The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment (28 page)

Read The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment Online

Authors: Chris Martenson

Tags: #General, #Economic Conditions, #Business & Economics, #Economics, #Development, #Forecasting, #Sustainable Development, #Economic Development, #Economic Forecasting - United States, #United States, #Sustainable Development - United States, #Economic Forecasting, #United States - Economic Conditions - 2009

Look at the line labeled “anthracite” in

Figure 17.3

and see what sort of trend you can discern. What you see is a steadily declining line, which indicates that less and less of the most desirable form of coal is being mined. The reason we aren’t mining more anthracite is because we

can’t

. It doesn’t exist; it’s pretty much all gone. Our entire “bank account” of anthracite, formed over hundreds of millions of years, has been largely exhausted in a span of about 100 years. Hundreds of millions of years to form; roughly a hundred years to consume. The point bears repeating:

When it’s gone, it’s gone

. You can’t burn the same lump of coal twice. As with oil, more and more was extracted, and then, due to geological realities, less and less could be extracted. We hit a peak and are far down the backside of that peak here in 2010.

Quite naturally, after anthracite went into decline, efforts then centered on to mining the next-best stuff—bituminous coal—and in

Figure 17.3

we observe that a peak in the production of bituminous coal was hit in 1990. Was this because coal companies lost interest in the next-best grade of coal? Hardly. It simply means that we started to run out of that grade, too. Naturally, we then moved on to the next-best grade after that, subbituminous coal, which we see making up the difference to allow U.S. domestic production of coal to continue steadily growing. Most recently, lignite has been getting into the game, although we shouldn’t expect to see lignite production really take off before the production of subbituminous coal peaks, which it someday will.

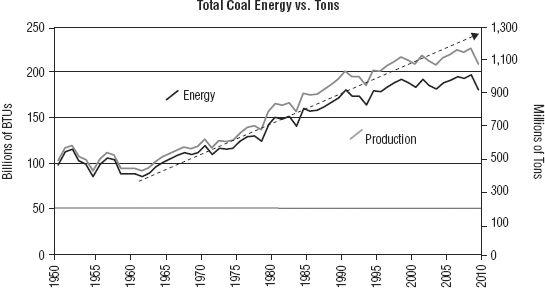

Now here’s the really interesting part. Remember when I said that the heat content, or available free energy, of coal got progressively worse with each grade? If we plot the total energy content of the coal mined, instead of the tonnage, we get a very different picture (see

Figure 17.4

).

Where the tonnage has been moving up at a nice, steady rate of 2 percent per year, we find that the total energy content of mined coal leveled off around 1990 and has gone up by exactly zero percent since then. This implies that the United States is using more energy and spending more money to produce

more tons

of coal, but is essentially getting

less energy

back per ton for its troubles.

This finding mirrors the results of a 2010 study performed by Patzek, et al., which determined that the net free energy from coal mined at all existing mining operations is nearing a permanent peak, possibly as early as 2011.

23

It’s important to note that study did not claim that the tons of coal mined will peak in 2011, but rather that the total net energy from those mined tons will hit a peak. This study wasn’t about the

quantity

of coal that will be mined (or amount), but its

quality

(or net free energy). After the peak, there will be slightly less and less available net free energy from coal. Of course, this shouldn’t surprise anyone, because it’s a perfectly logical finding that comports well with common sense. The highest grades of the most-accessible coal were exploited first, leaving the less-energy-dense, less-useful, and less-accessible reserves for later.

Welcome to “later.” The Energy Information Administration (EIA) projects that the United States will increase its coal consumption by 25 percent by 2030, reflecting the growth in demand for base electricity production. The International Energy Agency (IEA) projected in its 2010 World Energy Outlook that world coal demand for all uses will advance by an astounding 47 percent between 2008 and 2030.

24

Given the fact that coal grades are declining in their energy content, it’s safe to say that mining operations will have to increase enormously just meet the projected growth in demand for coal to be used for the production of electricity. Whether operations can be expanded that much (or that rapidly) is an open question. The bottom line here is that coal isn’t a nearly endless resource with hundreds of years of increasing production left in front of it, but a quite limited resource whose energy peak may not even be a decade away.

On top of this story, some people like to introduce the idea of converting coal to liquids to use in our fuel tanks. The coal-to-liquids (CTL) idea has a certain appeal. If the United States and other areas of the world have a lot of coal, then why not convert some of that coal into liquid fuels that we can put into our vehicles?

Unfortunately, you don’t have to scratch very hard at that idea to discover its flaws. First, there are no CTL plants running in the United States, and there are precious few anywhere in the world, raising the question of whether we could even build them fast enough to make a difference. Second, it’s a horribly inefficient way to use coal, wasting a lot of the energy content in coal at a time when we really shouldn’t be wasting much of anything. Third, there may not be enough coal coming from existing and planned mines to handle our base electricity needs, let alone supply an entire new industrial use.

On this last point, we will note that in 2010 China is building the equivalent of one new 1 gigawatt coal-fired plant every week

25

and consumed a full 50 percent of all the coal used in the world that year.

