Thinking, Fast and Slow (52 page)

Read Thinking, Fast and Slow Online

Authors: Daniel Kahneman

The following pair of problems elicits preferences that violate the dominance requirement of rational choice.

Problem 3 (

N

= 86): Choose between:

E. 25% chance to win $240 and 75% chance to lose $760 (0%)

F. 25% chance to win $250 and 75% chance to lose $750 (100%)

It is easy to see that F dominates E. Indeed, all respondents chose accordingly.

Problem 4 (

N

= 150): Imagine that you face the following pair of concurrent decisions.

First examine both decisions, then indicate the options you prefer.

Decision (i) Choose between:

A. a sure gain of $240 (84%)

B. 25% chance to gain $1,000 and 75% chance to gain nothing (16%)

Decision (ii) Choose between:

C. a sure loss of $750 (13%)

D. 75% chance to lose $1,000 and 25% chance to lose nothing (87%)

As expected from the previous analysis, a large majority of subjects made a risk averse choice for the sure gain over the positive gamble in the first decision, and an even larger majority of subjects made a risk seeking choice for the gamble over the sure loss in the second decision. In fact, 73% of the respondents chose A and D and only 3% chose B and C. The same cd Cce f pattern of results was observed in a modified version of the problem, with reduced stakes, in which undergraduates selected gambles that they would actually play.

Because the subjects considered the two decisions in Problem 4 simultaneously, they expressed in effect a preference for A and D over B and C. The preferred conjunction, however, is actually dominated by the rejected one. Adding the sure gain of $240 (option A) to option D yields a 25% chance to win $240 and a 75% chance to lose $760. This is precisely option E in Problem 3. Similarly, adding the sure loss of $750 (option C) to option B yields a 25% chance to win $250 and a 75% chance to lose $750. This is precisely option F in Problem 3. Thus, the susceptibility to framing and the S-shaped value function produce a violation of dominance in a set of concurrent decisions.

The moral of these results is disturbing: Invariance is normatively essential, intuitively compelling, and psychologically unfeasible. Indeed, we conceive only two ways of guaranteeing invariance. The first is to adopt a procedure that will transform equivalent versions of any problem into the same canonical representation. This is the rationale for the standard admonition to students of business, that they should consider each decision problem in terms of total assets rather than in terms of gains or losses (Schlaifer 1959). Such a representation would avoid the violations of invariance illustrated in the previous problems, but the advice is easier to give than to follow. Except in the context of possible ruin, it is more natural to consider financial outcomes as gains and losses rather than as states of wealth. Furthermore, a canonical representation of risky prospects requires a compounding of all outcomes of concurrent decisions (e.g., Problem 4) that exceeds the capabilities of intuitive computation even in simple problems. Achieving a canonical representation is even more difficult in other contexts such as safety, health, or quality of life. Should we advise people to evaluate the consequence of a public health policy (e.g., Problems 1 and 2) in terms of overall mortality, mortality due to diseases, or the number of deaths associated with the particular disease under study?

Another approach that could guarantee invariance is the evaluation of options in terms of their actuarial rather than their psychological consequences. The actuarial criterion has some appeal in the context of human lives, but it is clearly inadequate for financial choices, as has been generally recognized at least since Bernoulli, and it is entirely inapplicable to outcomes that lack an objective metric. We conclude that frame invariance cannot be expected to hold and that a sense of confidence in a particular choice does not ensure that the same choice would be made in another frame. It is therefore good practice to test the robustness of preferences by deliberate attempts to frame a decision problem in more than one way (Fischhoff, Slovic, and Lichtenstein 1980).

The Psychophysics of Chances

Our discussion so far has assumed a Bernoullian expectation rule according to which the value, or utility, of an uncertain prospect is obtained by adding the utilities of the possible outcomes, each weighted by its probability. To examine this assumption, let us again consult psychophysical intuitions. Setting the value of the status quo at zero, imagine a cash gift, say of $300, and assign it a value of one. Now imagine that you are only given a ticket to a lottery that has a single prize of $300. How does the value of the ticket vary as a function of the probability of winning the prize? Barring utility for gambling, the value of such a prospect must vary between zero (when the chance of winning is nil cinntric. We) and one (when winning $300 is a certainty).

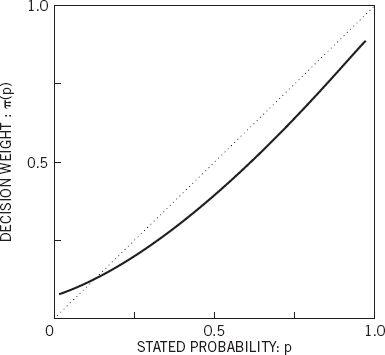

Intuition suggests that the value of the ticket is not a linear function of the probability of winning, as entailed by the expectation rule. In particular, an increase from 0% to 5% appears to have a larger effect than an increase from 30% to 35%, which also appears smaller than an increase from 95% to 100%. These considerations suggest a category-boundary effect: A change from impossibility to possibility or from possibility to certainty has a bigger impact than a comparable change in the middle of the scale. This hypothesis is incorporated into the curve displayed in Figure 2, which plots the weight attached to an event as a function of its stated numerical probability. The most salient feature of Figure 2 is that decision weights are regressive with respect to stated probabilities. Except near the endpoints, an increase of .05 in the probability of winning increases the value of the prospect by less than 5% of the value of the prize. We next investigate the implications of these psychophysical hypotheses for preferences among risky options.

