The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment (30 page)

Read The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment Online

Authors: Chris Martenson

Tags: #General, #Economic Conditions, #Business & Economics, #Economics, #Development, #Forecasting, #Sustainable Development, #Economic Development, #Economic Forecasting - United States, #United States, #Sustainable Development - United States, #Economic Forecasting, #United States - Economic Conditions - 2009

These transitions took decades, typically four or more, to happen. This is one more reason why we might not expect or hope for technology to fix the energy predicament we face: markets, economics, and behaviors operate on their own time scale, independent of technology itself. History suggests that a good time to begin the energy transition away from petroleum would have been a good 30–40 years prior to the peak. An excellent study by Robert Hirsch (then of SAIC) made a compelling case that 20 years prior is the cut-off for undertaking mitigation strategies to avoid damaging consequences.

1

Why Technology Can’t Fix This

Technology can help us exploit what energy we do have more cleanly, cheaply, and more efficiently, but it cannot create energy. And when we transform energy, we lose energy to the universe along the way in the form of diffuse heat. Therefore, it’s appropriate to view the fossil fuel store of the earth as if it were a gigantic pile of food that can only be eaten once. When we eat this bounty of the earth—our inheritance—it’s gone, never to be seen again. And technology holds little sway over economic and sociological impediments to rapid energy transitions.

Because economic order, complexity, and growth all require energy, and because our original allotment of energy cannot be increased by technology, technology alone cannot “fix” the predicament of needing more energy than we have. Technology has an enormous role to play in helping us to use our energy more wisely and with greater efficiency and utility, but these efforts will only slow the eventual day when our giant pile of free food is gone. At that point in time, we revert to eating what we can grow ourselves—an apt metaphor because we’ll be living within the energy budget supplied, once again, by the sun.

Between here and there, it’s up to us to decide what to do with this once-in-a-species energy bonanza.

Shall we increase our prosperity by creating enduring works of architecture and lavishly funding our best and brightest minds to stretch the limits of what’s possible? Or shall we use energy’s one trip down the frictionless slide merely to promote the most rapid economic growth and consumption that we can?

Both are choices that we could make, and in either case, nature doesn’t care; energy will be converted from concentrated forms into diffuse heat, remorselessly and relentlessly, whether we wish that to be the outcome or not. Nature will carry on whether we use up our energy stores wisely or shamefully, quickly or slowly, without any concern for how much or how little useful work we extract along the way.

Technology can provide a lot of things, but it cannot violate the laws of the universe. They are immutable and working just as they always have. And that is why technology can’t fix this—nothing is broken.

PART V

Environment

CHAPTER 19

Minerals

Gone with the Wind

These next few chapters won’t be a recitation of the various environmental stresses and issues that currently plague the world. There are many incredibly detailed sources chronicling the depletion and mismanagement of the earth’s resources, perhaps none better than Lester Brown’s

Plan B

series (currently in version 4.0) from the World Watch Institute, from which these next few chapters will draw heavily.

Instead, we’re going to tell a story around our dependence on and use of those resources, coupled with the energy story, to make the case that seismic shifts are in store for the economy. This isn’t to diminish the importance of environmental issues, or to intentionally or unintentionally subjugate them to money and the economy. Rather, the main point to which I adhere is this:

The most immediate “environment” impact we will feel in our own lives will be transmitted to us via the economy

. It responds more quickly and provides immediate feedback. More important, if the economy suffers and stumbles, or even collapses, then the environment will only suffer more. In that case, we will lack the resources to protect and preserve it, as we will be worrying about survival, which inevitably trumps all other considerations.

Quantity and Quality (Again)

The story of energy basically boils down to two “Qs,” quantity and quality. We noted that for oil, global discoveries peaked in 1964, which means that someday, inevitably, the

quantity

(amount) of oil coming out of the ground will someday peak as well. We noted that the issue isn’t just how much energy is coming out of the ground; it’s also the

quality

of that energy, with quality being an expression for the net free energy returned from those exploration and development activities.

This same story of quantity and quality applies to all other mineral resources, as well as any other primary sources of wealth that come from the earth. Our economy as we know it is an industrial economy that really began when we started harnessing the energy of coal to do work. The industrial economy began about 150 years ago, during which time the world has transformed considerably. Where abundant mineral resources were once lying around for the taking, now every last major deposit has been mapped and lesser and lesser grades of ores are being pursued at higher and higher costs, both energetic and monetary.

