The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment (22 page)

Read The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment Online

Authors: Chris Martenson

Tags: #General, #Economic Conditions, #Business & Economics, #Economics, #Development, #Forecasting, #Sustainable Development, #Economic Development, #Economic Forecasting - United States, #United States, #Sustainable Development - United States, #Economic Forecasting, #United States - Economic Conditions - 2009

And what about the massive amounts of oil allegedly contained within the tar sands and oil shales? These are often wrongly described as equivalent to “several Saudi Arabias.”

8

The net energy values for these are especially poor and are in no way comparable to the 100:1 (or higher) returns actually found in Saudi Arabia. Tar sands have a net energy return of around 5:1,

9

and tar shales are thought to be even worse, in the vicinity of 2:1 or less.

10

So while there may be the same

volume

of oil locked in those formations as there is in Saudi Arabia’s magnificent treasures, there isn’t the same amount of useful, desirable, delicious net energy in them. Nowhere near as much.

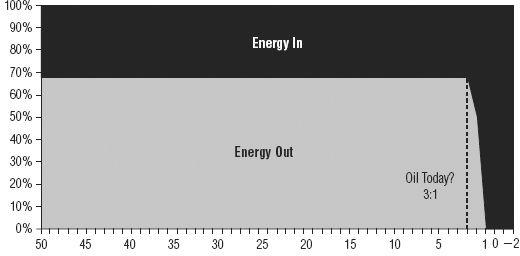

If we were to try and subsist entirely on the energy offered by a new source that was sporting a 3:1 net energy return, this is the world in which we’d live:

Look at how much less gray area and how much less surplus energy there is in this chart after we’ve begun to slide down the energy cliff, compared to the ones where there were 10:1 or 20:1 returns. The gray area represents how we “fund” our growth and our prosperity. The gray area is the net energy that feeds and supports our economic complexity. If we can appreciate how two societies, one abundantly supplied with food and the other nearly starving, can differ on the basis of their available net food energy, then we can also appreciate how a high-net-energy economy will be fundamentally more robust, complex, and interesting than a lower-net-energy economy.

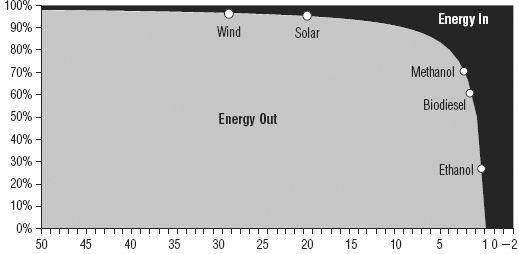

And what about renewable energy sources (

Figure 15.5

)? Methanol, which can be made from biomass, sports a net energy of about 2.6:1,

11

while biodiesel offers a net energy return of somewhere between 1:1 and 4:1, depending on whether we count just the biodiesel itself or include the energy left in the crushed meal, which can be burned.

12

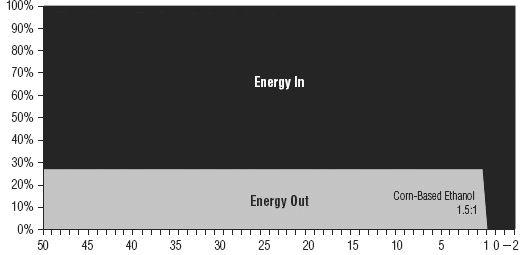

Corn-based ethanol, if we’re generous, might produce a net energy return of just slightly over 1:1,

13

but could also be negative, according to some sources.

14

Ethanol produced from sugar cane in Brazil has an EROEI of closer to 8:1

15

(largely because the sugarcane itself can be burned to fire the process), making it a viable proposition there, and some exciting work is being done on cellulosic and other forms of ethanol that might have much higher EROEIs than any other biofuels, but those are not yet out of the demonstration phase. We should work with all due haste on these prospects, but not count on them to arrive at the appropriate time and at the appropriate scale to save the day.

1

Figure 15.5

The Energy Cliff (4): Net Energy from Renewables

Not all energy forms are fully comparable on the basis of net energy returned. Solar and wind do not produce liquid fuels.

If we add in all the other new usable liquid fuel sources that we’ve just talked about, we see that they’re all somewhere “on the face of the energy cliff.” Solar and wind

16

are both capable of producing pretty high net returns, but it’s important to note that these produce electricity, not liquid fuels, which means that they are not at all comparable. Peak Oil represents “peak liquid fuels,” and that’s the primary issue here for petroleum. Once we get to Peak Coal (and we someday will), or begin to operate our transportation infrastructure on electricity, then electricity from the sun is more directly applicable to meeting our needs and solving our challenges. If we were to try and make a go of it on corn-based ethanol alone, this is the world in which we’d (be trying to) live:

There’s no gray zone to speak of left in that chart, and practically no surplus at all to fund even the basics of life, let alone a rich, complex economy full of prosperity and opportunities.

