also take a hit because the administration allowed GM to write off $45 billion in losses, which could amount to $15 billion in lost revenues. The total hit to taxpayers could amount to $38.6 billion.

23

Astronomical losses were also uncovered at Fannie Mae and Freddie Mac. While the administration claimed the actual cost of the federal government’s guarantees to the mortgage giants was $130 billion, the CBO put the real cost at almost 2.5 times that: $317 billion.

24

24

The administration received a couple more failing grades—this time from a surprising source, its former economic adviser Austan Goolsbee—for its Cash for Clunkers program and the home buyer tax credit passed in 2009, which Goolsbee said he would not back “if given a second chance.” Admitting the administration had misjudged how long it would take the economy to recover, Goolsbee explained that Obama was hedging his bets to cover either a long or short recovery. These two programs, he said, “were geared to trying to shift” the recovery from 2010 into 2009. “Given it’s taken this long [to recover], I don’t think you would do that short-run stuff.”

25

INFRASTRUCTURE BOONDOGGLES25

President Obama remains unchastened by his failed promises to jumpstart the economy or contain unemployment with his stimulus program. He just demands more of the same, as we saw with his push for a $50 billion high-speed rail project and his $447 billion jobs bill.

Obama’s disregard for empirical data on high-speed rail is remarkable. The experience of other countries with high-speed rail, available for all to review, is that it is an expensive undertaking, with relatively low public demand, high ticket prices, and a need for ample government subsidies. America’s own experience with such projects is no better. In 2011, planners of a California high-speed rail project tripled its projected costs (voters were told it would cost $33.6 billion when they voted to approve the project, and estimates later rose to $98.5 billion) and announced trains would not be running for twenty-two years. But this didn’t keep Vice President Joe Biden from heartily supporting the project, which received an infusion of $2.25 billion from the federal stimulus.

26

26

Obama’s initial stimulus bill allocated only a small percentage of monies to infrastructure improvements, despite his assurances that boundless shovel-ready jobs awaited. But his FY2013 budget seeks $50 billion to “jumpstart” transportation projects and $476 billion over six years for “surface transportation projects,” including high-speed rail. How would Obama pay for what would amount to a $135 billion spending increase? Simple: with phantom savings from the wars in Afghanistan and Iraq.

The administration, of course, continues to peddle the specious Keynesian claim that these stimulus dollars are not wasteful because they create jobs, exerting a multiplier effect as they ripple through the economy. As noted above, that would only be the case if this stimulus money appeared out of nowhere. But it has to come from somewhere, which means instead of stimulating the economy, we are just shifting resources.

27

Forcing so much federal spending leads to inefficiencies and often suppresses private-sector growth, which, along with other factors, could cause a net negative effect on the economy.

27

Forcing so much federal spending leads to inefficiencies and often suppresses private-sector growth, which, along with other factors, could cause a net negative effect on the economy.

A recent European Central Bank international study showed just that. Examining data from 108 national economies, the study concluded that “government consumption is consistently detrimental to growth,” and that this was true “irrespective of the country sample considered.” The ECB study found that while government spending can sometimes help, in excess it reduces economic growth through “government inefficiencies, crowding-out effects, excess burdens of taxation, distortion of the incentives systems, and interventions to free markets.” Economist Veronique de Rugy has also cited domestic studies concluding that “federal spending in states caused local businesses to cut back rather than grow.”

28

BUSH CREATED THIS MESS, SO I’LL MAKE IT WORSE—MUCH WORSE28

Obama and his fellow Democrats still blame President Bush for Obama’s disastrous economic record and the enormous, unprecedented deficits and national debt Obama has accumulated. Given their position, based on such obviously distorted spin, one might reasonably assume their argument would be, “President Bush permitted staggering debt to accrue. We are going to initiate policies to radically reverse this trend, balance the budget, and begin to retire our crippling debt.” Instead, they say, essentially, “We will continue to blame Bush for creating too much debt, but in fact we don’t care about the debt, and we’ll prove it to you by creating deficits and debt that dwarf anything Bush could have imagined in his most destructive fantasies. We will not only refuse to reduce the debt, we will continue to grow it to the point of unsustainability.” There is no better argument for attributing this view to Team Obama than its actual record: in February 2012, Obama racked up the worst one-month deficit in United States history—$229 billion, bringing the accumulated deficit for the first five months of fiscal year 2012 to $631 billion.

