Throw Them All Out (11 page)

Read Throw Them All Out Online

Authors: Peter Schweizer

God bless the Obama Administration and the U.S. government. We have really got the A-team now working on green innovation in our country.

âJOHN DOERR, Obama contributor and billionaire investor, who owns a large stake in sixteen companies that have received government loans or grants

Â

I

N

THE AUDACITY OF HOPE

,

Barack Obama tells a story about visiting Los Angeles in 2000: His credit card was declined by a rental car company. It was a "very dry period" for his law firm, and he was devoting most of his energy to his work as a state senator. Then suddenly a wealthy political donor named Robert Blackwell agreed to pay him a $112,000 legal retainer over a fourteen-month period.

But here's what Obama failed to note in his book, and what came to light only later, thanks to investigative reporting: State Senator Obama subsequently helped Blackwell's table tennis company receive $320,000 in Illinois tourism grants to subsidize a state Ping-Pong tournament.

1

Giving specific access and benefits to those who help you get elected (or get rich through investments) is a time-tested American tradition. You can make a business of government service by helping friends who help you. Politicians have always tried to provide favors in the form of tax breaks, regulatory exemptions, and constituent services to a select group of financial friends. Politicians regularly get special provisions inserted in the tax code to help friends in certain industries. Or they try to get them access to particularly powerful bureaucrats. But the best form of payoff and patronage for rich friends and supporters?

Give them billions of dollars in taxpayer cash.

When William "Boss" Tweed ran the Tammany Hall political machine in New York City in the nineteenth century, he forced potential candidates to put up cash to win nomination (and then certain election) to office. Once the electees arrived, they would enrich themselves, but they also funneled money back to Tammany Hall. It was more than just crony capitalism; it was also a system of rigged elections. What brought Tweed down, however, was classic cronyism. He began to construct a courthouse in lower Manhattan in 1861, siphoning off several times its value in government contracts. Finally, a

New York Times

investigative series pointed out so much blatant graftâone Tweed crony was paid so much for just two days of work that he became known as "the Prince of Plasterers"âthat charges were brought, and Tweed was jailed after milking the courthouse for a decade (construction would not be completed until 1880).

The game of funneling taxpayer money to friends has exploded to astonishing levels in recent years. Now that annual federal outlays exceed $3 trillion, there are extraordinary opportunities to get a piece of the action. Government checks routinely find their way to very wealthy Americans. Convincing the public that billionaires need the money can, needless to say, be tricky. But if a government check somehow serves the "public interest," it can become part of a larger program and might escape scrutiny.

With the dramatic events surrounding the 2008 financial crisis, beginning in 2009 the United States embarked on the greatest reverseâRobin Hood transfer of wealth in its history. Tax money was taken from all, rich and poor, and given to billionaires. Under the guise of an economic stimulus plan to create jobs and to develop alternative energy, Washington has handed out billions of dollars in cash and federal loan guarantees. With the exception of some reports on the solar power company Solyndra, almost entirely unreported by the media is the fact that an overwhelming amount of this money has been directed to wealthy financial backers of President Obama and the Democratic Party. This is Boss Tweed's financial payoffs writ large. Many recipients served on the President's campaign finance committee, or functioned as campaign donation "bundlers" (coordinators of individual contributions that can be combined into large gifts), or were major contributors themselves. In short, they raised and donated

millions

for Obama's 2008 campaign, and in return, the companies they own or lead have received

billions

in government-backed loans and outright grants. (The cash grants, by the way, are tax free.)

2

When President-elect Obama came to Washington in late 2008 following his electoral victory, he was outspoken about the need for an economic stimulus to revive a struggling economy. He wanted billions of dollars spent on "shovel-ready projects" to build roads; billions more for developing alternative energy projects; and additional billions for expanding broadband Internet access and creating a "smart grid" for energy consumption. After he was sworn in as President, he proclaimed that the allocation of taxpayer money would be based strictly on meritânot doled out to political friends. "Decisions about how Recovery Act dollars are spent will be based on the merits," he said, referring to the American Recovery and Reinvestment Act of 2009. "Let me repeat that: Decisions about how Recovery money will be spent will be based on the merits. They will not be made as a way of doing favors for lobbyists."

3

Really? Let's look at the results.