Unless we very rapidly find ways of boosting the net energy of the remaining energy options, we’ll simply find that we have far less surplus energy to dedicate to our basic needs and discretionary wants than we came to expect and enjoy from fossil fuels. We’ll be using far too much energy in the essential, mandatory practice of finding and producing more energy, and we’ll find ourselves with far too little left over to use as we wish. Our energy investment costs will skyrocket even as the returns dwindle. That’s just the basic reality of the situation; it’s not possible to fool nature with fraudulent accounting.

Oh, and where’s the so-called “hydrogen economy” in

Figure 15.6

? It’s below the

x

-axis in negative territory, meaning that it’s not a viable candidate around which to fashion a society. It’s negative because it has to be produced from other forms of energy—perhaps electricity (via hydrolysis) or from natural gas. Because there are no hydrogen reservoirs anywhere on earth, every single bit of it has to be created from some other source of energy—and, here’s the kicker,

always at an energy loss

. In other words, hydrogen is an energy

sink

, not a

source

; its tiny bubble would have to be placed below the zero percent mark on the above chart. In creating hydrogen, we

lose

energy. That’s not pessimism; that’s the law—the second law of thermodynamics, to be exact. We’ll talk more about the laws of thermodynamics in Chapter 18 (

Why Technology Can’t Fix This

).

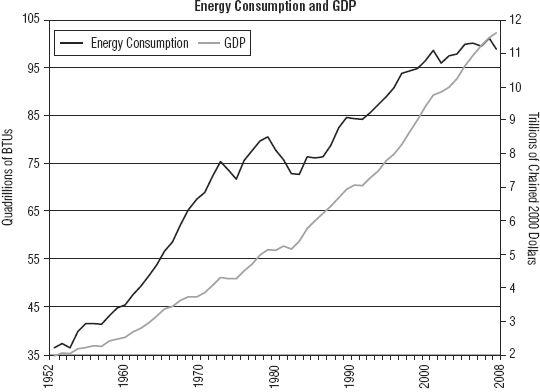

The Economy and Energy

A massive abundance of surplus energy, liberated by the lightning bolt of humanity, has enabled historically unparalleled levels of prosperity to be enjoyed by billions of people. But respect for the role of energy in providing this abundance has largely gone missing from the economics profession, which will prove to be a rather tragic mistake. It’s somewhat odd that it has been thus ignored, because the evidence for the connection between growth in energy utilization and economic growth (and prosperity) is extremely well documented and also intuitively obvious (

Figure 15.7

).

Figure 15.7

Energy Consumption and GDP in the United States

Source:

Energy Information Administration & Bureau of Economic Analysis.

Even less well appreciated is the degree to which economic complexity owes its existence not just to the total amount of energy being utilized, but to the net free energy that flows through society. Out of all the sources of energy, petroleum stands out as the most important of them all, due largely to its presence in nearly every consumer product that is made, transported, and sold. Oil is richly woven into our economic tapestry, and there are no substitutes waiting in the wings. Where we once transitioned from wood to coal, and later from coal to oil, there is currently no established candidate waiting to replace oil.

We Live Like Gods

In order to understand why oil, in particular, is so important to our economy and our daily lives, we have to understand something about what it does for us. We value any source of energy because we can harness it to do work for us. For example, every time you turn on a 100-watt light bulb, it’s the same as if you had a fit human being in the basement pedaling as hard as they can to keep that bulb lit. That’s how much energy a single light bulb uses. While you run water, take hot showers, and vacuum the floor, it’s as if your house is employing the services of 50 such extremely fit bike-riding slaves in the basement, ready to pedal their fastest, 24 hours a day, at the flick of a switch. When you jump in a car, depending on your engine, it’s the same as a king harnessing up a carriage to 300 horses. This “slave count,” if you will, exceeds that of kings in times past. Given the fact that even kings of times past could not whip out a credit card on a whim and find themselves halfway around the world in less than a day, it should be said that we enjoy the power of gods.

And how much “work” is embodied in a gallon of gasoline, our favorite substance of them all? Well, if you put a single gallon in a car, drove it away from your home until the gas ran out, and then got out and pushed the car home, you’d find out exactly how much work a gallon of gasoline can do. It turns out that a gallon of gas has the equivalent energy of somewhere between 350 and 500 hours of human labor.

17

Given that a gallon of gas can perform that much human work, how much value would you assign it? How much would 350 to 500 hours of your hard physical labor be worth to you? $4? $10? Assuming you decided not to push your car home and paid someone $15 an hour to do this for you, you’d find that a gallon of gasoline is “worth” $5,250 to $7,500 in human labor.

Here’s another example: It has been calculated that the amount of food that an average North American citizen consumes in a year requires the equivalent of 400 gallons of petroleum to produce and ship.

18

At $3/gallon, that works out to $1200 of your yearly food bill spent on fuel, which doesn’t sound too extreme. However, when we consider that those 400 gallons represent the energy equivalent of close to 100 humans working year-round at 40 hours a week, then it takes on an entirely different meaning. This puts your diet well out of the reach of most kings of times past. Just to put this in context, as it’s currently configured, food production and distribution uses fully two-thirds of the U.S. domestic oil production. This is one reason why a cessation of oil exports to the United States would be highly disruptive; most of our domestic production would have to go toward feeding ourselves.