29

29

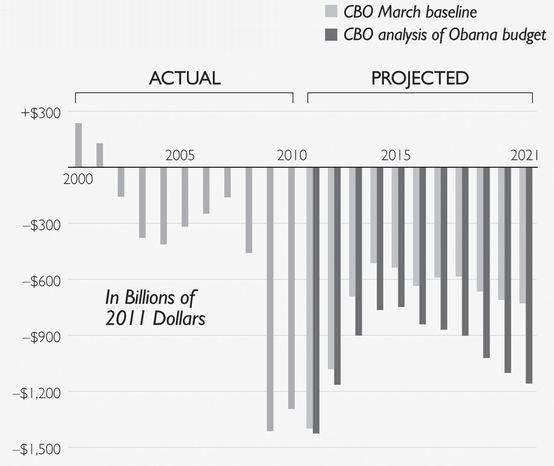

Is there anything to Obama’s claim that Bush created this mess, that it was much worse than Obama had imagined before he took office, and that Obama has worked hard to dig us out of the mess and reduce our deficits and debt? After Obama presented his FY2012 budget, which isn’t appreciably different from his FY2013 budget in terms of its projected spending and deficits, the Heritage Foundation prepared charts comparing deficits under Obama and Bush. The picture tells a grim story—one that Obama would prefer you not hear (or see)—and it does not lie:

Obama Budget Would Drive Deficits DeeperSources:

Congressional Budget Office (current law baseline),“An Analysis of the President’s Budgetary Proposals for Fiscal Year 2012,” April 2011 ; and Office of Management and Budget, Fiscal Year 2012 Budget, Historical Tables, Table 1.1.

A House Budget Committee chart also shows that Obama’s deficits dwarfed Bush’s (though experts have argued over who should be blamed for FY2009). It further shows how Obama makes no real effort to curb the long-term deficit, and that it even begins to climb again in the out years—and this is best case scenario. We must be mindful that these are

projected

figures—showing Obama doesn’t even aspire on his budgetary blackboard to control spending.

projected

figures—showing Obama doesn’t even aspire on his budgetary blackboard to control spending.

Deficit Under Obama Budget(Deficit Levels in Billions of Dollars)SOURCE: OMB

As noted above, the Bush deficit in 2007, when both the Iraq and Afghanistan wars were proceeding with full force, was a fraction of Obama’s 2011 deficit—putting the lie to the Democrats’ claim that the wars created our bankrupting deficits. As Heritage’s Mike Brownfield and Emily Goff explain,

Without a doubt, deficits during the Bush Administration were too high, especially in the early years. More could and should have been done to restrain spending. But, without a doubt, the Bush deficits were puny compared to what Obama and his congressional allies have inflicted. For Obama’s apologists to seek cover in the Bush deficits is shameless. To use these diversions to now take attention away from the real problem to which Obama has added is outrageous … . So next time Obama or his allies in the press go back to the well and recite the well-worn verse that spending is all the other guy’s fault, take a look at the facts. President Obama has steered a fiscal course that will lead to more spending and deeper deficits and ultimately to vastly higher taxes.

30

Considering Obama’s domestic record to date—the utter failure of his economic programs, the dismal state of the economy and jobs, the looming debt placing the United States within a stone’s throw of a Grecian-style financial collapse—rational observers might have expected the president, in his fourth and final try prior to the November elections, to present a fiscally responsible budget. But his addiction to profligacy, his obsessive desire to remake America in his image and advance his radical agenda for economic redistribution, and pressure from his leftist base must have been too much to resist—his fiscal year 2013 budget, presented in February 2012, was as reckless as its three predecessors.