26

Given that China doubled its energy consumption between 2000 and 2008, and given its current plans to continue building out its coal-fired electricity infrastructure at a very rapid clip, it’s a pretty safe bet that there will be some stiff competition for available coal supplies in the future.

Putting it all together for the United States, if coal becomes a net import product by 2015, the energy quality of existing coal declines, and demand ramps up worldwide by significant margins, the idea that coal will play any sort of a redeeming role for the loss of petroleum production might qualify as wishful thinking.

While some still, even today, mistakenly claim that the United States has 250 years of coal left, once we factor in declining coal grades plus the need for increased consumption to support increased energy growth, it’s entirely possible that U.S. coal won’t last even 50 years. Will coal play an important role in our energy future? Undoubtedly. Will coal be the energy savior that will enable us to make a seamless transition away from oil to something else and last for hundreds of years? No.

- Time:

Decades. There are no operating coal-to-liquids (CTL) plants in the United States, nor are there very many anywhere in the world. It would take several decades to open up new mines to feed additional coal to this industry and to build sufficient CTL plants. - Scale

: Assuming the world wants to get to the equivalent of 105 million barrels of oil a day by 2030, but that oil has instead peaked and slipped slightly to 65 million barrels per day, this implies the need to construct and feed 800 CTL plants, each with an average daily output of 50 thousand barrels. - Cost:

Assuming that each plant costs $5 billion to build and produces 50,000 barrels a day, the world will have to invest $4 trillion just in the construction of the plants.

27

The Alternatives

When people think of alternative energy, they are primarily talking about means of getting electricity from the sun, wind, and waves. While we still don’t have a means of running our transportation network on electricity, perhaps we could someday, and that’s the hope (dream?) of some. The reality is that alternative energy sources are generating such a low percentage of current electricity, even if they grew at astonishing compounding rates it would be a very long time before they made a majority contribution to the global energy outlook. In 2006, Simmons & Company International, an investment banking firm focused on energy, estimated that if solar power capacity grew at the incredibly high rate of 25 percent per year over the next 14 years (from 2006 to 2020), it would provide roughly 1 percent of global electricity demand.

28

The story with wind power is much the same as solar. Yes, these technologies can play a role, but the idea that they could somehow replace oil—even ignoring the fact that they are sources of electricity, not liquid fuels—is simply not rooted in the reality of the scales involved. Further, wind power only works when the wind is blowing, solar electricity only works when the sun is shining, and wave power only works when the waves are a certain height. The problem with electricity is that it needs to be constantly supplied to be useful, especially to noninterruptible processes such as those found in hospitals and manufacturing. If we could ever find a convenient large-scale way to store electricity, it would certainly help, but so far success has eluded us in this matter.

One area that deserves an enormous input of resources is the advance of batteries. The biggest game-changer out there isn’t to be found in developing a new energy source, but in figuring out how to store electrical energy more effectively. If we could store electricity better, a host of issues could be resolved. Right now, it’s sad to say, most batteries in use are little changed in design from the one invented by Allesandro Volta in 1800. If ever there were an area that deserved a massive government investment, electrical storage would be it.

The other point to make here is that 95 percent of all energy used to transport things within and across the global economy is supplied by petroleum-derived liquid fuels. Even if we obtained massive amounts of electricity from alternative sources and figured out how to store it effectively, we’d still have to retrofit our entire transportation fleet to run on electricity. Again, we need to raise the prospect of the time, scale, and cost of such an elaborate undertaking.

Biofuels, such as ethanol and biodiesel, were both initially presented as viable energy sources and ecologically protective products. This introduction turned out to be overly optimistic. The net energy returns from corn-based ethanol is a paltry 1.3, give or take a little, and requires the constant and unsustainable application of fertilizers and other industrial interventions to achieve the desired yields. If the United States were to try to completely replace its oil imports with corn ethanol, it would require nearly 550 million acres of farmland to be put to use,

29

representing 125 percent of all the cropland in the United States (which totals ∼440 million acres). Anything that requires more than 100 percent of your arable land cannot supply your demand for liquid fuel (or anything else).

In Europe, where a lot of biofuels are used, concerns have mounted about the destructive practices associated with such enterprises as Indonesian palm oil plantations, resulting in significant and legitimate controversy on ecological grounds. It turns out that the way the Indonesians produce the palm oil is to grow it on peat bogs, which has the unfortunate result of both destroying sensitive ecologies and liberating more CO

2

than if oil alone had been burned.

30

Where people initially thought biofuels represented a “green” alternative with the lowest impacts (if any), now they are more aware of the quite significant environmental costs of biofuels that sometimes even exceed those of fossil fuels. We may someday discover a free lunch, but so far biofuels are not it, at least not at the scale required to run a global industrial society.

There are promising signs from algal biodiesel,

31

which I am interested in because it offers the prospect of nutrient recycling and supplies liquid fuels. But as pleasing as the early signs are from this promising technology, here in 2010 we might note that virtually zero algal biodiesel is yet on the market, meaning that an enormous build-out and scale-up of this technology will be required for it to have any meaningful impact. Again, there’s a world of difference, and usually several decades, between the birth of an idea and full-scale implementation and adoption.