The Road to Freedom (18 page)

Read The Road to Freedom Online

Authors: Arthur C. Brooks

This is not just conjecture, but demonstrable truth. In dozens of studies, economists have shown that government funding “crowds out” voluntary contributions of both money and time to charities.

30

This stands to reason. If the government is supporting something, people don't “need” to. Furthermore, people will be less likely to ask for help: One major research finding is that nonprofits quickly conform to government support and spend less time and effort fund-raising.

31

This pattern is not innocuous when it comes to a flourishing nation. Government insinuates itself into more and more corners of people's lives, alienating them from each other and their communities. It obviates what philosopher Edmund Burke called the “little platoons” of ordinary life, which create meaning in a way the government never can or will. That is the conclusion of a great deal of research.

32

It is also the essence of an entire philosophical and religious principle called

subsidiarity

, which teaches that in order to help people thrive, matters ought to be handled by the smallest, lowest, or least centralized authority.

33

If the family can solve the problem, don't call on the city. If the city can solve it, don't call on the state. And so on.

In other words, if people are to flourish, they need incentives and the ability to help each other voluntarily. In many cases, this amounts to keeping the government out, even if things aren't perfect.

I AM CLEARLY MAKING A CASE

for government that is far more circumscribed than the government in America today. A state that restricts itself to minimum basic standards for the poor, and sorting

out market failures cost effectively, is in stark contrast to today's exploding public sector. The sculpture is much smaller than the block that currently contains it.

In this chapter, I have tried to explain

what

I believe the government should and shouldn't do. And we already know the

why

: to allow free enterprise's moral promises to help the greatest number of people flourish. Still, we need to get down to specifics and identify the actual policies Americans care most about and the ways in which we can make them into an expression of our values. That is our task for the next chapter.

W

INNING THE

M

ORAL

D

EBATE ON THE

P

OLICY

I

SSUES

T

HAT

M

ATTER

M

OST TO

A

MERICANS

O

ne recent afternoon, a congressman friend of mine called with an unusual request. He knew I was writing a book about how to win the fight for free enterprise. He knew all my arguments about earned success, meritocratic fairness, and lifting up the poor. However, he wanted advice on something more specific: how to make the best possible moral argument for a particular tax policy that was about to come before Congress.

As the president of a think tank, I'm used to giving answers to specific policy questions. What is the right income exclusion so that a flat tax is not regressive? What is the economic multiplier on military spending? What leads to better growth in an economyâcutting government spending or raising taxes? But I have rarely had a policymaker ask me how to construct the moral argument for a specific policy. That's a very different challenge from making the moral argument for free enterprise as a whole. A huge philosophical exegesis about the morality of freedom won't have the

right effect. It would be like reciting

Paradise Lost

at a limerick competition.

To argue specific policies, free enterprise advocates need to be fluent in the moral case and make it in just a few sentences. We need to follow it with the relevant facts and data, and offer practical principles for good governance. And we need to have the specific policy proposals that are consistent with the moral case. In this chapter, I will demonstrate this process and make the argument in the case of five domestic economic policy issues Americans are most concerned about today.

What are these issues? If you listen to the pundits, you might think that most Americans are fixated on “wedge” issues like illegal immigration and gay marriage. There are shrill proponents on both sides of these issues that make for great TV. But in reality, when Americans shut off the TV and sit around the kitchen table to talk, they aren't mostly concerned with these issues. Over many years, polls have repeatedly revealed that when it comes to domestic policy, Americans are primarily concerned with a core set of topics, almost all of which revolve around economics.

A June 2011 CNN poll listed a large number of policy issues and asked people to evaluate how important each would be to their vote for president.

1

The most important issues were, in order: the economy, unemployment, health care, the deficit, gas prices, terrorism, taxes, and the Medicare entitlement. Five of the top eight issues focus directly on economics, and two of the other three are closely related. To be relevant to American voters, these are the issues advocates of free enterprise must be ready to address, morally and practically.

In the following sections, I will focus on most of these important issues with structured arguments on the subjects of economic growth, jobs and unemployment, deficits and debt, entitlements,

and taxes. Obviously, in just a few pages, I won't pretend to give readers a truly comprehensive policy treatment. Whole books have been written on each topic. Nonetheless, each section serves as an example of how to build a policy argument in a way that will arm those sympathetic to the free enterprise viewpoint and persuade (or at least gently confront) those who are not.

Each argument follows a specific outline: First, I start with the brief moral case for policy reform. This is not a long treatise on the morality of every issue, but rather the “elevator speech” for the

why

of each policy, highlighting the basic moral points I believe are essential to address before moving on to the

what

.

Second, I present salient evidence that makes the case that policy change or reform is necessary. This evidence is generally quite counterintuitive, not because I am searching for surprises per se, but because if the facts were intuitive, reform would already have taken place.

Third, I offer what I believe are the basic principles for better policy. I have found these to be the guideposts to improvement in each policy area. As circumstances change, these principles will not.

Finally, I lay out the actual policies I think are currently most necessary and constructive. The policies I propose are some of those my AEI colleagues and I have worked on most intensively, have offered to presidential candidates and in congressional testimony, and which we believe should be part of any broader set of policy solutions.