Obama’s budget was so bereft of sensible stewardship that he knew it could never pass Congress. So his strategy was obviously to leverage it to curry favor with his base and use it as further ammunition to blame Republicans for his economy and debt. In the words of syndicated columnist Charles Krauthammer, “This administration is so used to blaming everything on Republicans—earthquakes, hailstorms, who knows, the rising of the ocean…. The president knows that we are headed over a cliff. He just wants to get past Election Day as he does on everything—on Keystone, on debt ceiling limits, on everything. But this is a budget worthy of Greece and for the president of the United States to offer it knowing how dire our situation is, is truly scandalous.”

31

31

In this budget Obama demonstrated that he’d learned nothing from his failed policies; if anything, he doubled down on the worst of them. His budget amounted to an unimaginative recycling of his inaptly named “Winning the Future” and “An America Built to Last” campaigns. The budget not only didn’t propose spending reductions; it called for substantial increases of $227 billion, and added $329 billion to the projected deficit. It called for $315 billion more “stimulus” spending—completely disregarding the failures of his previous stimuli—and included $2.7 trillion more spending over the next ten years than the Congressional Budget Office’s baseline projections. While Obama glibly proclaimed he was cutting deficits by $4 trillion over the next decade, more than $2 trillion of this illusory $4 trillion in “savings” were already in law—not added with this budget—including almost $1 trillion for money that had neither been requested nor spent in Iraq and Afghanistan.

32

More damningly, his budget would in fact add $7 trillion in deficits over the next ten years.

33

32

More damningly, his budget would in fact add $7 trillion in deficits over the next ten years.

33

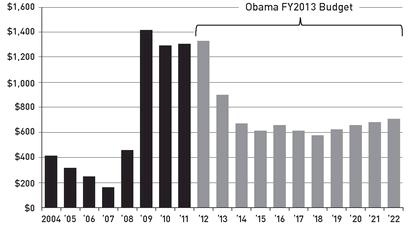

This FY2013 budget was the fourth straight in which Obama called for a deficit exceeding $1 trillion, flagrantly disgracing his promise to cut the deficit in half in four years. This House Budget Committee Chart juxtaposes the actual deficit figures against Obama’s February 23, 2009 promise, “Today I am pledging to cut the deficit we inherited by half by the end of my first term in office”:

President’s Broken Promise on Deficit(in Billions of Dollars)

Obama’s budget calls for spending $47 trillion and raising taxes by $1.9 trillion over the next decade—an increase over current projections when what we need is a radical decrease. It also foresees spending $3.8 trillion in the next fiscal year and increasing it incrementally—yet substantially—to $4.3 trillion in 2016 and to a staggering $5.8 trillion in 2022.

34

34

Clearly, Obama isn’t even attempting to bring the budget, the deficit, or the national debt under control. When he took office the national debt was $10.626 trillion. By March 20, 2012, after just just three years and two months, it had increased by almost $5 trillion to $15.583 trillion, which was about the same amount it increased during George W. Bush’s entire eight-year tenure.

35

And Obama’s latest budget projects will add almost another $1 trillion to the debt this year—and these are optimistic forecasts—meaning he will have increased the national debt by a staggering $6 trillion in his first term.

35

And Obama’s latest budget projects will add almost another $1 trillion to the debt this year—and these are optimistic forecasts—meaning he will have increased the national debt by a staggering $6 trillion in his first term.

Even if it’s unfair to attribute this entire amount to Obama because some of the spending was set in place when he took office, he is responsible for the lion’s share of it, and he has not made a good faith effort to reverse the problem. Indeed, according to the House Budget Committee and Senate Budget Committee Republican Summary of President’s FY2013 Budget, the total national debt by the end of FY2022 under Obama’s latest budget would be almost $26 trillion, at which time annual interest payments on the debt would be almost $1 trillion.

36

36

Putting all this in perspective, the Heritage Foundation reports that Obama’s projected budget foresees spending in excess of 22 percent of GDP “throughout the decade … more than twice the New Deal’s share of the economy in its peak years. In constant dollars, outlays are more than three times the peak of World War II.”

