How to Create the Next Facebook: Seeing Your Startup Through, From Idea to IPO (16 page)

Read How to Create the Next Facebook: Seeing Your Startup Through, From Idea to IPO Online

Authors: Tom Taulli

You may even want to try non-automated approaches, which is what Pandora has done. The company’s product is not necessarily viral, but its growth rate has been staggering. Of course, it was smart that Pandora developed a mobile product in the early days of smartphones. It also has a great service that delivers songs based on what a user likes. But Pandora has gone even further.

When you sign up, you get an e-mail from the personal account of co-founder Tim Westergren. If you respond, you get an answer! This has been a highly effective way to turn users into rabid fans.

After all, when you sign up for a new service, you often get a message that says something like, “Don’t respond to this e-mail.” What kind of way is that to treat a customer?

When using viral marketing techniques, you need to avoid any inkling of spam. Users are becoming increasingly intolerant of these dubious tactics. Such approaches get tweeted about and may end up as part of an exposé story by a blogger. Always make it clear what you plan to do with any information from a user. And if you send out e-mail alerts or newsletters, they should be opt-in.

SEO has become a huge business over the past decade. The idea is that by producing lots of relevant content, your site’s links should rise to the top of search listings for Google, Bing, and Yahoo!.

But this isn’t easy to pull off, and some companies push the boundaries beyond ethics and decency. Because of this, search engines are becoming more diligent about preventing SEO spam. These efforts can actually shut down a company.

Also be wary of third-party SEO consulting firms. They make grandiose promises but don’t necessarily deliver. Or they may engage in shady practices.

Despite all this, SEO is a great way to get free distribution for your product. The key is that the content must be authentic and relevant—not an attempt to try to game the system.

It also helps if the business relies on heavy amounts of user-generated content. This is certainly the case with Yelp. Its users have created over 25 million reviews, which has caused Yelp merchant profiles to rank high on online searchers.

When entering a new city, Yelp hires a community manager who is a local resident. The manager writes a weekly e-mail and organizes events. These efforts are essential in getting users to write lots of useful reviews.

This extra step—having “feet on the street”—is often lacking in startups. Somehow the belief is that the users will automatically start contributing content. But this is often a false hope. To be successful, it is usually critical that you engage in proactive actions.

Meetups can be extremely helpful in getting exposure for your product. They aren’t hard to put together and aren’t necessarily expensive. You can have a meetup at a nice hotel, with free drinks.

Don’t expect to get an immediate spike in users after a meetup. Keep in mind that the people who attend meetups are probably already avid users.

But this is an advantage: the event can be a way to maintain intensity as well as an opportunity to get feedback and ideas about possible features. Requesting such input will impress your avid users, and they may tell more of their friends about your product. Such word-of-mouth marketing can be powerful.

At a meetup, it’s a good idea to have giveaways. At a minimum, you should provide t-shirts—your users can become walking billboards for your company. Raffle something like an iPad. And make sure you take pictures of the event and post them on your company’s blog as well as your Twitter and Facebook pages.

It’s important to follow up with all the people who attend the meetup. Say thanks, and ask for feedback.

Now: what about launch parties, which seem to be

de rigueur

in Silicon Valley? I consider them a waste of money. They’re really just a way for people to throw a free party! In the end, you probably won’t get much lift in your user base. Meetups, on the other hand, offer a better opportunity to reach more people at a much cheaper price.

PR is critical for any company. It is the best kind of exposure because you are getting an unbiased view from a third party. In today’s skeptical world, this can be huge when you are trying to acquire users and customers.

But here’s the problem: it’s not easy to get good PR exposure. There aren’t many influential blogs and publications. Thus there aren’t many reporters and bloggers—at least, compared to the thousands of startups looking for coverage.

As a blogger for Forbes.com, I have some insights that can help with your PR efforts. Much of my advice is simple. For example, you need a News section on your web site. When I visit a company’s site, this is the first place I go; before I write about the company, I want to see who else has covered it and learn about the key points that set it apart from the crowd. Unfortunately, the

News section often contains little useful information (if the section even exists!).

A company should also devote some effort to its own blog. Write about the latest developments, especially major partnerships and customers, and try to show that your company has real traction.

It’s also good for your CEO to post regularly. But don’t make these posts solely about the company’s products. The CEO should blog about pressing issues in the industry. If your CEO becomes a thought leader, this may lead to more PR opportunities. Remember, bloggers like to quote experts.

Before you pitch a blogger, you need to read their stuff. Nothing is more aggravating than getting a pitch that concerns something I’ve never written about. Do you expect me to suddenly start covering something new? It’s not going to happen. Such a pitch shows that a company gave little thought to the effort.