One hundred and fifty years, it should be noted, is a relative blink of an eye. Consider that Cleopatra was born and ruled closer in time to the launching of the space shuttle than to the building of the Great Pyramid of Cheops,

1

and somehow 150 years doesn’t seem like all that much time. It’s not, really, and that’s the point.

One of my favorite images from the past shows two dapper gentlemen reclining on what appears, in the grainy black-and-white 1800s-era photo, to be a large rock in a streambed. In fact, that “rock” happens to be a copper nugget, an enormously concentrated form of mineral wealth that was just lying around waiting to be found and used. Before long, all of the large copper nuggets were swept up and used, so smaller and smaller nuggets were pursued, until finally all of those were commercially depleted, too. Then we moved onto the highest-grade copper ores, which were soon exhausted, and today we find ourselves consigned to and chasing after lesser and lesser ore grades.

In the United States, one of the largest copper mines is the Bingham Canyon Mine in Utah. It’s 2.5 miles across, three-quarters of a mile deep, and used to be a rather sizeable hill that has since been hauled away, crushed, smelted, and transformed into a very large hole. The ore grade at Bingham Canyon is quite low, only 0.2 percent when all the waste rock is factored in. Now think of a hole in the ground that’s nearly 4,000 feet deep, and imagine trying to get the ore and waste rock up and out of that hole without using gigantic diesel trucks. Think of the energy involved in hoisting rocks and earth thousands of feet into the air just so that we can get at the remaining dregs of copper in the earth’s crust.

Where our financial markets might tell us that this is a reasonable thing to do, perhaps because copper is at $3.00/lb., while diesel fuel is only at $2.85/gal., it doesn’t make a lot of sense on an energetic basis. Once we convert that highly concentrated diesel fuel into waste heat, humans will never be able to use that energy again to do anything else. Perhaps bringing rocks up from 4,000 feet down so that we can extract a relatively tiny proportion of copper from them really is the best use for that energy, or perhaps there are more pressing priorities. This is one way that financial markets can lead to perfectly rational

economic

decisions that also happen to be perfectly irrational

energetic

decisions.

The other point that I want to be sure to communicate here is the stunning sense of pace in this story. From giant nuggets lying in streambeds to 0.2 percent ore bodies in only 150 years. That’s an astonishingly short amount of time. What will we do for an encore over the next 150 years? When put in this context, it’s sobering to consider just how fast the mineral wealth of the earth has been exploited and how relatively few years remain until all of the known deposits are completely exhausted.

Actually, that’s an overstatement. The deposits will never be completely exhausted, as that would likely require far more energy than we actually have. As we recall from Chapter 15 (

Energy and the Economy

), one gallon of gas is equivalent to between 350 and 500 hours of human labor. How much is 350 to 500 hours of your labor worth to you? My prediction is that once petroleum energy begins to be priced at something closer to its intrinsic worth based on the work it can perform, most marginal mining activities will cease, and we will never get around to removing those last few flecks of mineral wealth.

Instead of thinking of the dollar costs associated with chasing after 0.2 percent copper ore, I want you to think of the energy costs, because those are what are going to shape the future. Remember how difficult it is to instantly appreciate nonlinear curves? Another nonlinear curve relates to the amount of energy required to go after and produce metals and other minerals that must be extracted from depleting ore bodies.

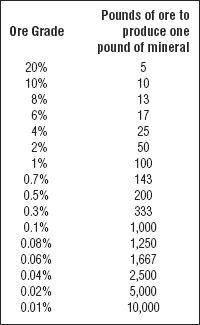

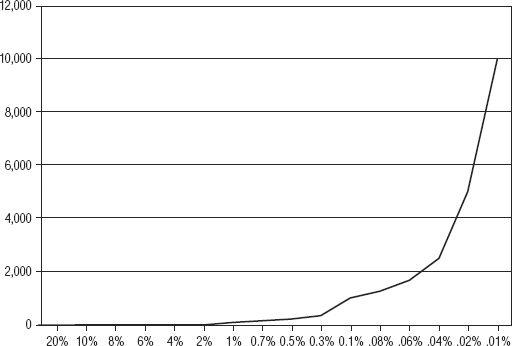

Figure 19.1

and

Figure 19.2

illustrate the declining quality of mineral ores.