37

ENTITLEMENTS TO CONSUME ALL TAX REVENUES BY 205237

Obama has relentlessly pushed for high-speed rail and other “stimulus” construction jobs such as repairing and rebuilding roads, bridges, and schools. Not once in arguing his case has he apologized for the failure and corruption of his first stimulus bill or his cynical, callous misrepresentation that shovel-ready jobs awaited the infusion of federal money. In a meeting with his Jobs and Competitiveness Council in Durham, North Carolina in June 2011, Obama wise-cracked, “Shovel-ready was not as shovel-ready as we expected.”

38

38

But he just demands more. Even with his proposed tax increases, which he scores statically—as if increasing tax rates on producers won’t dampen economic growth—and his proclaimed savings based on money that was never allocated in the first place (e.g., Afghanistan and Iraq), his projected deficits never come in under $575 billion—the low point in his projections in 2018. But then his projected deficits soar back to $704 billion in 2022. Note that our average post-World War II publicly held debt has been 43 percent of GDP; today it is 74.2 percent and will increase to 76.5 percent by 2022 under Obama’s budget.

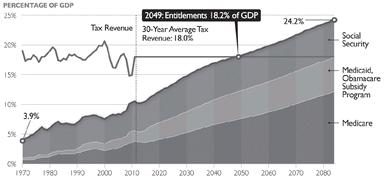

On top of all this, Obama has not even taken a run at entitlement reform for Medicare, Medicaid, and Social Security, though they are the principal drivers of our deficits and debt. To illustrate what a farce and scandal this omission is: by 2050, these three entitlements plus ObamaCare are projected to gobble up 18 percent of GDP, which is around the historical average of federal tax revenue. Other than retreading the tired proposals of top-down cuts to medical providers, Obama refuses to acknowledge that, fiscally speaking, we are doomed unless we restructure entitlements.

39

This Heritage Foundation chart, based on the 2010 budget figures—and matters are much worse now—illustrates this sobering reality:

39

This Heritage Foundation chart, based on the 2010 budget figures—and matters are much worse now—illustrates this sobering reality:

Medicare, Medicaid, and Social Security Will Consume All Tax Revenues by 2049If the average historical level of tax revenue is extended, spending on Medicare, Medicaid and the Obamacare subsidy program, and Social Security will consume all revenues by 2049. Because entitlement spending is funded on autopilot, no revenue will be left to pay for other government spending, including constitutional functions such as defense.Source:

Congressional Budget Office.Entitlements Chart I * 2011 Budget Chart Bookheritage.org

Obama claims ramped up education spending is a key to economic growth, believing jobs will magically appear if central planners create job-training partnerships between academia and the private sector. So he proposed a 3.5 percent increase (above 2012 levels) to $69.8 billion for the Department of Education, with $850 million in new grants for his Race to the Top program and $80 million in federal funding for teacher training in science, technology, engineering, and mathematics. As for higher education, he would authorize $8 billion in new spending for the Community College Career Fund to expand certification programs and job training at community colleges. His budget also increases the maximum Pell Grant award.

40

40

His budget forbids any of this money from funding for-profit colleges—the dreaded private sector. This is consistent with his previous policy targeting for-profit universities, exemplified by the Department of Education’s new restrictions on these institutions. These include restrictions on student loan access for students attending for-profit institutions whose average debt-to-earnings ratio exceeds 12 percent of a graduate’s income.

41

41

As noted, Obama’s budget calls for $1.9 trillion in new taxes over the next decade, and when you subtract his $88 billion in tax cuts—mainly incentives for pursuing behavior he approves, such as green activities—he’s proposing a net increase of $1.8 trillion. Projected revenues would equal 20.1 percent of GDP in ten years, well above the historical average. He would raise taxes on families making above $250,000 per year and would knife through their existing personal exemptions and deductions. He would increase capital gains taxes to 20 percent (which would amount to 23.8 percent if the new ObamaCare surtax applies) and also raise the estate tax.

