The Great Destroyer: Barack Obama's War on the Republic (20 page)

Read The Great Destroyer: Barack Obama's War on the Republic Online

Authors: David Limbaugh

BOOK: The Great Destroyer: Barack Obama's War on the Republic

13.91Mb size Format: txt, pdf, ePub

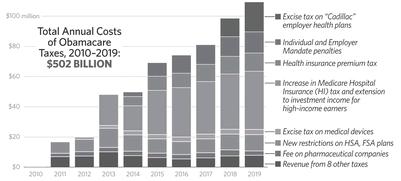

Taxed Enough Already? Just wait until Obamacare kicks inTo pay for generous subsidies to purchase health insurance, a huge expansion of Medicaid, and other new spending, Obamacare raises taxes and adds 17 new taxes or penalties that will affect all Americans.Source:

Heritage Foundation calculations based on data from the Joint Committee on Taxation, March 2010 report.Obamacare in Picturesheritage.org

FURTHER EMPOWERING THE IPAB: “A RADICAL AND COUNTERPRODUCTIVE PLAN”

Obama’s budget merely nibbles around the edges of Medicare and Medicaid which, along with Social Security—as noted—are the main drivers of our impending financial crisis. Moreover, his initial bill created the Independent Payment Advisory Board (IPAB), which will be a frighteningly powerful bureaucratic entity comprised of fifteen appointees who will make one-size-fits-all command decisions on healthcare accessibility, treatment, and fees. Despite justifiable fears that it could limit our freedoms and medical choices, including end-of-life decisions, Obama’s budget has proposed to expand the board’s powers. He and his experts and propagandists can characterize it in creative ways, but this board, among other things, will be a glorified rationing body, and if it does exercise cost-savings, it will do so at considerable cost to our freedoms and our access to and quality of care.

65

65

Essentially, the IPAB—which ObamaCare entrusts with overseeing Medicare—could only cut medical costs overall and/or Medicare spending by assuming the power to unilaterally enforce spending caps via payment cuts to service providers. By law, the IPAB is required to keep total Medicare spending below a specified legal cap that will increase at a marginally faster pace than the growth rate of the nation’s economy. Since the IPAB will have no jurisdiction to affect how beneficiaries interact with Medicare, virtually its only option to reduce costs will be to impose arbitrary spending caps, which is what Medicare has been doing for decades. Such categorical reductions in reimbursement rates have failed to restrain Medicare costs and have reduced access of seniors to essential healthcare. Congressional Republicans unsuccessfully moved to repeal IPAB, knowing it can only be effective if it’s granted arbitrary and draconian authority.

66

66

ObamaCare and IPAB double down on this failed Medicare model—and according to many experts, this will result in more and more medical professionals refusing to accept Medicare patients, thus reducing seniors’ access to care. This is not a moderate approach by reasonable reformers. In the words of economics expert J. D. Foster, “It is a radical and counterproductive plan to hand over immense power to an unelected board to reduce payment rates by fiat and implicitly to ration services for seniors.”

67

67

In addition to all this, the Obama administration also created a $6 billion network of nonprofit “CO-OPs” that will “compete” with private insurers, according to columnist Michelle Malkin, which she calls “socialized medicine through the side door.” While Republicans sliced $2 billion from this “slush fund,” Malkin says the program is still alive and well, with some $700 million in taxpayer-funded low-interest loans being recently parceled out to seven such CO-OPs in eight states with more to come the next year. More scandalous, Kaiser Health is reporting that the ObamaCare CO-OP overseers are already predicting a nearly 40 percent default rate for these loans

68

—in keeping with Obama’s practice of ignoring accountability when it serves his cause. It should come as no surprise that a number of these loan recipients are leftwing groups and, in some cases, friends of Obama.

69

68

—in keeping with Obama’s practice of ignoring accountability when it serves his cause. It should come as no surprise that a number of these loan recipients are leftwing groups and, in some cases, friends of Obama.

69

At one time, when ObamaCare was new and fresh, Obama insisted that it was a crucial part of his economic agenda, but by the time of its second anniversary, he had begun retreating from that position.

70

The ObamaCare legislation is a whopping 2,700 pages, containing 425,116 words, but the regulations promulgated to implement it contain over 2 million words.

71

“CRONY CAPITALISM, BAILOUT FAVORITISM, AND GANGSTER GOVERNMENT”70

The ObamaCare legislation is a whopping 2,700 pages, containing 425,116 words, but the regulations promulgated to implement it contain over 2 million words.

71

ObamaCare is already so damaging that the administration arbitrarily issued more than a thousand waivers to various groups and companies in order to defer their pain and further deceive the public about the bill’s actual costs—at least until after the 2012 election. At issue is ObamaCare’s requirement that health insurers raise their annual benefit limits gradually until 2014, when all such limits would become illegal.

72

In March 2011, the administration granted 128 new, one-year waivers to this rule, bringing the total number of recipients to 1,168 businesses, insurers, unions, and other groups, involving around 3 million people. Congressman Fred Upton stated the obvious: “The fact that over 1,000 waivers have been granted is a tacit admission that the healthcare law is fundamentally flawed.”

73

72

In March 2011, the administration granted 128 new, one-year waivers to this rule, bringing the total number of recipients to 1,168 businesses, insurers, unions, and other groups, involving around 3 million people. Congressman Fred Upton stated the obvious: “The fact that over 1,000 waivers have been granted is a tacit admission that the healthcare law is fundamentally flawed.”

73

Looking at these numbers, Columnist Michael Barone raised a separate question: “Why are more than half of those 3,095,593 in plans run by labor unions, which were among ObamaCare’s biggest political supporters? Union members are only 12 percent of all employees but have gotten 50.3 percent of Obamacare waivers.” Barone noted that when coupled with the administration’s NLRB action against Boeing and the IRS’s attempt to levy a gift tax on donors to certain groups “that just happen to have spent money on Republicans,” it appears the administration is “punishing enemies and rewarding friends—politics Chicago style.” To Barone, it smelled of “crony capitalism, bailout favoritism and gangster government.”

74

That stench grew stronger when it came to light that some 20 percent of the 204 waivers granted in April 2011 were given to gourmet restaurants, nightclubs, and fancy hotels in Nancy Pelosi’s congressional district.

75

In January 2012, amidst growing accusations of corruption, the HHS announced an end to the waiver program. By that time some 1,231 companies had received waivers, covering almost 4 million people.

76

“SITUATIONAL TRUTH”74

That stench grew stronger when it came to light that some 20 percent of the 204 waivers granted in April 2011 were given to gourmet restaurants, nightclubs, and fancy hotels in Nancy Pelosi’s congressional district.

75

In January 2012, amidst growing accusations of corruption, the HHS announced an end to the waiver program. By that time some 1,231 companies had received waivers, covering almost 4 million people.

76

The financial centerpiece of ObamaCare is the individual mandate, which forces people to buy healthcare insurance. In March 2012 the Supreme Court heard arguments surrounding the mandate’s dubious constitutionality. The administration’s lawyer told the justices that the government-imposed charge for violating the individual mandate is a tax—as opposed to a fine or penalty—and thus Congress has the authority to impose it.

77

Interestingly, when ABC’s George Stephanopoulos asked Obama in September 2009 if the individual mandate was a tax increase, Obama replied, “I absolutely reject that notion.”

78

But when it was necessary for his administration to argue otherwise, it did.

77

Interestingly, when ABC’s George Stephanopoulos asked Obama in September 2009 if the individual mandate was a tax increase, Obama replied, “I absolutely reject that notion.”

78

But when it was necessary for his administration to argue otherwise, it did.

The administration showed its slipperiness on this question in February 2012 during the testimony of Obama’s director of the Office of Management and Budget, Jeffrey Zients, before the House Budget Committee. Congressman Scott Garrett tried to get Zients to admit that the individual mandate is a tax, and would thus violate Obama’s repeated promise not to impose new taxes on middle-and lower-income groups. “Wouldn’t this be a tax on people who make less than $250,000 a year?” asked Garrett. Finally, after bumbling about, Zients said, “No”—a direct contradiction of the argument the administration put to the Supreme Court.

