How to Create the Next Facebook: Seeing Your Startup Through, From Idea to IPO (21 page)

Read How to Create the Next Facebook: Seeing Your Startup Through, From Idea to IPO Online

Authors: Tom Taulli

The rich are different than you and me.

—F. Scott Fitzgerald

Yes, they have more money.

—Ernest Hemingway

It seems inconceivable that Mark Zuckerberg would ever sell his company. Keep in mind that he set in place powerful mechanisms to keep control. He has also rebuffed several mega-buyout offers.

Yet there was a point when Zuckerberg agreed to sell his company. It was in 2006, and he had a deal with Yahoo! for $1 billion. But then Yahoo! reported a weak quarter, and the stock price fell. The deal was off.

There is nothing wrong with selling your company. It’s a much more likely outcome than going public. It can also be a stepping-stone to creating another company, which may turn out to be the real breakout opportunity. The first venture will certainly have been a great learning experience.

This chapter looks at the decision to sell out, describing the process and how you can make the right moves to maximize the outcome.

There are many reasons to take a buyout offer. Some of the most pressing involve your company facing a rapidly competitive environment or a disruptive new technology. These forces can wipe out a company.

Just look at the case of Flip, which sold out to Cisco for $590 million in 2009. A few years before, the company launched a handheld camcorder that quickly dominated the market, with sales over 2 million units.

Cisco saw the deal as a way to break into the red-hot consumer market. But it turned out to be a disaster. The launch of Apple’s iPhone disrupted the camcorder market, and Flip quickly flamed out. By April 2011, Cisco shut down the operation.

In the tech world, the time from success to failure can be painfully quick. So when you have a hot company, you need to do a gut check: is your product built to last? Do you have real, sustainable advantages? If not, then you should seriously look at selling out.

Other times, a company may sell out because the valuations have reached insane levels. A classic example is Mark Cuban. He was a natural born entrepreneur who started his first business when he was 12, selling garbage bags. He paid for his college tuition by collecting stamps and operating a pub he acquired.

In the early 1980s, Cuban saw the huge potential of the emerging PC market and launched MicroSolutions, a software reseller. He sold the company to CompuServe for $6 million.

But this was only a warm-up. In 1995, he co-founded Audionet with his partner, Todd Wagner, to broadcast Indiana University college basketball games. They soon realized that the opportunity was much larger, and they expanded their platform into many other categories. The company changed its name to Broadcast.com and went public. In 1999, Yahoo! bought the company for a whopping $5.9 billion. Broadcast.com had less than $20 million in revenue at the time.

Cuban was now a billionaire, but his wealth was in Yahoo! stock. Realizing that the dot-com boom could easily fizzle, he put a collar on his holdings. This was a sophisticated financial structure to give him downside protection if the stock plunged. It turned out to be a savvy move and meant that Cuban remained a billionaire. He went on to buy the Dallas Mavericks and fund other hot companies. His net worth is now about $2.3 billion.

Many other dot-com millionaires and billionaires were not so lucky. Many wound up with little, and some went bust.

Chapter 15

looks at strategies for entrepreneurs to protect their hard-earned wealth.

When you decide to sell your company, you need to generate interest. The best scenario is to create an auction environment with multiple bidders, which should allow for a higher valuation. If your company is hot, you’ve probably already received buyout offers.

But how can you get more potential buyers to the table? One approach is to hire an investment bank, which provides a variety of services such as valuing your company and helping navigate the acquisition process. The firm also helps to identify the right types of buyers. This involves first putting together a pitch book that provides key details so as to elicit interest. The name of your company isn’t disclosed, to maintain confidentiality. (It’s never a good idea for the market to know that your company is up for sale; it may be seen as a sign of desperation.)

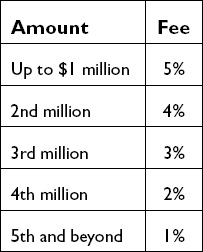

For its services, an investment bank gets an ongoing retainer and a percentage of the transaction. A common approach for arriving at the percentage is the Lehman Formula that goes back to the 1970s and got its start from the investment bank, Lehman Brothers.

1

You should negotiate the fee, but don’t be too aggressive. You want to make sure there is enough incentive for the investment bank to obtain a high price.

Even if you don’t use an investment bank, you should definitely get the help of an M&A attorney. It’s also important to seek advice from your board of directors and other trusted advisors with experience in deal-making.

When you sell your company, there are no do-overs.

The preliminary negotiations can take a long time. In some cases, a buyer may woo a candidate for several years until a deal is done.

But when a seller is serious, there is talk about the key terms, such as the valuation, the financial structure, and due diligence matters. These become part of the letter of intent (LOI), which is a nonbinding proposal to acquire the company.

The rest of this chapter examines the key terms in this document.

