The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment (27 page)

Read The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment Online

Authors: Chris Martenson

Tags: #General, #Economic Conditions, #Business & Economics, #Economics, #Development, #Forecasting, #Sustainable Development, #Economic Development, #Economic Forecasting - United States, #United States, #Sustainable Development - United States, #Economic Forecasting, #United States - Economic Conditions - 2009

The largest known uranium reserves in the world are located in Kazakhstan, Canada, and Australia.

12

By now, you’ll find the story of uranium to be familiar, because it so closely parallels the story of petroleum. The highest grades and most convenient ores of uranium were exploited first and are nearly all gone, and the remaining ores are more dilute and/or more difficult to exploit. It’s the same story as that of oil.

High-grade uranium ore deposits, such as those still found in Canada, can be close to 20 percent in purity.

13

But most of the world’s known deposits are in the range of 1 percent to 0.1 percent, with a few deposits even listed as “proven reserves,” implying that they are worth going after even despite having an ore purity grade of less than 0.01 percent, which is two thousand times more dilute than the higher-grade ores in Canada.

In 2006, the 104 operating U.S. nuclear power plants purchased 66 million pounds of uranium, of which 11 million pounds came from domestic sources and the balance from foreign sources.

14

Over the past decade, the world’s nuclear power plants have been running, in part, on the uranium from decommissioned U.S. and (former) Soviet warheads, with some 13 percent

15

of the world’s total reactor fuel coming from the “Megatons to Megawatts” program.

16

If the United States cannot currently meet its own needs for uranium domestically with only 104 operating reactors, how much hope should we place on the idea of building and operating hundreds more over the coming years? Even if the United States somehow managed to double its total number of operating reactors, it would still only be obtaining 16 percent of its total energy needs from nuclear power. And even this assumes that power demand does not grow at all between now and then.

For the world to move significantly to nuclear power above and beyond current levels, it will first need to figure out where the uranium to fuel the reactors will come from. The short answer is that it won’t come from conventional mining, because that industry is having a hard time keeping up with the plants that are already in operation. It couldn’t possibly service a doubling or tripling from these levels, let alone meet the 18-fold increase implied by the gap being left behind by Peak Oil.

Some hopeful nuclear power proponents then turn to the idea of fast breeder reactors, possibly those running on thorium (which is much more abundant than uranium), which could theoretically provide energy for the next thousand years. At least that’s the story brought about in a couple of thought papers put out in the popular media. It bears noting that only a handful of experimental fast breeder reactors have been constructed for demonstration purposes. As of 2010, no commercial breeder reactors have yet been deployed. Not one.

17

Several of the early experiments have already been shut down and/or decommissioned, but a small handful of experimental, demonstration, and pilot breeder reactors remain: one in India, one in Japan, and two in Russia.

18

The basic story here is that fast breeder reactors look very good on paper, but they have proved to be something of an operational nightmare, which is to say nothing of the intense national security risks that they pose by virtue of their production of plutonium if running on uranium, and uranium 233 (a fissile material useful for making nuclear bombs) if running on thorium.

Whether or not breeder reactors are a good idea is relatively insignificant when you consider that no commercial reactors are yet on the drawing boards, let alone currently built, operating, and adding to our available energy. If we are going to entertain hopes that these complicated machines will contribute to our energy story, we must first admit that they can’t possibly do this if they aren’t built. This seems a trite concept, but you’d be surprised how many people earnestly inform me that we are going to solve our energy predicament with breeder reactors. If Peak Oil arrives in 2014 (as I write this near the end of 2010), it seems incredibly unlikely that the world will somehow manage to build hundreds of breeder and nuclear reactors in the span of a decade, which is what would be required to offset the energy decline.