79

79

Obama used similar deceit on the Medicare issue. Despite promising ObamaCare would “put Medicare on a sounder financial footing.” Obama warned during the budget negotiations around a year later that Medicare could go insolvent. Charles Krauthammer commented, “You’ve heard of situational ethics? This is situational truth.”

80

GUTTING NATIONAL DEFENSE80

How do Obama’s budgets handle national security, a realm Obama constantly promises he won’t shortchange? Well, his assertions might fly if you accept his naive beliefs that we don’t need to be prepared to fight two wars at once, that rivals such as China, Russia, and Iran aren’t increasing their military budgets and readiness, and that Islamic terrorism isn’t a major threat. But most people understand that our national security will be imperiled by systematic military downgrading—and that is what Obama’s budgets do.

Although national security is one of the few clearly constitutionally prescribed areas of federal expenditures, it is the one area in which Obama pushes for major spending cuts. Specifically, he seeks to reduce our total defense spending from $721.3 billion in FY2010 to $601.3 billion in FY2017. Obama’s FY2013 budget would decrease the Department of Defense budget 1 percent below the 2012 level,

81

which has already proved to be insufficient, given the military’s expanded commitments.

81

which has already proved to be insufficient, given the military’s expanded commitments.

If his budget proposals are adopted, the Navy, for example, might be rendered impotent to stave off Iranian military action in the Strait of Hormuz while simultaneously attending to its other interests at sea. The Coast Guard may have to choose between defending the sea or our borders. Our Air Force might be forced to pursue missions without any certainty that it will be able to control the airspace. The Marines would be short of ships necessary to make their force deployments. And the Army’s resources would be dangerously downscaled.

82

82

Nor does Obama’s budget account for further defense cuts, totaling half a trillion dollars over the next nine years, that will be imposed by the Budget Control Act of 2011—provisions that kicked in when the vaunted congressional “Super-Committee” was unable to agree to budget cuts. Secretary of Defense Leon Panetta said the cuts would be devastating, but Obama has offered no assurances that he would support their repeal. To the contrary, he has promised he would veto any effort to forestall or thwart this “sequestration.” Through this ill-conceived sequestration, defense would bear half the automatic cuts, though it accounts for less than 20 percent of the federal budget—a recklessly disproportionate result.

83

83

One major problem with Obama’s economic stewardship is that he doesn’t learn from his failures. This is doubtlessly due to his ideological zeal for a comprehensive array of leftist causes and pressure from his progressive base. Every failed stimulus program, green energy boondoggle, and debt-laden budget proposal is followed up with demands for more of the same. More than three years into his presidency, he continues to blame President Bush for all our economic troubles, disregarding the fact that his own federal spending on Cash for Clunkers, windmills, high-speed rail lines, and other so-called economic stimuli and redistributionist schemes, along with his failure to tackle entitlement reform, have blown up the deficit while failing to improve the economy.

Now, in this election season, we are supposed to believe that these policies will work if only we try them for four more years.

CHAPTER SIX

THE WAR ON OUR FUTURE

C

ongressman Paul Ryan has been the national leader in offering an alternative vision to President Obama’s reckless, bank-busting spending agenda. Ryan’s updated Path to Prosperity (2.0) plan, recently passed by the GOP Congress and rejected by the Democratic Senate, is a balanced approach to our budgetary and systemic entitlement problems. It would preserve the existing Medicare program for those currently enrolled or becoming eligible in the next ten years (those fifty-five and older today), but would provide new options for those under age fifty-five, with extra support for those who have greater medical needs. It includes Medical Savings Accounts that are fully funded for low-income beneficiaries and wholly available to those above that income category.

ongressman Paul Ryan has been the national leader in offering an alternative vision to President Obama’s reckless, bank-busting spending agenda. Ryan’s updated Path to Prosperity (2.0) plan, recently passed by the GOP Congress and rejected by the Democratic Senate, is a balanced approach to our budgetary and systemic entitlement problems. It would preserve the existing Medicare program for those currently enrolled or becoming eligible in the next ten years (those fifty-five and older today), but would provide new options for those under age fifty-five, with extra support for those who have greater medical needs. It includes Medical Savings Accounts that are fully funded for low-income beneficiaries and wholly available to those above that income category.

Ryan’s plan would strengthen the healthcare safety net by making Medicare permanently solvent—a claim validated for an earlier version of the plan by CBO estimates and consultations with the Office of the Actuary of the Centers for Medicare and Medicaid Services.

1

It would also modernize Medicaid by reforming high-risk pools and giving states maximum flexibility to tailor their own Medicaid programs to the needs of their citizens.

1

It would also modernize Medicaid by reforming high-risk pools and giving states maximum flexibility to tailor their own Medicaid programs to the needs of their citizens.

Ryan’s Roadmap plan, as distinguished from his Path to Prosperity plan, also contains specific and concrete reform measures for Social Security, analogous to the Path’s Medicare proposals. It would preserve existing benefits for those at or approaching retirement age and provide new options for those under 55, including personal retirement accounts for more than a third of their Social Security taxes. But because not enough GOP Congress members would support this Social Security component of Ryan’s Roadmap plan, his Path to Prosperity, which Congress did approve, instead just calls for bipartisan action to restore Social Security to solvency.

Obama and the Democrats have responded to Ryan’s Path to Prosperity, both the original version and the updated one, with insult, ridicule, demagoguery, demonization, and fear-mongering. Obama has repeatedly misrepresented the plan as robbing Americans of their Social Security, Medicare, and Medicaid, all of which it expressly preserves.

Without addressing the unfunded liabilities from these entitlements, the long-term budget can never be balanced and the United States will become insolvent. But Obama has continually kicked the entitlements issue down the road, virtually ignoring the looming crises in his current budget and even exacerbating the problem by approving ObamaCare, a monstrous new entitlement. Because he refuses to tackle entitlements or to make any appreciable dent in discretionary spending (other than for our vital national defense needs), he can’t balance the budget—even in the long-term and even using his ultra-rosy economic forecasts.

This was evident in February 2012 when Obama’s Office of Management and Budget director Jeffrey Zients testified before the House Budget Committee about Obama’s FY2013 budget proposal. Congressman Scott Garrett asked Zients a simple question: “If we pass this budget tomorrow, when does the budget balance in this country under your proposal?” Zients began his reply, “We achieve significant progress … ” Garrett cut him off and demanded to know “just the year.” After floundering around further, Zients stammered, “That’s not a year question.” Incredulous, Garrett asked, “Is it your answer that this budget never balances?” Committee Chairman Paul Ryan then interceded, saying, “Time for the gentleman is expired. Witness is obviously not going to answer the question.”

2

2

There was a reason Zients wouldn’t respond to the question—because the true answer would be: “President Obama’s budget will never balance.”

THE ECONOMY “SHUTS DOWN IN 2027”Treasury Secretary Timothy Geithner’s testimony before Congress two days later was no more reassuring. Paul Ryan asked him, “Do you think this budget averts the deterioration of our fiscal problem?” Geithner responded, “We’re not claiming this solves all the problems facing the country. But it does meet the critical essential test … of restoring our deficits to a more sustainable position for the next ten years.”

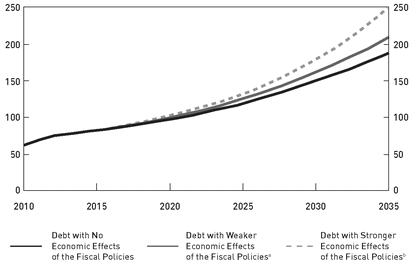

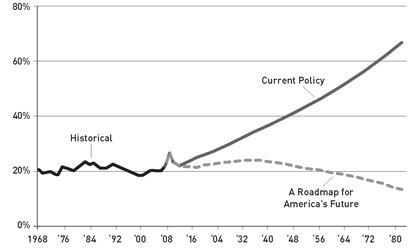

Publicly Held Debt Under 2013 Budget Policy Extended

Holding up the chart, Ryan said, “I just don’t see the rhetoric matching the results…. Out of your budget … you say that—this is your budget—says that the government’s position gradually deteriorates, that our fiscal condition deteriorates. These are

your

numbers…. This is

your

deficit path.”

your

numbers…. This is

your

deficit path.”

Geithner claimed the chart showed “just exactly what I said, which is if you look at 2012, for the next 10 years, it stabilizes that debt burden as a share of the economy.”

