Throw Them All Out (14 page)

Read Throw Them All Out Online

Authors: Peter Schweizer

The question of Silver Spring's success in the smart-grid business is particularly interesting. The stimulus bill was vague on the protocols and technical standards required. The bill simply read:

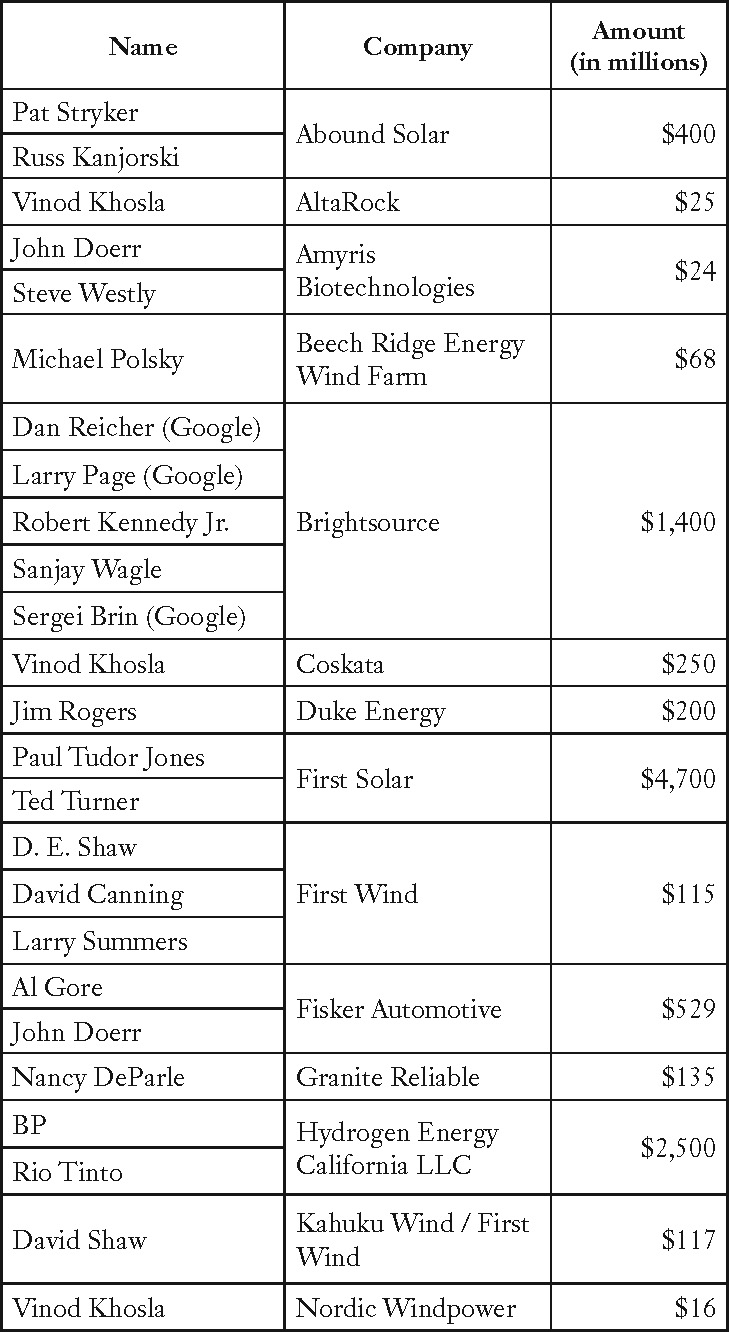

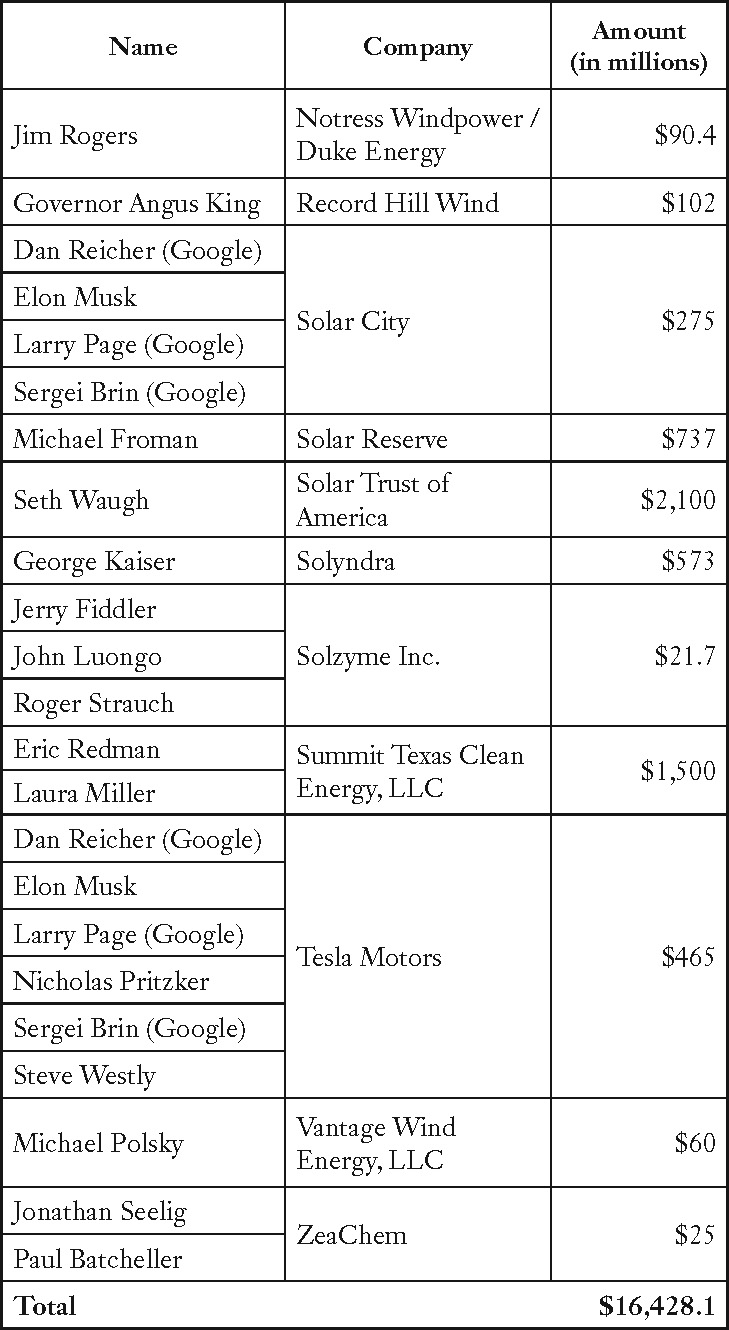

Obama Bundlers, Large Donors, and Supporters

(as of September 15, 2011)

Â

Â

Â

Â

"The Secretary shall require as a condition of receiving funding under this subsection that demonstration projects utilize open protocols and standards if available and appropriate."

42

This language had several Silver Spring competitors crying foul. According to Ed Gray, vice president of regulatory affairs for the smart-meter competitor Elster, the insistence on "open protocols" gave a leg up to Silver Spring at the expense of other providers. Some smart-grid companies rely on other types of standards or use proprietary technology in parts of their smart-grid networks. Silver Spring does not. And Silver Spring seemed not at all defensive about the move. "There's going to be a lot of people complaining," one executive told

USA Today.

"Leadership is helping people adapt to uncomfortable realities."

43

Billionaire Vinod Khosla was also a big winner in the taxpayer-funded giveaway. Khosla had been the head of Obama's India Policy Team during the 2008 election and contributed to Democratic candidates. He was a major investor in Coskata, a relatively new company whose goal is to make fuel out of waste. Coskata received a $250 million loan guarantee from the federal government.

44

Company executives have been quite clear that one important measure of corporate success is the amount of "government money we attract."

45

Khosla's Nordic Windpower was approved for another $16 million for a wind power manufacturing facility in Idaho. And his company AltaRock secured $25 million in stimulus money.

- In April 2010, $25 million went to ZeaChem, which hired Steve Farber (mentioned above) to lobby on its behalf. One of ZeaChem's major investors are Globespan Capital, where managing director Jonathan Seelig is a Democratic donor (he too has never given to another party). The other major investor is PrairieGold Venture Partners, which is headed by Paul Batcheller, a former aide to then-Senator Tom Daschle. The grant was awarded to modify a "demonstration sale" biorefinery. According to the federal government, the project created two jobs as of December 2010.

