Financial Markets Operations Management (26 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

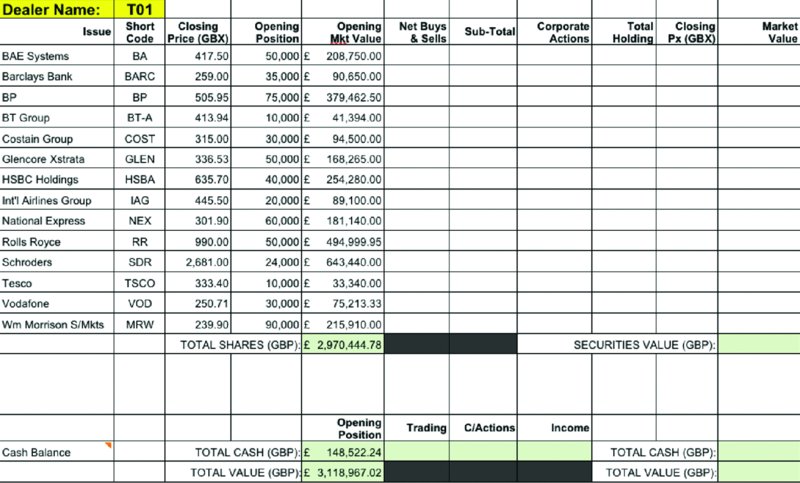

The dealer's blotter is a record of the assets that the dealer is responsible for, and is updated whenever assets are bought or sold. T01's blotter (see

Figure 7.9

) is a simplified version that lists all 14 holdings and includes last night's closing prices,

1

the dealer's opening positions plus their market values. In our example, the shares are worth GBP 2,970,444.78 and there is a cash balance of GBP 148,522.24.

FIGURE 7.9

Dealer's blotter

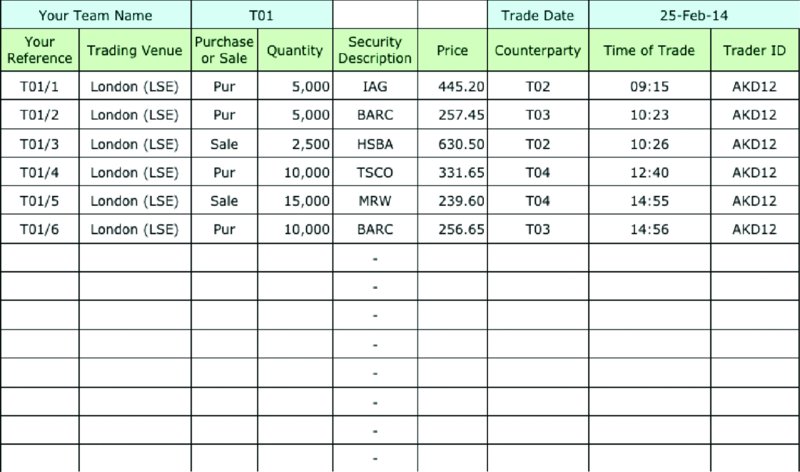

In our settlement simulation, the dealer executes six transactions against various counterparties and these transactions are entered either in an electronic trade capture system or manually on trade tickets.

These six transactions are shown on the dealing sheet (see

Figure 7.10

); note that whilst the information provided is minimal, it is sufficient for Operations to perform the necessary clearing and settlement activities.

FIGURE 7.10

Dealing sheet

From the dealing sheet we can see not only the various transactions but also the trading venue on which the transactions were executed, the times the transactions were executed and the trader's identification.

The information contained in the dealing sheet will be submitted to the Middle Office either electronically or manually using a trade ticket.

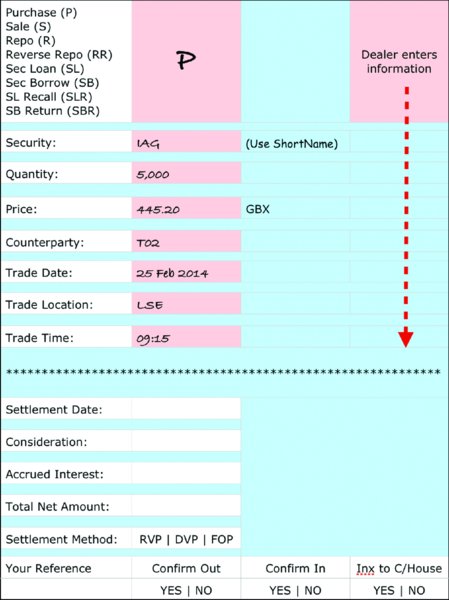

Figure 7.11

illustrates an example of a trade ticket.

FIGURE 7.11

Trade ticket

Copying information from the blotter to a trade ticket is not ideal as it takes time and there is the risk of incorrectly rekeying information. For example, a sale might be incorrectly entered as a purchase.

The Middle Office will start the process of making each transaction ready for clearing. This involves the following activities:

- Ensuring that the dealer has entered all the required information on the trade ticket.

- Calculating the purchase costs or sale proceeds. This will include accrued interest for bonds, stamp duty for equities (where appropriate) and brokerage fees for client

transactions. For simplicity, we will not consider stamp duty for our settlement simulation example. - Updating the company's risk profiles. This includes ensuring that the individual dealer is authorised to trade these particular assets and whether or not the dealer has exceeded trading limits. With equities in particular, it is also important to ensure that any post-trade positions do not breach disclosure levels (in the event that they do, these positions need to be disclosed to the appropriate authorities).

- Ensuring that the quantity of securities traded is an exact multiple of that security's board lot size.