Also, from time to time I receive a PR e-mail that has been messed up by the mass e-mailer. When I get a pitch that starts with

Hi {Name}

it’s an automatic delete for me.

When pitching your company, get to the point. Avoid sending an e-mail that goes on

ad nauseam

. Reporters don’t have time to read treatises. Keep your pitches to no more than a couple of paragraphs. You may even want to paste in a screen shot that gives a good idea of the product.

To boost your odds of getting the attention of a reporter or blogger, you need to provide a

hook

: a nugget that is interesting to readers. An example is a pitch I got that—in the subject line—mentioned “the power of the hoodie.” It was in reference to Zuckerberg’s attire during the IPO roadshow. I loved the phrase; it was interesting enough that I contacted the PR person. In the end, I wound up writing a story on the topic.

Sometimes, founders need to restrain themselves. To get publicity, it’s tempting to stretch the truth or even lie. It’s okay to be optimistic—that’s mandatory for an entrepreneur—but you need to act with integrity. In today’s world, it’s often easy to spot untruths.

Just because a reporter responds to a pitch, this doesn’t mean a story is inevitable. Sometimes a writer is only making an introductory call and getting your company on their radar. But a response is a good sign; chances are, the writer will cover your company at some point.

What if a blogger writes a negative piece? Your first instinct may be to lash out. But you need to control yourself. If the story contains a glaring error or misrepresentation, get in touch with the blogger and point it out. But again, don’t be hostile—that will probably make things worse.

Negative media coverage is inevitable, especially for successful companies. In the early days of Facebook, the reporting was far from glowing. It was common to see pieces about how the site was a fad and a terrible violator of privacy. But in reality, the media attention was a good thing. It showed that Facebook was interesting to readers, which gave writers a reason to keep writing about it. Zuckerberg quickly realized this and did not fight back against negative coverage. It took a strong stomach but was definitely the winning strategy.

Some types of businesses can benefit tremendously from being associated with celebrities. Keep in mind that getting adopted by Hollywood stars was a key fuel for Twitter’s growth. This was also a factor for Facebook.

If your venture is focused on the consumer side—especially if it’s in fashion or entertainment—try to get celebrities on board. This has happened with various companies that have had success connecting with Shakira, Will Smith, Rihanna, Jay-Z, and Snoop Dogg.

And of course, Ashton Kutcher has become an Internet tycoon by taking advantage of his celebrity. His star power has been a key driver for the success of companies like Fab.com.

This chapter just scratched the surface of the possible go-to-market strategies. It’s a highly specialized topic. In fact, one of your early hires should be an expert in marketing.

The next chapter looks at financial matters. These can be a bit boring, but you need to know the core principles. This means understanding the income statement, balance sheet, and cash flow statement. They are important in guiding the early success of your company.

In the end, all business operations can be reduced to three words: people, product, and profits.

—Lee Iacocca

A key to Facebook is its focus on data. From the early days, Mark Zuckerberg made it a priority to develop systems that tracked numerous metrics such as daily active users, time spent on the site, mobile traffic, and so on.

But in order for the data to have any meaning, it must be connected to the financials. Toward this end, Zuckerberg has also focused on creating a highly sophisticated financial reporting system. This has made it easier to monetize traffic and also to meet the rigorous compliance requirements of being a public company. This is why Zuckerberg had to learn how to interpret financial statements and understand important concepts like margins.

This chapter covers these things—by analyzing Facebook’s own financials.

The basics of accounting go all the way back to Renaissance Italy. At the time, Luca Pacioli came up with the system of double-entry bookkeeping, with the premise that every transaction needed two equal components. Here’s a modern-day example. If you buy a server for your company, you increase the asset amount on your financial statements but also decrease the cash balance by the same amount. Why? To help avoid accounting errors. If the two columns don’t balance, there is definitely something wrong.

Since Pacioli’s time, the accounting profession has seen much evolution. Just look at the case of Zynga. The company innovated a business model that involves selling virtual items for its social games. But no guidelines existed for

how to account for the revenues. Do you recognize them when a purchase is made or ratably over the period a player is engaged in the game? To resolve this issue, Zynga had to use its best judgment and also get the help of its auditors.

A critical part of accounting are Generally Accepted Accounting Principles (GAAP). These include an extensive set of accounting guidelines that have been developed by authorities like the Securities and Exchange Commission, the American Institute of Certified Public Accountants (AICPA), the Financial Accounting Standards Board (FASB), and the Public Company Accounting Oversight Board (PCAOB).