- $21.7 million went to Solazyme, based in South San Francisco. The company was founded and is chaired by Jerry Fiddler, a large Democratic donor (who has also never given to another party). He was a contributor to the Obama Victory Fund, gave $24,000 to the campaign, and made contributions to the DNC. Principal owners of Solazyme include Kennedy's VantagePoint, Lightspeed Ventures, which is headed by John Luongo, another major Obama donor, and the Roda Group, where Roger Strauch is a DNC and Obama campaign supporter. Solazyme had receipts of $38 million in 2010 and lost $13.7 million. Taxpayer money created a total of thirteen jobs. After it received the money, Solazyme announced plans for an IPO.

The list goes on and on. It would take a large team of investigative reporters to untangle every example of cronyism, and it will take more time to assess how many actual jobs these billions of dollars might have helped stimulate. But there is no question that the money failed to produce any significant short-term job gains. The true short-term effect has been to enrich cronies of the party in power. The only thing that many of these grants and loans appear to have in common is how they stimulated the wallets of well-connected investors.

Cathy Zoi, who oversaw the awarding of grants, left the Department of Energy in 2011. Where did she go? She landed as the head of a new green-tech investment fund being established by George Soros, the investor whose firms received taxpayer money through Zoi. As Steve Coll of

The New Yorker

recently wrote, subsidies and support for individual companies amount to "Obama-era crony capitalism," which entails "politically connected investment groups using their inside-information networks to attach themselves to those sections of the federal bureaucracy that will be primed by their party's imperatives of federal spending."

46

Crony capitalism is good for those on the inside. And it is lousy for everyone else. But it does provide a hybrid-powered vehicle to sustain a large base of rich campaign contributors with taxpayer money.

Â

Imagine for a minute that you are a corporate executive and you start using your company's assets to "invest" in projects that in turn benefit you directly. What would happen? You would be risking possible criminal charges for the misuse of those assets. But if it's taxpayer money? Suddenly it becomes legal. Even acceptable. And for the billionaire who is looking to get a big return on his investment, there are few returns that can be higher than those resulting from campaign contributions. After all, how else can you turn half a million dollars from yourself and your friends into hundreds of millions of dollars after a single election?

Not surprisingly, many of those named here are raising money again, for President Obama's 2012 campaign. As a jobs programâthe stated purposeâthese billions in grants and loans were a failure. But as a method for transferring billions in taxpayer funds to friends, cronies, and supporters, they worked perfectly.

I

N NINETEENTH-CENTURY AMERICA

, as part of the "blue law" movement that tried to protect the sanctity and sobriety of the Sabbath, there was a concerted effort to ban alcohol sales on Sunday. It was pushed by what can only be described as an odd alliance: Baptists and bootleggers. Baptists pushed publicly for the ban on moral and religious grounds. And the bootleggers? They pushed for the ban privately, lobbying politicians so they could make bigger profits. Stifling legal alcohol purchases for even one day each week meant added profits for their illegal sales. Bans were enacted state by state, and many blue laws still exist (for example, in Arkansas, Indiana, Minnesota, and Mississippi, among others), although restrictions have been lifted steadily in recent years.

In modern-day Washington, there is a new equivalent to that coalition of Baptists and bootleggers. True believers push a cause that calls for a substantial change in government policy. And opportunists support it because they see a chance for healthy profits. In these situations, politicians can enrich their friends and allies, and sometimes themselves, while coming off as earnest "Baptists" for a worthy cause. Lobbyists, on the other hand, are widely considered bootleggers, no matter how nobly they cloak their arguments. But what if a capitalist could somehow manage to sound like a Baptist?

Consider Warren Buffett. Often seen as a sort of grandfatherly figure who is above the rough and tumble of politics, Buffett seems to be above the folly and excess of finance too. He lives in Omaha, Nebraska, in a house he first purchased in 1958 for $31,000. He uses folksy words and illustrations to make his point. ("You don't know who's swimming naked," he said during the height of the financial crisis, "until the tide goes out.") He has uttered populist ideas, such as declaring that billionaires don't pay enough in taxes. The title of an article he wrote for the

New York Times

captures the tone: "Stop Coddling Billionaires." And his value-based investing has made himself and his investors at Berkshire Hathaway very rich.