Amazed, Ryan asked, “And so we’ll just allow it to take off after that?”

Geithner replied, “No, no. No. And then … and then you’re right, and as millions of Americans more retire, then those costs in Medicare and Medicaid start to increase again. And that’s why we’re saying openly and directly to you, that we’re gonna have some work to do.”

Geithner then criticized Ryan’s Path to Prosperity budget plan, saying, “You would lower that path—in ways that would substantially increase the burden of health care costs on middle-income seniors. And although we agree with you we’re gonna have more work to do, but we’re not gonna adopt an approach that would undermine that basic benefit …”

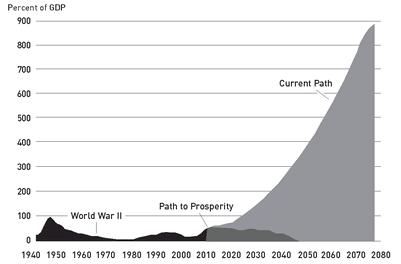

Ryan then presented his own chart showing the dramatic contrast between the administration’s plan and his own:

A Choice of Two Futures(Debt as a Share of the Economy)SOURCE: OMB/CBO

Ryan pointed out that under the administration’s current approach of ignoring entitlement reform and continuing to accrue trillion-dollar deficits, the CBO tells us that the economy “shuts down in 2027.”

Geithner implied that what follows after 2020 is largely irrelevant, that all we should be focusing on today is what happens between 2010 and 2020, and that there is a “pretty small gap” between the two approaches during those years. In other words, the administration’s budget only addresses the next ten years and we’ll deal with what comes after that later.

Ryan would have none of it, saying,

Here’s the point: leaders are supposed to fix problems. We have a $99.4 trillion unfunded liability. Our government is making promises to Americans that it has no way of accounting for them. And so you’re saying, yeah, we’re stabilizing it but we’re not fixing it in the long run. That means we’re just gonna keep lying to people. We’re gonna keep all these empty promises going. And so what we’re saying is, in order to avert a debt crisis, I mean, you’re the treasury secretary… if we can’t make good on our bonds in the future, who’s gonna invest in our country?We do not want to have a debt crisis. And so it comes down to confidence and trajectory. Do we have confidence that we’re getting our fiscal situation under control and we’re preventing the debt from getting at these catastrophic levels? … You’re showing that you have no plan to get this debt under control. You’re saying we’ll stabilize it but then it’s just gonna shoot back up. And so my argument is, that’s Europe. That is bringing us toward a European debt crisis because we’re showing the world, the credit markets, future seniors, people who are organizing their lives around the promises that are being made to them today, we don’t have a plan to make good on this.

4

Notably, Geithner did not deny Ryan’s point that the administration’s budget is nothing more than a band-aid—if that—to make the fiscal situation slightly less catastrophic over the next ten years, and does nothing to address the years thereafter, when the unfunded liabilities will come due and place the United States in an immediate crisis. “Maybe we’re not disagreeing in a sense that I made it absolutely clear that what our budget does is get our deficits down to a sustainable path over the budget window,” said Geithner.

Ryan then interjected, “And then they take back off.”

Geithner responded,

And … let’s talk to ourselves why do they take off again? Why do they do that? Because we have millions of Americans retiring every day and that will drive a substantial growth in health care costs. And so you were right to say we’re not coming before you today to say we have a definitive solution to that long-term problem. But what we do know is we don’t like yours because … what yours would do is put an undue burden on middle-income seniors and substantially raise the burden on them for rising health care costs.

5

Ryan shot back, “We’re fine that you don’t like our path. That’s what politics and Republicans and Democrats and difference of opinions are all about. But if we don’t come up with a plan for this country we’re gonna pull the rug out from under people who are relying on these benefits.”

Ryan also refuted Geithner’s glib argument that Ryan’s plan would allow seniors to wither on the vine, saying, “Now, we don’t agree with your interpretation of our plan because we provide more for the poor and the middle-income and less for the wealthy. And we think that’s the smart way to go on funding these important guaranteed programs.”

6

“IT’S DEEPLY DISTRESSING THAT THE CUTS WE AGREED TO … YOU HAVE ELIMINATED IN THIS BUDGET”6

In a separate budgetary meeting before the Senate Committee on the Budget, Geithner was forced by Senator Jeff Sessions to admit that the administration has no plan to address the nation’s unsustainable long-term fiscal path. “Even if Congress were to enact this budget, we would still be left with—in the outer decades as millions of Americans retire—what are still unsustainable commitments in Medicare and Medicaid,” said Geithner. “And we are going to have to find ways to come together and make progress on those commitments.” He claimed that the administration’s plan would make the budget sustainable for the next ten years and “give us some time to figure out how we resolve our major differences and how to make sure we reform Medicare and Medicaid in a responsible way.”

7

7

But time is just an excuse. Ryan produced his “roadmap” for restructuring entitlements in 2008, his original Path to Prosperity budget plan in April 2011, and his updated Path to Prosperity 2.0 plan in March 2012, while the administration still has presented no plan to reform entitlements. Obama’s team doesn’t even dispute that Ryan’s plan would restore America’s long-term solvency, but Obama refuses to endorse it because he would apparently prefer to bankrupt the nation before agreeing to a sound, fair Republican plan to restructure entitlements.

Sessions then strongly criticized the administration for having already breached its recent promises regarding budget cuts—which illustrates the futility in compromising with Democrats. Sessions commented, “It’s deeply distressing that the cuts we agreed to six months ago you have eliminated in this budget. And you’re not marking to them, and you increased spending. And even when you count the war savings [billions in illusory savings from withdrawing troops from Iraq and Afghanistan], which are bogus, the CBO will technically agree with that, but we know the other committees haven’t counted those, you will have an increase in spending.”

8

“THIS WOULD CAUSE U.S. INDEBTEDNESS TO EXPLODE”8

Ryan’s warnings to Geithner about the U.S. bond markets deserve attention. James Pethokoukis, the Money and Politics columnist for Reuters, reported that the White House often quotes the outside economic-analysis firm “Macroeconomic Advisers.” But back in July 2011, shortly after Congressman Ryan unveiled his first Path to Prosperity budget, the firm seemed to validate Ryan’s concerns. It issued a statement declaring,

Assuming current fiscal policies remain in force, our economic model suggests that interest rates will rise considerably over the next decade, with the yield on the 10-year Treasury note reaching nearly 9% by 2021. Private interest rates will rise as federal borrowing competes for savings that might otherwise finance private investment. In addition, yields could rise if there is growing risk associated with current fiscal policy. If such risk is systemic, it raises yields generally. If it reflects a growing probability of sovereign default, it raises Treasury yields relative to private yields. Rising rates would be a precursor to something worse: a full-fledged fiscal crisis with further sharp increases in yields, declines in stock prices, and a plummeting dollar.

Pethokoukis then noted,

This is bad. Really bad. The official budget forecasts one typically hears about in the media are from the Congressional Budget Office. And those forecasts assume Uncle Sam can borrow at low interest rates, like, forever. The super-cautious CBO baseline predicts the U.S. government will add an additional $6.8 trillion in debt over the next decade, bringing cumulative debt held by the public to $18.2 trillion. Debt as a share of the economy would be 76.7 percent. The forecast also assumes short-term interest rates 3.3 percent, long-term 4.8 percent.

But, said Pethokoukis, Macroeconomic Advisers thinks long-term rates will reach 9 percent. “This,” he argued, “would cause U.S. indebtedness to explode.”

To confirm all this, Pethokoukis reported, Ryan asked the CBO to forecast how various interest rate scenarios would affect U.S. debt. The results were startling. If interest rates rose to 9 percent, it would add an additional $5 trillion to the national debt by 2021. But even this may understate the problem because the calculations were based on the CBO’s baseline forecast. Many analysts believe that’s way too optimistic and that the debt-to-GDP ratio will already be 101 percent in 2021, even with low interest rates. Furthermore, these static calculations did not factor in the possibility that this astronomical debt would depress economic growth.