This is often the main point of contention, as should be no surprise. In some cases, the price is easy to understand—for example, when the buyer offers an all-cash deal. But the seller may put restrictions on this. One way is with an

earnout

, which means the founder and employees receive additional cash or stock if certain milestones are hit.

The situation is much more complicated when the purchase price includes stock. This is especially the case when the buyer is privately held, because it’s not easy to determine the stock’s true value. If the seller doesn’t go public or is sold to a larger player, you may wind up with little to show for the acquisition. This is fairly common.

It’s often better to get stock in a public company, because the market is liquid. You can also check out the company’s financial disclosures and gain a better sense of its performance.

But there are still risks. The stock you receive in an acquisition is

unregistered

, which means you can’t immediately sell it. Until a company files a statement with the Securities and Exchange Commission, no sales are allowed for at least a year. A lot can happen during that time.

Regardless of the type of consideration, a transaction has various adjustment mechanisms that can impact the valuation. For example, a portion of the cash is held back in an escrow account (known as the

hold back

), to provide

compensation for any breaches of the seller’s promises. You can negotiate the hold back but not eliminate it. A typical approach is to have 10% to 20% of the purchase price set aside for about 12 to 18 months.

Another adjustment is for changes in the working capital. This accounts for any spikes in expenses or deterioration in the business that occur between the signing of the LOI and the closing of the transaction. It can be a substantial amount and weigh on the valuation. So, it’s important for the seller to remain focused on the business’s operations.

Money may also be put in escrow for

retention bonuses

. These are cash bonuses paid to management based on the time they remain at the company. During tech acquisitions, the buyer is often looking to keep talented engineers and managers for the long haul.

There are generally two ways to structure an M&A deal: an asset purchase or a stock purchase.

An

asset purchase

means the seller transfers all or most of the assets of the business in exchange for stock or cash (or a combination of the two). This essentially involves a bill of sale for each asset, such as real estate, patents, trademarks, equipment and so on.

An asset purchase tends to be favorable for the buyer. Perhaps the biggest advantage is that there is no assumption of the company’s liabilities, because they remain with the seller’s corporation. But some jurisdictions still attempt to shift liability exposure to the buyer; this may be the case if there is evidence of fraud or product liability issues.

Another key to an asset purchase is that it provides tax benefits for the buyer. It allows for stepped-up basis in the assets purchased. After the acquisition, the buyer can depreciate the assets and get non-cash deductions, which should mean a lower tax bite.

An asset purchase may also result in terminations of contracts with suppliers. Keep in mind that contracts often contain

assignment clauses

that are triggered on an acquisition. In this case, the supplier may see an opportunity to renegotiate a higher price on the new contract.

If an asset purchase is not the right approach, then there is a

stock purchase

. In this case, the buyer purchases all or a majority of the shares from the seller. For larger transactions, the buyer may use a

statutory merger

(also known as a

reorganization

). It’s based on state law—often in Delaware—that provides for potentially significant tax benefits.

The buyer assumes all the liabilities of the seller’s company, which legally disappear. But the buyer may create a subsidiary and merge it into the seller’s company. This is a smart way to help contain any potential exposures.

What if some of the shareholders don’t want to sell out? A statutory merger usually requires only a majority vote, so all shareholders must ultimately tender their stock. There may be an appraisal right that lets a shareholder bring a court action to attempt to get a higher stock price.

These are also known as

reps

and

warranties

. They are written expressions that document when a buyer or seller vouches for something, such as a company’s finances, litigation, rights to intellectual property, and so on. For the most part, the reps and warranties are made by the seller. But if a company is selling to a private company, it’s smart to get strong reps and warranties from the buyer, because it’s more difficult to verify information.

A violation of reps and warranties during the negotiation of a merger can easily kill the deal or result in a lower valuation. If a violation occurs after the deal is struck, then damages may come out of the hold back. Or, if there is a carve-out, the buyer may have the right to go after the sellers personally. This can cause a hostile situation if they still work for the buyer. For this reason, it’s important not to agree to any language that would result in personal liability for reps and warranties.

Negotiating reps and warranties is often a time-consuming and contentious process, because the buyer is taking a big risk in striking the deal. Might there be hidden time bombs? Does the business have major problems ahead?

To lessen the impact of reps and warranties, a seller has some options. They can use

materiality clauses

, which put a cap on liability exposure. For example, the reps and warranty for any lawsuits could state that there will be no liability over $1 million. Without this, the exposure could be unlimited.

Another helpful approach is the

knowledge qualification

. This means you agree to reps and warranties to the “best of your knowledge.” It’s a great way to

minimize the liability exposure, because it’s not easy for a buyer to prove what you knew at the time of the acquisition.

This is standard. The buyer is making a substantial commitment and doesn’t want to lose the deal to a rival—or have to pay a higher price. It’s a reasonable position.

But you should negotiate the time period—which prevents you to seek out other potential buyers—anywhere from 30 to 60 days is good. This should be enough time to complete a deal.