Financial Markets Operations Management (25 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

Securities Clearing

In Chapter 5: Clearing Houses and CCPs, we defined clearing as: “The process of transmitting, reconciling and, in some cases, confirming payment orders or security transfer instructions prior to settlement, possibly including the netting of instructions and the establishment of final positions for settlement. Sometimes the term is used (imprecisely) to include settlement.”

Clearing, therefore, is the post-trade preparation for settlement, i.e. the completion of the trade. This preparatory phase should be completed shortly after the trade has been executed; how long afterwards depends on the market convention and type of asset.

By the end of this chapter, you will be able to:

- Follow the stages within the clearing cycle;

- Differentiate between securities and derivatives clearing;

- Forecast cash requirements and securities availability.

We have seen that a clearing house differs from a central counterparty (CCP) in one fundamental way.

In this chapter, we will look at clearing from the points of view shown in

Table 7.1

.

TABLE 7.1

Clearing House and CCP clearing

| Asset Type | Clearing Method | Example |

| Equities | Central counterparty | LCH.Clearnet |

| Eurobonds | Clearing house | International CSDs: Clearstream Banking Luxembourg and Euroclear Bank |

The objective of the clearing cycle is to enable all transactions to be settled according to market convention. The macro operation is the transformation of trade details received from the Front Office through a series of micro operations into a completed (i.e. settled) transaction. These micro operations include the following:

- Trade capture.

- Trade enrichment and validation.

- Trade reporting.

- Confirmation/affirmation.

- Clearing instructions.

- Forecasting â cash.

- Forecasting â securities.

We will look at these micro operations in more detail; in the meantime, here are some brief summaries.

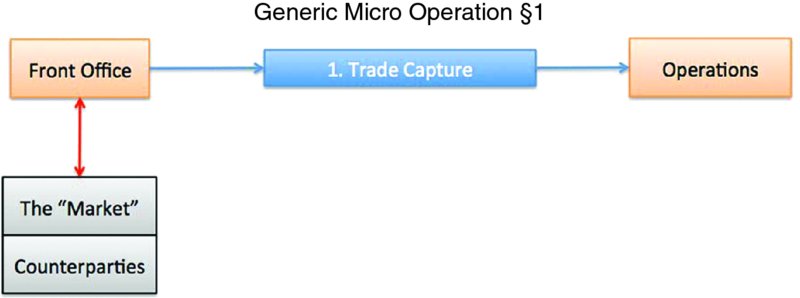

All transactions executed by the Front Office will be entered onto a trade/dealer's blotter. The blotter can either be electronic or spreadsheet-based, depending on the product traded and the organisational structure of the Front Office (as shown in

Figure 7.1

).

FIGURE 7.1

Trade capture

Summary: the Front Office books trades and corrects errors.

Trade data are fed into applications that:

- Hold trade details;

- Calculate Profit & Loss;

- Calculate risk.

The trades should be validated to ensure that limits and authorities have not been exceeded.

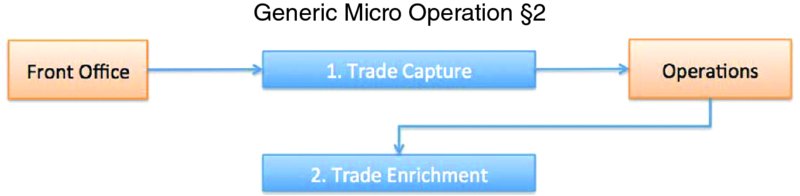

Trade information will be basic and will need to be enriched (see

Figure 7.2

) with reference to the appropriate databases (e.g. securities, counterparty, etc.) and calculations made (e.g. accrued interest, total settlement amounts, brokerage, etc.).

FIGURE 7.2

Trade enrichment

Summary: Operations should ensure that trades are executed correctly and additional information is added to the basic trade details.