When a company goes public, it’s required to report its financials in accordance with GAAP. But it has the option to add other measures, called

pro forma metrics

, which are at the discretion of management. As should be no surprise, the temptation is to be extremely liberal so as to inflate the company’s profitability.

A common metric is earnings before interest, taxes, depreciation, and amortization (EBITDA). There may also be variations, known as

adjusted

EBITDA. The rationale is that certain items should be excluded from earnings because they are not part of the main operations of a company (such as interest) or don’t involve a current outlay of cash (depreciation).

But these accounting games are unfortunate. Why does management need to resort to such shenanigans, especially when professional investors can see what’s really going on? Perhaps one of the most notable examples of using pro forma numbers is Groupon. In its S-1 filing, the company highlighted its own accounting invention: adjusted consolidated segment operating income (adjusted CSOI). Besides being a mouthful, it turned into a major controversy with IPO investors. Adjusted CSOI excluded marketing and customer-acquisition costs, even though these expenditures were critical to the company’s business model!

The SEC ultimately required Groupon to underemphasize this metric in its S-1. After the company came public, it wound up having to restate its first quarter earnings report, which was a major embarrassment. The stock lost as much as 70% of its value.

Facebook took another approach. When it filed for its IPO, the company didn’t resort to fancy metrics. Instead, it published clean GAAP numbers, which made it easy for investors to understand things and helped to bolster credibility. It also allowed for a smooth approval process with the SEC.

For startups, being creative is crucial in building a breakout company. But it’s a terrible strategy when it comes to accounting.

For the most part, accounting principles emphasize conservative approaches. One is the concept of

historical cost

. To understand this, let’s take an example. If Facebook buys a server, it must book this at its cost, even if the company bought the server at well below its worth. It doesn’t matter.

But the historical cost approach can be misleading. Let’s say Facebook purchased land for its headquarters five years ago for $10 million. With the surge in prices, it’s now worth $13 million. Despite this, Facebook cannot increase the value of the property on its financials. The land must remain at its historical cost. This is a hard-line rule.

Another important accounting principle is the

accrual method

. This has two parts, but they are intertwined. First, a company must recognize revenues when they’re earned, not when cash is paid. If Facebook has generated $1 million in sales from Zynga, it’s a sale even though the payment won’t be made until the end of the month.

Second, a company must recognize expenses when they’re incurred, not when cash is paid. Again, let’s say Facebook agrees to buy software for $500,000. At this moment, it’s an expense.

This seems convoluted, but there is a rationale. It’s part of something called the

matching principle,

which says a company must report all expenses that relate to revenues. Doing so makes it easier to get a sense of the company’s overall progress.

Without the matching principle, financials would often be mess. Just imagine if Facebook prepaid rent for six months. Would it make sense to recognize the entire expense for the current month? Definitely not. Doing so would give a false impression. The proper way is for Facebook to recognize the expense over the six-month period as it uses the property.

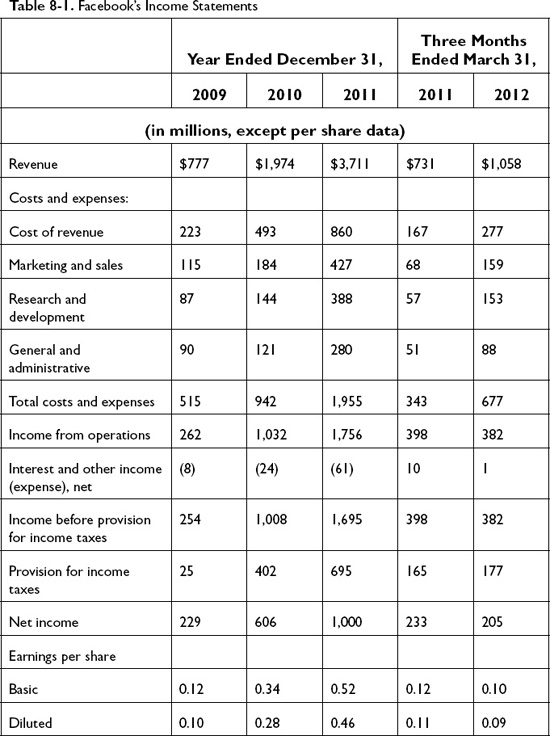

The income statement starts with revenues and then subtracts costs. The result is either a profit or a loss. Although profitability is not a consideration for early-stage companies, it’s a key factor when a company scales its growth and especially when it comes public. Facebook posted a profit of $1 billion in 2011, which compares to only $229 million in 2009.