In response to Ryan’s questions, the CBO conceded that economic variables would have a dramatic impact on the forecasts. It said that a rise in interest rates of just 1 percent a year could increase deficits by $1.3 trillion over ten years. Likewise, reduced economic growth of just 0.1 percent each year could increase deficits by $310 billion over ten years, and a 1 percent annual rise in inflation could add nearly $900 billion to deficits. The result of this “alternative fiscal scenario” is that our debt-to-GDP ratio could reach 250 percent.

9

Here is the CBO’s chart illustrating these nightmare scenarios:

9

Here is the CBO’s chart illustrating these nightmare scenarios:

Alternative Fiscal ScenerioSOURCE: Congressional Budget Office.

Contrary to what Team Obama would have you believe, our current deficits do not stem from unduly low tax rates on the wealthy or anyone else; our current taxes are no lower, and in some cases are higher, than under President George W. Bush—and Bush’s deficits were dramatically lower. These deficits largely arise from Obama’s profligate spending— though, it’s important to note, that is not the sole cause. Another important factor, which accounts for hundreds of billions of dollars in budgetary shortfalls, is the sluggishness of the economy, which is contributing to a constricted economic base that generates less productivity and income and thus less tax revenue. Obama’s oppressive tax and regulatory policies across the board are devastating to jobs, economic growth, and ultimately to the budget as well.

To address the problem, we don’t necessarily have to adopt every jot and tittle of Ryan’s plan. But it is specific and warrants serious consideration. We must either implement Ryan’s plan or another that does just as good a job stimulating economic growth, slashing domestic spending, preserving our vital national defenses, and restructuring entitlements while preserving benefits for seniors and others most dependent on them.

Ryan’s Path to Prosperity—both its original and revised versions—deserves more than the administration’s contemptuous dismissals. It is a sound and sensible strategy for stabilizing the economy, stimulating economic growth, and eliminating our looming national debt crisis. The revised version 2.0, which is largely the same as the original except for a few important tweaks such as with Medicare, would:

* Cut $5.3 trillion in government spending over the next decade compared to the president’s budget;

* Eliminate hundreds of duplicative programs, ban earmarks, and aim to bring non-security discretionary spending to levels below those of 2008;

* Reduce government spending to lower than 20 percent of GDP, as distinguished from President Obama’s budgets, in which spending sometimes exceeds 22 percent and even 23 percent over the next decade;

* Dramatically reduce the national deficits and put the budget on the path to balance and actually pay off the national debt;

* Reject Obama’s proposed tax increases and simplify the tax code by substituting two personal income tax rates (10 percent and 25 percent) for the six current rates and by reducing the corporate income tax rate from 35 percent to 25 percent;

* End corporate welfare by stopping taxpayer bailouts of failed financial institutions, reforming Fannie Mae and Freddie Mac, and preventing Washington from picking the winners and losers across sectors of the economy;

* Repeal and defund ObamaCare, thus eliminating some $800 billion in tax increases and the budget-busting spending increases it imposes, which have turned out to be much higher than Obama originally projected;

* Reject Obama’s proposals for across-the-board cuts in national defense funding and provide $554 billion for national defense spending in FY2013, which is a realistic amount to achieve America’s military goals and strategies. This plan allows for future real growth in defense spending to modernize our armed forces. Because of the sequester imposed by the Budget Control Act, our defense budget is in line to be cut by $55 billion in January 2013, pursuant to Obama’s budget. Ryan’s plan would eliminate these additional cuts and replace them with other spending cuts.

* End Obama’s war on domestic energy and remove regulatory and tax barriers on the energy industry;

* Reform Medicaid by converting the federal share of Medicaid spending into a block grant, giving states the flexibility to tailor their own programs to fit their citizens’ needs;

* Restructure Medicare by protecting those in and near retirement and giving younger Americans choices such as a traditional fee-for-service Medicare plan or other options that are currently enjoyed by Congress members;

* Call for bipartisan action to restore Social Security to solvency.

10

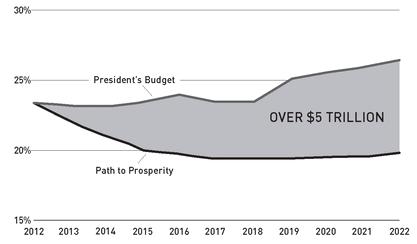

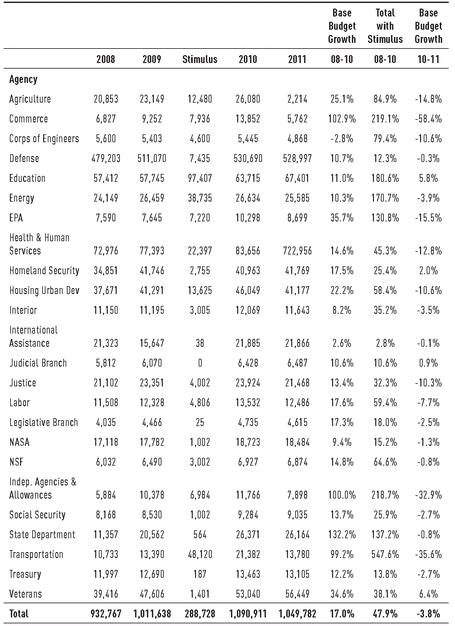

The first of the following three charts shows the stark contrast between Ryan’s Path to Prosperity 2.0 and President Obama’s FY2013 budget.

11

The second contrasts government spending as a share of the economy under the president’s budget over the next decade with that under the Path to Prosperity 2.0,

12

and the third contrasts the respective spending trajectories of Ryan’s Roadmap and our current spending path over the long term:

13

11

The second contrasts government spending as a share of the economy under the president’s budget over the next decade with that under the Path to Prosperity 2.0,

12

and the third contrasts the respective spending trajectories of Ryan’s Roadmap and our current spending path over the long term:

13

A Contrast in Visions

The President’s Budget

The Path to Prosperity

Spending

Net $1.5 trillion increase to current policy

Cuts spending by $5 trillion relative to President’s budget

Taxes

Imposes a $1.9 trillion tax increase; Adds new complexity and new hurdles for hard-working taxpayers, making it more difficult to expand opportunity

Prevents President’s tax increase; Reforms broken tax code to make it simple, fair and competitive; Clears out special interest loopholes and lowers everybody’s tax rates to promote growth

Deficits

Four straight trillion-dollar deficits; Breaks promise to cut deficit in half by end of first term; Budget never balances

Brings deficits below 3 percent of GDP by 2015; Reduces deficits by over $3 trillion relative to President’s budget; Puts budget on path to balance

Debt

Adds $11 trillion to the debt—increasing debt as a share of the economy—over the next decade; Imposes $200,000 debt burden per household; Debt skyrockets in the years ahead

Reduces debt as a share of the economy over the next decade; Charts a sustainable trajectory by reforming the drivers of the debt; Pays off the debt over time

Size of Government

Size of government never falls below 23 percent of the economy, making it more difficult to expand opportunity

Brings size of government to 20 percent of economy by 2015, allowing the private sector to grow and create jobs

National Security

Slashes defense spending by nearly $500 billion; Threatens additional cuts by refusing to specify plan of action to address the sequester; Forces troops and military families to pay the price for Washington’s refusal to address drivers of debt

Prioritizes national security by preventing deep indiscriminate cuts to defense; Identifies strategy-driven savings, while funding defense at levels that keep Americans safe by providing $544 billion for the next fiscal year for national defense spending

Health Security

Doubles down on health care law, allowing government bureaucrats to interfere with patient care; Empowers an unaccountable board of 15 unelected bureaucrats to cut Medicare in ways that result in restricted access and denied care for current seniors, and a bankrupt future for the next generation

Repeals President’s health care law; Advances bipartisan solutions that take power away from government bureaucrats and put patients in control; No disruption for those in or near retirement; Ensures a strengthened Medicare program for future generations, with less support given to the wealthy and more assistance for the poor and sick

Government Spending(As a Share of Economy)SOURCE: CBO/HBC

Federal Government Spending(As Percentage of GDP)SOURCE: Office of Management and Budget /Congressional Budget Office

“NO WONDER THAT WE ARE HEADED FOR THE LARGEST DEFICIT EVER”

In contrast to the Ryan and Republican approach, Obama has not seriously attempted to reduce the deficit or debt since he took office, because these problems are necessary byproducts of his addiction to spending and redistribution, as well as his slavish attachment to tired Keynesian economic theories holding that the best way to promote economic growth is through government spending. Even CBO Director Douglas Elmendorf, following a report that the 2011 budget came in at more than $1.5 trillion, in testimony before the Senate Budget Committee in January 2011, admitted what Obama and Timothy Geithner either can’t see or can’t admit: if we want to avert a debt-driven fiscal calamity, we will have to bring deficit spending under control soon. “The longer that you wait to make those policy changes … the greater the negative consequences [of the national debt] will be,” he said.