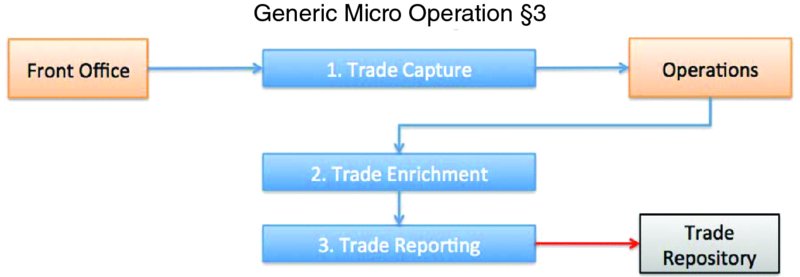

Exchange-traded transactions are transparent and can be seen by the regulatory authorities. This is not the case for OTC transactions which tend to be opaque in nature. All transactions should be reported (see

Figure 7.3

) either to a trade repository or an authorised reporting mechanism (ARM).

FIGURE 7.3

Trade reporting

Summary: transactions should be reported to the appropriate authorities.

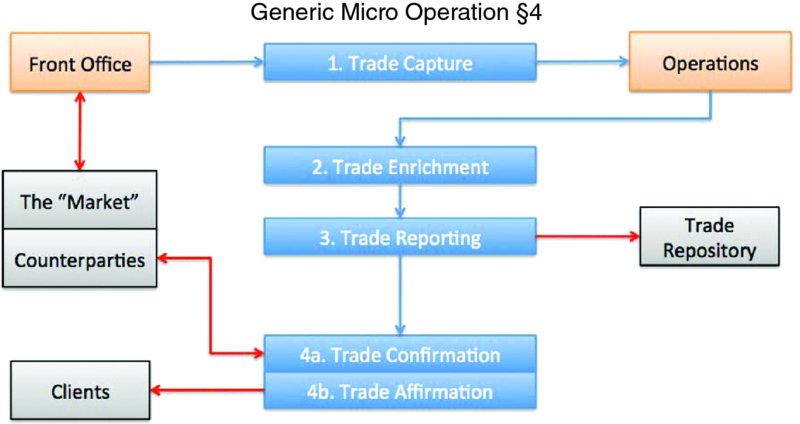

It is quite possible for transaction details to differ in one or more respects from those of the counterparty. To ensure that both the buyer and the seller have the same transaction details, both parties will confirm transaction details with each other (see

Figure 7.4

). This usually happens on the trade date.

Where a broker, for example, has traded on behalf of a client, two-way confirmation is not appropriate. Instead, the broker alleges the transaction against its client and the client either affirms the trade (i.e. agrees the details) or rejects/queries the trade. Trade affirmation should be completed no later than the day after the trade date (T+1).

FIGURE 7.4

Trade confirmation/affirmation

Summary: confirmation and affirmation ensure that both parties to a transaction are in agreement with the contract details.

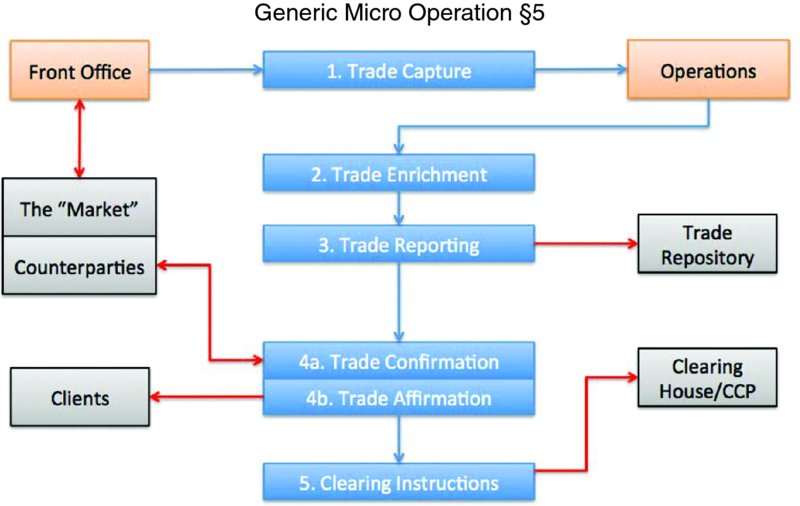

At this stage, both counterparties have captured transaction details from the Front Office and confirmed those details with each other. At this point, both counterparties submit clearing instructions to the appropriate clearing system (see

Figure 7.5

).

