Throw Them All Out (7 page)

Read Throw Them All Out Online

Authors: Peter Schweizer

When the House Financial Services Committee was crafting legislation for the

TARP

bailout of banks in the fall of 2008, eight members of the committee were actively and aggressively trading bank stocks. So too were members of the Senate Finance Committee. As the Treasury Department was conferring over which banks would get the bailout money, Senator John Kerry started buying Citigroup stock. The markets might have been down and in turmoil, but Kerry was buying the troubled company. Lots of it. He purchased up to $550,000 in Citigroup stock in early and mid-October. He also bought up to $350,000 in Bank of America shares.

Days later,

on October 28, it was announced that Citigroup was getting $25 billion from the

TARP

Capital Purchase Program and another $25 billion from the Targeted Investment Program. On November 4, it was announced that Citi would be provided additional loan guarantees that could total $277 billion, from the Treasury, the Federal Reserve, and the Federal Deposit Insurance Corporation.

19

Members of Congress are privy to all sorts of inside information about pending government actions. Some of it comes from their actual actionsâthat is, passing legislation. Some of it comes as a result of their position of power. Legislators are told things by regulators or bureaucrats in private because they ask about them. While a committee's public hearings are generally about stagecraft, very frank and detailed conversations often take place behind closed doors. The most valuable information is revealed in private meetings, phone calls, and correspondence. If members of Congress buy and trade stock based on that information, or if they pass that information along to a campaign contributor or their own financial advisers, they are not considered guilty of any wrongdoing. Yes, this is an outrageous standard. But remember, they write their own rules.

Consider for a moment the fact that the political class regularly trades stock in government-backed entities like Fannie Mae and Freddie Mac while

at the same

time

determining the fate of those very entities.

Fannie and Freddie were chartered by Congress, and both have implied government guarantees. For many years, these entities were exempt from the nation's financial disclosure regulationsâand politicians traded shares in these companies. Indeed, Fannie and Freddie were even exempt from insider trading rules. And in this murky world, Senate and House members invested with one hand while they exercised oversight with the other.