2

First off, we have to make the moral case for economic growth. But economic growth isn't “moral,” right? Wrong. In the words of Harvard economist Benjamin Friedman, “Economic growth . . .

fosters greater opportunity, tolerance of diversity, social mobility, commitment to fairness, and dedication to democracy.”

3

All of these things have deep moral implications.

Weak economic growth means the end of the opportunity society in America. Your grandparents believed your parents could do better than they did; your parents wanted the same for you. That's how the American Dream works, and it is not fair to steal that legacy from our children by consuming tomorrow's growth today in the form of exploding government and lavish entitlements we can't afford.

Furthermore, weak growth disproportionately hurts those who most need new economic opportunities: the poor. The world experienced effectively no economic growth for millennia, and then saw explosive growth due to capitalism. This has literally saved billions of people from brutish poverty. But there is more to do, here in America and around the world. To fulfill the moral promises of the pursuit of happiness, basic fairness, and help for the less fortunate, America's economy must continue to grow.

Here are some essential facts to help people understand why better policies are needed to stimulate growth:

â¢

America's growth is spiraling downward, just like growth in the European countries. From 1950 to 2000, the U.S. averaged 3.6 percent real annual GDP growth. For the last ten years, GDP has grown at an annual rate of 1.7 percent. Since the recession began in 2007, U.S. growth has fallen to 0.1 percent.

4

â¢

Many economists believe our natural growth rate is now too low to pull the U.S. out of its economic malaise and solve its fiscal crisis. Even to lower the budget deficit to 5 percent of GDP, America would need to achieve a year-on-year growth rate of at least 4 percent.

5

â¢

Growth today means a better life for the future. Every 1 percent of additional growth today will double real incomes seventy-two years from now.

6

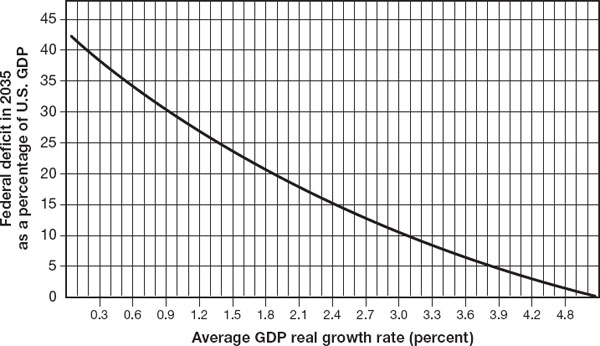

Figure 7.1

. What would it take to grow our way out of our problems? Growth rates needed today to lower the 2035 projected budget deficit. (Source: Author's calculations. Congressional Budget Office 2011 Long-Term Budget Outlook Alternative Fiscal Scenario,

http://www.cbo.gov/doc.cfm?index=12212

.)

There are two contradictory and irreconcilable strategies for achieving higher economic growth in the U.S., and Americans must choose which one they want to pursue.

According to the first, the key to restarting economic growth is the state. The policy prescription is therefore higher levels of governmentâmore stimulus, more taxes, and more borrowing.

According to the second strategy, the source of economic growth is free enterprise. The policy prescription is to get government out of the way of entrepreneurs. That means tax reform, less government spending, and policies that make it easier for entrepreneurs to succeed.

If we choose the second strategy, there is just one basic principle to remember in making policy: Break down barriers to entrepreneurship. The president should wake up each morning andâbefore his feet hit the floorâask, “What will I do today to get the government out of the way of entrepreneurs?”

WITH A MORAL IMPERATIVE

firmly in mind, and armed with both the key facts and fundamental principle for economic growth, what specific policy measures should we advocate?

Fixing the tax code is a top priorityâAmerica's tax system is a huge barrier to entrepreneurship. At a minimum, the U.S. should drop the top federal corporate income tax rate to no more than 25 percent, from the current 35 percent, which is internationally uncompetitive. As for individuals, the U.S. should replace the current income tax with a consumption tax to stop discouraging investment. These reforms would spur growth significantly, according to the best nonpartisan estimates available.

7

More specifics on each of these policies will come a bit later in the chapter.

In addition to fixing the tax code, the U.S. should also lower regulatory barriers to business. Examples of onerous regulation have been easy to find for years. But most recently and prominently, the Obama Administration's regulatory response to the financial crisisâthe Dodd-Frank Actâcreated huge new sets of damaging rules for companies large and small. Yet no evidence suggests it will do anything to prevent another economic calamity.

8

But shouldn't we do something to prevent another housing and financial crisis? Yes, and that means facing up to what really went wrong in the American economy. The housing crisis occurred because people borrowed too much to buy houses, with down payments that were too low. Without a sufficient down payment,

people had an incentive to walk away from their mortgages when their home values fell below what they owedâand millions walked away as a simple business decision during the 2008â2009 recession.

To mitigate the risk of another collapse of this sort, America doesn't need 848 pages of legislation. It needs a government that stops encouraging people with subsidized mortgages and tax deductions to buy houses they cannot afford. And on the private sector side, lenders could simply require a 20 percent down payment on any residential housing loan. A 20 percent down payment requirement would ensure that every homeowner had enough invested to forbear most housing price downturns without walking away. It would do more to prevent the next collapse than the myriad regulations of the Dodd-Frank Act, and would do so without hindering growth.