Figure 2. A Hypothetical Weighting Function

In Figure 2, decision weights are lower than the corresponding probabilities over most of the range. Underweighting of moderate and high probabilities relative to sure things contributes to risk aversion in gains by reducing the attractiveness of positive gambles. The same effect also contributes to risk seeking in losses by attenuating the aversiveness of negative gambles. Low probabilities, however, are overweighted, and very low probabilities are either overweighted quite grossly or neglected altogether, making the decision weights highly unstable in that region. The overweighting of low probabilities reverses the pattern described above: It enhances the value of long shots and amplifies the aversiveness of a small chance of a severe loss. Consequently, people are often risk seeking in dealing with improbable gains and risk averse in dealing with unlikely losses. Thus, the characteristics of decision weights contribute to the attractiveness of both lottery tickets and insurance policies.

The nonlinearity of decision weights inevitably leads to violations of invariance, as illustrated in the following pair of problems:

Problem 5 (

N

= 85): Consider the following two-stage game. In the first stage, there is a 75% chance to end the game without winning anything and a 25% chance to move into the second stage. If you reach the second stage you have a choice between:

A. a sure win of $30 (74%)

B. 80% chance to win $45 (26%)

Your choice must be made before the game starts, i.e., before the outcome of the first stage is known. Please indicate the option you prefer.

Problem 6 (

N

= 81): Which of the following options do you prefer?

C. 25% chance to win $30 (42%)

D. 20% chance to win $45 (58%)

Because there is one chan ce i toce in four to move into the second stage in Problem 5, prospect A offers a .25 probability of winning $30, and prospect B offers .25 × .80 = .20 probability of winning $45. Problems 5 and 6 are therefore identical in terms of probabilities and outcomes. However, the preferences are not the same in the two versions: A clear majority favors the higher chance to win the smaller amount in Problem 5, whereas the majority goes the other way in Problem 6. This violation of invariance has been confirmed with both real and hypothetical monetary payoffs (the present results are with real money), with human lives as outcomes, and with a nonsequential representation of the chance process.

We attribute the failure of invariance to the interaction of two factors: the framing of probabilities and the nonlinearity of decision weights. More specifically, we propose that in Problem 5 people ignore the first phase, which yields the same outcome regardless of the decision that is made, and focus their attention on what happens if they do reach the second stage of the game. In that case, of course, they face a sure gain if they choose option A and an 80% chance of winning if they prefer to gamble. Indeed, people’s choices in the sequential version are practically identical to the choices they make between a sure gain of $30 and an 85% chance to win $45. Because a sure thing is overweighted in comparison with events of moderate or

high probability

, the option that may lead to a gain of $30 is more attractive in the sequential version. We call this phenomenon the pseudo-certainty effect because an event that is actually uncertain is weighted as if it were certain.

A closely related phenomenon can be demonstrated at the low end of the probability range. Suppose you are undecided whether or not to purchase earthquake insurance because the premium is quite high. As you hesitate, your friendly insurance agent comes forth with an alternative offer: “For half the regular premium you can be fully covered if the quake occurs on an odd day of the month. This is a good deal because for half the price you are covered for more than half the days.” Why do most people find such probabilistic insurance distinctly unattractive? Figure 2 suggests an answer. Starting anywhere in the region of low probabilities, the impact on the decision weight of a reduction of probability from

p

to

p

/2 is considerably smaller than the effect of a reduction from

p

/2 to 0. Reducing the risk by half, then, is not worth half the premium.

The aversion to probabilistic insurance is significant for three reasons. First, it undermines the classical explanation of insurance in terms of a concave utility function. According to expected utility theory, probabilistic insurance should be definitely preferred to normal insurance when the latter is just acceptable (see Kahneman and Tversky 1979). Second, probabilistic insurance represents many forms of protective action, such as having a medical checkup, buying new tires, or installing a burglar alarm system. Such actions typically reduce the probability of some hazard without eliminating it altogether. Third, the acceptability of insurance can be manipulated by the framing of the contingencies. An insurance policy that covers fire but not flood, for example, could be evaluated either as full protection against a specific risk (e.g., fire), or as a reduction in the overall probability of property loss. Figure 2 suggests that people greatly undervalue a reduction in the probability of a hazard in comparison to the complete elimination of that hazard. Hence, insurance should appear more attractive when it is framed as the elimination of risk than when it is described as a reduction of risk. Indeed, Slovic, Fischhoff, and Lichtenstein (1982) showed that a hypotheti ct arnative cal vaccine that reduces the probability of contracting a disease from 20% to 10% is less attractive if it is described as effective in half of the cases than if it is presented as fully effective against one of two exclusive and equally probable virus strains that produce identical symptoms.

Formulation Effects

So far we have discussed framing as a tool to demonstrate failures of invariance. We now turn attention to the processes that control the framing of outcomes and events. The public health problem illustrates a formulation effect in which a change of wording from “lives saved” to “lives lost” induced a marked shift of preference from risk aversion to risk seeking. Evidently, the subjects adopted the descriptions of the outcomes as given in the question and evaluated the outcomes accordingly as gains or losses. Another formulation effect was reported by McNeil, Pauker, Sox, and Tversky (1982). They found that preferences of physicians and patients between hypothetical therapies for lung cancer varied markedly when their probable outcomes were described in terms of mortality or survival. Surgery, unlike radiation therapy, entails a risk of death during treatment. As a consequence, the surgery option was relatively less attractive when the statistics of treatment outcomes were described in terms of mortality rather than in terms of survival.