Stunningly, he proposed to tax dividends at ordinary income tax rates, the highest of which, in some cases, would amount to 43.4 percent when combining the 39.6 percent rate with the 3.8 percent ObamaCare surcharge, when applicable. In that dividends are already double taxed (being taxed at 35 percent at the business level), the new effective rate would approximate 63 percent. Obama’s budget also includes a rough outline to replace the Alternative Minimum Tax with the so-called Buffett Rule, which would impose a new minimum tax of 30 percent on millionaires, just to further gouge higher income earners. On top of that, as another punitive tweak, he would eliminate deductions for families earning more than $1 million per year—including deductions for mortgage interest, retirement savings, and healthcare expenses.

42

42

These tax increases would cripple an already sluggish economy and stalled job market, inevitabilities Obama doesn’t factor into his projections, making them look more optimistic than is warranted.

ROSY PROJECTIONSThe Heritage Foundation’s economic experts tell us that all administrations are accorded some license in adopting optimistic growth projections for their budgets, but that their forecasts rarely deviate substantially from the Blue Chip forecasts, which is an average of selected private sector prognosticators. The January Blue Chip forecast projects real output in 2012 at 2.2 percent, as does the Congressional Budget Office’s forecast. Well, the administration chose to use a 2.7 percent growth figure—for 2012, the most important year because, obviously, all other years included in the calculation follow, and their projected growth accrues to that higher first-year budget figure.

According to Heritage, the net effect of these assumptions is that the administration shows 3.9 percent more cumulative growth than the Blue Chip forecast. Heritage’s J. D. Foster observes, “In economic terms, that’s like adding an extra year of growth—an extra

very good

year of growth.” In real terms, this means, for example, that with the more realistic Blue Chip assumptions, the projected deficit for 2016 would be $844 billion instead of the $649 billion foreseen by the administration.

43

“NOTHING COULD BE FURTHER FROM THE TRUTH”very good

year of growth.” In real terms, this means, for example, that with the more realistic Blue Chip assumptions, the projected deficit for 2016 would be $844 billion instead of the $649 billion foreseen by the administration.

43

Perhaps no part of Obama’s budget is more myopic and brings about more senseless waste than his “green energy” projects. Even Department of Energy Inspector General Gregory Friedman admitted that the Obama administration’s goal of stimulating the economy with “shovel-ready” energy jobs was unrealistic. “The concept of shovel-ready projects was not realized, nor, as we now have confirmed, was it a realistic expectation,” Friedman told the House Oversight Committee.

44

44

With his FY2013 budget he continues on that path, notwithstanding his scandalous failures with Solyndra and other green energy boondoggles, as discussed in chapter eight. To mention just one example, he called for $310 million for the SunShot initiative, which seeks to make solar energy competitive and subsidy free by 2020. Instead of allowing consumers and the energy industry to make their own choices, Obama prefers his Department of Energy to act as commissar in making those decisions irrespective of market forces. His budget also allocates funds for development of other green sources, including wind, geothermal, and biofuels.

Obama is impervious to the notion that these energy sources will naturally develop if global demand warrants it, and if not, they’ll likely fail anyway, as has been the case with his forced projects so far. He can’t understand that businesses and investors make their own decisions about the wisdom of investing their dollars, taking into account market signals and other factors.

When government interposes itself and manipulates those factors, including by injecting taxpayer subsidies into a president’s pet projects, it skews market signals and virtually builds in failure. But Obama is compelled to dicker with industry, and so his budget gives the Department of Energy some $290 million for R&D to boost energy efficiency in manufacturing processes.

45

45

All these policies stem from Obama’s core belief that government, not the private sector, is the main source of societal advancement and technological progress. Consider natural gas; after Obama attributed America’s current natural gas boom to public funding, Heritage expert Nicolas Loris retorted that “nothing could be further from the truth.” Yet Obama “wants to unnecessarily dump money into an already-booming industry,” so his budget proposes $421 million in fossil energy R&D, which includes $12 million to advance technology to develop natural gas resources. Much of the rest of this money is carved out for the development of other green technologies. In the meantime, while subsidizing these energy sources, Obama is seeking to punish reliable domestic energy sources via measures such as eliminating tax deductions for the oil industry.