It’s clear that the energy requirement of chasing depleting ore bodies is very much a nonlinear story. Assuming that the ore is coming from mines that are a similar depth and distance from the processing mill, every decrease in the ore concentration requires a big increase in the amount of ore that is removed for processing to obtain the same amount of the desired material. This is ore that must be broken away from surrounding material, transported, crushed, and refined. Every step is energy intensive.

One trait that humans share with all animals is that we go after the easiest, highest-quality sources of materials first. That’s just natural. Those that are more concentrated and nearer to the surface (or markets) are preferentially exploited first. We tend to farm the best soils first, harvest the tallest trees, and go after the most concentrated ore bodies. It’s a process called “high grading,” and it simply means doing the obvious: using up the best and most convenient stuff before the other stuff. Which means that by the time we’re chasing the less-attractive ores as a second order of business, there’s a very good chance that these ores are inconveniently located, perhaps deeper in the ground or in a more remote location, or both, and/or in more dilute form. Because of this, as we go forward, the energy required to chase the lesser ores will be even more than is implied by a simple chart comparing the ore percentages to processing amounts.

Quite simply, the key point here is this: To get more and more minerals from depleting ore bodies in the future won’t require just a little bit more energy, it will require exponentially more energy.

Economic Growth and Minerals

The economy, which I’ve attempted to convince you is due for a shake-up, depends on ever-increasing flows of materials (and energy) running through it. That’s what an exponentially increasing economy implies—more stuff in ever-increasing quantities. The predicament is that sooner or later this will no longer be possible, because there’s a limit to all resources. Even the most pie-in-the-sky optimists admit that eventually there will be limits, although some cling fast to the belief that those limits are still very far off in the future, maybe even too far off to concern ourselves with at this time.

One of the favorite devices used by such optimists is to state that we have many remaining decades of resources x, y, and z “at current rates of consumption.” The problem with that, as I hope you can now immediately appreciate, is that an exponential economy cannot be satisfied with “current rates of consumption” because that amounts to the same thing as saying “zero growth.” Our particular brand of economy is based on ever-increasing amounts of everything flowing through it. More money, more debt, more gasoline, more cars, more minerals, more profits, more buildings, more clothes, more, more, more of everything.

So if you ever hear the phrase “at current rates of consumption” in regard to a nonrenewable natural resource, this is a sure sign that the person wielding the statistics has painted an erroneously rosy picture of that resource, either accidentally or on purpose.

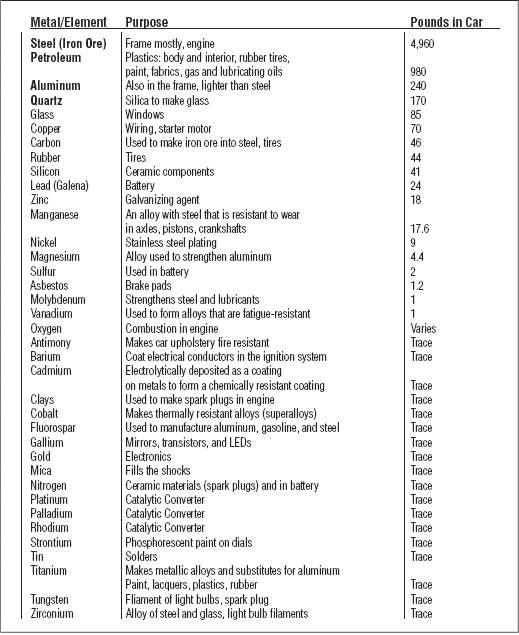

To illustrate the importance of mineral wealth to economic growth, consider what goes into our cars and trucks. Automobiles are a perfect starting point because mobility is extremely important to people everywhere on the globe. We can easily appreciate how economic growth translates into more cars on the road, and cars use up lots of different minerals in their construction and operation.

To manufacture a car or truck, the following mineral elements are needed (

Figure 19.3

):

Figure 19.3

Types of Metal or Element (by Weight) in a Typical Automobile

Source:

McLelland, “What Earth Materials Are in My Subaru?”

2