Â

It would take an entire book to analyze every single grant and government-backed loan doled out since Barack Obama became President. But an examination of grants and guaranteed loans offered by just one stimulus program run by the Department of Energy, for alternative energy projects, is stunning. The so-called 1705 Loan Guarantee Program and the 1603 Grant Program channeled billions of dollars to all sorts of energy companies. The grants were earmarked for alternative fuel and green-power projects, so it would not be a surprise to learn that those industries were led by liberals. Furthermore, these were highly competitive grant and loan programsânot usually a hallmark of cronyism. Often less than 10% of applicants were deemed worthy to receive government support.

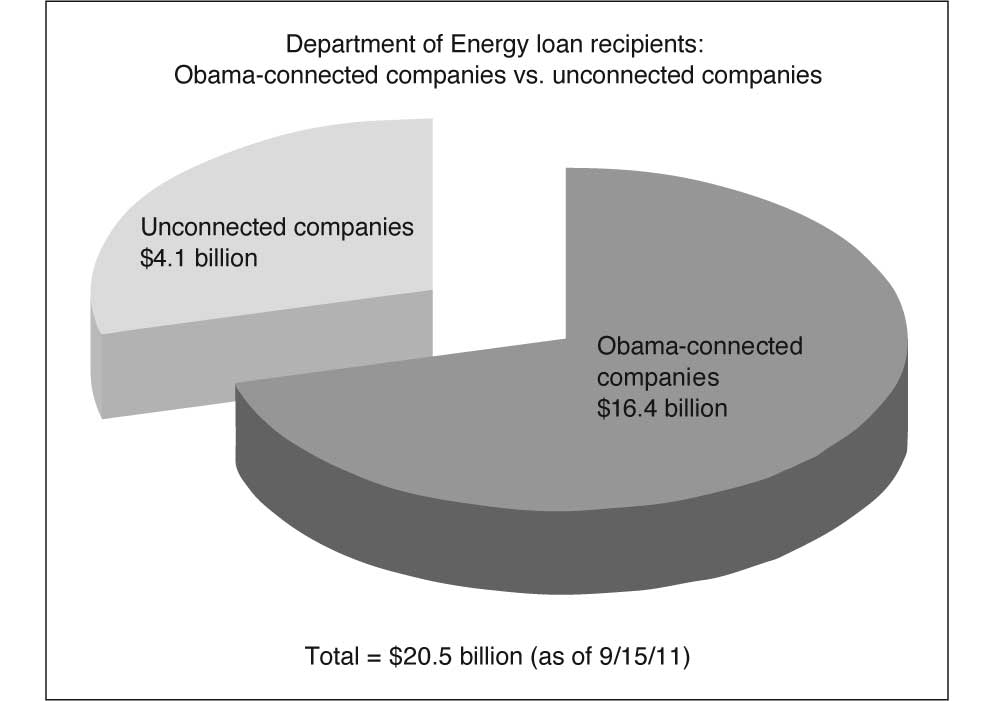

Nevertheless, a large proportion of the winners were companies with Obama-campaign connections. Indeed, at least ten members of Obama's finance committee and more than a dozen of his campaign bundlers were big winners in getting your money. At the same time, several politicians who supported Obama managed to strike gold by launching alternative energy companies and obtaining grants. How much did they get? According to the Department of Energy's own numbers ... a lot. In the 1705 government-backed loan program, for example, $16.4 billion of the $20.5 billion in loans granted went to companies either run by or primarily owned by Obama financial backersâindividuals who were bundlers, members of Obama's National Finance Committee, or large donors to the Democratic Party.

4

The grant and guaranteed loan recipients were early backers of Obama, before he ran for President, people who continued to give to his campaigns and exclusively to the Democratic Party in the years leading up to 2008. Their political largesse is probably the best investment they ever made in alternative energy. It brought them returns many times over.

FRIENDS GIVE FRIENDS BILLIONS OF OUR MONEY

Â

Â

Those who directed these loan programs were themselves fundraisers for the Obama campaign. One might think that the Department of Energy's Loan Program Office, for example, which has doled out billions in taxpayer-guaranteed loans, is directed by a dedicated scientist or engineer. Or perhaps a civil servant with considerable financial knowledge. Instead, the department's loan and grant programs are run by partisans who were responsible for raising money during the campaign from the same people who later came to seek government loans and grants. Steve Spinner, who served on the Obama campaign's National Finance Committee, and was a bundler himself, was the campaign's "liaison to Silicon Valley." His responsibilities included fundraising, recruiting more bundlers, and managing Obama's relationship with a cadre of very wealthy donors. After the 2008 campaign, Spinner joined the Department of Energy as the "chief strategic operations officer" for the loan programs. A lot of the money he helped hand out went to that same cadre of wealthy Silicon Valley campaign donors. He also sat on the White House Business Council, which is made up of Obama-supporting corporate executives.