FIGURE 7.5

Clearing instructions

The buyer will instruct the clearing system to receive securities against payment of cash and the seller to deliver securities against payment of cash. The clearing system will validate any incoming instructions to ensure that the transaction has the potential to be correct and is, therefore, settleable.

This is followed by a matching process in which the clearing system attempts to pair off one counterparty's delivery instruction with another counterparty's receipt instruction. Successful pairings are known as

matched instructions

; unsuccessful pairings are

unmatched instructions

and these will have to be investigated and corrected by the relevant counterparties.

Matched instructions can now be forwarded for settlement; however, unmatched instructions can never settle.

Summary: the clearing system will attempt to match the buyer's instructions with the seller's. Subject to further clearing phases, matched instructions can settle, whilst unmatched instructions can never settle.

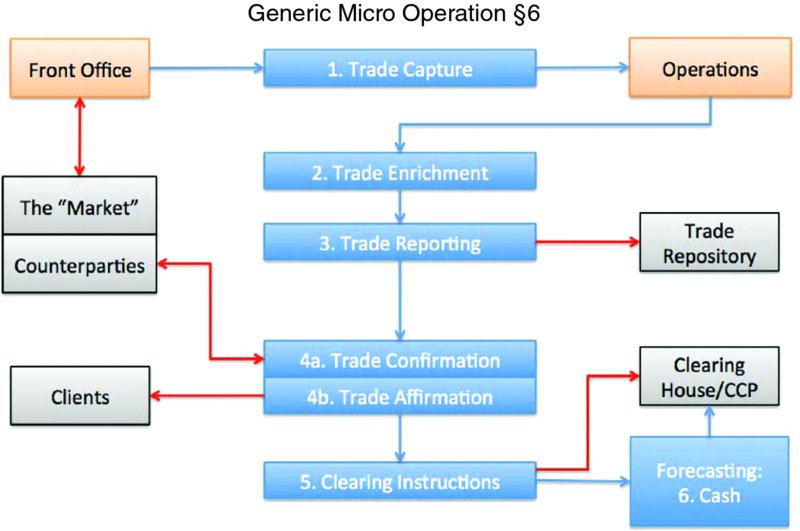

Rather than borrow cash for each purchase and lend cash from each sale, market participants tend to net their cash exposures on a currency-by-currency basis. Participants will make cash forecasts in advance (or on the day itself) of when the cash is due to be debited or credited.

Efficient cash forecasting helps to make the best use of cash and in so doing reduces financing costs (see

Figure 7.6

). The challenge for Operations is to estimate the odds of expected cash movements actually taking place on the intended dates. Techniques such as

fund to fail

and

fund to settle

can certainly help in the forecasting process.

FIGURE 7.6

Cash forecasting

Summary: correct cash forecasting helps to ensure efficient settlement; conversely, poor cash forecasting will lead to financing costs at best and failed settlements, together with associated interest claims, at worst.

