Iconoclast: A Neuroscientist Reveals How to Think Differently (11 page)

Read Iconoclast: A Neuroscientist Reveals How to Think Differently Online

Authors: Gregory Berns Ph.d.

Tags: #Industrial & Organizational Psychology, #Creative Ability, #Management, #Neuropsychology, #Religion, #Medical, #Behavior - Physiology, #General, #Thinking - Physiology, #Psychophysiology - Methods, #Risk-Taking, #Neuroscience, #Psychology; Industrial, #Fear, #Perception - Physiology, #Iconoclasm, #Business & Economics, #Psychology

An Alternative to Fear: The Idea Market

Jim Lavoie, age sixty, is the CEO of Rite-Solutions, a software company based in Newport, Rhode Island, that creates novel software solutions for demanding environments. The company makes programs for submarine command and control systems and visualization tools for Coast

Guard helicopter pilots on rescue missions. With his business partner and longtime friend, Joe Marino, fifty-eight, who is the president, the two formed a company whose founding principle is the creation of a culture that fosters fun and innovation. Lavoie is the gregarious one. He exudes energy and enthusiasm and possesses a personality well suited for networking and raising capital. Marino is serious. Down-to-earth, practical, he knows how to run a company and has a good sense for the type of employee who benefits from the culture that they have created. He boasts that Rite-Solutions has a 2 percent annual attrition rate, a feat unheard of in the software industry, in which the norm is 10 to 20 percent. Rite-Solutions is not a big company (about 150 employees), but it has attracted a great deal of attention for its approach to innovation. Lavoie and Marino are not iconoclasts, but they are attempting to coax potential iconoclasts out of their shells. They represent the antithesis of the CA management style.

“Most companies have this funnel,” says Lavoie. “Give me all of your ideas and we’ll choke them down to two ideas. In my old company, if you had a great idea, we would tell you, ‘Okay, we’ll make an appointment for you to address the murder board,’ because the murder board’s job was to make sure the company took no risk. Their job was to shoot down ideas.”

13

Marino explains what would happen. “Some technical guy comes in with a good idea. Of course questions are asked of that person that they don’t know. Like, ‘How big’s the market? What’s your marketing approach? What’s your business plan for this? What’s the product going to cost?’ It’s embarrassing. Most people can’t answer those kind of questions. The people who made it through these boards were not the people with the best ideas.

They were the best presenters

.”

Lavoie confesses, “If you know the game, you can get through the funnel. You make up stuff. I made it to executive VP not by being bright, but by being theatrical. By being passionate. You can fake passion. And

the better ideas were being shot down because the other guy didn’t do theater as well.”

Their approach to coaxing innovation, even iconoclasm, is through the idea market. Everyone, on the day they start work at Rite-Solutions, is given $10,000 in opinion money. This money can be invested in ideas in an internal stock market. The market has a superficial similarity to a real stock market, but it has some crucial differences that allow ideas to evolve. Employees log in to the market and can view an “expectus,” which is a brief description of an idea that someone else in the company came up with. It might be a simple idea, such as developing a piece of computer code to perform some new visualization function. At this stage of the game, it is still just an idea. If another employee likes the idea, they can invest part of their opinion money in that idea.

An investment grows in value through the next two components of the market. For an idea to gain traction, other people have to make comments and criticisms within the market about how to improve the idea. This is called “interest” money. Lavoie and Marino operationalize the amount of interest by the number of comments for a particular idea. They have structured the market so that interest money counts for twice as much opinion money. But to realize a profit, employees must put in real time working on an idea. This is called the investment phase, and it is the most valuable of all, because it transitions an idea off the drawing board into reality. It need not be complex. It can be as simple as someone saying, “Here’s what needs to be done, and I’m willing to contribute two hours of my own time.”