Echoing Paul Ryan, Elmendorf said that waiting too long to curb spending and reduce the debt could make investors anxious about the government’s ability to finance its debt, resulting in higher interest rates, higher taxes, and governmental paralysis in responding to emergencies. Elmendorf warned—and this was in January 2011—that if our current policies continue, the deficit could reach almost 100 percent of GDP by the end of the decade. Committee Chair Kent Conrad, a Democrat, observed, “Spending as a share of our national income is at the highest level in 60 years. Revenue as a share of our national income is at its lowest level in 60 years. No wonder that we are headed for the largest deficit ever.”

14

14

Yet in his State of the Union speech earlier that week, President Obama’s words on the deficits and debt were, as usual, painfully unserious. He called for a five-year freeze on non-mandatory domestic spending (whatever happened to that?) and waxed eloquent about the need to reform entitlements while offering no specifics (and more than a year later, he had still offered no specifics). In fact, in his speech Obama called for

new

government spending on infrastructure, education, and research to help boost job creation—funding he would call for again, unimaginatively, in his next State of the Union speech.

15

Far from pleas for austerity, Obama was demanding more profligacy and merely paying lip service to a domestic spending freeze and entitlement reform.

new

government spending on infrastructure, education, and research to help boost job creation—funding he would call for again, unimaginatively, in his next State of the Union speech.

15

Far from pleas for austerity, Obama was demanding more profligacy and merely paying lip service to a domestic spending freeze and entitlement reform.

Unveiled a few weeks later, Obama’s FY2012 budget contained the same disappointing features he signaled in his SOTU speech. Illustrating that the deficit and debt problems were low priorities, Obama didn’t mention the word “debt” until thirty-five minutes into his remarks.

16

He again called for the five-year domestic-spending freeze, which Paul Ryan had warned would not be enough to solve the debt crisis. Indeed, Obama’s budget would have reduced budget deficits over the next decade by $1.1 trillion, only a quarter of the amount proposed by his own Bipartisan Debt Commission ($4 trillion),

17

whose recommendations he mostly ignored despite having promised he would be “standing with them.”

16

He again called for the five-year domestic-spending freeze, which Paul Ryan had warned would not be enough to solve the debt crisis. Indeed, Obama’s budget would have reduced budget deficits over the next decade by $1.1 trillion, only a quarter of the amount proposed by his own Bipartisan Debt Commission ($4 trillion),

17

whose recommendations he mostly ignored despite having promised he would be “standing with them.”

Obama touted budget “cuts” that were mere smoke and mirrors and gimmicks. First, he redefined Pell grants as mandatory spending instead of discretionary spending, thus taking it “off budget” for the manipulative purpose of selling his plan. Without this bogus re-categorization, discretionary spending would have increased by $14 billion. He similarly reclassified $54 billion of surface transportation from discretionary to mandatory spending, and he resorted to his all-purpose gimmick of touting “savings” from Iraq and Afghanistan. Obama’s sham accounting on these three items alone made discretionary spending appear to be $106.2 billion lower than it actually was. An honest rendering showed that his budget didn’t cut discretionary spending at all, but increased it by $31 billion.

18

18

Considering the nation’s financial straits, Obama’s FY2012 budget was disgraceful. He proposed $3.73 trillion total spending for the fiscal year (25 percent of GDP, the highest levels since World War II); $46 trillion in spending over the next decade, including $8.7 trillion of new spending; and $26.3 trillion in total new debt by 2021,

19

including entitlement obligations, which he made no effort to reduce. All in all, as our financial condition became more dire, his approach stayed exactly the same—as it would the following year.

“WE WILL NOT BE ADDING MORE TO THE NATIONAL DEBT”19

including entitlement obligations, which he made no effort to reduce. All in all, as our financial condition became more dire, his approach stayed exactly the same—as it would the following year.

Grossly mischaracterizing his FY2012 budget as a prescription for austerity, Obama declared that his plan “puts us on a path to pay for what we spend by the middle of the decade.” The statement clearly implied he would balance the budget within four or five years, though as ABC News’ Jake Tapper correctly noted, “At no point in the president’s 10-year projection would the U.S. government spend less than it’s taking in.”

20

But Obama claimed, “We will not be adding more to the national debt…. We’re not going to be running up the credit card any more.” I responded in my syndicated column,

But Obama claimed, “We will not be adding more to the national debt…. We’re not going to be running up the credit card any more.” I responded in my syndicated column,

Now juxtapose that sentence with the facts, even as he presents them. He has pledged to freeze—at already unacceptably high levels—domestic spending for five years. What cuts he would make over the next 10 years would only total $1.1 trillion—an average of just over $100 billion a year. Look at Obama’s own budget deficit projections for the next decade, beginning with 2012. 2012: $1.101 trillion, 2013: $768 billion, 2014: $645 billion, 2015: $607 billion, 2016: $649 billion, 2017: $627 billion, 2018: $619 billion, 2019: $681 billion, 2020: $735 billion, 2021: $774 billion. Total for 10 years: $7.205 trillion—an average deficit of $720 billion per year.You simply cannot square these numbers with Obama’s statement that he wouldn’t be adding to the debt, unless he’s actually confused about the difference between “deficits” and “debt,” and that’s almost as scary a thought as the numbers themselves. That is, when you operate at staggering deficits that will add almost three-quarters of a trillion dollars to the debt each year, you are adding to the national debt; you are continuing to run up the national credit card. A third-grader could understand that. So tell me: What do you make of a man who presents a projected 10-year budget that, best case, would add $7.205 trillion to the national debt but simultaneously tells you he won’t add to the debt?

21

The president’s refusal to address the deficit, debt, and entitlement problems is astonishing given his declaration early in his term, “I didn’t come here to pass our problems to the next President or the next generation—I’m here to solve them.” The administration’s own summary budget tables, comparing budgeted receipts to budgeted outlays year by year, made the point strikingly clear:

2010: Receipts: 2,163 [Billion Dollars] / Outlays: 3,456 [Billion Dollars]

2011: Receipts: 2,174 [Billion Dollars] / Outlays: 3,819 [Billion Dollars]

2012: Receipts: 2,627 [Billion Dollars] / Outlays: 3,729 [Billion Dollars]

2013: Receipts: 3,003 [Billion Dollars] / Outlays: 3,771 [Billion Dollars]

2014: Receipts: 3,333 [Billion Dollars] / Outlays: 3,977 [Billion Dollars]

2015: Receipts: 3,583 [Billion Dollars] / Outlays: 4,190 [Billion Dollars]

2016: Receipts: 3,819 [Billion Dollars] / Outlays: 4,468 [Billion Dollars]

2017: Receipts: 4,042 [Billion Dollars] / Outlays: 4,669 [Billion Dollars]

2018: Receipts: 4,257 [Billion Dollars] / Outlays: 4,876 [Billion Dollars]

2019: Receipts: 4,473 [Billion Dollars] / Outlays: 5,154 [Billion Dollars]

2020: Receipts: 4,686 [Billion Dollars] / Outlays: 5,422 [Billion Dollars]

2021: Receipts: 4,923 [Billion Dollars] / Outlays: 5,697 [Billion Dollars]

22

AN ADDITIONAL $80,000 OF DEBT PER HOUSEHOLD22

On top of this already depressing news, the Congressional Budget Office found that Obama’s budget request had significantly understated costs and deficits. Obama projected that his budget would generate $7.2 trillion in deficits—which would have been reckless enough—but the CBO calculated deficits of $9.5 trillion—a staggering figure that exceeds the entire accumulated federal debt from the beginning of the Republic through 2010. While Obama routinely eviscerated President George W. Bush for his annual deficits, Obama’s deficits have dwarfed Bush’s. When Bush implemented his tax cuts, his FY2003 budget deficit was $377 billion, and within four years it had shrunk to $161 billion.