46

THE ONGOING OBAMACARE DEBACLE46

Obama continues to dissemble about his signature “accomplishment,” the Patient Protection and Affordable Care Act, or ObamaCare, which is making healthcare neither more affordable nor more accessible, and whose fate awaits the ruling of the Supreme Court. In fact, in September 2011, Gallup reported that the percentage of American adults who were without health insurance has increased during Obama’s presidency and has continued rising since the passage of ObamaCare.

47

47

In his FY2013 budget, Obama once again made the false assertion that ObamaCare would bend the healthcare cost curve down, even claiming it would reduce the deficit by $1 trillion over the next ten years. Brazenly, he continued to make these claims after the double counting (Medicare) and other fraudulent accounting tricks (e.g., the “Doc Fix”) had long since been exposed as a “shell game.”

48

Moreover, shortly after he presented his budget, it was revealed that ObamaCare’s gross cost during the next decade was expected to be almost double the $940 billion estimate Obama represented to the American people. The mathematical gyrations the Democrats used to conjure the $940 billion figure were nothing short of deceitful; the Congressional Budget Office, long after it had favorably scored the bill in time to validate it for enactment into law, announced on March 14, 2012 that the costs would be closer to $1.76 trillion.

49

48

Moreover, shortly after he presented his budget, it was revealed that ObamaCare’s gross cost during the next decade was expected to be almost double the $940 billion estimate Obama represented to the American people. The mathematical gyrations the Democrats used to conjure the $940 billion figure were nothing short of deceitful; the Congressional Budget Office, long after it had favorably scored the bill in time to validate it for enactment into law, announced on March 14, 2012 that the costs would be closer to $1.76 trillion.

49

In another egregious misrepresentation, Obama had claimed that under ObamaCare, Americans could keep their own insurance plans if they liked them. But the CBO now estimates that as ObamaCare kicks in, many more Americans will lose their private coverage—and will be subject to fines—than we were originally told. The CBO estimates that the government will fine individuals $45 billion, instead of $34 billion, for not having coverage, and businesses will pay closer to $96 billion, some $15 billion more than the initial projections.

50

According to this CBO report, ObamCare could cause up to 20 million people to lose their coverage.

51

Along the same lines, a

McKinsey Quarterly

survey from June 2011 found that nearly one-third of employers say they will “definitely or probably” stop offering their employees healthcare coverage under ObamaCare.

52

50

According to this CBO report, ObamCare could cause up to 20 million people to lose their coverage.

51

Along the same lines, a

McKinsey Quarterly

survey from June 2011 found that nearly one-third of employers say they will “definitely or probably” stop offering their employees healthcare coverage under ObamaCare.

52

According to a survey by the insurer Willis Group, the situation is even worse than that. Willis reports, “Survey respondents indicate into the second year of Health Care Reform implementation, less than 30 percent of employers were able to maintain grandfathered status of their health care plans.” Willis notes that the “rapid loss of grandfathered status far outpaces The Department of Health & Human Services’ expectations.” HHS projected that 78 percent of employers would retain their grandfathered status by the end of 2011, that 62 percent would by the end of 2012, and that 49 percent would by the end of 2013. Willis says the accelerated loss of grandfathered status “suggests that employers have had to make many plan changes to offset cost increases,” and that employers have likely chosen to forfeit their grandfathered status to control costs. When ObamaCare opponents had warned this would happen, the bill’s supporters ridiculed them as partisan fear-mongers. But the facts are sometimes a disturbing inconvenience.

53

53

Time has revealed even more deceit in the administration’s cost projections for ObamaCare. The administration, in its budget request in early 2012, asked for an increase of $111 billion in subsidies to help poor people buy insurance. House Ways and Means chairman Dave Camp said, “This staggering increase in health insurance exchange subsidy spending cannot be explained by legislative changes or new economic assumptions, and therefore must reflect substantial changes in underlying assumptions regarding the program’s utilization and cost.”