One wonders why someone would spend their own time working on ideas that are not directly related to Rite-Solutions’ contract work. Marino believes the answer has to do with trust. “Going in on Day 1, we let our people see anything that anybody is working on. Very few companies do that.” Another reason is that the market helps people create their own jobs. “Not only does the originator of an idea benefit financially, but

if the idea is successful, then he’s going to be the one working on that technology,” Lavoie says. This is a nice perk especially if it’s a particularly hot technology that people are dying to work on.

Lavoie and Marino came up with a novel solution to the problem of social fear and how this fear stifles innovation. To be sure, it doesn’t remove all of the fear of sharing one’s ideas publicly, but it attempts to take some of the drama out of it. It also has another, unanticipated benefit in terms of transparency. The market makes it clear to everyone in the company what everyone else is working on, in essence providing a big picture for everyone who wants to know how their work fits into the company as a whole. Lavoie and Marino didn’t design the market to address the problem of secrecy in organizations, but the market has turned out to help decrease a third common fear that gets in the way of iconoclasm: the fear of the unknown.

Fear of the Unknown: A Biological View of Uncertainty

Although fear of the unknown is an entirely different type of phobia from the fear of failure, it is also processed through the amygdala. This is actually good news, because it means that the pathways by which fear inhibits behavior flow through this one structure. We have learned a great deal about the amygdala in the last several years, and this knowledge can be applied to ameliorate this particular roadblock to iconoclasm.

Fear of the unknown, or ambiguity, is a funny thing. It is not a specific event such as an electric shock or the pain experienced from the criticism of an unempathetic supervisor. Ambiguity stems from a lack of knowledge. It looms over the psyche like a dark cloud on the horizon. The brain constantly tries to predict what’s going to happen next, and when it can’t, a sense of foreboding ensues. Some people are better at dealing with ambiguous situations than others, but when fear of ambiguity bubbles to the surface, it is universally experienced the same way.

Recent advances in neuroeconomics offer clues about heading off this demon before it inhibits behavior. Consider a classic conundrum, known as the Ellsberg paradox.

14

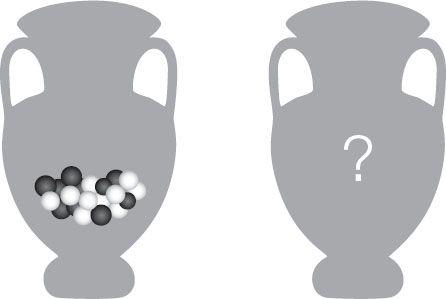

There are two large urns placed in front of you (see figure 3-1). The urns are completely opaque, so you cannot see their contents. The urn on the left contains ten black marbles and ten white ones. The urn on the right contains twenty marbles, but you do not know the proportion of black to white. Now, the game is to draw a black marble from one of the urns. If you are successful, you win $100. You only have one chance, so which urn will you draw from? Keep the answer in your mind.

Let’s play again. Now, the game is to draw a white marble. Again, you only have one chance, so which urn will it be?

Most people when confronted with these choices choose the urn on the left—the one with the known proportions of black and white

marbles. And therein lies the paradox. If you choose the left-hand urn when trying to pull a black marble, that means you think your chances are better for that urn. But because there are only two colors in both urns, the odds of pulling a white must be complementary to the odds of pulling a black. Logically, if you thought the left-hand urn was the better choice for a black marble, then the right hand urn should be the better choice for a white marble. The fact that most people avoid the right-hand urn altogether suggests that people have an inherent fear of the unknown (also called

ambiguity aversion

).

FIGURE 3-1

The Ellsberg paradox

The urn on the left contains ten black marbles and ten white marbles. The urn on the right contains twenty marbles of an unknown ratio of black to white. Draw a black marble to win $100. Which urn do you choose to draw from?