23

Obama’s deficits for the first four years have exceeded or will exceed $1 trillion, and there appears to be no end in sight. Looking at the next decade, based on Obama’s FY2012 budget proposal (FY2013 would show little, if any improvement), the CBO indicated that his deficits would never fall short of $748 billion and will start skyrocketing again in the out years, reaching as high as $1.2 trillion by 2021—and this assumed there would be no major military conflicts to finance.

23

Obama’s deficits for the first four years have exceeded or will exceed $1 trillion, and there appears to be no end in sight. Looking at the next decade, based on Obama’s FY2012 budget proposal (FY2013 would show little, if any improvement), the CBO indicated that his deficits would never fall short of $748 billion and will start skyrocketing again in the out years, reaching as high as $1.2 trillion by 2021—and this assumed there would be no major military conflicts to finance.

This merely confirmed the obvious: that revenues from Obama’s tax increases—he would raise taxes by 1.3 percent of GDP—could never keep up with his spending hikes of 4 percent of GDP, even assuming a static analysis with no suppression of growth based on these tax hikes. As long as he refuses to tackle entitlements, the deficit simply cannot be controlled. Over the next ten years, according to these numbers, Obama would pile an additional $80,000 per household of debt onto American families.

24

24

Try as they might, Obama’s team could not defend his deficits. During her Senate confirmation hearing on March 17, 2011, Heather Higginbottom, Obama’s nominee for deputy director of OMB, was told by Senator Jeff Sessions, “In years 8, 9 and 10 it [Obama’s budget proposal] goes up every year and reaches approximately $900 billion from $600 billion, as a low point in the entire 10 years.” He continued, “The highest debt Bush ever had was $450 billion. You don’t have a single year when the budget falls below $600 billion do you?”

25

25

Higginbottom replied, “That’s correct, and Senator, both the president and the director have talked repeatedly about these being the first steps we need to take, and we need to come together in a bipartisan fashion as the chairman and some of his other colleagues are doing to look at these long-term issues. So this isn’t the end of the road.” She insisted, “The president’s budget is the first step in the budget process.”

While Higginbottom attempted to deflect equal responsibility for these deficits onto Republicans, the figures in question came directly from Obama’s budget. His own proposals out of the gate showed these enormous deficits, so even had Republicans sprinted across the aisle and embraced them in toto, the deficits would remain at these unsustainable levels.

Sessions also asked Higginbottom about assertions by Obama and his budget director, Jacob Lew, that Obama’s budget wouldn’t add to the debt. When Higginbottom began an evasive response, Sessions pressed, “No, I asked you, heard by the American people, is that a true statement or not?” Higginbottom replied, “I can’t express how the American people would hear that. What I can say is of course the interest payments on the debt will add to the debt.”

Higginbottom later tried to deflect this question through a Clintonian parsing of the meaning of words. “I’d like to explain what they are referring to,” she explained. “Both the president and the director are referring to an effort to pay for the programs the government’s operating costs as they’re proposed. That’s a concept of primary balance, which I know you and the director have discussed. That notion doesn’t speak to the interest payments. When the president came to office it was a $1.3 trillion deficit. We have to borrow money to pay on that deficit.”

Sessions responded, “Did Mr. Lew or the president of the United States, when they made that statement, we will not be adding to the debt, did they say, ‘by the way American people, what we really meant is some arcane idea about not counting interest payments that the United States must make as part of our debt?’ Did they say that?” Higginbottom answered, “I’m not sure exactly what they did say.”

26

26

So we were left with Obama’s nominee for this crucial position telling us that when Obama said he wouldn’t add to the national debt, he really meant that he wouldn’t add to the “primary balance”—a manufactured, meaningless term obviously designed to deceive the public by ignoring interest payments that must be made with the very same greenbacks as primary debts or principal payments.

“BLISTERING PARTISANSHIP AND MULTIPLE DISTORTIONS”For those who believed claims by Barack Obama and his top officials that they sought a bipartisan solution to our fiscal problems, the administration’s venomous response to the unveiling of Paul Ryan’s original “Path to Prosperity” plan must have been a real eye-opener.

In a speech at George Washington University on April 13, 2011, Obama neither soberly considered Ryan’s plan nor presented an alternative one; he just engaged in Chicago-style attacks and insults, actually disparaging Ryan’s and the Republicans’ human decency. “Their vision is less about reducing the deficit than it is about changing the basic social compact in America,” Obama proclaimed. He accused Republicans of pitting “children with autism or Down’s syndrome” against “every millionaire and billionaire in our society.” Claiming the plan would “end Medicare as we know it,” he bitterly remarked, “There’s nothing courageous about asking for sacrifice from those who can least afford it and don’t have any clout on Capitol Hill.” He continued,

“THERE’S STILL NOTHING OUT THERE. WHY NOT JUST RELEASE THE PLAN?”

“THERE’S STILL NOTHING OUT THERE. WHY NOT JUST RELEASE THE PLAN?”

They paint a vision of our future that’s deeply pessimistic. It’s a vision that says if our roads crumble and our bridges collapse, we can’t afford to fix them. If there are bright young Americans who have the drive and the will but not the money to go to college, we can’t afford to send them…. It’s a vision that says America can’t afford to keep the promise we’ve made to care for our seniors…. This is a vision that says up to 50 million Americans have to lose their health insurance in order for us to reduce the deficit…. Worst of all, this is a vision that says even though America can’t afford to invest in education or clean energy; even though we can’t afford to care for seniors and poor children, we can somehow afford more than $1 trillion in new tax breaks for the wealthy.

27

Obama then outlined his own “plan,” which was no plan at all—there were no specifics, just his usual empty promises, platitudes, and misrepresentations.

In the speech, Obama once again blamed America’s fiscal problems on President George W. Bush and his “two wars.” He also faulted Bush’s prescription drug entitlement, even though the Democrats’ alternative plan at the time was projected to cost far more than Bush’s.

28

28

Obama also had the audacity to acknowledge that “around two-thirds of our budget is spent on Medicare, Medicaid, Social Security, and national security,” yet he showed no real willingness to tackle any of those, save national security. After those categories and interest on the debt, he said, all that’s left is 12 percent of the budget, and that so far the cuts proposed by Washington politicians “have focused almost exclusively on that 12%.” Note that Obama made this charge in response to Paul Ryan’s plan, which comprehensively addresses the other 88 percent and was shrilly denounced by Democrats for that very reason.

The

Wall Street Journal

‘s editorial board called Obama’s jeremiad “extraordinary,” with “its blistering partisanship and multiple distortions … the kind Presidents usually outsource to some junior lieutenant.” They noted that Obama’s initial political goal was to defuse criticism about his unseriousness on the debt—unseriousness shown by his $3.73 trillion budget and his dismissal of the fiscal commission’s recommendations, even while reports were confirming that his deficit for the preceding year was at an all-time high.

29

Wall Street Journal

‘s editorial board called Obama’s jeremiad “extraordinary,” with “its blistering partisanship and multiple distortions … the kind Presidents usually outsource to some junior lieutenant.” They noted that Obama’s initial political goal was to defuse criticism about his unseriousness on the debt—unseriousness shown by his $3.73 trillion budget and his dismissal of the fiscal commission’s recommendations, even while reports were confirming that his deficit for the preceding year was at an all-time high.

29

When Congressional Budget Office Director Doug Elmendorf was asked in congressional hearings how Obama’s spending blueprint—as laid out in his speech at George Washington University—would affect the budget framework, Elmendorf replied, “We don’t estimate speeches,” which served as a fitting and devastating metaphor for Obama’s approach to the budget.

30

30

In the end, although Obama may have made progress in demonizing Paul Ryan, he was less successful in advocating his own budget plans; despite all his posturing, he couldn’t get even one member of his own party in the Senate to vote for his FY2012 budget proposal, which went down to an embarrassing 97 - 0 defeat in May 2011.

31

This kind of unanimity is becoming a habit for Obama’s budgets—less than a year later, the House rejected his FY2013 budget proposal by a perfect 414 - 0 margin.

32

That alone, in saner times, would have been enough to ensure Obama’s defeat in 2012.