Another Obama fundraiser who was positioned to lead the allocation of taxpayer money to Obama contributors was Sanjay Wagle, who served as the managing cochairman of Cleantech and Green Business Leaders for Obama, which raised millions for Obama's campaign. Wagle's day job was as a principal at VantagePoint Venture Partners. After the 2008 election, Wagle joined the Obama administration as a "renewable energy grants adviser" at the Department of Energy. VantagePoint owned firms that would later see federal loan guarantees roll in.

Leading the loan programs at the DOE with Steve Spinner was Jonathan Silver, who would serve as executive director. Silver formerly served in the Clinton administration, first as counselor to the secretary of the interior and later as assistant deputy secretary of the Department of Commerce. He is a strict partisan: when it comes to his own campaign contributions, the recipients have all been Democrats. His wife has served as financial director for the Democratic Leadership Council. His business partner, Tom Wheeler, was an Obama bundler, and his wife was an outreach coordinator for the campaign. According to the DOE, as director of the loan programs "Silver will be responsible for staffing the programs, and leading organization analysis, and negotiation."

Silver managed the loans with advice from his "strategic adviser," Steve Spinner. The grants, on the other hand, originated in the office of Cathy Zoi, who served as the assistant secretary of energy for efficiency and renewable energy. (Wagle was her adviser.) Zoi had previously worked in the Clinton White House as the chief of staff on environmental policy, then as the CEO of former Vice President Al Gore's Alliance for Climate Protection. You may be thinking, "So what? Why would we expect anything less of political appointees?" But the numbers don't lie: the recipients of loans and grants from these programs were Obama cronies. Were the funds doled out based on the merits? You decide.

The Government Accountability Office has been highly critical of the way guaranteed loans and grants were doled out by the Department of Energy, complaining that the process appears "arbitrary" and lacks transparency. In March 2011, for example, the GAO examined the first eighteen loans that were approved and found that

none

were properly documented. It also noted that officials "did not always record the results of analysis" of these loan applications. A loan program for electric cars, for example, "lacks performance measures." No notes were kept during the review process, so it is difficult to understand how loan decisions were made. The GAO further declared that the Department of Energy "had treated applicants inconsistently in the application review process, favoring some applicants and disadvantaging others." As the GAO noted in another report, the Recovery Act "never defined what was meant by transparency." Similarly, the Department of Energy's inspector general, Gregory Friedman, who was not a political appointee, chastised the alternative energy loan and grant programs for their absence of "sufficient transparency and accountability." He has testified that contracts have been steered to "friends and family."

5

Friends indeed. The Department of Energy loan and grant programs might be the greatestâand most expensiveâexample of crony capitalism in American history. Tens of billions of dollars were transferred to firms controlled or owned by fundraisers, bundlers, and political allies, many of whomâsurprise!âare raising money for Obama again.

The stated goal of the energy giveaways was to create "green jobs." Yet many of these grants and loan guarantees created few or no jobs, according to the federal government's own records. Often, taxpayer money was given to politically connected companies for projects that were already under way or even completed. Often these companies were money losers that needed government funds to stay in business or turn a profit. By the White House's own admission in internal memos, these grants and guaranteed loans proved to be very lucrative for key political financiers. Several huge checks or loan guarantees were given to small companies with revenues of less than $1 million.

In a memorandum for the President, signed on October 25, 2010, and leaked to the media, senior White House officials Larry Summers, Ron Klain, and Carol Browner explained what an economic boon the grants and loans were to the companies involved. Many of the companies had "relatively small private equity (as low as 10%)," reads the memo, while generating "an estimated return on equity of 30%." Those companies would have been hard-pressed to negotiate that sort of arrangement in the private sector. The memo further points out that if you win government money, it can make all the difference between success and failure. A wind farm can cost 55% less than it would for a company that didn't get government support. Government grants cut costs in half for some solar energy companies. The memo also makes clear that the grant review process was not handled solely by the Department of Energy; the White House staff itself was involved in picking winners and losers. The memo notes that the grants and loans receive a "policy review" by the White House.

6