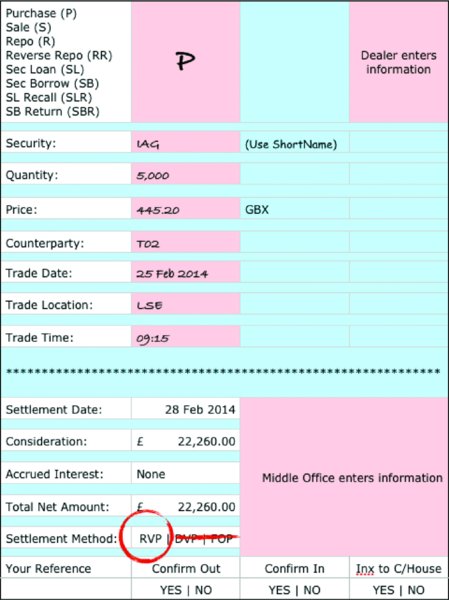

For our purposes, the Middle Office will add the settlement date, consideration and total net amount to the trade ticket and will identify the correct settlement method (shown in

Figure 7.12

).

FIGURE 7.12

Transaction ticket

We can see that we now have almost the full details of this particular transaction, as follows:

- The settlement date for this particular asset type is T+3, making it 28 February 2014.

- The consideration is the quantity of shares multiplied by the price (remembering that, as these are UK equities, they have been priced in pence and should be converted into pounds sterling).

- There is no accrued interest and we are disregarding stamp duty in our example.

- As this transaction is a purchase, the regular settlement method will be receive versus payment (RVP).

There are two pieces of information missing at this stage: the account numbers of both trading counterparties and the name of the clearing system. In an automated environment, this information would be picked up from the appropriate databases, as shown in

Table 7.2

.

TABLE 7.2

Counterparties and clearing system

| Database | Comments |

| Company T01 | T01 is a clearing member of the clearing house and will have an associated participant account number/code. |

| Counterparty | T02 is a clearing member of the clearing house and will have an associated participant account number/code. |

| Asset type | UK equities traded on the London Stock Exchange clear through a specified clearing system. |

| Clearing system | LCH.Clearnet. |

By contrast, in a manual environment, Middle Office or Settlements staff would add these extra details to the trade ticket, confirmation and clearing house instructions.

As part of a regulatory authority's obligations to maintain confidence in the financial markets and reduce financial crime, regulated firms have to send reports of their transactions to the regulator at the earliest possible opportunity (i.e. by close of business on T+1). This helps the regulator detect and investigate suspected incidents of market abuse and/or market manipulation.

Regulated firms must report all purchases and sales of financial instruments whether acting as principal or agent. There are transaction types that are not reportable:

- Securities financing transactions (e.g. securities lending/borrowing).

- The exercise of options and covered warrants.

- Primary market transactions in equities and bonds (including depository receipts on these).

Regulated firms have to report transactions that have been executed:

- In any financial instrument (e.g. equities, bonds, derivatives, etc.) that has been admitted to trading on a regulated market;

2

or - In any OTC derivative where the underlying asset is either an equity or debt-related financial instrument, as noted in (1) above.

There are exceptions; the following need not be reported:

- Transactions in any OTC derivative where the underlying asset is either a multiple equity or multiple debt-related financial instrument (e.g. a stock index);

- Transactions in commodity, interest rate and foreign-exchange OTC/listed derivatives (e.g. a commodity futures contract).

A transaction report contains information regarding an individual transaction executed on a financial market and contains 21 separate fields, including:

- The financial instrument identifiers;

- The firm that executed the transaction;

- The counterparty to the transaction;

- The buy/sell identifier;

- The price;

- The quantity, etc.

The regulators regard transaction reporting as being so important in their role of ensuring that the markets function well that they will heavily fine firms which either mis-report transactions or fail to report them altogether.

Transactions can be reported to the regulator by firms using systems known as

approved reporting mechanisms

(ARMs).

Table 7.3

lists ARMs approved by the UK's Financial Conduct Authority.

TABLE 7.3

List of approved ARMs

| ARM | System | ISIN | OTC | AII |

| Credit Suisse Securities (Europe) Limited | DARE | Yes | Yes | Yes |

| Euroclear UK and Ireland | CREST | Yes | No | No |

| Xtrakter | TRAX | Yes | Yes | Yes |

| London Stock Exchange | UniVista | Yes | Yes | Yes |

| Getco Europe Ltd | GETCO | Yes | Yes | Yes |

| Abide Financial Ltd | TransacPort | Yes | Yes | Yes |

AII â Alternative Instrument Identifier

The over-the-counter (OTC) derivatives markets are inherently opaque because trading takes place away from an exchange in products that are formulated to suit the buyer and seller. Globally, regulators have become concerned that this opacity prevents them from monitoring the build-up and distribution of exposures in the relevant markets. To overcome this problem, regulators have introduced the requirement that trade repositories (TRs) capture and retain key information regarding open (OTC) derivative trades.

The information held by the TRs is then disseminated to the appropriate regulators. This not only enhances market transparency but also helps public authorities and market participants to monitor OTC derivative exposures. The overall objectives for the TRs are to support sound risk management, market discipline and effective oversight, regulation and supervision of the markets.

In Europe, several TRs have been registered by the European Securities Markets Association (ESMA) in accordance with the European Market Infrastructure Regulation (EMIR). These are shown in

Table 7.4

.

TABLE 7.4

European trade repositories

| Trade Repository | Derivative Asset Class |

| DTCC Derivatives Repository Ltd | All asset classes |

| Krajowy Depozyt Papierów Wartosciowych S.A. | All asset classes |

| Regis-TR S.A. | All asset classes |

| UnaVista Limited | All asset classes |

| CME Trade Repository Ltd | All asset classes |

| ICE Trade Vault Europe Ltd | Commodities, credit, equities and interest rates |