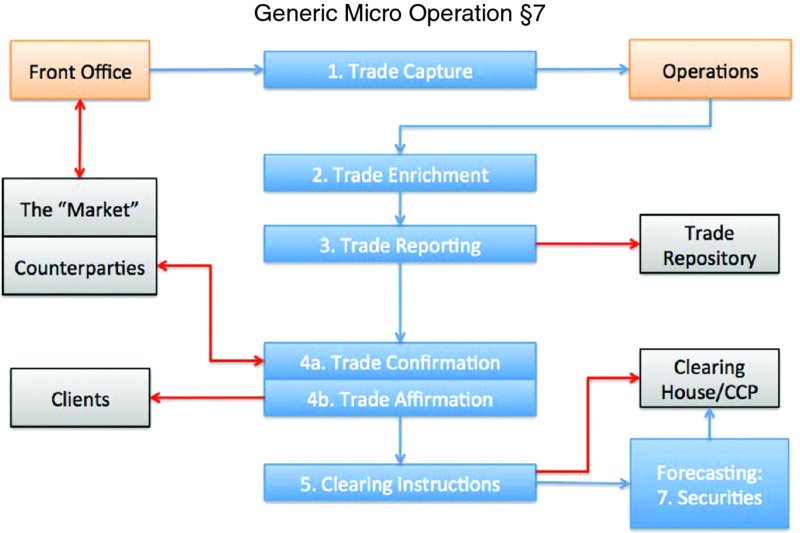

Where sales of securities are due for settlement, participants need to ensure that the securities are available (“available for delivery”) (see

Figure 7.7

).

There could be good reasons why securities are not available, for example, the participant might be waiting for a previously traded purchase to settle. Whatever the reason, Operations need to take appropriate action to reduce the impact of a failed settlement.

Sales that failed to settle have a knock-on effect on the associated cash pay proceeds, resulting in an inability to reinvest cash and an impact on the overall cash-forecasting process.

FIGURE 7.7

Securities forecasting

Summary: in the same way that cash must be actively managed (see above), so should the availability or otherwise of securities. Again, as with cash, Operations need to be proactive in how they predict securities' movements and balances.

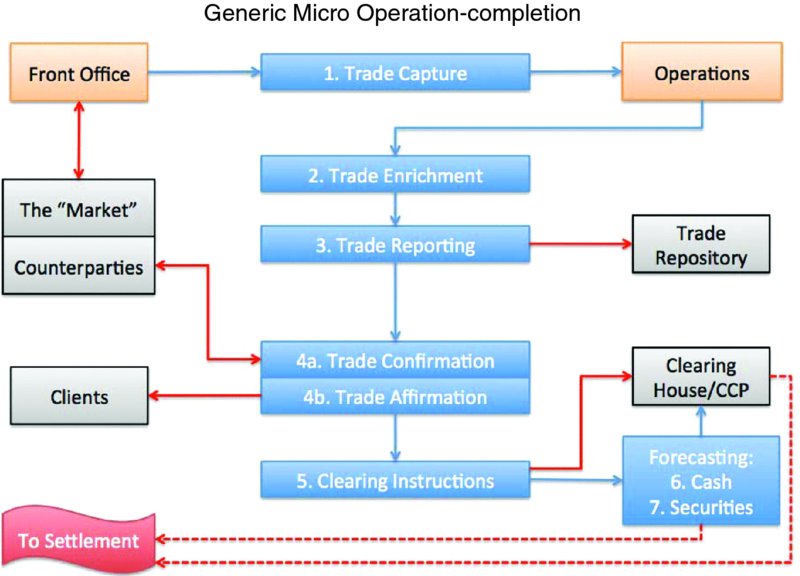

In conceptual terms, these seven generic micro operations represent very much the same transformation of an executed transaction into a completed contract. Each market will maintain different practices in detail for each and every asset class traded in that market. At the end of the clearing phase, transactions can be moved into the settlement phase, as shown in

Figure 7.8

. We will cover settlements in the next

chapter.

FIGURE 7.8

The completed clearing phase

We will now look at these phases in more detail using a small equities portfolio as an example. This portfolio is managed by a trading organisation known as T01 and consists of 14 holdings of UK equities. The securities are valued at approximately GBP 3 million using last night's closing prices and there is a cash balance of approximately GBP 150,000.

This example portfolio is based on one of a selection of settlement simulations that the author uses in his training courses. By necessity, it is spreadsheet-based and delivered in paper format. This enables students to appreciate the underlying process that might otherwise be disguised in an automated, electronic operational environment.