But the image does not always reflect the reality. Warren Buffett is very much a political entrepreneur, whose best investments are often in powerful political relationships, and who in recent years has used taxpayer money as an important vehicle to even greater wealth and profit. Indeed, the success of some of his biggest bets, and the profitability of some of his largest investments, rely on government largesse and "coddling" with taxpayer money.

During the financial crisis in the fall of 2008, Buffett became an important symbol on television. He filled the role of fiscal adult, a responsible father figure in the midst of irresponsible Wall Street speculators. While pushing for calm and advocating specific policies in both public and private, however, he was also investing (sometimes quietly) so he could profit once his policy advice was implemented. This put Buffett in the position of being both the Baptist and the bootlegger, praised for his moral character and at the same time enjoying a trip to the bank.

The crisis started in the summer of 2008, when credit became scarce and Fannie Mae and Freddie Mac and several investment houses teetered on the brink of financial collapse. In the words of the

Guardian,

a London paper, Buffett was "uncharacteristically quiet through much of the financial crisis."

1

It was only on September 23 that he became a highly visible player in the drama, when he invested $5 billion in the investment house of Goldman Sachs, which was overleveraged and short of cash. Buffett gave them a much-needed cash infusion, and made a heck of a deal for himself. Berkshire Hathaway received preferred stock with a 10% dividend yield and an attractive option to buy another $5 billion at $115 a share.

2

Wall Street was on fire, and Buffett was running toward the flames. But he was doing so with the expectation that the fire department (that is, federal government) was right behind him with buckets of bailout money. As Buffett admitted on CNBC at the time, "If I didn't think the government was going to act, I wouldn't be doing anything this week."

Indeed, Buffett

needed

the bailout. Goldman was not as badly leveraged as some of its competitors, but the crisis was so serious that it was in danger and in need of a government infusion. And beyond Goldman Sachs, Buffett was heavily invested in several other banks that were at risk and in need of federal cash.

He began immediately to campaign for the $700 billion

TARP

rescue plan that was being hammered together in Washington. The first vote on the funding bill in the House of Representatives failed. But Buffett was in a unique position to help reverse its fate.

Warren Buffett is highly respected in political circles. During the 2008 presidential campaign he was in the unusual spot of being mentioned as a candidate for Treasury secretary by both John McCain and Barack Obama. Buffett made it clear where his loyalties lay: he had been an early financial supporter of Barack Obama's going back to 2004, when Obama had first run for the U.S. Senate and the two men had met. Each had been impressed, and Buffett said at a fundraiser in Nebraska that the two "had a lot of time to talk." In 2008, presidential candidate Obama made it clear that while he got plenty of advice on the campaign trail, "Warren Buffet is one of those people that I listen to." Obama added that he was one of his "economic advisers."

3

Buffett's role was important too in that several senators and representatives were shareholders in Berkshire Hathaway, and they had to know that passing the bailout bill would bring big returns for their Berkshire stock. Senator Ben Nelson of Nebraska, for example, held between $1 million and $6 million in Berkshire stock, by far his largest asset.

4

Initially resistant to the bailout bill, he ended up voting in favor of it after Buffett bought into Goldman. There were many legitimate reasons to support the bill, and it can hardly be said that Buffet's support was the deciding factor. But his Baptist-bootlegger position was noteworthy for its strength in both directions: a lot of people followed his advice, and he and they made a lot of money by pushing for the bailout.

Throughout the financial crisis and the debate over the stimulus in early 2009, several members of Congress were buying and trading Berkshire stock. Senator Dick Durbin bought Berkshire shares four times in September and October 2008, over a three-week period, up to $130,000 worth. He bought shares during the debate over the bailout, during the vote, and after the vote. Senator Orrin Hatch bought the stock, as did Senator Claire McCaskill, who bought up to half a million dollars' worth just days after the bailout bill was signed. Some also followed Buffett by buying shares in Goldman Sachs after the bailout. Among them were Congressman John Boehner, Senator Jeff Bingaman, and Congressman Vern Buchanan. In other words, the naked self-interest of the lawmakers who shorted the market based on Ben Bernanke's briefings in September 2008 became more twisted in late 2008 and early 2009: Buffet urged passage of the bailout and put his money where his mouth was, and members of Congress listened to him and invested with him.