- Time

: Decades. It will be at least 10 years (and probably more like 20) before the number of operating nuclear reactors in the world, currently standing at 440 (in 2010), could possibly be doubled. - Scale

: Enormous. The world’s capacity to build nuclear plants depends upon a limited number of engineers with the requisite training and skills, and there are a limited number of factories that can manufacture the specialty items needed to build a plant. More worryingly, it’s not clear that the necessary fuel will be available from conventional mining sources. Dealing with the waste issue even at the current scales of operation has not yet been solved. - Cost

. Trillions and trillions of dollars. The price tag to build a modern 1 gigawatt nuclear plant is $5 billion (in 2010). Maintenance and fuels costs add another $6 million per year per plant. Merely doubling the world’s nuclear plants would cost $2.2 trillion. Assuming we could get past the issues outlined in time and scale, and could build the roughly 200 nuclear reactors

per year

required to offset falling oil production, the price tag over just a single decade would be in the vicinity of $10 trillion.

The Coal Story

When he was president, George W. Bush gaffed on national television when he declared that the United States still has “250 million years of coal left.”

19

Even if he were to have said what he meant, which was” 250

years

of coal left,” he would still have been wrong. In truth, the only possible way to get to 250 years of coal is to start with the most optimistic possible estimate about U.S. coal reserves and then divide it by current consumption, which is unrealistic because our consumption of coal is constantly growing. Realistically, if coal consumption continues to increase as it has done in every decade since at least 1800,

20

it’s not possible to have anything close to 250 years of coal remaining.

As Albert Bartlett makes clear, one cannot reasonably leave out growth in consumption when discussing how long something will last. That would be like claiming that you had spent nothing in the past five minutes and that therefore the money in your wallet would last forever. Bartlett has been dissecting the innumeracy of our growth and energy policies for decades, and has pointed out some massive logical errors in our thinking, such as this statement taken from a U.S. Senate report: “At current levels of output and recovery, these American coal reserves can be expected to last more than 500 years.” Of this, Bartlett said:

There is one of the most dangerous statements in the literature. It’s dangerous because it’s true. It isn’t the truth that makes it dangerous, the danger lies in the fact that people take the sentence apart: they just say coal will last 500 years. They forget the caveat with which the sentence started. Now, what were those opening words? “At current levels.” What does that mean? That means if—and only if—we maintain zero growth of coal production

21

He goes on to note that even the Department of Energy admits that perhaps half the coal reserves aren’t recoverable, immediately dropping the estimate to 250 years. If we do that and assume that coal production increases at the same rate that it has for the past 20 years, then the known reserves will last for between 72 and 94 years; within the life expectancy of children born today. In terms of outlook, what’s the difference between 250 years of coal left and 72 years? In a word, everything.

So what can we say about coal consumption? First, coal is by far the dominant energy source for the production of electrical power (see

Figure 17.1

).

The use of coal has been growing worldwide at very fast rates, largely driven by China but also by the base growth of power needs in other countries. Even in the United States, where 250 years of coal supposedly remain, the United States is likely to become a net importer of coal by 2015 or so

22

because it won’t be able to meet its own demand for certain types of coal, principally low-sulfur coal. Not by much, mind you, but a net importer all the same.

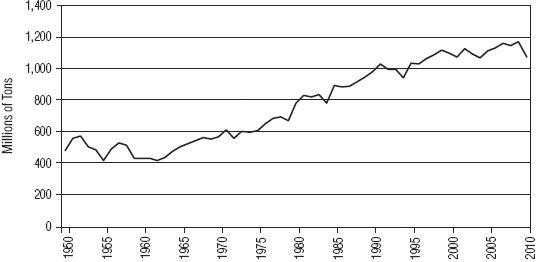

Coal production in the United States, as measured by tons mined, has been steadily growing at roughly 2 percent per year since the 1940s. This sort of stable, continuous, but ultimately exponential growth is exactly what our economy and society demand (see

Figure 17.2

).

Of course, there’s a wrinkle in this story. Coal comes in several different grades. The most desirable grade is shiny, hard, black anthracite coal. It yields the most heat when burned, has low moisture content, and is highly valued in the steel-making industry. After anthracite comes bituminous coal, offering slightly less energy per pound of weight, and then subbituminous, and then finally something called lignite (a.k.a. “brown coal”), which is low-energy, high-moisture stuff that really has no use besides burning.

Next let’s look at the United States’ history with mining coal, separated out by the different grades (see

Figure 17.3

).