54

54

Even before it has fully taken effect, ObamaCare is having other negative effects that undermine the administration’s assorted justifications for the bill. For example, Gallup has found:

* Nearly half of small businesses aren’t hiring due to healthcare costs and government regulation.

* The cost of health insurance for many Americans climbed more sharply this year than in previous years, outstripping any increases in workers’ wages and showing ObamaCare is actually making healthcare less affordable.

* The lack of clarity about the cost implications of ObamaCare is an impediment for companies to begin hiring.

* ObamaCare regulations are preventing small businesses from expanding, with 74 percent of small business owners blaming ObamaCare for hurting job creation.

55

In addition, the

New York Times

confirms that doctors are leaving small private practices in droves, and that small insurance firms are disappearing.

56

According to one survey, nine out of ten physicians are unwilling to recommend healthcare as a profession now that ObamaCare has been enacted. That survey also shows that 60 percent of doctors believe ObamaCare will negatively affect patient care, and 51.4 percent believe it could compromise the doctor-patient relationship. In addition, some 43 percent of physicians are contemplating retirement within the next five years because of ObamaCare.

57

New York Times

confirms that doctors are leaving small private practices in droves, and that small insurance firms are disappearing.

56

According to one survey, nine out of ten physicians are unwilling to recommend healthcare as a profession now that ObamaCare has been enacted. That survey also shows that 60 percent of doctors believe ObamaCare will negatively affect patient care, and 51.4 percent believe it could compromise the doctor-patient relationship. In addition, some 43 percent of physicians are contemplating retirement within the next five years because of ObamaCare.

57

Additionally, when some groups recommended less screening for prostate, breast, and cervical cancer—stressing that such screenings can be harmful,

58

an argument we never seemed to hear before—many observers attributed the proposal to new cost concerns created by ObamaCare.

59

58

an argument we never seemed to hear before—many observers attributed the proposal to new cost concerns created by ObamaCare.

59

ObamaCare also unleashed some seventeen new taxes (some say twenty),

60

which would cost $502 billion between 2010 and 2019, including a tax on “Cadillac” employer health plans, individual and employer mandate penalties, a health insurance premium tax, and a web of tax implementation rules to take effect in 2013 that are harming private industry.

61

60

which would cost $502 billion between 2010 and 2019, including a tax on “Cadillac” employer health plans, individual and employer mandate penalties, a health insurance premium tax, and a web of tax implementation rules to take effect in 2013 that are harming private industry.

61

A punitive 2.3 percent medical device excise tax will be particularly damaging, resulting in higher costs and job losses in the medical device industry. Stephen Ferguson, chairman of Cook Medical, says new taxes and regulations will “consume 15 percent more of our earnings.” Another company, Stryker, which makes artificial hips and knees, announced that ObamaCare’s burdens were causing it to cut 5 percent of its global workforce, or about 1,000 workers. Many other companies will be similarly affected.

62

62

ObamaCare also imposes an additional 3.8 percent “sales” tax on a certain portion of the gain (in excess of $500,000 for married couples or $250,000 for singles) on certain home sales (and other unearned income) for couples whose adjusted gross income exceeds $250,000 ($200,000 for singles).

63

Grover Norquist, president of Americans for Tax Reform, says that five of these new taxes will fall most directly on seniors.

64

The following chart illustrates the extent of these seventeen new taxes:

63

Grover Norquist, president of Americans for Tax Reform, says that five of these new taxes will fall most directly on seniors.

64

The following chart illustrates the extent of these seventeen new taxes:

Other books

My Masters' Nightmare Season 1, Episode 1 by Marita A. Hansen

The Stars Will Shine by Eva Carrigan

Pieces of Camden (Hole-Hearted #1) by Yessi Smith

Hunting a Soul by Viola Grace

Nameless by Jessie Keane

Bind Our Loving Souls by April Marcom

Are You There, Vodka? It's Me, Chelsea by Chelsea Handler

The Wombles by Elizabeth Beresford

Secrets of a Side Bitch 2 by Watkins, Jessica

Drawing The Line by Kincaid, Kimberly