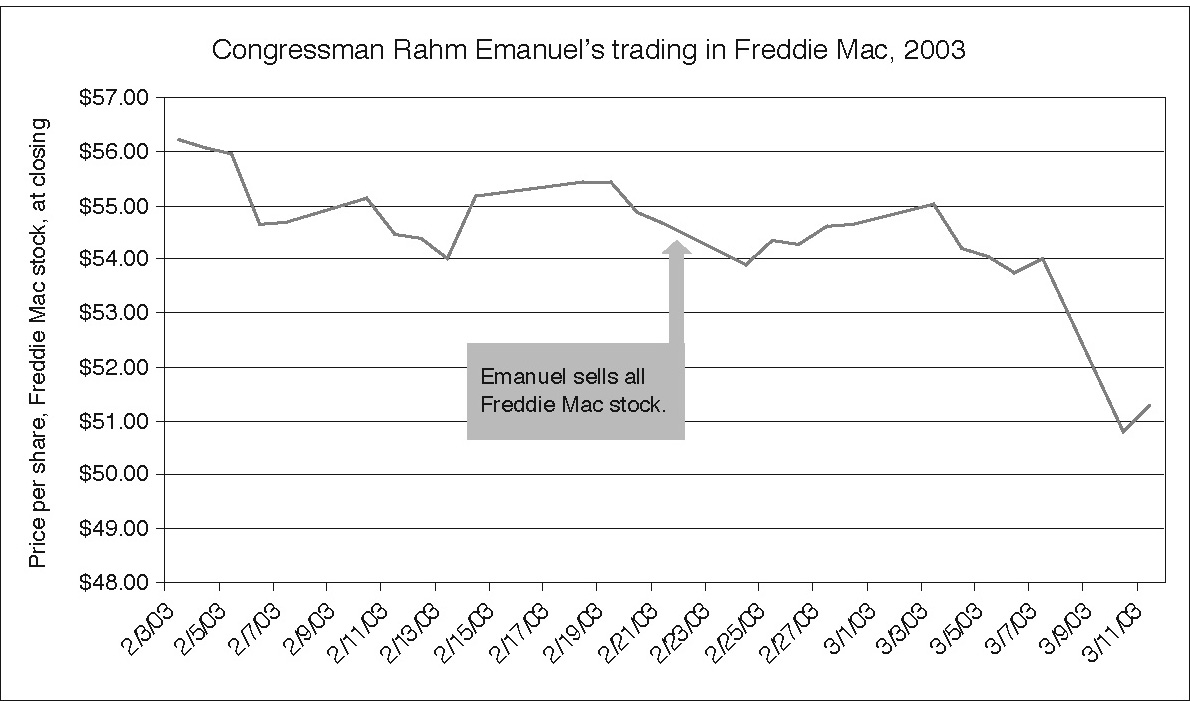

In February 2003, Rahm Emanuel was a newly elected member of Congress from Chicago. He had a seat on the House Financial Services Committee's Subcommittee on Capital Markets, Insurance, and Government-Sponsored Enterprises, which had direct supervision over Fannie and Freddie. Emanuel had previously served on the Freddie Mac boardâhe'd been appointed by President Clinton in 2000âso he was very familiar with its inner workings. On February 21, Emanuel suddenly sold off all of his Freddie Mac stock, up to $250,000 worth.

20

He did so

just days

before a nearly 10% drop in the share price. It was not until the late spring that the public learned in full what was going on at Freddie Mac: there was a criminal investigation of its senior executives, and its earnings had been inflated and would need to be restated to the tune of billions of dollars. (The Freddie Mac accounting scandal was actually larger than that of Enron.)

Were a board member or employee with intimate knowledge of a corporation to dump all of his shares right before an announcement of bad news and a plunge in the stock price, it would at least warrant a look by the SEC. But when a member of Congress does the same thing, he gets a free pass.

The profitability and stock price of Fannie and Freddie have been closely tied to the politics of Washington. On Election Day 2004, when exit polls initiallyâand wrongly, as it turned outâsuggested that John Kerry would win the presidency, Fannie Mae stock markedly rose. When it became clear on November 3 that President Bush had been reelected, Fannie stock opened down and fell sharply for the day, while financial stocks gained overall.

21

The reason is simple: George W. Bush was seen as a likely proponent of reforming the government-backed financial giant, whereas Senator Kerry was an opponent of such reforms.

WE KNOW WHAT'S HAPPENING BEFORE YOU DO

Â

Â

There is nothing wrong or unusual about that stock movement, nor anything surprising about the positions taken by Bush and Kerry on the issue. But were those positions influenced by self-interest? For years, Kerry had been an advocate for expanding Fannie Mae's mission, not reforming it.

22

He was generally opposed to removing any government guarantees, tightening lending standards, or greater regulatory oversight by Congress. As Kerry was resisting legislative efforts to impose additional regulatory restrictions on the financial giant, he and his wife were quietly selling off their extensive Fannie Mae holdings throughout early 2005.

23

Indeed, over a six-month period they dumped around $1 million in Fannie Mae stock. (Again, only ranges were disclosed, not actual figures.) Furthermore, the Kerrys were trading their shares at the same time that the company was telling all of its employees that they could not trade the stock until the new earning results were made public.

24

The Kerrys, who had traded Fannie Mae shares for years, dumped the stock before it suffered serious declines. They actually managed to post capital gains on the stock of up to $250,000 on those transactions.

25

How many other Fannie Mae investors could claim that, in what was a bad time for the stock?

Â

Members of Congress sometimes pay lip service to avoiding potential conflicts of interest. Indeedâand ironicallyâin 2009, when the federal government was passing out hundreds of billions of dollars in

TARP

funds to private financial institutions, Speaker of the House Nancy Pelosi argued that "when there's been a thought of conflict of interest" between a member's financial holdings and government bailouts, then that member "should divest."

26

But there is simply no evidence that Pelosi, or any other member, did so. And there is no evidence of any member of Congress recusing himself when it came to voting on matters that would directly benefit him.

They bet on their own games. They bet on failure. Is there any solid evidence that their political decisions were tied to these bets?

For that, you have to look at some very narrow, tailored bets. Sometimes legislators receive big financial favors from specific companiesâand then they work to help those firms.

I

F YOU COME

into Congress already rich, serving there will give you an opportunity to become even richer.

In early 2008, Speaker of the House Nancy Pelosi and her husband, Paul, placed a very big bet. On March 18, the Pelosis made the first of three purchases of Visa stock, totaling between $1 million and $5 million.

1

But this was no ordinary stock transaction. Somehow the Pelosis managed to get their hands on shares of what would become one of the most popular and lucrative initial public offerings of stock in American history. An IPO, as the name implies, is the first stock offering made by a company prior to its going public. Visa had been privately held by a group of banks up until that year.