A SHEEP IN HAWK’S CLOTHING31

This kind of unanimity is becoming a habit for Obama’s budgets—less than a year later, the House rejected his FY2013 budget proposal by a perfect 414 - 0 margin.

32

That alone, in saner times, would have been enough to ensure Obama’s defeat in 2012.

In his budget battles, Obama consistently masquerades as a deficit hawk even as he resists budget cuts and demands more spending. On July 15, 2011, Paul Ryan, referring to yet another of Obama’s feints toward frugality, summarized what Obama had actually done since taking office in 2009. Ryan noted that Obama had initiated a 24 percent increase in non-discretionary spending, which would add $734 billion in spending over the next ten years. Under his budgets, the government was spending some 24 percent of GDP when it had historically averaged slightly above 20 percent. Under his FY2012 budget, according to the CBO, he would never spend less than 23 percent of GDP in ten years, and at the end of the ten years it would climb back to 24 percent. This pattern, it should be noted, would be repeated in his FY2013 budget: applying temporary fiscal band-aids and letting the debt gush out later, after he will be long gone from office.

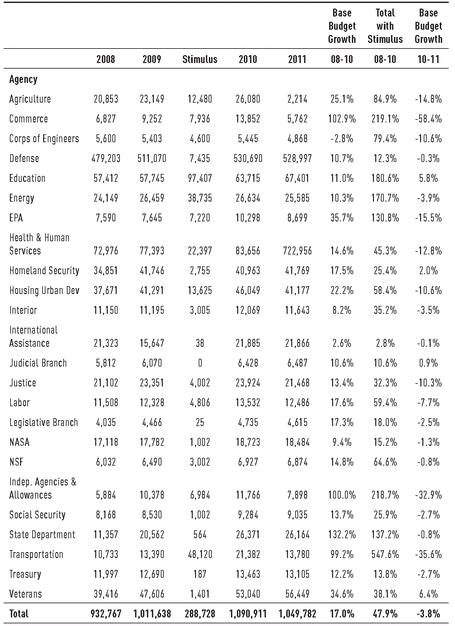

Ryan provided a table from the CBO to illustrate the reckless allocations Obama has made to increase the base budgets for major government agencies. People tend to forget that while Obama pretends Republicans are demanding extreme austerity and want to cut off essential services, Obama had increased the base budgets for his pet agencies both in his stimulus bill, which should have had nothing to do with such expenditures, and in his yearly budgets. Most of this new spending was special interest spending for domestic government agencies. One “egregious” example, noted Ryan, was that the EPA’s budget increased by 36 percent in just two years, and if you include the $7 billion stimulus injection, it enjoyed a two-year increase of 131 percent. These spending increases are shown in the following CBO table.

33

33

Table 2

: Discretionary Spending By Government Agency

: Discretionary Spending By Government Agency

Scored Non-Emergency BA (in Millions of Dollars)

Source: Congressional Budget Office Score of Enacted Appropriations

Obama repeatedly claimed that Republicans had offered no plan to reduce the deficit and debt and were only criticizing his plans, which was an extraordinary display of projection, even for Obama. In fact, the GOP-controlled House had advanced numerous substantive proposals, including Ryan’s Path to Prosperity and the Cut, Cap, and Balance Act, both of which Obama and his Democratic colleagues roundly rejected.

When pressed during the budget negotiations, White House press secretary Jay Carney floundered when trying to explain why Obama hadn’t produced a detailed plan to tackle the debt. One reporter asked, “There’s still nothing out there. Why not just release the plan?”

Carney replied, “You need something printed for you, you can’t write it down?”

The questioner retorted, “It’s not a plan. No, it’s not a plan…. It wasn’t a plan the same way that we’re getting a plan on the House side or that we’re getting a plan on the Senate side. It’s not.”

34

34

The House passed Ryan’s plan 235 - 189 on April 15, 2011, with no Democrats supporting the measure and only four Republicans voting against it.

35

The Senate voted down Ryan’s plan on May 25, 2011, by a 57 - 40 vote, with five Republicans voting with Democrats, though one of those, Senator Rand Paul, voted no because he didn’t believe the spending cuts went far enough. Paul Ryan later responded that the Senate’s action represented an “irresponsible abdication of leadership.”

36

35

The Senate voted down Ryan’s plan on May 25, 2011, by a 57 - 40 vote, with five Republicans voting with Democrats, though one of those, Senator Rand Paul, voted no because he didn’t believe the spending cuts went far enough. Paul Ryan later responded that the Senate’s action represented an “irresponsible abdication of leadership.”

36

During the acrimonious debt-ceiling debates, the Republican House made certain demands as a condition to agreeing, yet again, to increase the debt ceiling. Democrats argued this was petty partisan politics, but in fact the Republicans, having no majority in the Senate and facing a recalcitrant Democratic president, had limited options to press for fiscal responsibility. Obama and the Democrats bitterly resisted major spending cuts and insisted only on tax hikes on the “wealthy,” which wouldn’t have made a dent in the deficit and would have been devastating to an ailing economy. Among the Republicans’ demands was that the president agree to their cut, cap, and balance proposal. The plan was to

cut

the deficit in half the next year through discretionary and mandatory spending reductions; implement statutory enforceable

caps

to align federal spending with average revenues at 18 percent of GDP with automatic spending reductions to be triggered if the caps are violated; and to send the states a

balanced budget amendment

, which would include protections against tax increases and a spending limitation amendment that would align spending with average revenues.

37

cut

the deficit in half the next year through discretionary and mandatory spending reductions; implement statutory enforceable

caps

to align federal spending with average revenues at 18 percent of GDP with automatic spending reductions to be triggered if the caps are violated; and to send the states a

balanced budget amendment

, which would include protections against tax increases and a spending limitation amendment that would align spending with average revenues.

37

Rejecting all the GOP proposals on sight, Obama, in a

Today Show

interview in June, found a creative scapegoat for the sluggish economy: ATMs. Speaking as if the machines had just materialized since his inauguration, Obama declared, “There are some structural issues with our economy, where a lot of businesses have learned to become much more efficient with a lot fewer workers. You see it when you go to a bank and you use an ATM, you don’t go to a bank teller… or you go to the airport and you use a kiosk instead of checking in at the gate. So all these things have created changes.”

38

A few months later, the

IBD

editorial page listed all the things which Obama had blamed for his economic failures, including President Bush, ATMs, Republicans, gridlock, the media, businesses, and “misfortune.”

39

The editors omitted a few others, such as the Gulf oil spill and the Japanese tsunami.

Today Show

interview in June, found a creative scapegoat for the sluggish economy: ATMs. Speaking as if the machines had just materialized since his inauguration, Obama declared, “There are some structural issues with our economy, where a lot of businesses have learned to become much more efficient with a lot fewer workers. You see it when you go to a bank and you use an ATM, you don’t go to a bank teller… or you go to the airport and you use a kiosk instead of checking in at the gate. So all these things have created changes.”

38

A few months later, the

IBD

editorial page listed all the things which Obama had blamed for his economic failures, including President Bush, ATMs, Republicans, gridlock, the media, businesses, and “misfortune.”

39

The editors omitted a few others, such as the Gulf oil spill and the Japanese tsunami.

During a presidential press conference on June 29, Obama condescendingly chided Congress for not working out a compromise on the debt ceiling as punctually as his children do their homework, though he had been AWOL for much of the process, and when he wasn’t, he was actually obstructing a reasonably responsible agreement to cut spending. Showing a remarkable degree of self-absorption, Obama detailed how hard he was working to reach a deal, saying he had met Republican leaders and had put Vice President Biden in charge of the effort. Predictably, he concluded that it was all the fault of Republicans; referencing GOP leaders, he exclaimed, “At a certain point, they need to do their job.”

40

“HE IMPERIOUSLY SUMMONED CONGRESSIONAL LEADERS”40

On July 15, 2011, Obama strutted out to a press conference to make an indignant announcement that he opposed the Cut, Cap, and Balance Act as well as a balanced budget amendment to the Constitution. As a counterpoint, he focused on raising taxes, saying, “The American people are sold [on tax increases]. The problem is members of Congress are dug in ideologically.” He said “poll after poll” showed Republican and Democratic voters want “a balanced approach,” including both tax hikes and spending cuts, and warned that the country was “running out of time” to avoid fiscal “Armageddon.” As if he’d not been alternatively obstructing and abdicating any leadership role throughout the process, Obama added, “we should not even be this close on a deadline. This is something we should have accomplished earlier.”