An income statement covers activity for a period of time, such as a quarter or a year. Facebook’s income statement provided a break-out for 2009 to 2011 and then the first quarter of 2011 and 2012, as shown in

Table 8-1

.

When you look at this table, notice that the numbers are in millions, which makes them easy to interpret. You also see that some numbers are surrounded by brackets; these are negative numbers.

Now let’s take a deeper look at the items on the income statement.

Revenues

or

sales

refer to the total amount a company receives from selling products or providing services. This is also called the

top line

because it’s listed at the top of the statement. In some cases, you see

Net Sales

, which excludes certain items from gross sales like discounts, promotions, and returns.

Facebook gets about 82% of its revenues from advertising and the rest from fees resulting from its Credits platform, which provides payment services (mostly for social gaming partners like Zynga). From 2010 to 2011, the number of users for virtual goods went from 5 million to 15 million.

Even though Facebook is available in most countries, it still gets a majority of its revenues from the US. The other main sources include Western Europe, Canada, and Australia. It takes considerable time and resources to set up the infrastructure to monetize a web site in another country; this is why revenues are low in areas like India. Even though traffic has been growing at a rapid clip, there is little infrastructure to deliver ads. But over the next few years, Facebook will make the necessary investments to capitalize on the massive revenue opportunities.

It’s also important to understand that revenue can be subject to seasonality. This means some quarters are stronger than others due to factors such as weather, budget decisions, and industry customs. In 2012, Facebook noted that it had a relatively weak first quarter because of seasonality. For most ad-based companies, this time period often sees the lowest activity.

This may have not been a problem in prior years because Facebook was growing at a torrid pace. But as it reached $4 billion in revenue, it appeared that seasonality was becoming a reality. It’s natural as a company begins to mature and its growth rate slows.

The cost of revenue includes all expenses that are directly related to the delivery of a company’s products. For Facebook, these include the costs for data centers, equipment, bandwidth, energy, processing fees, and maintenance.

Of these, energy has been tough to control. This is why Facebook has situated data centers near electric power plants or in cold climates, because it is expensive to cool down servers

This is revenues minus the cost of revenue. Investors analyze this number using the gross profit margin:

Gross Profit / Revenues

You want to see this above 50% because that means your company has much more room to be profitable. Facebook’s gross margin was 73.4% by the first quarter of 2012, which was standout.

It’s important for gross margins to increase over time, which indicates leverage in the business model. Again, it’s a key source of profitability—which can drive massive valuations. This has been the case with companies like Microsoft and Google. And this is why VCs often talk about gross margins.

There has never been a Facebook Super Bowl commercial—or any Facebook television commercial, for that matter. Because of its mega-brand and global reach, the company has had little need to engage in large-scale marketing efforts, except for sponsoring conferences and events. This has been a huge advantage that has helped the company post strong profits.

On the sales side, Facebook has built a self-service ad platform, which has also been a cost saver. But the company has had to ramp up the hiring of top sales and business-development people as well as customer representatives. Top-notch brands aren’t satisfied with automated ad systems; they instead want the counsel of smart people who can create compelling campaigns. For this reason, Facebook has 30 sales offices around the globe.

This item consists mostly of salaries, benefits, and share-based compensation for engineers and computer scientists. Facebook has been aggressively hiring not just product-development people but also those with experience in areas like data mining and personalization technologies, content delivery, media storage and serving, power distribution, and advertising technologies.

These people are not cheap. In some cases, a top engineer commands a multi-million-dollar pay package.

As a result, R&D expenditures have increased substantially for Facebook. From 2009 to 2011, the costs went from $87 million to $388 million.

These are known as

overhead

costs. That is, they tend to remain the same regardless of overall sales, at least in the short run. G&A costs include functions like finance, legal, and HR.

This is a company’s

bottom line

(yes, because it’s at the bottom of the income statement). A positive number is a profit, and a negative number is a loss. A company calculates its earnings per share (EPS):

Net Income / Outstanding Shares

The outstanding shares can be those that are already owned. Or it can be on a diluted basis, which assumes that all options and warrants are exercised. Because fast-growing tech companies usually see high levels of exercises, it’s better to focus on the diluted figure.

Once you have the EPS, you can find the price-to-earnings (PE) ratio:

Stock Price / EPS

This is a rough guide to a company’s valuation. As a general rule, a hot tech company has a high PE ratio—say over 30 or 40—because investors pay a premium for growth. But it can also mean the stock is volatile. Even a small drop in the growth rate can hurt a stock. This has happened with public companies such as Zynga, Groupon, Yelp, and Pandora.