Mere mortals would have to wait until March 19, when the stock would be publicly traded, to get their shares. According to the Pelosis' financial disclosures, two of their purchases were made after the nineteenth, but one was made before. They listed all three purchases together on their disclosure statement, making it impossible to know how many shares they purchased in the initial offering.

In any event, getting access to this IPO was virtually impossible for the average individual investor. MarketWatch and other news organizations reported that the IPO was "oversubscribed." In the words of IPO analyst Scott Sweet, it was drawing "extreme demand." Virtually all of the Visa IPO shares were going to institutional investors, or large mutual funds or pension funds. Renaissance Capital declared the offering to be the "IPO of the year."

2

Who got these coveted shares? Only "special customers," hand-picked investors, received the IPO shares at the opening price of $44. Two days later, after public trading began, the stock price jumped to $65 a share. In short, the Pelosis made a 50% profit on their investment in a matter of two days. They liked the stock so much, they made another purchase, on March 25. On June 4, 2008, they made a third purchaseâand Visa stock closed at $85 a share.

What makes this all the more remarkable is that this single investment represented at least 10% of the Pelosis' stock portfolio and potentially as much as half of their equity holdings (depending on where in the range of $1 million to $5 million it actually fell). They were staking a good part of their fortune on one company. How unusual was this for the Pelosis? Although rich in real estate, according to their financial disclosure form, they had only once before committed more than $1 million of their assets to a large, publicly traded corporation: Apple Computer.

It was an enormous risk. Or was it?

The Speaker of the House and her husband just happened to get those IPO shares barely two weeks after a threatening piece of legislation for Visa was introduced in the House of Representatives. John Conyers, chairman of the House Judiciary Committee and an old liberal warhorse, was joined by conservative Republicans Chris Cannon of Utah and Steve King of Iowa, among others, in introducing the Credit Card Fair Fee Act of 2008. The bill had forty-five sponsors in all. It would effectively allow retailers to negotiate lower fees with Visa and the other credit card companies. Retailers argued that these companiesâAmerican Express, Visa, MasterCard, and Discoverâoften set fees together, like a cartel.

By way of background, it's important to understand that Visa does not issue credit cards or make loans; banks do. Visa makes its money by licensing the Visa name and through something called an interchange fee. Every time you use a card at a store, the merchant pays Visa an interchange fee, somewhere between 1% and 3%. Merchants argued that Visa, MasterCard, American Express, and Discover should not be able to keep their fees so high. The Credit Card Fair Fee Act would have amended antitrust laws to require the card companies to enter negotiations with merchants over their interchange fees, and if they could not agree on fees, the Justice Department and the Federal Trade Commission would be empowered to arbitrate. These fees are a huge source of revenue for Visa and the other credit card companies, and a constant thorn in the side of merchants. In 2008, the four companies took in $48 billion in revenue, or about $427 per household, from interchange fees.

3

Needless to say, Visa and the others were adamantly opposed to the legislation. It was a very "bad bill," in the words of Visa's general counsel.

4

One would think that this piece of legislation would appeal to Pelosi. She had been outspoken about antitrust problems posed by insurance, oil, and pharmaceutical companies. And she was vocal about the need for controlling the interest rates individual banks charged to use their credit cards. This particular bill had grown out of a House Judiciary Committee Antitrust Task Force Subcommittee study.

5

Big lobbying groups like the National Retail Federation and the National Grocers Association were strongly in favor of it. Indeed, the Maplight Foundation looked at the campaign contributors pushing for this bill on both sides of the aisle and found that Pelosi received twice as many contributions from supporters than from opponents. On top of that, the bill was popular with the public, too. One survey revealed that a whopping 77% of voters were in favor of its passage.

6

In fact, the bill did pass in the Judiciary Committee on a 19â16 vote, with yeas from 10 Democrats and 9 Republicans. Supporters of the bill were excited. "There is certainly time for the bill to reach a vote before the full House before the end of the year," said one. It was only mid-July.

7

The National Association of Convenience Stores lobbied for a vote. "It is imperative to tell your Representative to request a vote on the House Floor from Nancy Pelosi," the association wrote to its members. Supporters of the bill waited. And waited. And waited. Speaker Pelosi made sure it never got a hearing on the House floor.

Around the same time, Congressman Peter Welch of Vermont introduced a second bill on interchange fees. Called the Credit Card Interchange Fee Act of 2008, it did not go as far as the Credit Card Fair Fee Act. Welch's bill was merely a call for transparency: it would require the credit card firms to let consumers know how much they were paying in interchange fees. Again, Visa was adamantly opposed. This second bill suffered the same fate as the first, never making it to the House floor.