41

41

Unable to get anywhere with Obama, House Republicans passed Cut, Cap, and Balance on July 19 by an almost straight party-line vote, 234 - 190. Paul Ryan noted that the bill “cuts $5.8 trillion in spending over the next decade, locks in those savings with enforceable caps on spending, and forces Washington to finally live within its means with a Balanced Budget Amendment.” Ryan charged that the White House refused to cooperate with Republicans or offer a credible plan of its own and that Senate Democrats had not passed a budget for over 800 days (and hundreds more days have passed since then—the last time they passed a budget was April 29, 2009). He warned, “The coming debt crisis is the single most predictable economic disaster in the history of the nation.”

42

42

Obama had vowed to veto the bill,

43

but that proved unnecessary because the Democratic Senate voted on July 22, by a strict party-line 51 - 46 vote, to table it. Majority Leader Harry Reid spectacularly denounced the plan as “one of the worst pieces of legislation to ever be placed on the floor of the United States Senate.”

44

43

but that proved unnecessary because the Democratic Senate voted on July 22, by a strict party-line 51 - 46 vote, to table it. Majority Leader Harry Reid spectacularly denounced the plan as “one of the worst pieces of legislation to ever be placed on the floor of the United States Senate.”

44

Increasingly frustrated that Republicans wouldn’t bend to his dictates, Obama, in the words of columnist George Will, “imperiously summoned congressional leaders to his presence: ‘I’ve told them I want them here at 11 a.m’ … . upon what meat doth this our current Caesar feed that he has grown so great that he presumes to command leaders of a coequal branch of government?” Will argued, “The current occupant’s vanity and naivete—a dangerous amalgam—are causing the modern presidency to buckle beneath the weight of its pretenses.”

Will also provided a trenchant summary of the debt-ceiling negotiations, praising the “87 House Republican freshman” whose “inflexibility astonishes and scandalizes Washington because it reflects the rarity of serene fidelity to campaign promises” and who, by refusing to roll over to Obama’s dictates, had vindicated the separation of powers doctrine and “rescued the nation from Obama’s preference for a ‘clean’ debt-ceiling increase that would ignore the onrushing debt tsunami.” Obama said he wondered whether Republicans “can say yes to anything.” Will answered this too: “Well, House Republicans said yes to ‘cut, cap and balance.’ Senate Democrats, who have not produced a budget in more than 800 days, vowed to work all weekend debating this. But Friday they voted to table it, thereby ducking a straightforward vote on the only debt-reduction plan on paper, the only plan debated, the only plan to receive Democratic votes.”

45

“I CANNOT GUARANTEE THAT THOSE CHECKS GO OUT”45

The administration constantly resorted to demagoguery to cloak its obstruction of Republican proposals to reduce the deficits and national debt. This was all the more appalling considering Obama’s castigation of President George W. Bush for “challenges that have been unaddressed over the previous decade.”

46

As the government approached the debt ceiling, Obama began fear-mongering about the United States defaulting on its principal obligations. This was always an unlikely occurrence because even with the ceiling reached, enough revenues would still come in to satisfy our primary obligations. Nevertheless, Obama ratcheted up his rhetoric, threatening to withhold Social Security checks. “I cannot guarantee that those checks go out on August 3

rd

if we haven’t resolved this issue,” he warned, “because there may simply not be the money in the coffers to do it.”

46

As the government approached the debt ceiling, Obama began fear-mongering about the United States defaulting on its principal obligations. This was always an unlikely occurrence because even with the ceiling reached, enough revenues would still come in to satisfy our primary obligations. Nevertheless, Obama ratcheted up his rhetoric, threatening to withhold Social Security checks. “I cannot guarantee that those checks go out on August 3

rd

if we haven’t resolved this issue,” he warned, “because there may simply not be the money in the coffers to do it.”

This was more deception. The government would receive $2.174 trillion in revenues during the year, with Social Security outlays totaling $727 billion, and it had already borrowed money to supplement that $2.174 trillion. So Obama undoubtedly knew there would be plenty of money to service our primary obligations and Social Security benefits.

47

47

Meanwhile, Obama invoked class warfare against private jet owners, as if to imply that we couldn’t balance the budget as long as we allowed these “tax breaks for the wealthy.” But this was another red herring, as eliminating the deduction, even assuming no negative impact on private usage, would yield only about $3 billion in additional revenue, which is 0.075 percent of the $4 trillion in deficit reduction that Obama was allegedly seeking—a statistically insignificant figure.

48

48

In typical fashion, Obama, his demagoguery in full tilt, declared, “It’s my hope that everybody is gonna leave their ultimatums at the door, that we’ll all leave our political rhetoric at the door.”

49

Columnist Charles Krauthammer pointedly highlighted Obama’s hypocrisy, writing, “And then, from the miasma of gridlock, rises our president, calling upon those unruly congressional children to quit squabbling, stop kicking the can down the road, and get serious about debt.”

50

49

Columnist Charles Krauthammer pointedly highlighted Obama’s hypocrisy, writing, “And then, from the miasma of gridlock, rises our president, calling upon those unruly congressional children to quit squabbling, stop kicking the can down the road, and get serious about debt.”

50

Incongruously, White House press secretary Jay Carney took time out from the administration’s doom-mongering over the debt ceiling to brag about the wonderful state of the economy. In July 2011, he said, “Well, two things remain uncontestably true. The economy is vastly improved from what it was when Barack Obama was sworn into office as president. We were in economic free-fall. There were predictions that we were headed to the second Great Depression.”

51

Illustrating the administration’s poor record of economic analysis, weeks after Carney’s comments, former White House economic adviser Jared Bernstein, who had co-authored the administration’s famous report predicting the stimulus would keep unemployment below 8 percent, admitted he was wrong and forecast that unemployment would not fall below 8 percent before the end of 2012.

52

51

Illustrating the administration’s poor record of economic analysis, weeks after Carney’s comments, former White House economic adviser Jared Bernstein, who had co-authored the administration’s famous report predicting the stimulus would keep unemployment below 8 percent, admitted he was wrong and forecast that unemployment would not fall below 8 percent before the end of 2012.

52

Meanwhile, as noted previously, our ever-rising national debt led Standard & Poor’s to downgrade the United States’ credit rating for the first time in ninety-four years, a move Obama promptly blamed on Republican opposition to increasing the debt ceiling. America had retained its credit rating through two world wars, the Great Depression, FDR’s New Deal, LBJ’s Great Society, and the military buildup of the Cold War, yet S&P found that America’s new, unprecedented debt levels warranted a downgrade.

53

Obama responded that when it came to domestic spending and defense, “there’s not much further we can cut.”

54

53

Obama responded that when it came to domestic spending and defense, “there’s not much further we can cut.”

54

The defense issue aside, it was a revealing look at his worldview. By merely curbing the rate of increase in domestic spending, he believed he had gone way beyond the bounds of reason.

“I MAKE NO APOLOGIES FOR BEING REASONABLE”Even after the parties agreed to a deal to resolve the budget ceiling impasse, Obama was still champing at the bit to hike spending. As soon as the Budget Control Act of 2011 was passed, Obama announced new spending proposals—under the euphemism “key investments”—which included higher taxes, extended unemployment benefits, and a “national infrastructure bank.” As columnist Michelle Malkin observed, “The infrastructure banks would borrow more money the government doesn’t have to dole out grants that wouldn’t be paid back and don’t require interest payments.”

55

Essentially, Obama was looking to create an entirely new financial structure to facilitate his profligacy.

55

Essentially, Obama was looking to create an entirely new financial structure to facilitate his profligacy.

Other books

HeartoftheOracle by Viola Grace

The Strangers by Jacqueline West

B00CCYP714 EBOK by Bradshaw, R. E.

The Society of S by Hubbard, Susan

And the Land Lay Still by James Robertson

Wolf of Arundale Hall by Leeland, Jennifer

Stay Dead: A Novel by Steve Wands

His Wicked Pleasure by Christina Gallo

Hardy 05 - Mercy Rule, The by John Lescroart

Hearts' Desires by Anke Napp