In 2005, researchers at Caltech performed an important neuroimaging study of the Ellsberg paradox. Although the paradox had been known for decades, the neurobiological reason for ambiguity aversion remained a mystery. Economists had relegated the effect to the growing garbage bin of anomalies from expected utility theory. The Caltech group placed subjects in an MRI scanner while they performed a series of trials based on the Ellsberg paradox. When the researchers examined the brain responses to risky versus ambiguous decisions, they found two regions that were more strongly activated to ambiguity. One region was the underside of the cortex that sits above the eyeballs, called the

orbitofrontal cortex

. The other region was the amygdala.

Taming the Amygdala Through Reappraisal and Extinction

The amygdala is a twitchy character with a long memory. Once the amygdala encodes an unpleasant association, it doesn’t forget. These memories sometimes resurface at the most inopportune times, and in the worst of circumstances, the amygdala is responsible for traumatic flashbacks. But all is not lost. There are two ways to keep the amygdala in check. One is proactive, preventing or limiting the brain from making unpleasant associations that it will remember. The second is reactive,

which acknowledges the fact that unpleasantness is unavoidable but need not be paralyzing.

For many people, the types of fears that get in the way of iconoclastic thinking were laid down long ago. Although key brain structures like the amygdala are responsible for the fear response, it is often formative experiences during childhood and adolescence that end up rearing their heads in adult life. Consider the fear of public speaking. Thirty percent of the U.S. population has a fear of public speaking.

15

It is, by far, the most common phobia. Although some fears may be innate and hardwired, such as the fear of snakes and spiders, the fear of public speaking is an acquired phobia. In this sense, the neurobiological mechanisms are no different from the classical conditioning experiments described earlier. The only difference is that instead of an electrical shock, a person experiences the pain of social embarrassment. Typically, this conditioned response is laid down in childhood when children are made to perform in front of classmates, teachers, and parents. From a child’s perspective, they are in the position of extreme uncertainty (ambiguity aversion here). They are trying to learn material that everyone else knows, but they themselves do not. Depending on how well this goes for them, they may learn to like speaking in public, or they may learn to fear it. As far as fear conditioning goes, it does not take many negative outcomes to solidify an unpleasant association. And the fact that this never really goes away, but instead may be inhibited by the prefrontal cortex, underscores the deep-seated nature of this type of phobia.

So, instead of trying to eradicate the fear response, a more reasonable approach is to examine the situations that tend to set off the amygdala, and use the prefrontal cortex to inhibit it. Lavoie and Marino exemplified this tactic. They identified one of the critical fears that inhibit people from sharing their ideas: the fear of being rejected. At its core, this fear has its origin in social pressure, which is one of the most

common of human phobias. Their solution was novel. By removing as much of the social drama as possible, Lavoie and Marino were able to create an environment in which individuals who tended toward social reticence felt comfortable pitching half-baked ideas. Although their stock market still relies on input from coworkers, the movement into virtual space stripped away some of the social pressure. This works particularly well in an environment in which people spend most of their time in front of a computer. As Lavoie and Marino realized, most of their employees were more comfortable instant messaging each other than walking down the hallway for a face-to-face conversation. Of course, criticism still stings, but the virtual nature of the stock market makes the process a little less painful and a little less personal.

The other triggers of the amygdala, such as uncertainty and fear of failure, require a different approach. While it is impossible to eliminate uncertainty in any competitive environment, it is still possible to keep the amygdala in check through fairly simple psychological approaches. The amygdala has an input and an output stage. The lateral amygdala serves as the input stage and makes the associations between environmental cues and unpleasant events. But it is the central part of the amygdala that is primarily responsible for activating the stress response. Although a conditioned fear may not ever go away, the output, or expression of this fear, can be inhibited. One of the most effective strategies for regulating the expression of fear is through a technique called

cognitive reappraisal

. This simply means reinterpreting emotional information in such a way that the emotional component is diminished. For example, if you saw a woman crying outside a church, your initial reaction might be to interpret the crying as evidence that someone had died. However, as we have seen before, perception is ambiguous. It would be equally possible to reappraise the scene as someone crying for joy, as at a wedding.